Question

I have a project where I need to compose a small portfolio of stocks based on a 5 year time horizon. I must be able

I have a project where I need to compose a small portfolio of stocks based on a 5 year time horizon.

I must be able to show expected and required return, and the [expected] ending value of the investment after the 5 year period.

- How can I calculate the expected returns for five years? I only know how to do them for one year. Yahoo Finance provides the table below. Can I use the "Next 5 Years (per annum)" as a reference for expected return? Is the 64.35% number for each year, or is it the total for all five?

| Growth Estimates | TMUS | Industry | Sector(s) | S&P 500 |

|---|---|---|---|---|

| Current Qtr. | 163.20% | N/A | N/A | N/A |

| Next Qtr. | 1,955.60% | N/A | N/A | N/A |

| Current Year | 233.50% | N/A | N/A | N/A |

| Next Year | 39.70% | N/A | N/A | N/A |

| Next 5 Years (per annum) | 64.35% | N/A | N/A | N/A |

| Past 5 Years (per annum) | -9.90% |

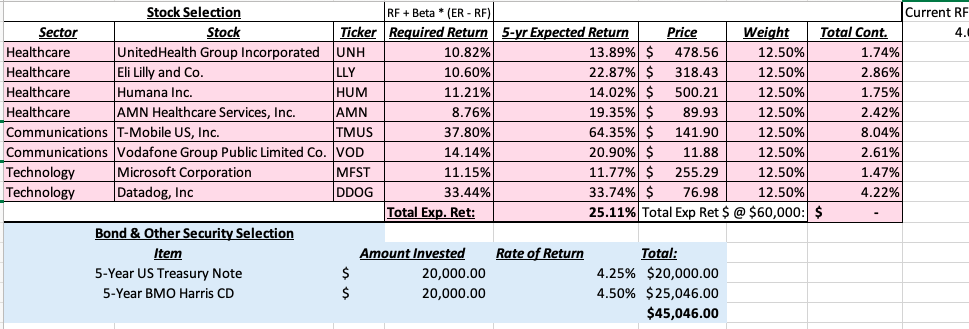

I used this number originally, and for equal weights of eight investments (AMN, DDOG, HUM, LLY, MSFT, TMUS, UNH & VOD) comprising 60% of an investment portfolio I got an annual return of 25.11% which seems impossible. Attached below is my table of calculations. Any advice on how to do this properly would be much appreciated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started