I have allocated two countries one is from australia Transurban Group ticker symbol is (TCL.AX) and VENTURE company of singapore and ticker symbol is (V03.SI). website for australian company and singapore company are

I have allocated two countries one is from australia Transurban Group ticker symbol is (TCL.AX) and VENTURE company of singapore and ticker symbol is (V03.SI). website for australian company and singapore company are

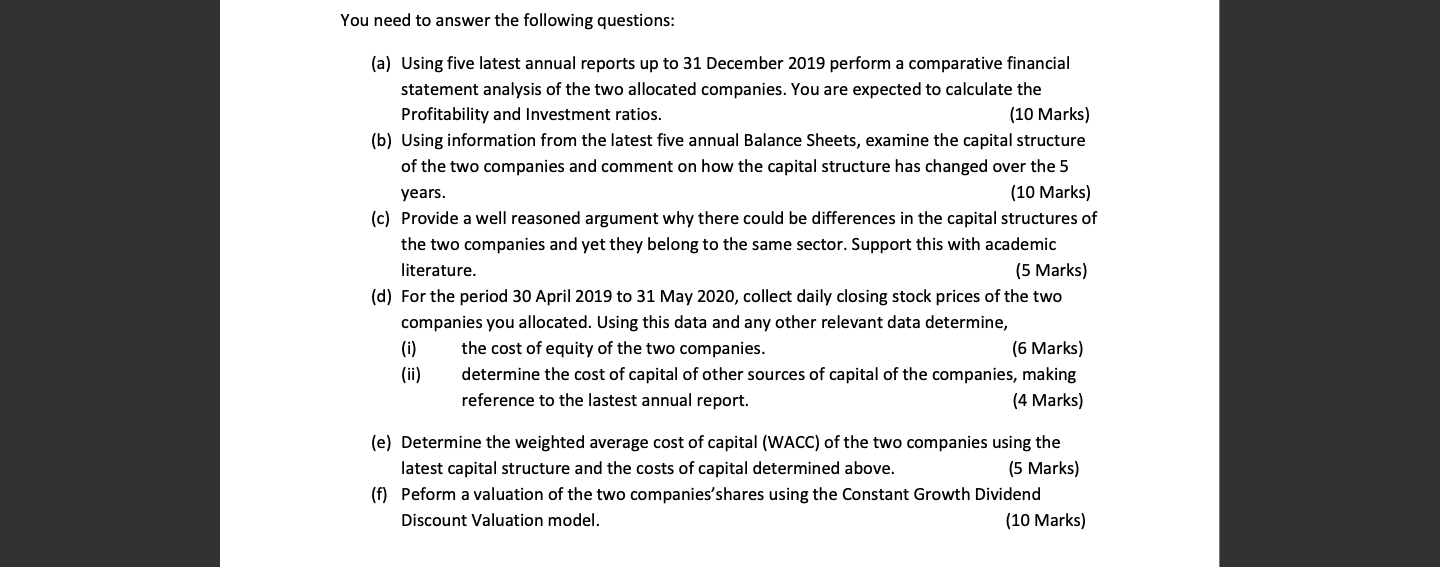

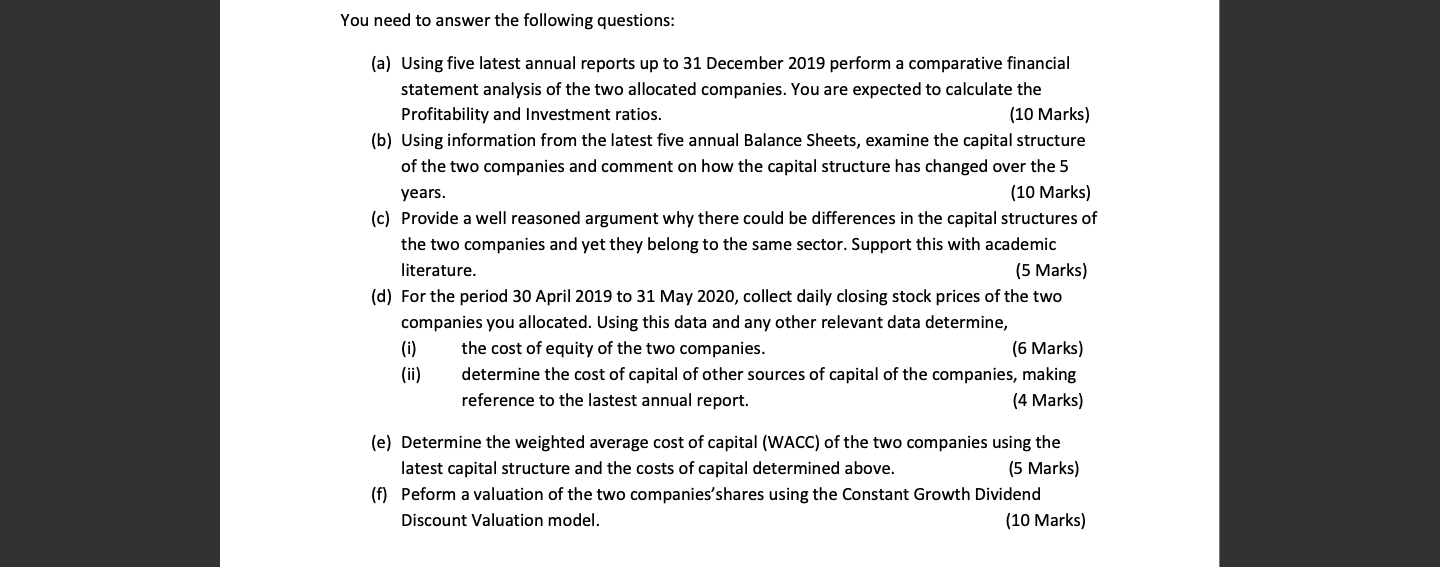

You need to answer the following questions: (a) Using five latest annual reports up to 31 December 2019 perform a comparative financial statement analysis of the two allocated companies. You are expected to calculate the Profitability and Investment ratios. (10 Marks) (b) Using information from the latest five annual Balance Sheets, examine the capital structure of the two companies and comment on how the capital structure has changed over the 5 years. (10 Marks) (c) Provide a well reasoned argument why there could be differences in the capital structures of the two companies and yet they belong to the same sector. Support this with academic literature. (5 Marks) (d) For the period 30 April 2019 to 31 May 2020, collect daily closing stock prices of the two companies you allocated. Using this data and any other relevant data determine, (1) the cost of equity of the two companies. (6 Marks) determine the cost of capital of other sources of capital of the companies, making reference to the lastest annual report. (4 Marks) (e) Determine the weighted average cost of capital (WACC) of the two companies using the latest capital structure and the costs of capital determined above. (5 Marks) (f) Peform a valuation of the two companies'shares using the Constant Growth