I have a project and we should do an excl with calculation

I mean, roughly the prices we expect for (car services and repair) project

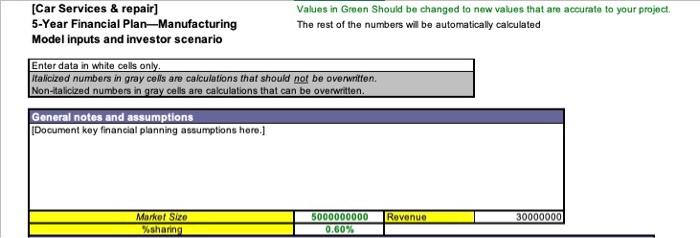

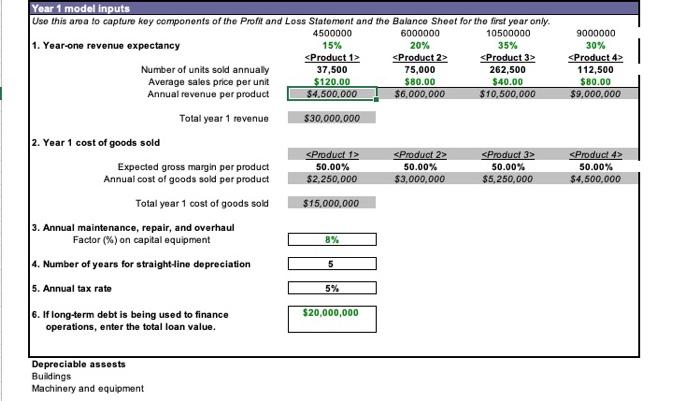

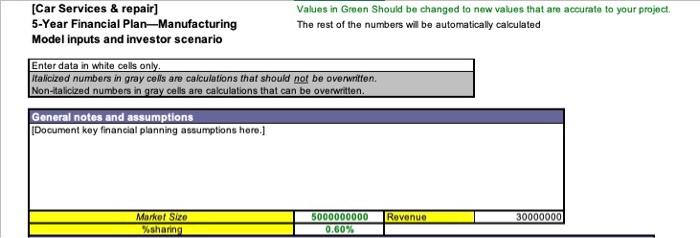

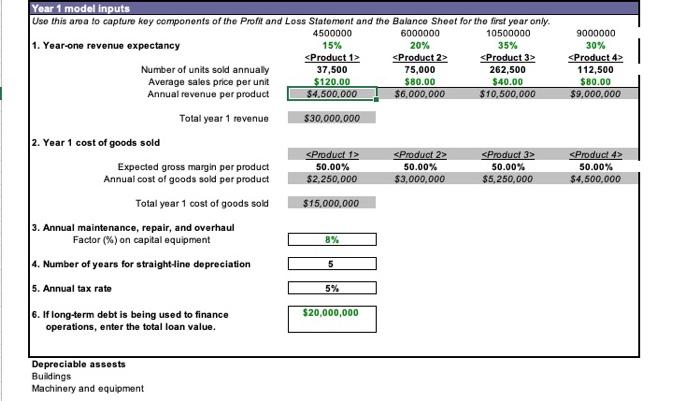

[Car Services & repair] 5-Year Financial Plan-Manufacturing Model inputs and investor scenario Values in Green Should be changed to new values that are accurate to your project. The rest of the numbers will be automatically calculated Enter data in white cells only. Italicized numbers in gray cells are calculations that should not be overwritten Non-italicized numbers in gray cells are calculations that can be overwritten. General notes and assumptions Document key financial planning assumptions horo.] 5000000000 0.60% Rovenue Market Size %sharing 30000000 9000000 6000000 20% 15% 35% 30% Year 1 model inputs Use this area to capture key components of the Profit and Loss Statement and the Balance Shoot for the first year only. 4500000 10500000 1. Year-one revenue expectancy

