Answered step by step

Verified Expert Solution

Question

1 Approved Answer

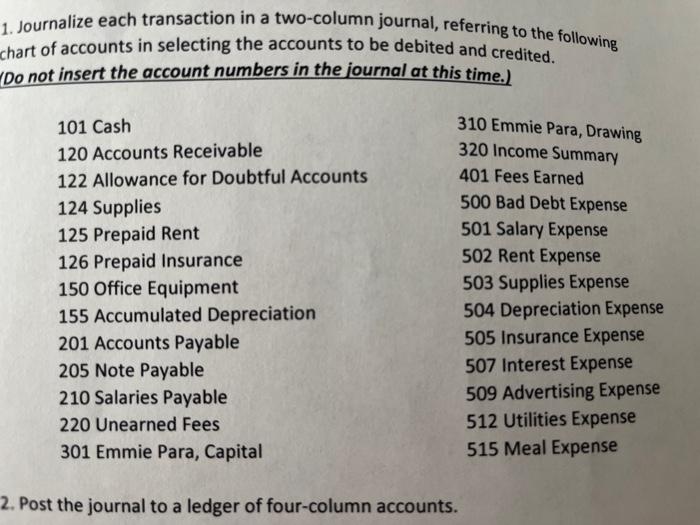

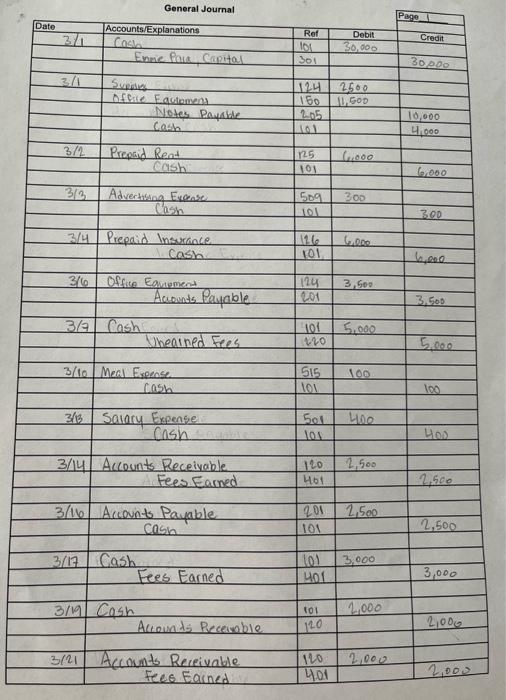

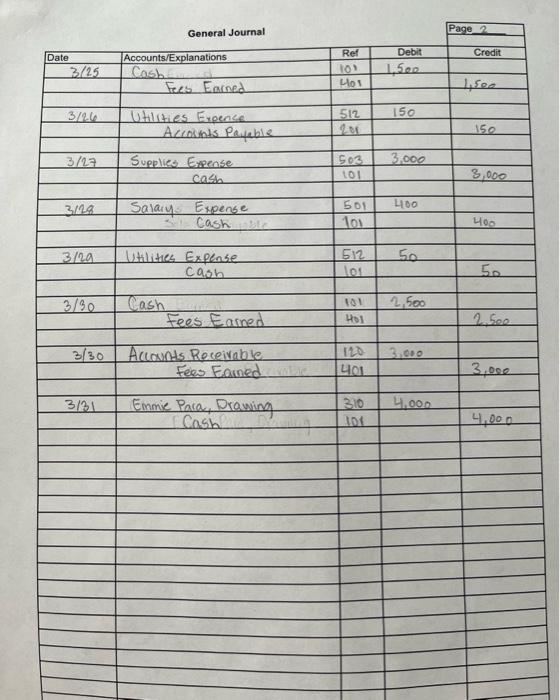

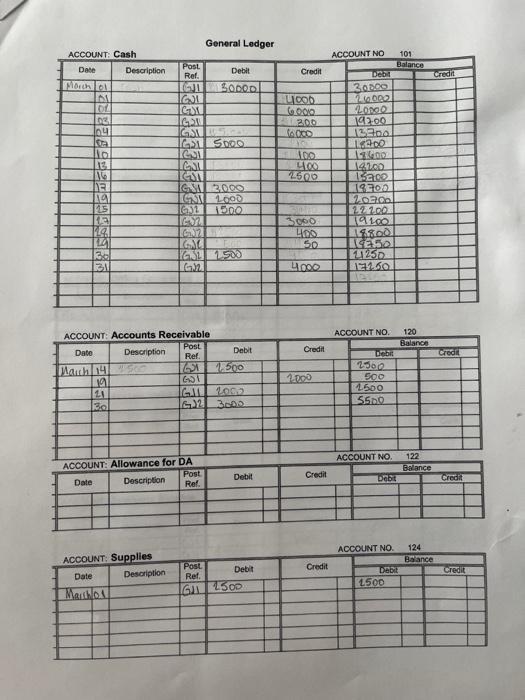

