Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have answered all of it except 2 parts where it is showing wrong please help me to solve this 2 part. Follow the given

I have answered all of it except 2 parts where it is showing wrong please help me to solve this 2 part. Follow the given format

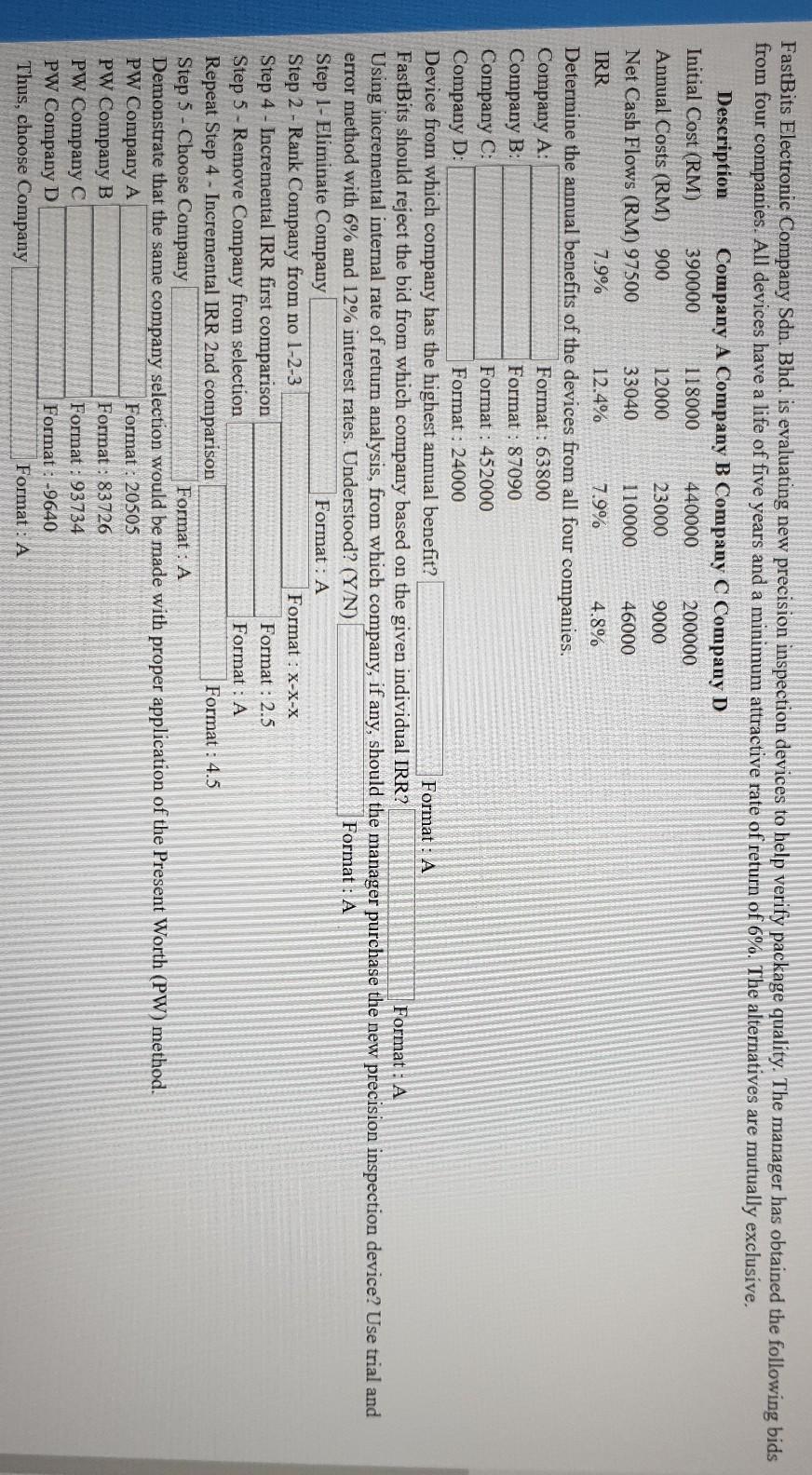

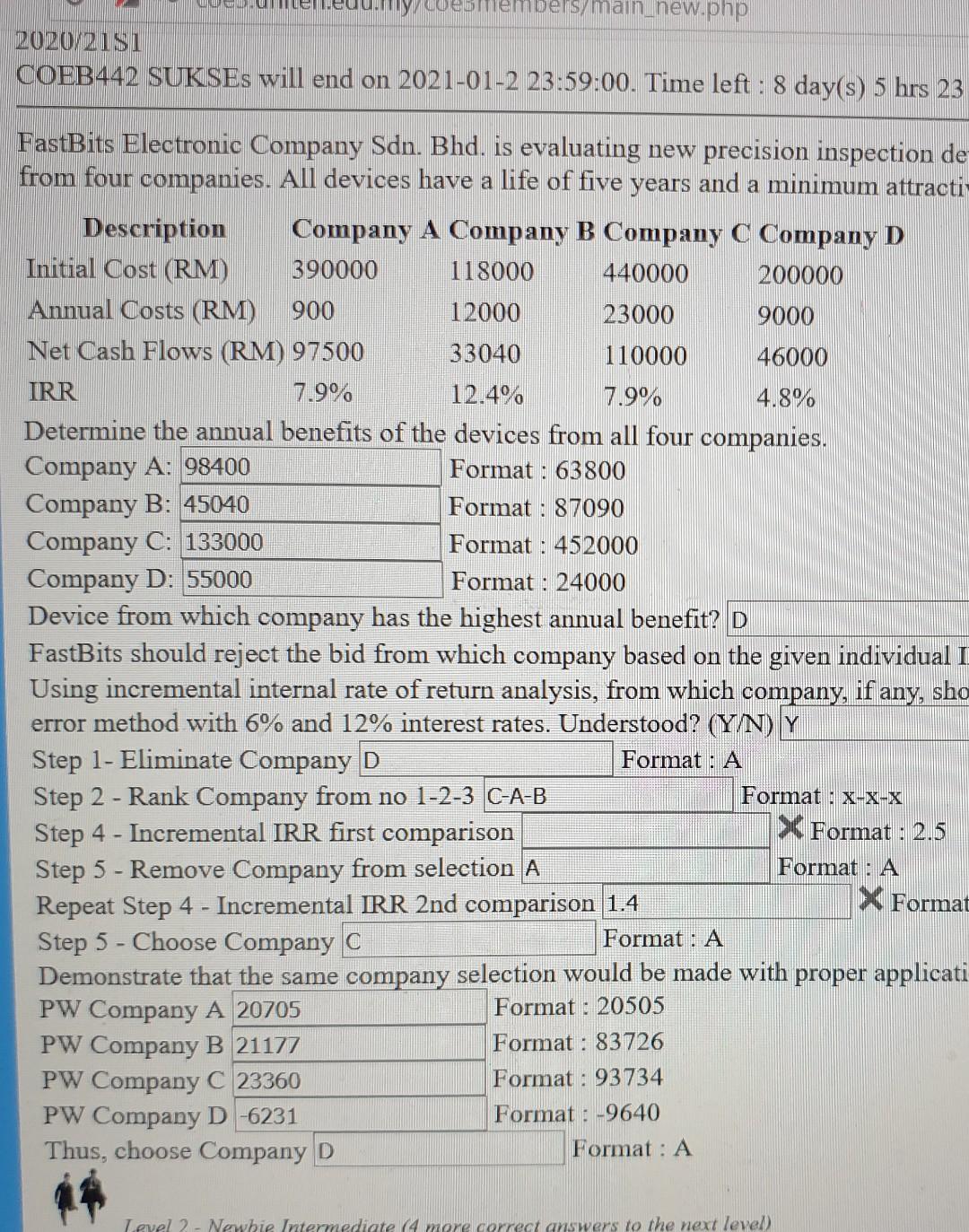

FastBits Electronic Company Sdn. Bhd. is evaluating new precision inspection devices to help verify package quality. The manager has obtained the following bids from four companies. All devices have a life of five years and a minimum attractive rate of return of 6%. The alternatives are mutually exclusive. Description Company A Company B Company C Company D Initial Cost (RM) 390000 118000 440000 200000 Annual Costs (RM) 900 12000 23000 9000 Net Cash Flows (RM) 97500 33040 110000 46000 IRR 7.9% 12.4% 7.9% 4.8% Determine the annual benefits of the devices from all four companies. Company A: Format : 63800 Company B: Format : 87090 Company C: Format : 452000 Company D: Format : 24000 Device from which company has the highest annual benefit? Format : A FastBits should reject the bid from which company based on the given individual IRR? Format : A Using incremental internal rate of return analysis, from which company, if any, should the manager purchase the new precision inspection device? Use trial and error method with 6% and 12% interest rates. Understood? (Y/N) Format : A Step 1- Eliminate Company Format : A Step 2 - Rank Company from no 1-2-3 Format : X-X-X Step 4 - Incremental IRR first comparison Format : 2.5 Step 5 - Remove Company from selection Format : A Repeat Step 4 - Incremental IRR 2nd comparison Format : 4.5 Step 5 - Choose Company Format : A Demonstrate that the same company selection would be made with proper application