Question

I have a practice set due soon. and I just want to check my answers to make sure I'm doing it right. Required #1 Using

I have a practice set due soon. and I just want to check my answers to make sure I'm doing it right.

Required #1

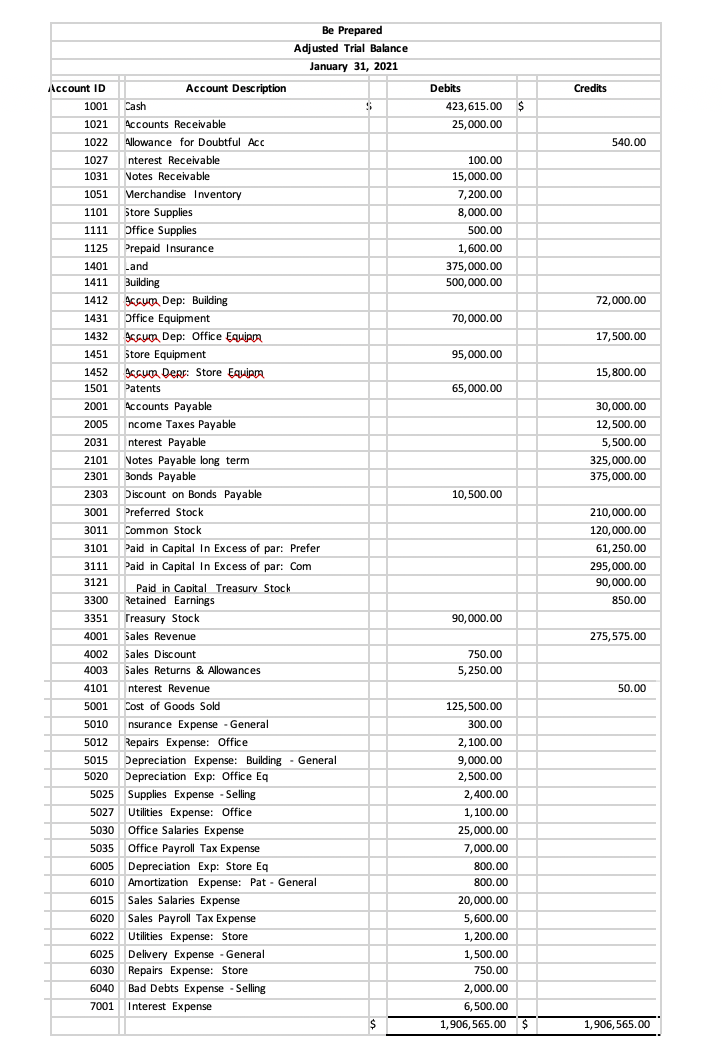

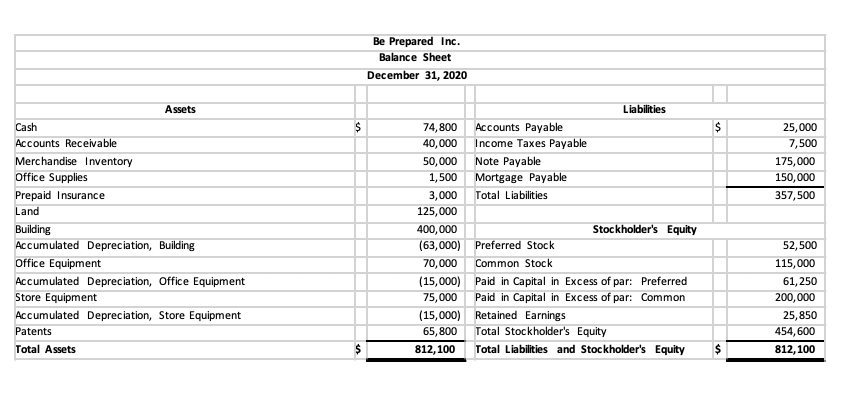

Using Be Prepared, Inc.s adjusted trial balance and prior periods balance sheet, prepare the following Financial Reports:

- Multi-Step Income Statement for the month of January 2021 (see page 181 in your textbook for guidance).

- Statement of Retained Earnings for the month of January 2021 (see page 479 in your textbook for guidance). Note: There are no prior period adjustments and all dividends declared and paid are cash dividends in the amount of $25,000.

- Comparative Balance Sheet for the months of December 2020 and January 2021 (See page 616 in your textbook for guidance

Required #2

Use the Comparative Balance Sheet you prepared in Required #1, step #3 and the following additional information to prepare the Statement of Cash Flows for the month of January 2021. Use the indirect method to prepare the operating activities section.

- Issued 10,000 new shares of common stock in exchange for a Building. The stock was selling on the market at an average price of $10 per share on the date of sale and the par value of the stock was 50 cents.

- Purchased land with a cost $250,000. A down payment was made in the amount of $100,000 cash and a 10% 5-year note payable was signed for the difference.

- Purchased additional store equipment for $20,000 paying cash.

- The $15,000 notes receivable was related to the sale of merchandise inventory to a credit customer this period. Hint: The increase in notes receivable should be reported as an addition to the operating activities section of the statement of cash flows.

- Issued bonds with a face amount of $375,000 at 97. Hint: The amortization of the bond discount in the amount of $750 should be reported as an addition to the operating activities section.

- Used the cash proceeds from the bond issue to pay off the mortgage payable of $150,000.

- The company repurchased 20,000 shares of its common stock on the open market for $9 per share.

- The company reissued 10,000 of the treasury shares at a price of $18 per share.

- Issued 1,500 shares of preferred stock at $105 per share.

- Paid cash dividends of $25,000 to preferred and common stockholders.

Required #3

Prepare the following Ratios for January 2021:

- Current Ratio

- Acid-Test Ratio

- Debt Ratio

- Profit Margin Ratio

- Gross Margin Ratio

Thank you so much!

Thank you so much!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started