Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have an exam in financial accounting after 2 days and I don't know anything. These 5 are exercise samples that the teacher sent me.

I have an exam in financial accounting after 2 days and I don't know anything. These 5 are exercise samples that the teacher sent me. Besides solving them if anyone knows any link videos or tutorials that show me the way to solve these questions so I can be able to solve them myself in the exam that would be great

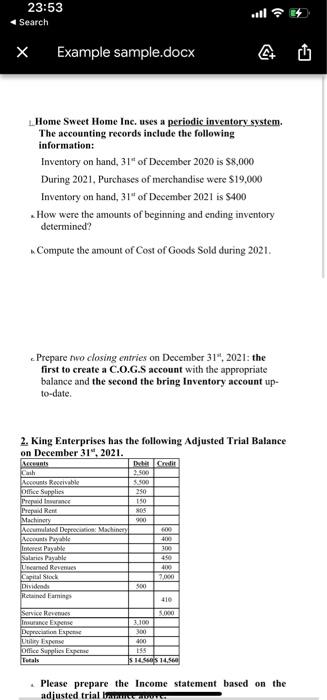

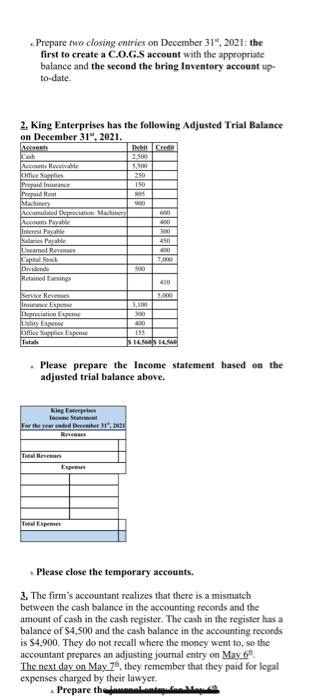

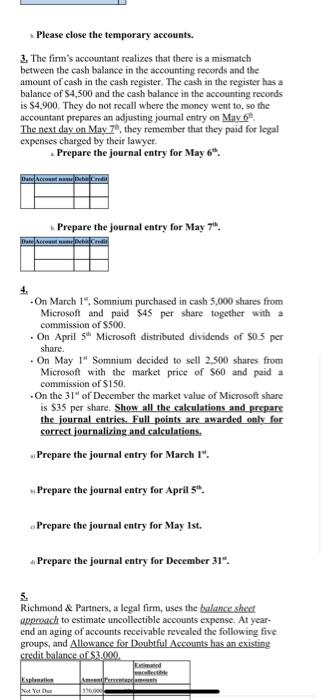

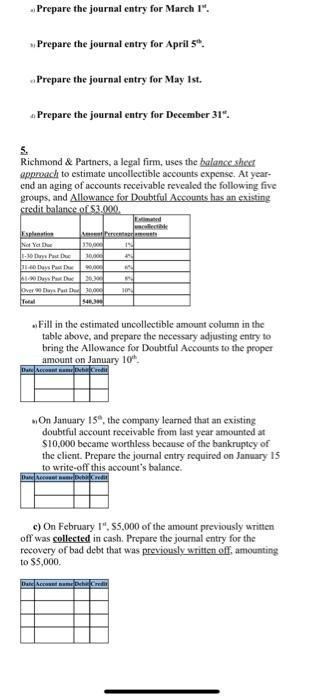

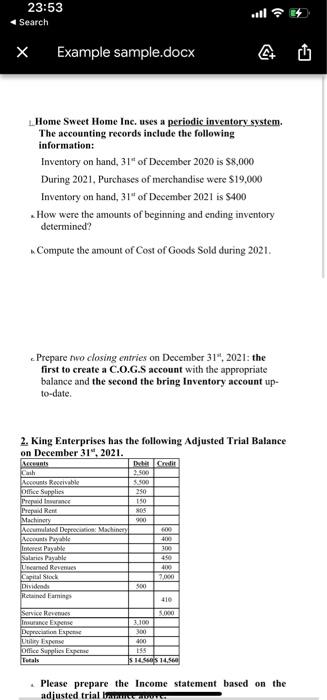

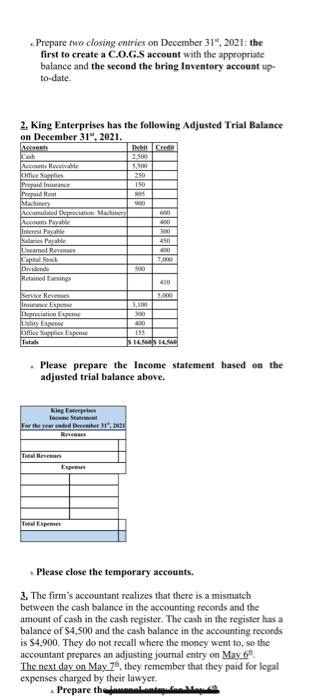

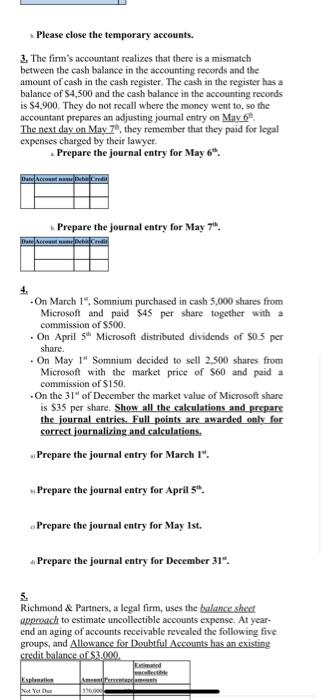

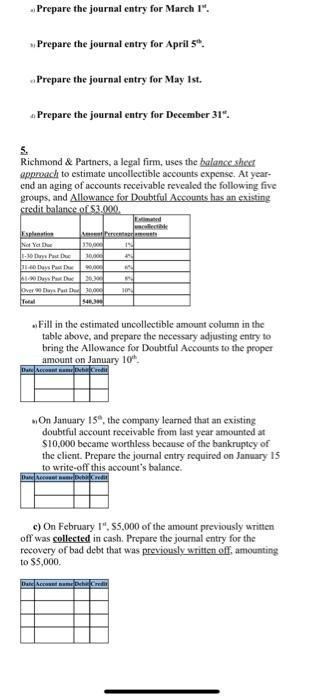

23:53 Search ill? 4 ) X Example sample.docx Home Sweet Home Inc. uses a periodic inventory system. The accounting records include the following information: Inventory on hand, 31* of December 2020 is $8,000 During 2021, Purchases of merchandise were $19.000 Inventory on hand, 31" of December 2021 is $400 How were the amounts of beginning and ending inventory determined? Compute the amount of Cost of Goods Sold during 2021. Prepare no closing entries on December 31", 2021: the first to create a C.O.G.S account with the appropriate balance and the second the bring Inventory account up- to-date 2. King Enterprises has the following Adjusted Trial Balance on December 31, 2021. Mens Credir 00 250 150 MOS 900 Rouss Receivable Office Supplies Proud Proud Row Machinery Accurated Depresion Machinery counts Payable Interest Payable Salaries Payable Uncerned Bene Capital Stock Dividends Rendamine 400 300 450 400 000 SO 410 Service Heves Trance Exam Depreciation Espete Utily Office Supplies Expected SO 2.100 300 100 195 SIGOS 14.5 Please prepare the Income statement based on the adjusted trial Prepare two closing entries on December 31, 2021: the first to create a C.O.G.S account with the appropriate balance and the second the bring Inventory account up- to-date 2. King Enterprises has the following Adjusted Trial Balance on December 31, 2021. The Crew 2.500 Account Receivable 5500 Omer Supplies 250 Prepaid in 1.50 Puidem Machines Accumulated Depreciation Machine 00 AP Interest Pavle Solaris Parabic 450 Lecimed Revens 400 Capital 7,600 Dividende S00 Renderings 410 Service Rey 5.000 Ime Esporte 3,100 Depreciation Dispone 100 Llity Exe 200 Dffice Supplies Espace 155 14.SHES Please prepare the income statement based on the adjusted trial balance above. King Katerprises Ine S For the year de 1071 RS Tv Please close the temporary accounts. 3. The firm's accountant realizes that there is a mismatch between the cash balance in the accounting records and the amount of cash in the cash register. The cash in the register has a balance of $4,500 and the cash balance in the accounting records is $4,900. They do not recall where the money went to, so the accountant prepares an adjusting journal entry on May 6 The next day on May 7, they remember that they paid for legal expenses charged by their lawyer. Prepare the Please close the temporary accounts. 