i have 0 clue how to do it, any help would be appreciated

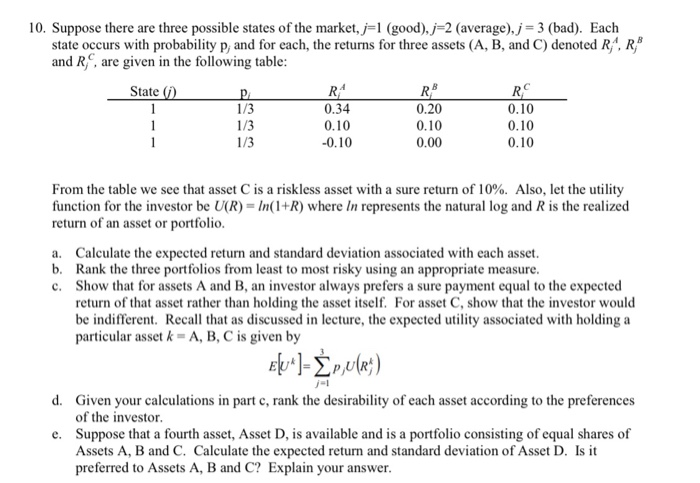

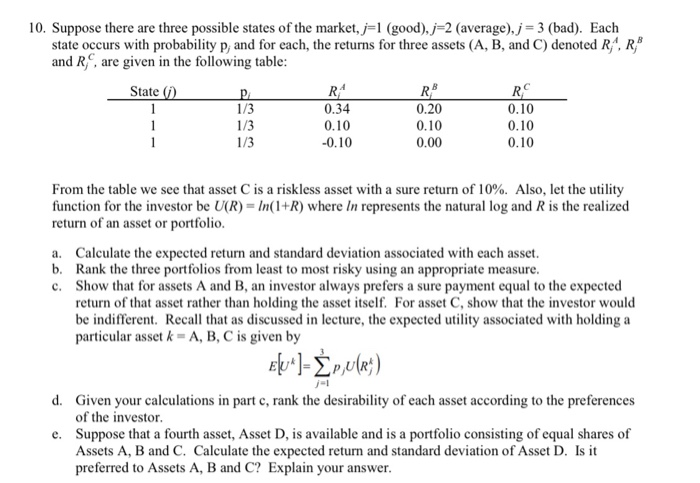

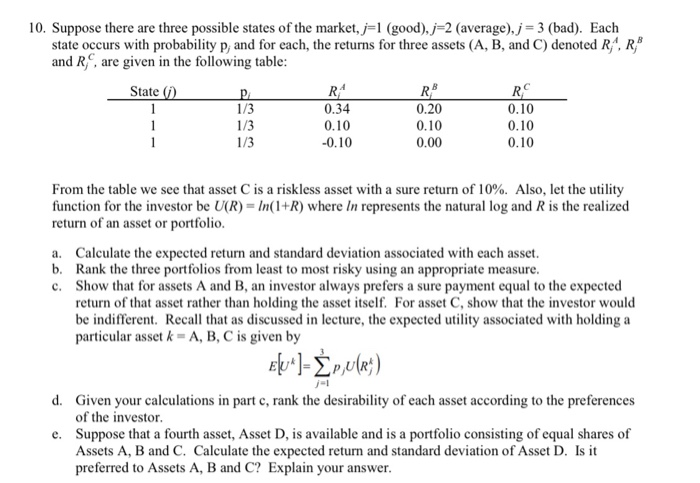

10. Suppose there are three possible states of the market, j=1 (good), j=2 (average), j = 3 (bad). Each state occurs with probability p, and for each, the returns for three assets (A, B, and C) denoted R", R and R", are given in the following table: State (0) P R R RO 1 1/3 0.34 0.20 0.10 1 1/3 0.10 0.10 0.10 1 1/3 -0.10 0.00 0.10 From the table we see that asset C is a riskless asset with a sure return of 10%. Also, let the utility function for the investor be U(R)= In(1+R) where in represents the natural log and R is the realized return of an asset or portfolio. a. Calculate the expected return and standard deviation associated with each asset. b. Rank the three portfolios from least to most risky using an appropriate measure. c. Show that for assets A and B, an investor always prefers a sure payment equal to the expected return of that asset rather than holding the asset itself. For asset C, show that the investor would be indifferent. Recall that as discussed in lecture, the expected utility associated with holding a particular asset k = A, B, C is given by E%u* )= p,v(R4) d. Given your calculations in part c, rank the desirability of each asset according to the preferences of the investor. e. Suppose that a fourth asset, Asset D, is available and is a portfolio consisting of equal shares of Assets A, B and C. Calculate the expected return and standard deviation of Asset D. Is it preferred to Assets A, B and C? Explain your answer. 10. Suppose there are three possible states of the market, j=1 (good), j=2 (average), j = 3 (bad). Each state occurs with probability p, and for each, the returns for three assets (A, B, and C) denoted R", R and R", are given in the following table: State (0) P R R RO 1 1/3 0.34 0.20 0.10 1 1/3 0.10 0.10 0.10 1 1/3 -0.10 0.00 0.10 From the table we see that asset C is a riskless asset with a sure return of 10%. Also, let the utility function for the investor be U(R)= In(1+R) where in represents the natural log and R is the realized return of an asset or portfolio. a. Calculate the expected return and standard deviation associated with each asset. b. Rank the three portfolios from least to most risky using an appropriate measure. c. Show that for assets A and B, an investor always prefers a sure payment equal to the expected return of that asset rather than holding the asset itself. For asset C, show that the investor would be indifferent. Recall that as discussed in lecture, the expected utility associated with holding a particular asset k = A, B, C is given by E%u* )= p,v(R4) d. Given your calculations in part c, rank the desirability of each asset according to the preferences of the investor. e. Suppose that a fourth asset, Asset D, is available and is a portfolio consisting of equal shares of Assets A, B and C. Calculate the expected return and standard deviation of Asset D. Is it preferred to Assets A, B and C? Explain your