Answered step by step

Verified Expert Solution

Question

1 Approved Answer

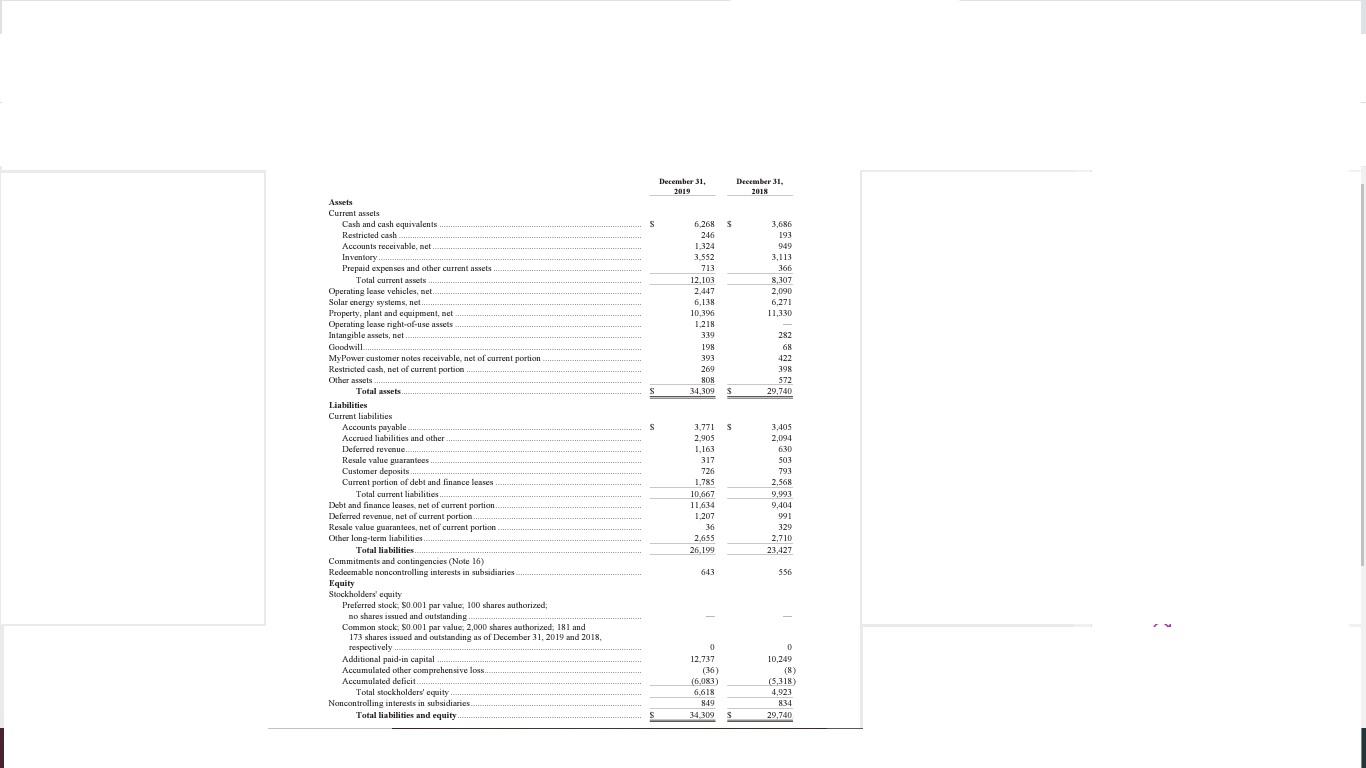

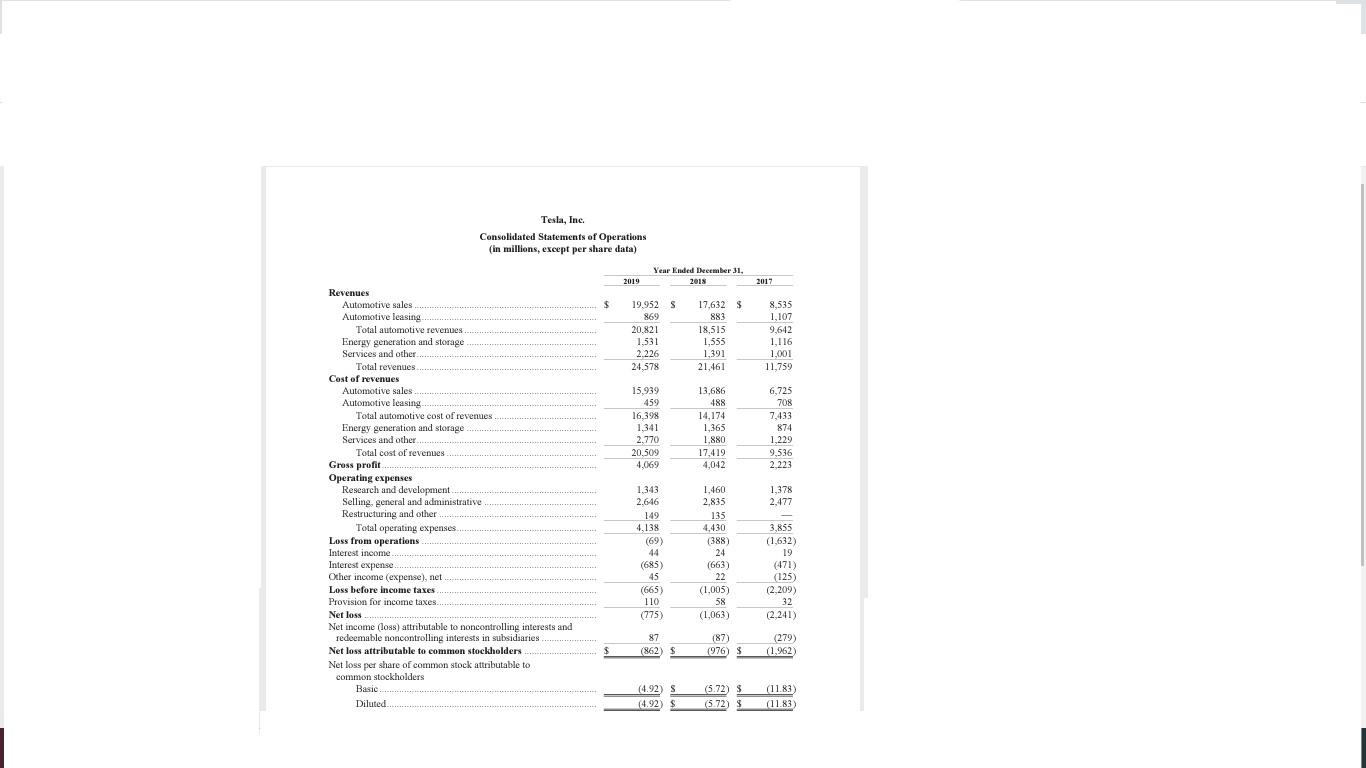

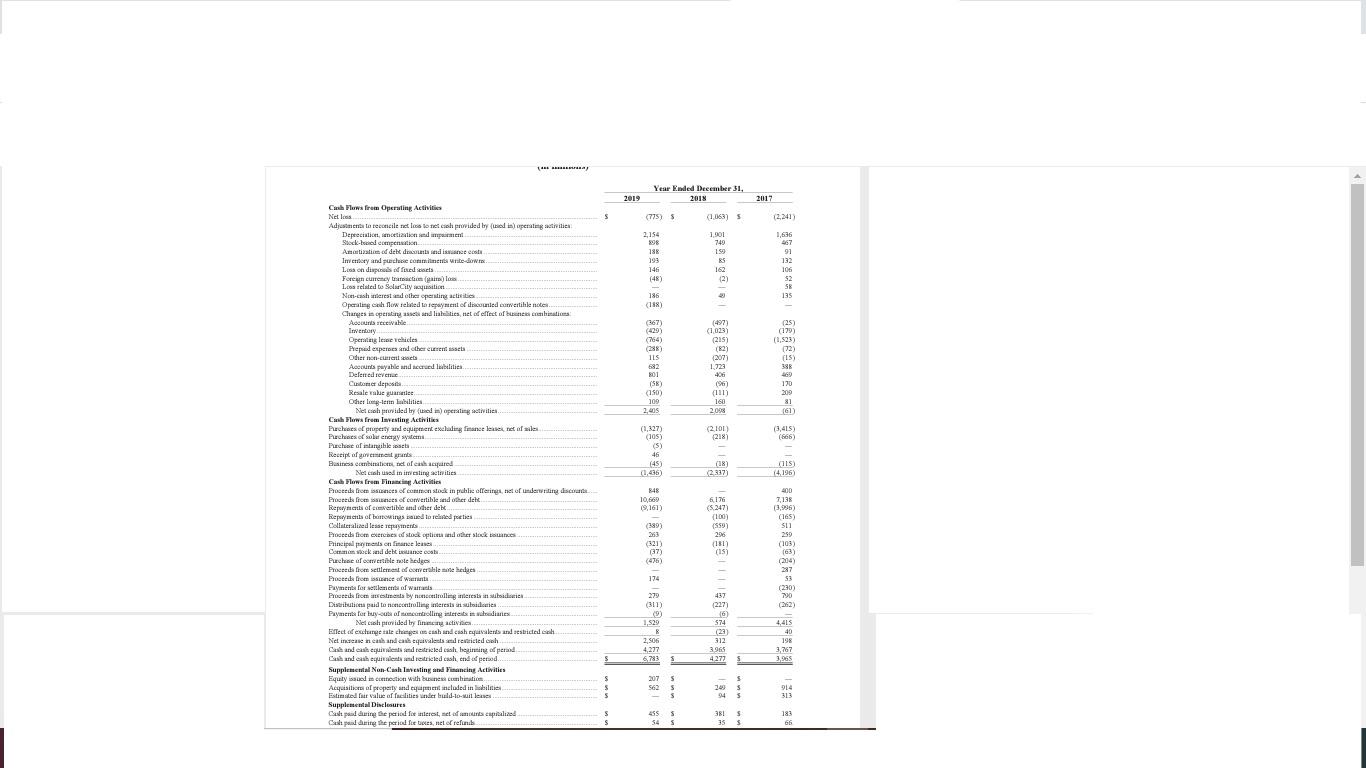

I have attached balance sheet, income statement and cash flow statement please find a). Short term solvency or liquidity ratio, b). Long-term solvency ratio, c).

I have attached balance sheet, income statement and cash flow statement please find a). Short term solvency or liquidity ratio, b). Long-term solvency ratio, c). Asset Utilization turnover ratio, d). Profitability Ratio, e). Market Value Ratio.

Attached:

Balance sheet

Income Statement

Cash flow

Wersale Current cash equivalents an equivalents 726 10 current portion Total liabilities ling interests an subsidiarie 643 100 shares authorized - December 31, 2019 and 2018 P. Toomades com is and equity Tesla, Ine. Consolidated Statements of Operations (in millions, except per share data) Year Ended hember 31, 2018 2019 2017 $ 19,9525 869 20.821 1,531 2.226 24,578 17,632 $ 883 18,515 1,555 1,391 21,461 8,535 1,107 9,642 1,116 1,001 11,759 15,939 459 16,398 1.341 2.770 20.509 4.069 