3. The firm's accountant realizes that there is a mismatch between the cash balance in the accounting records and the amount of cash in the cash register. The cash in the register has a balance of $4,500 and the cash balance in the accounting records is $4.900. They do not recall where the money went to, so the accountant prepares an adjusting journal entry on May 6 The next day on May 7, they remember that they paid for legal expenses charged by their lawyer. Prepare the journal entry for May 6. Dr. Account band Prepare the journal entry for May 7 Damaran On March 1", Somnium purchased in cash 5,000 shares from Microsoft and paid 545 per share together with a commission of $500. . On April 5* Microsoft distributed dividends of $0.5 per share. On May 1" Somnium decided to sell 2,500 shares from Microsoft with the market price of $60 and paid a commission of SISO. . On the 31" of December the market value of Microsoft share is $35 per share. Show all the calculations and prepare the journal entries. Full points are awarded only for correct journalizing and calculations. Prepare the journal entry for March 1". Prepare the journal entry for April 5". Prepare the journal entry for May Ist. Prepare the journal entry for December 31". Richmond & Partners, a legal firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year- end an aging of accounts receivable revealed the following five groups, and Allowance for Doubtful Accounts has an existing credit balance of $3.0.0.0 plante Yetu Lendah Prepare the journal entry for March 1". Prepare the journal entry for April 5*. Prepare the journal entry for May Ist. Prepare the journal entry for December 31". S. Richmond & Partners, a legal firm, uses the balance sheer approach to estimate uncollectible accounts expense. At year- end an aging of accounts receivable revealed the following five groups, and Allowance for Doubtful Accounts has an existing credit balance 3.000 th 14 spletne Yet the 390,00 136 Push 10.00 1.Days Pass DPD 20.00 Over de 30 Fill in the estimated uncollectible amount column in the table above, and prepare the necessary adjusting entry to bring the Allowance for Doubtful Accounts to the proper amount on January 10" Darderool medit On January 15, the company learned that an existing doubtful account receivable from last year amounted at S10,000 became worthless because of the bankruptcy of the client. Prepare the journal entry required on January 15 to write-off this account's b s balance Dan Aarariablamil c) On February 1", S5,000 of the amount previously written off was collected in cash. Prepare the journal entry for the recovery of bad debt that was previously written off, amounting to $5,000 Dale unor ( because the teacher will change up the numbers in the exam)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started