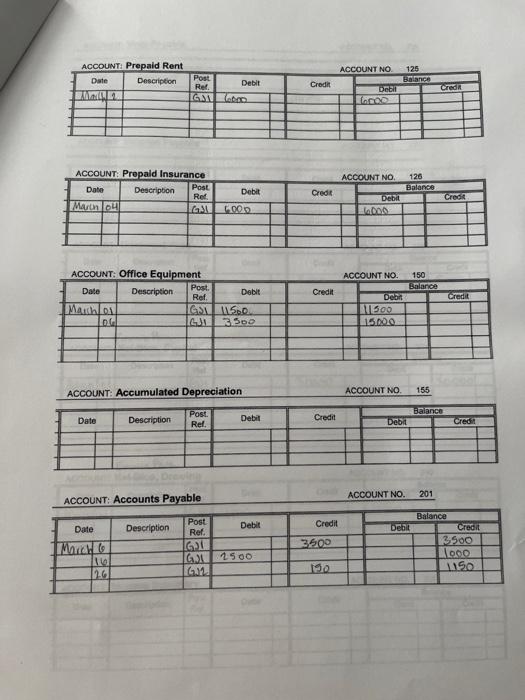

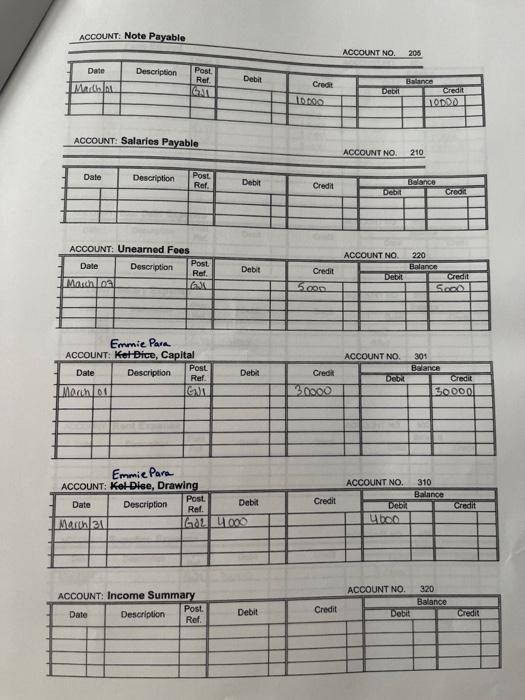

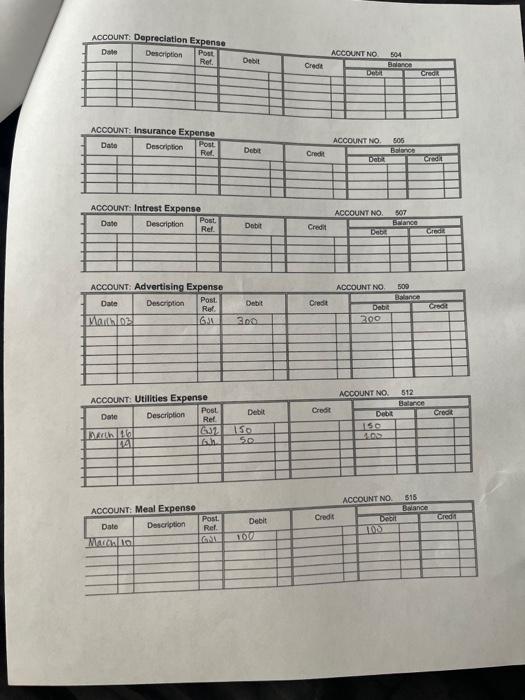

I have a few questions from my accounting class I would like help on. I will include pictures of all the information that is needed