13,686 488 14,174 1,365 1,880 17,419 4,042 6,725 708 7,433 874 1.229 9,536 2.223 Revenues Automotive sales Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling general and administrative Restructuring and other Total operating expenses Loss from operations Interest income Interest expense Other income (expense), net Loss before income taxes Provision for income taxes Net loss Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries Net loss attributable to common stockholders Net loss per share of common stock attributable to common stockholders Basic Diluted 1,378 2,477 1.343 2.646 149 4,138 (69) 1,460 2,835 135 4,430 (388) 24 (663) 22 (1,005) 58 (1,063) (685) 45 (665) 110 (775) 3,855 (1.632) 19 (471) (125) (2.209) 32 (2.241) 87 (862) S (87) (976) S (279) (1.962) 11 11 (4.92) S (4.92 $ (5.72) S (5.72) S (11.83) (1183) #| # - @ % @ % | 8At) , Year Ended December 31 Wersale Current cash equivalents an equivalents 726 10 current portion Total liabilities ling interests an subsidiarie 643 100 shares authorized - December 31, 2019 and 2018 P. Toomades com is and equity Tesla, Ine. Consolidated Statements of Operations (in millions, except per share data) Year Ended hember 31, 2018 2019 2017 $ 19,9525 869 20.821 1,531 2.226 24,578 17,632 $ 883 18,515 1,555 1,391 21,461 8,535 1,107 9,642 1,116 1,001 11,759 15,939 459 16,398 1.341 2.770 20.509 4.069 13,686 488 14,174 1,365 1,880 17,419 4,042 6,725 708 7,433 874 1.229 9,536 2.223 Revenues Automotive sales Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling general and administrative Restructuring and other Total operating expenses Loss from operations Interest income Interest expense Other income (expense), net Loss before income taxes Provision for income taxes Net loss Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries Net loss attributable to common stockholders Net loss per share of common stock attributable to common stockholders Basic Diluted 1,378 2,477 1.343 2.646 149 4,138 (69) 1,460 2,835 135 4,430 (388) 24 (663) 22 (1,005) 58 (1,063) (685) 45 (665) 110 (775) 3,855 (1.632) 19 (471) (125) (2.209) 32 (2.241) 87 (862) S (87) (976) S (279) (1.962) 11 11 (4.92) S (4.92 $ (5.72) S (5.72) S (11.83) (1183) #| # - @ % @ % | 8At) , Year Ended December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started