of the Present Worth (PW) method. PW Company A Format : 20505 PW Company B Format : 83726 PW Company C Format : 93734 PW Company D Format: -9640 Thus, choose Company Format: A euuy esmembers/main_new.php 2020/2151 COEB442 SUKSEs will end on 2021-01-2 23:59:00. Time left : 8 day(s) 5 hrs 23 FastBits Electronic Company Sdn. Bhd. is evaluating new precision inspection de from four companies. All devices have a life of five years and a minimum attracti- Description Company A Company B Company C Company D Initial Cost (RM) 390000 118000 440000 200000 Annual Costs (RM) 900 12000 23000 9000 Net Cash Flows (RM) 97500 33040 110000 46000 IRR 7.9% 12.4% 7.9% 4.8% Determine the annual benefits of the devices from all four companies. Company A: 98400 Format : 63800 Company B: 45040 Format : 87090 Company C: 133000 Format : 452000 Company D: 55000 Format : 24000 Device from which company has the highest annual benefit? D FastBits should reject the bid from which company based on the given individual I Using incremental internal rate of return analysis, from which company, if any, sho error method with 6% and 12% interest rates. Understood? (Y/N) Y Step 1- Eliminate Company D Format: A Step 2 - Rank Company from no 1-2-3 C-A-B Format : x-x-X Step 4 - Incremental IRR first comparison X Format : 2.5 Step 5 - Remove Company from selection A Format : A Repeat Step 4 - Incremental IRR 2nd comparison 1.4 X Format Step 5 - Choose Company C Format: A Demonstrate that the same company selection would be made with proper applicati PW Company A 20705 Format : 20505 PW Company B 21177 Format : 83726 PW Company C 23360 Format : 93734 PW Company D -6231 Format : -9640 Thus, choose Company D Format : A Level 2 - Newbie Intermediate (4 mere correct answers to the next level)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started