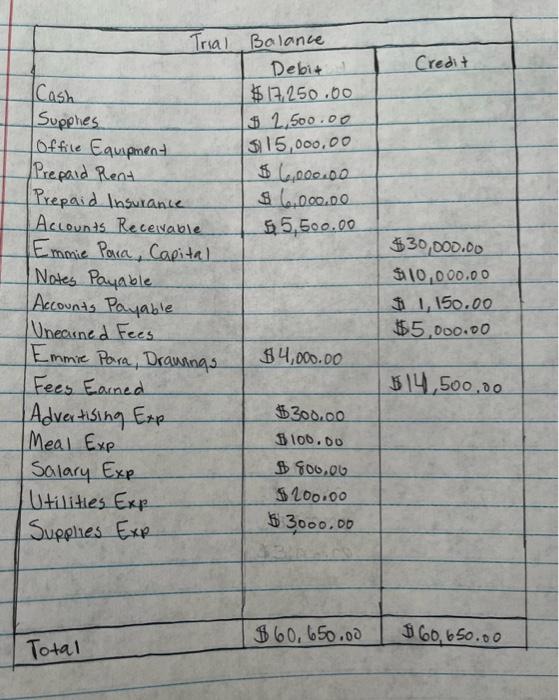

I have a few questions from my accounting class I would like help on. I will include pictures of all the information that is needed to complete these questions.

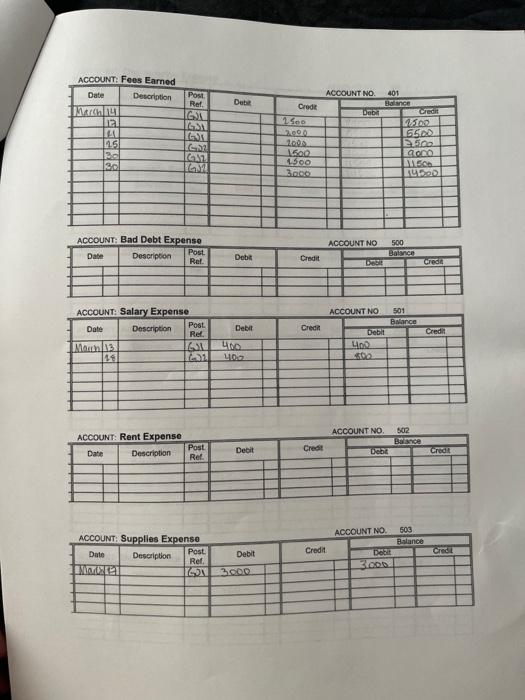

4. Journalize and post the adjusting entries:

a) One month of insurance has expired.

b) Supplies on hand at the end of the month are $2000.

c) Accrued receptionist salary for the remainder of the month is $100.

d) One month of rent was used.

e) Unearned fees at the end of the month are $1500.

f) $2000 of fees needs to be accrued.

g) Calculate the interest for one month on the Note Payable using a 6% interest rate. (Use the note payable account and round to the nearest whole number)

h) Depreciation of office equipment for the month based on SL depreciation over 5 years. (Round to the nearest whole number)

i) Bad debt is 2% of sales for the month. (Round to the nearest whole number)

5. Prepare the adjusted trial balance for the end of the month.

6. Prepare an income statement, a statement of owner's equity, and a classified balance sheet for the end of the month.

7. Journalize and post the closing entries. (Income Summary is account #320 in the chart of accounts) Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry.

8. Prepare a post-closing trial balance for the end of the month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started