Answered step by step

Verified Expert Solution

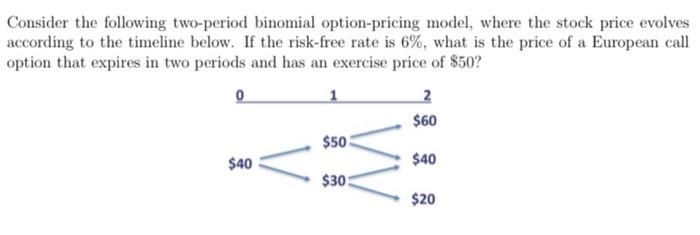

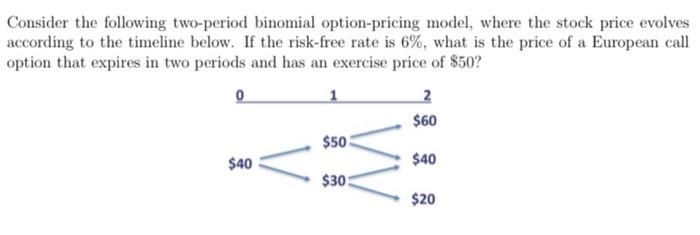

Question

1 Approved Answer

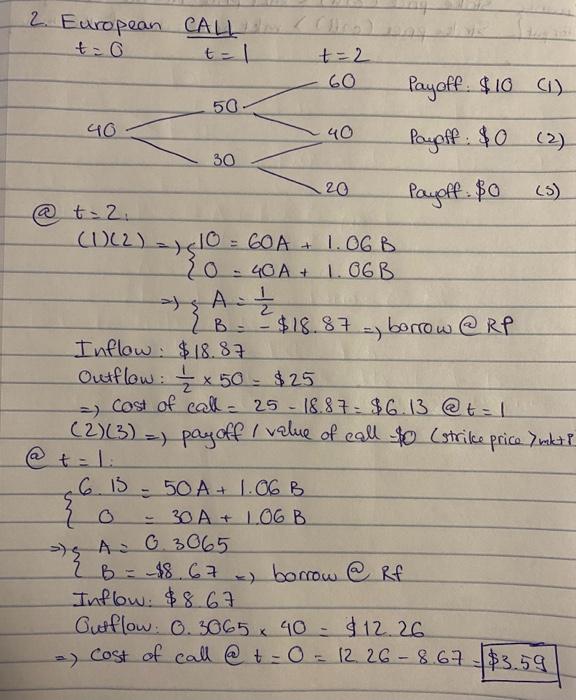

I have a question and a solution to the question as in the 2 pictures below. Can you explain this solution (without using the Black

I have a question and a solution to the question as in the 2 pictures below. Can you explain this solution (without using the Black Scholes formula), especially the inflow and outflow part?

In particular, when is the value of the inflow the value of the bond borrowed at risk free rate, and when is it the value of shorted stock? Does it depend on whether it's a call or put option, or does it depend on whether A (number of stock) or B (bond value) is negative? If so, what if both A and B are positive or negative?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started