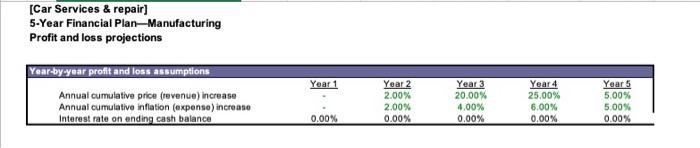

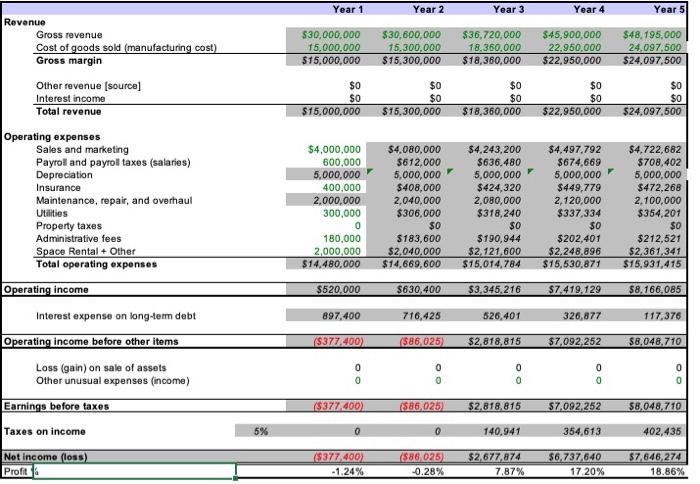

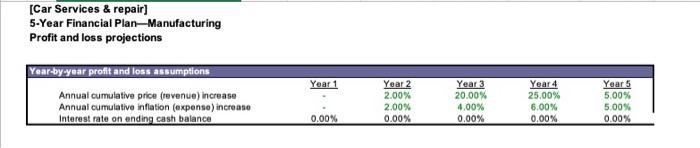

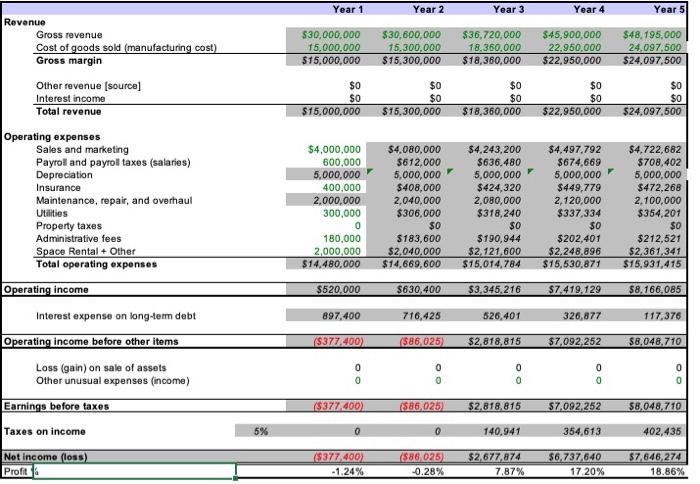

Number of units sold annually 37,500 75,000 262,500 Average sales price per unit $120.00 $80.00 $40.00 Annual revenue per product $4.500.000 $6,000,000 $10,500,000 112,500 $80.00 $9,000,000 Total year 1 revenue $30.000.000 2. Year 1 cost of goods sold Expected gross margin per product Annual cost of goods sold per product 50.00% $2,250,000 50.00% $4.500.000 Total year 1 cost of goods sold $15,000,000 3. Annual maintenance, repair, and overhaul Factor (%) on capital equipment 8% 5 5% 4. Number of years for straight-line depreciation 5. Annual tax rate 6. If long-term debt is being used to finance operations, enter the total loan value. $20,000,000 Depreciable assests Buildings Machinery and equipment [Car Services & repair] 5-Year Financial Plan-Manufacturing Profit and loss projections Year-by-year profit and loss assumptions Year 1 Annual cumulative price (revenue) increase Annual cumulative inflation (expense) increase Interest rate on ending cash balance Year 2 2.00% 2.00% 0.00% Year 3 20.00% 4.00% 0.00% Year 4 25.00% 6.00% 0.00% Year 5 5.00% 5.00% 0.00% 0.00% Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Gross revenue Cost of goods sold (manufacturing cost) Gross margin $30,000,000 15.000.000 $15.000.000 $30,600,000 15,300,000 $15.300.000 $36,720,000 18,360,000 $18,360.000 $45,900,000 22,950,000 $22.950.000 $48,195,000 24.097,500 $24,097,500 Other revenue (source) Interest income Total revenue $0 $0 $0 $0 $0 $0 $18,360,000 $0 $0 $22.950.000 $0 $0 $24,097,500 $15,000,000 $15.300.000 Operating expenses Sales and marketing Payroll and payroll taxes (salaries) Depreciation Insurance Maintenance, repair, and overhaul Utilities Property taxes Administrative fees Space Rental + Other Total operating expenses $4,000,000 600,000 5.000.000 400,000 2,000,000 300,000 0 180,000 2,000,000 $14.480,000 $4.080.000 5612,000 5,000,000 $408,000 2,040,000 $306,000 $0 $183,600 $2,040.000 $14,669,600 $4,243,200 $636.480 5,000,000 $424,320 2,080,000 $318,240 $0 $190,944 $2.121.600 $15.014,784 $4,497.792 $674,669 5,000,000 $449,779 2,120,000 $337,334 $0 $202,401 $2.248.896 $15,530,871 $4.722,682 $708,402 5,000,000 $472,268 2,100,000 $354,201 $0 $212,521 $2.361.341 $15.931,415 Operating income $520,000 $630,400 $3,345,216 $7.419.129 58.166,085 Interest expense on long-term debt 897.400 716,425 526,401 326,877 117,376 Operating income before other items ($377,400) ($86,025) $2,818,815 $7,092,252 $8,048.710 0 0 0 0 0 Loss (gain) on sale of assets Other unusual expenses (income) 0 0 0 0 (3377.400) (586,025) $2.818.815 $7.092.252 $8.048.710 Earnings before taxes Taxes on income 5% 0 0 140.941 354,613 402,435 Net Income (loss) Profit ($3774400) -1.24% (586 025) -0.28% $2,677,874 7.87% $6,737,640 17 20% $7.646.274 18.86% [Car Services & repair] 5-Year Financial Plan-Manufacturing Model inputs and investor scenario Values in Green Should be changed to new values that are accurate to your project. The rest of the numbers will be automatically calculated Enter data in white cells only. Italicized numbers in gray cells are