I have a question about #5. The answer is $500(1500*1/3). Can you please explain? Thanks!

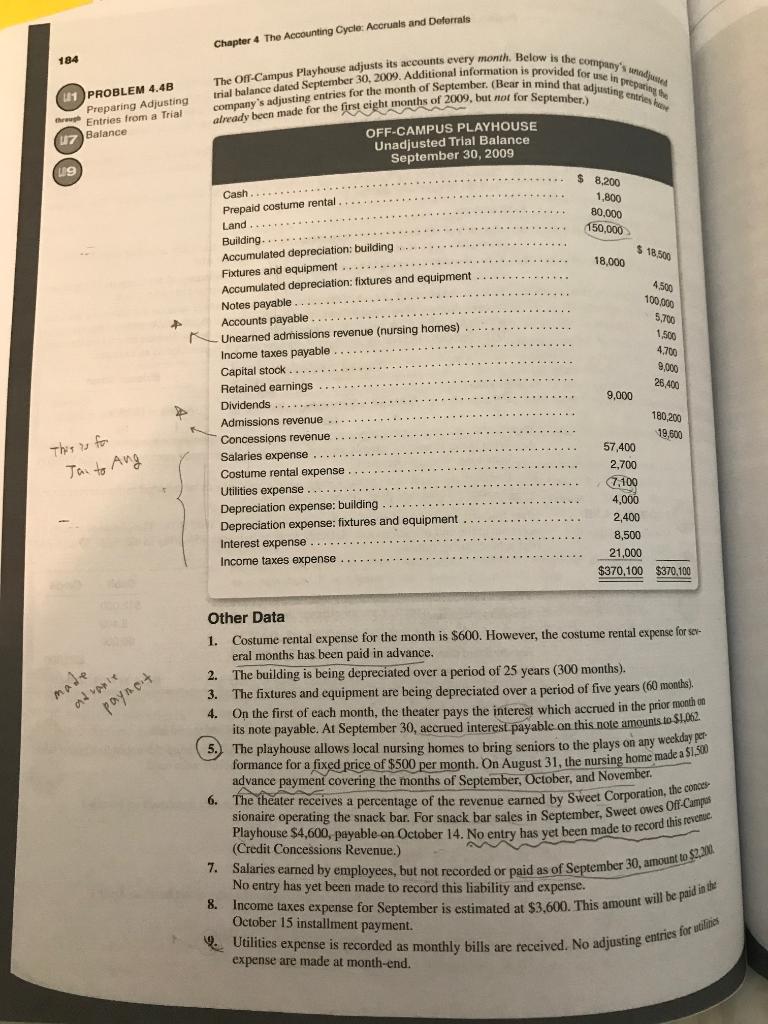

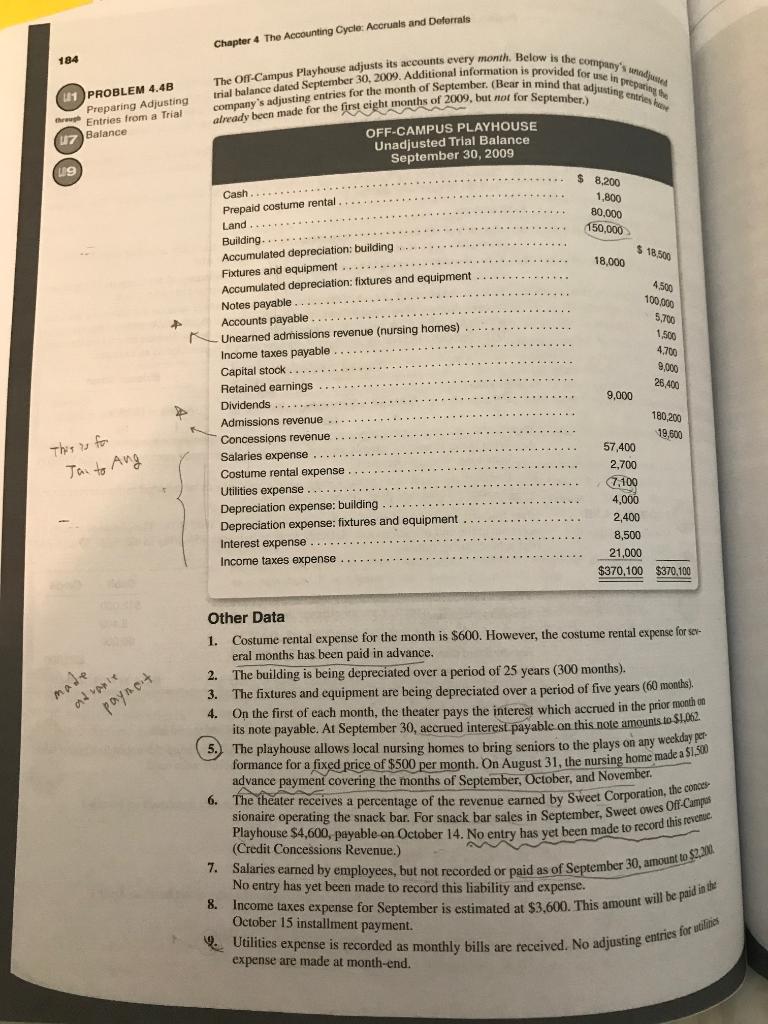

Chapter 4 The Accounting Cycle: Accruals and Deferrals 184 had 11 PROBLEM 4.4B Preparing Adjusting Entries from a Trial trial balance dated September 30, 2009. Additional information is provided for use in the The Off-Campus Playhouse adjusts its accounts every month. Below is the company's neste company's adjusting entries for the month of September. (Bear in mind that adjusting already been made for the first eight months of 2009, but not for September.) OFF-CAMPUS PLAYHOUSE Unadjusted Trial Balance 7 Balance September 30, 2009 19 Cash... Prepaid costume rental $ 8.200 1.800 80.000 150.000 Land. $18.500 18.000 4.500 1000000 5,700 1.500 4.700 8,000 26,400 9,000 Building Accumulated depreciation building Fixtures and equipment Accumulated depreciation: fixtures and equipment Notes payable Accounts payable Unearned admissions revenue (nursing homes) Income taxes payable Capital stock .... Retained earnings Dividends Admissions revenue Concessions revenue Salaries expense Costume rental expense Utilities expense Depreciation expense: building Depreciation expense: fixtures and equipment Interest expense.... Income taxes expense 180,200 19,600 This is for Tai to Ang 57,400 2,700 7.100 4,000 2,400 8,500 21,000 $370,100 $370,100 1. made adanie paynet Other Data Costume rental expense for the month is $600. However, the costume rental expense for sev- eral months has been paid in advance. 2. The building is being depreciated over a period of 25 years (300 months). 3. The fixtures and equipment are being depreciated over a period of five years (60 months). 4. On the first of each month, the theater pays the interest which accrued in the prior month in its note payable. At September 30, accrued interest payable on this note amounts to 81,062 The playhouse allows local nursing homes to bring seniors to the plays on any weekday per formance for a fixed price of $500 per month. On August 31, the nursing home made a $1.500 advance payment covering the months of September, October, and November 6. The theater receives a percentage of the revenue earned by Sweet Corporation, the company sionaire operating the snack bar. For snack bar sales in September, Sweet owes Off-Campus Playhouse $4,600, payable on October 14. (Credit Concessions Revenue.) 7. Salaries earned by employees, but not recorded or paid as of September 30, amount to $2,2. No entry has yet been made to record this liability and expense. 8. Income taxes expense for September is estimated at $3,600. This amount will be paid in the October 15 installment payment. 9. Utilities expense is recorded as monthly bills are received. No adjusting entries for tiles expense are made at month-end. No entry has yet been made to record this revenue