Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have a question with answers i just want step by step explanation of the question since i cant understand it. including: - why portfolio

i have a question with answers

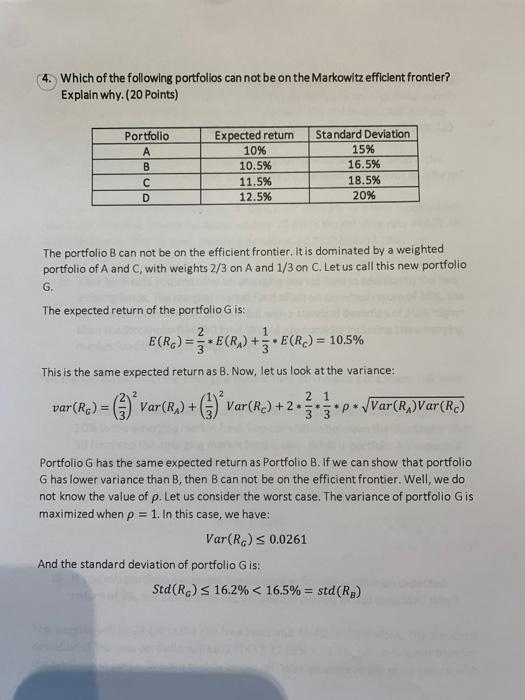

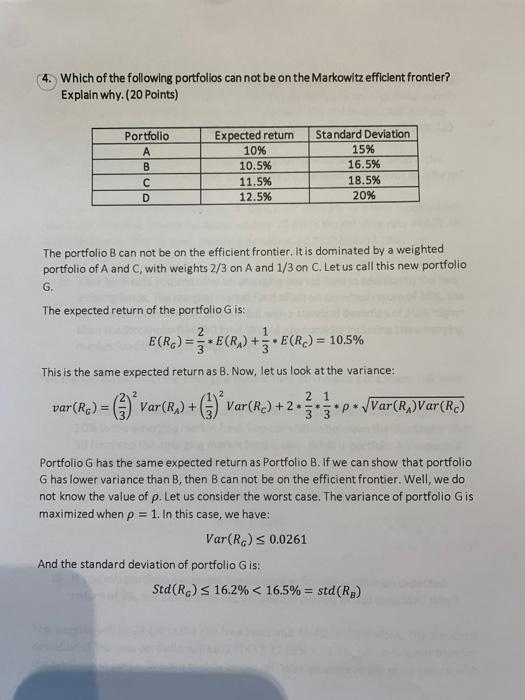

4. Which of the following portfolios can not be on the Markowitz efficient frontier? Explain why. (20 points) Portfolio A B D Expected retum 10% 10.5% 11.5% 12.5% Standard Deviation 15% 16.5% 18.5% 20% The portfolio B can not be on the efficient frontier. It is dominated by a weighted portfolio of A and C, with weights 2/3 on A and 1/3 on C. Let us call this new portfolio G. The expected return of the portfolio G is: 2 ECRC) = E(R.) +5=E(RC) = 10.5% 1 . This is the same expected return as B. Now, let us look at the variance: 2 2 var(RC) = = () Var (8x) + (1) *var (R) +2.p.Var()Var (ra) R 21 3 3 Portfolio G has the same expected return as Portfolio B. If we can show that portfolio G has lower variance than B, then B can not be on the efficient frontier. Well, we do not know the value of p. Let us consider the worst case. The variance of portfolio Gis maximized when p = 1. In this case, we have: Var(R.) s 0.0261 And the standard deviation of portfolio Gis: Std(R) s 16.2% i just want step by step explanation of the question since i cant understand it.

including:

- why portfolio B is weighted by A and C?

why couldnt portfolio B be weighted by any other portfilio combinations? how did they come up with B being weighted by A and c?

- and how did they come up with the weights.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started