calculations that should not be overwritten Non-italicized numbers in gray cells are calculations that can be overwritten. General notes and assumptions Document key financial planning assumptions horo.] 5000000000 0.60% Rovenue Market Size %sharing 30000000 9000000 6000000 20% 15% 35% 30% Year 1 model inputs Use this area to capture key components of the Profit and Loss Statement and the Balance Shoot for the first year only. 4500000 10500000 1. Year-one revenue expectancy Number of units sold annually 37,500 75,000 262,500 Average sales price per unit $120.00 $80.00 $40.00 Annual revenue per product $4.500.000 $6,000,000 $10,500,000 112,500 $80.00 $9,000,000 Total year 1 revenue $30.000.000 2. Year 1 cost of goods sold Expected gross margin per product Annual cost of goods sold per product 50.00% $2,250,000 50.00% $4.500.000 Total year 1 cost of goods sold $15,000,000 3. Annual maintenance, repair, and overhaul Factor (%) on capital equipment 8% 5 5% 4. Number of years for straight-line depreciation 5. Annual tax rate 6. If long-term debt is being used to finance operations, enter the total loan value. $20,000,000 Depreciable assests Buildings Machinery and equipment [Car Services & repair] 5-Year Financial Plan-Manufacturing Profit and loss projections Year-by-year profit and loss assumptions Year 1 Annual cumulative price (revenue) increase Annual cumulative inflation (expense) increase Interest rate on ending cash balance Year 2 2.00% 2.00% 0.00% Year 3 20.00% 4.00% 0.00% Year 4 25.00% 6.00% 0.00% Year 5 5.00% 5.00% 0.00% 0.00% Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Gross revenue Cost of goods sold (manufacturing cost) Gross margin $30,000,000 15.000.000 $15.000.000 $30,600,000 15,300,000 $15.300.000 $36,720,000 18,360,000 $18,360.000 $45,900,000 22,950,000 $22.950.000 $48,195,000 24.097,500 $24,097,500 Other revenue (source) Interest income Total revenue $0 $0 $0 $0 $0 $0 $18,360,000 $0 $0 $22.950.000 $0 $0 $24,097,500 $15,000,000 $15.300.000 Operating expenses Sales and marketing Payroll and payroll taxes (salaries) Depreciation Insurance Maintenance, repair, and overhaul Utilities Property taxes Administrative fees Space Rental + Other Total operating expenses $4,000,000 600,000 5.000.000 400,000 2,000,000 300,000 0 180,000 2,000,000 $14.480,000 $4.080.000 5612,000 5,000,000 $408,000 2,040,000 $306,000 $0 $183,600 $2,040.000 $14,669,600 $4,243,200 $636.480 5,000,000 $424,320 2,080,000 $318,240 $0 $190,944 $2.121.600 $15.014,784 $4,497.792 $674,669 5,000,000 $449,779 2,120,000 $337,334 $0 $202,401 $2.248.896 $15,530,871 $4.722,682 $708,402 5,000,000 $472,268 2,100,000 $354,201 $0 $212,521 $2.361.341 $15.931,415 Operating income $520,000 $630,400 $3,345,216 $7.419.129 58.166,085 Interest expense on long-term debt 897.400 716,425 526,401 326,877 117,376 Operating income before other items ($377,400) ($86,025) $2,818,815 $7,092,252 $8,048.710 0 0 0 0 0 Loss (gain) on sale of assets Other unusual expenses (income) 0 0 0 0 (3377.400) (586,025) $2.818.815 $7.092.252 $8.048.710 Earnings before taxes Taxes on income 5% 0 0 140.941 354,613 402,435 Net Income (loss) Profit ($3774400) -1.24% (586 025) -0.28% $2,677,874 7.87% $6,737,640 17 20% $7.646.274 18.86%