Dividend Discount Valuation model. (10 Marks) You need to answer the following questions: (a) Using five latest annual reports up to 31 December 2019 perform a comparative financial statement analysis of the two allocated companies. You are expected to calculate the Profitability and Investment ratios. (10 Marks) (b) Using information from the latest five annual Balance Sheets, examine the capital structure of the two companies and comment on how the capital structure has changed over the 5 years. (10 Marks) (c) Provide a well reasoned argument why there could be differences in the capital structures of the two companies and yet they belong to the same sector. Support this with academic literature. (5 Marks) (d) For the period 30 April 2019 to 31 May 2020, collect daily closing stock prices of the two companies you allocated. Using this data and any other relevant data determine, (1) the cost of equity of the two companies. (6 Marks) determine the cost of capital of other sources of capital of the companies, making reference to the lastest annual report. (4 Marks) (e) Determine the weighted average cost of capital (WACC) of the two companies using the latest capital structure and the costs of capital determined above. (5 Marks) (f) Peform a valuation of the two companies'shares using the Constant Growth Dividend Discount Valuation model. (10 Marks)

I have allocated two countries one is from australia Transurban Group ticker symbol is (TCL.AX) and VENTURE company of singapore and ticker symbol is (V03.SI). website for australian company and singapore company are

I have allocated two countries one is from australia Transurban Group ticker symbol is (TCL.AX) and VENTURE company of singapore and ticker symbol is (V03.SI). website for australian company and singapore company are