I have a homework i need help with in Finance and Investment. Attached is the questions.

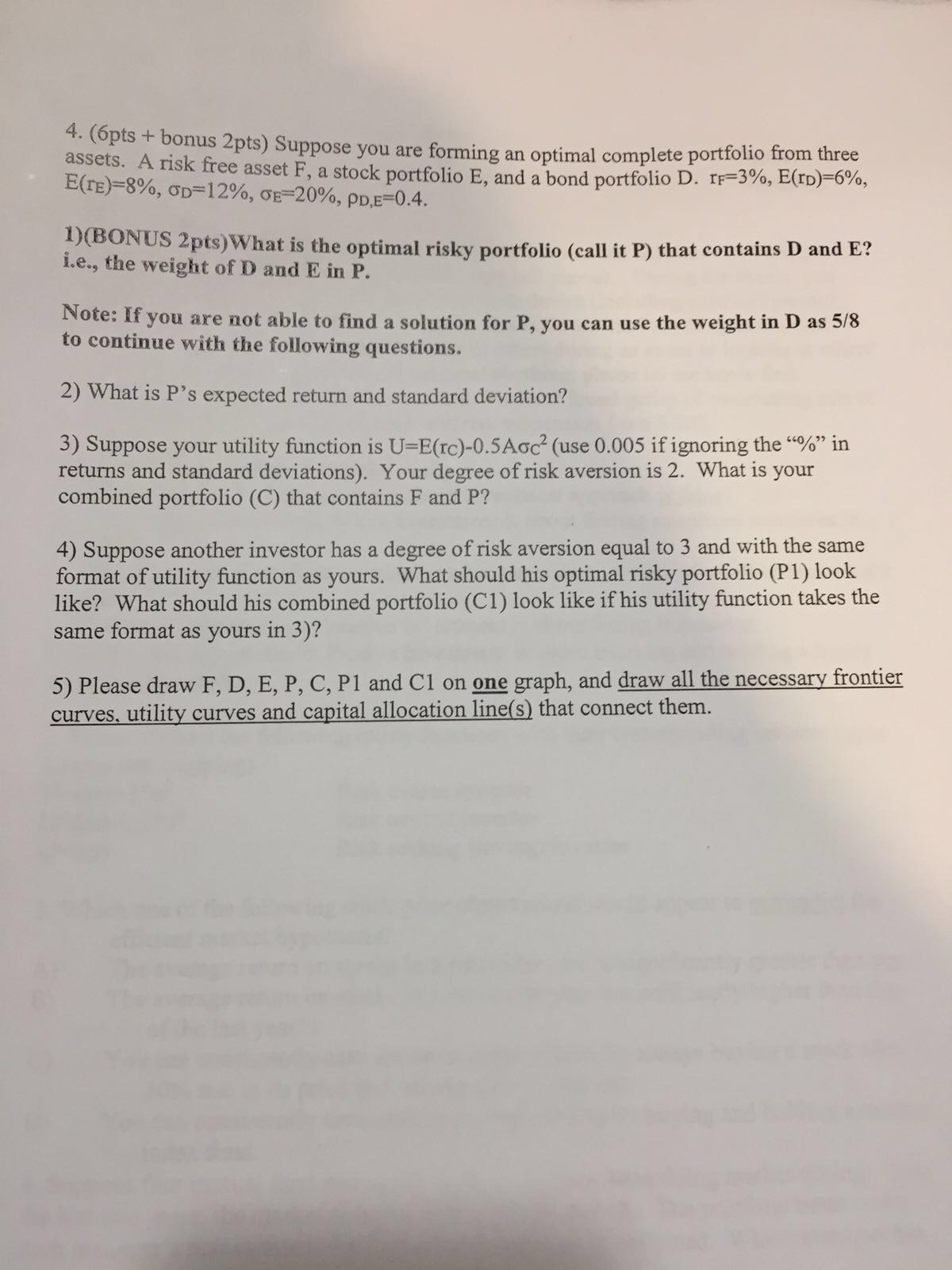

Suppose you are forming an optimal complete portfolio from three assets. A risk free asset F, a stock portfolio E, and a bond portfolio D. r_F=3%, E(r_D)=6%, E(r_E)=8%, sigma_D=12%, Rho_D,E=0.4. What is the optimal risky portfolio (call it P) that contains D and E? i.e., the weight of D and E in P. Note: If you are not able to find a solution for P, you can use the weight in D as 5/8 to continue with the following questions. What is P's expected return and standard deviation? Suppose your utility function is U=E(rc)-0.5Aoc2 (use 0.005 if ignoring the "%" in returns and standard deviations). Your degree of risk aversion is 2. What is your combined portfolio (C) that contains F and P? Suppose another investor has a degree of risk aversion equal to 3 and with the same format of utility function as yours. What should his optimal risky portfolio (PI) look like? What should his combined portfolio (C1) look like if his utility function takes the same format as yours in 3)? Please draw F, D, E, P, C, P1 and C1 on one graph, and draw all the necessary frontier curves, utility curves and capital allocation line(s) that connect them. Suppose you are forming an optimal complete portfolio from three assets. A risk free asset F, a stock portfolio E, and a bond portfolio D. r_F=3%, E(r_D)=6%, E(r_E)=8%, sigma_D=12%, Rho_D,E=0.4. What is the optimal risky portfolio (call it P) that contains D and E? i.e., the weight of D and E in P. Note: If you are not able to find a solution for P, you can use the weight in D as 5/8 to continue with the following questions. What is P's expected return and standard deviation? Suppose your utility function is U=E(rc)-0.5Aoc2 (use 0.005 if ignoring the "%" in returns and standard deviations). Your degree of risk aversion is 2. What is your combined portfolio (C) that contains F and P? Suppose another investor has a degree of risk aversion equal to 3 and with the same format of utility function as yours. What should his optimal risky portfolio (PI) look like? What should his combined portfolio (C1) look like if his utility function takes the same format as yours in 3)? Please draw F, D, E, P, C, P1 and C1 on one graph, and draw all the necessary frontier curves, utility curves and capital allocation line(s) that connect them