Answered step by step

Verified Expert Solution

Question

1 Approved Answer

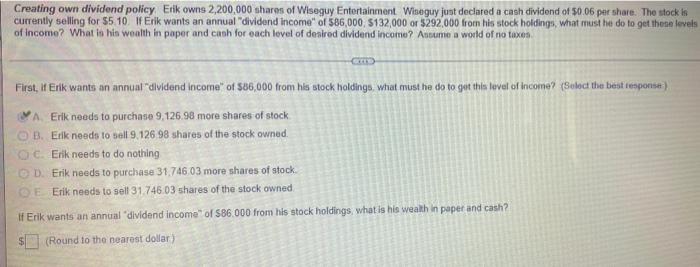

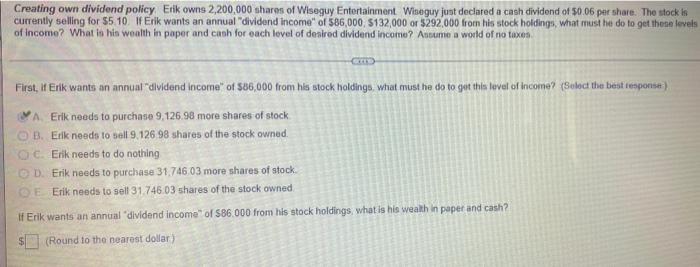

I have answered the 1st question already. I need: if Erik wants an annual dividend income of $86000... Creating own dividend policy Erik owns 2,200,000

I have answered the 1st question already.

Creating own dividend policy Erik owns 2,200,000 shares of Wiseguy Entertainment Wineguy just declared a cash dividend of 50.06 per share. The stock is currently selling for $5 10 Erik wants an annual "dividend income of 586,000, 5132,000 or $292,000 from his stock holdings, what must he do to get the levels of incomo? What to his wealth in paper and cash for each level of desired dividend income? Anume a world of no taxes First, I Erik wants an annual dividend income of $86,000 from his stock holdings, what must he do to get this tovel of income? (Select the best response) A Erik needs to purchase 9,126.98 more shares of stock B. Erik needs to sell 9.126 98 shares of the stock owned. OC. Erik needs to do nothing OD. Erik needs to purchase 31.746.03 more shares of stock. Erik needs to sell 31.746.03 shares of the stock owned If Erik wants an annual dividend income of 586.000 from his stock holdings, what is his wealth in paper and cash? (Round to the nearest dollar I need: "if Erik wants an annual dividend income of $86000...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started