Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have 30 min left Market Top Investors, Inc., is considering the purchase of a $345,000 computer with an economic life of five years. The

i have 30 min left

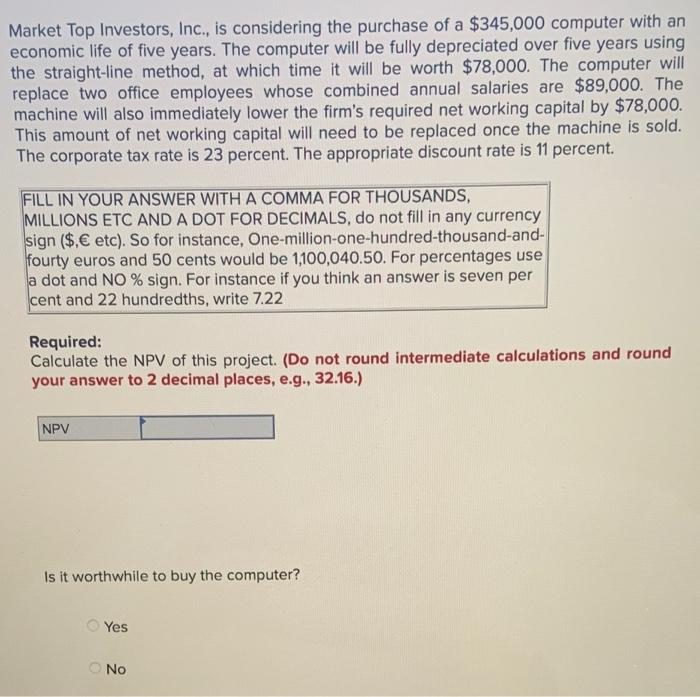

Market Top Investors, Inc., is considering the purchase of a $345,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line method, at which time it will be worth $78,000. The computer will replace two office employees whose combined annual salaries are $89,000. The machine will also immediately lower the firm's required net working capital by $78,000. This amount of net working capital will need to be replaced once the machine is sold. The corporate tax rate is 23 percent. The appropriate discount rate is 11 percent. FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($. etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Is it worthwhile to buy the computer? Yes No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started