I have attached the screenshots. I have additional excel sheets and can,t be attached here.

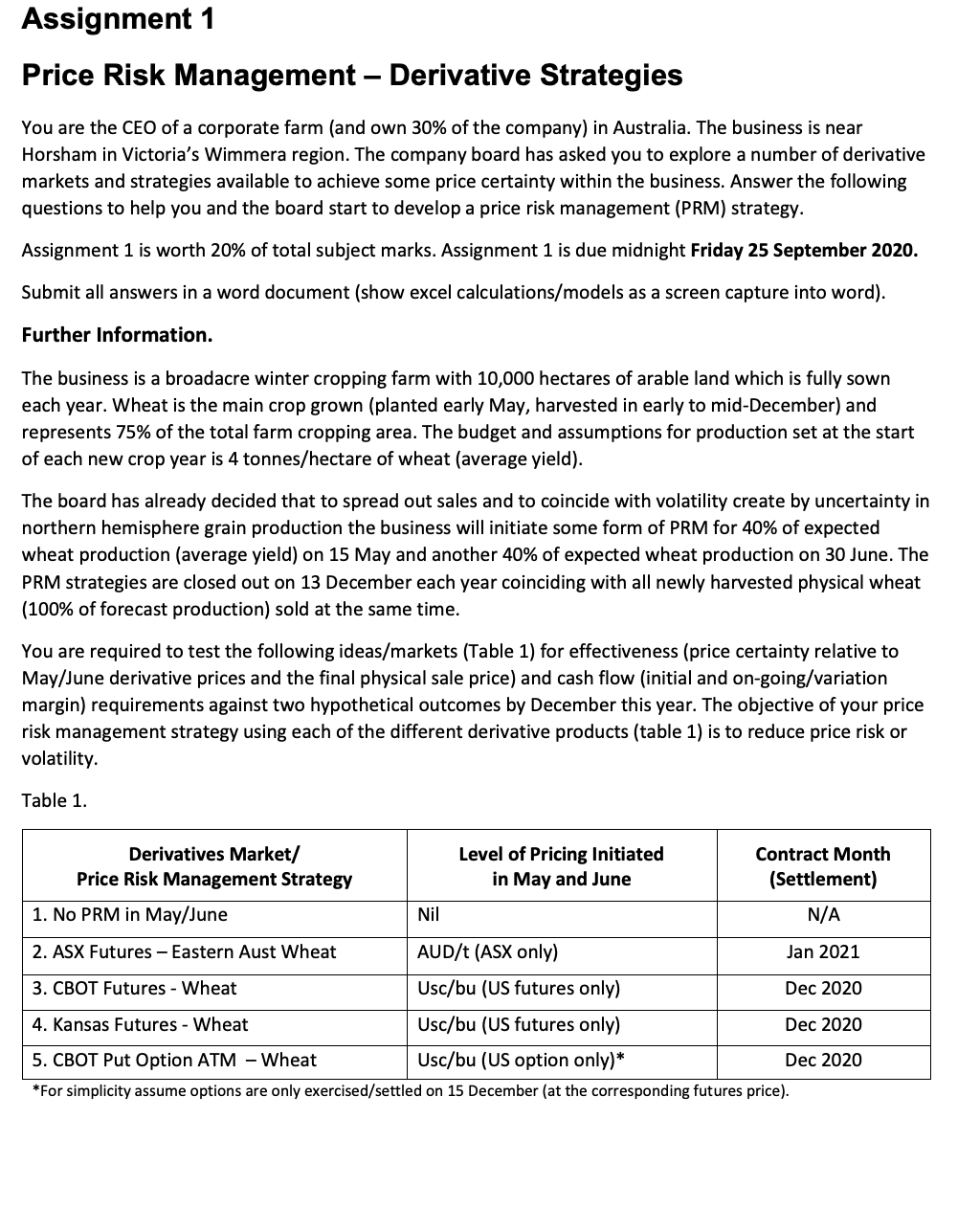

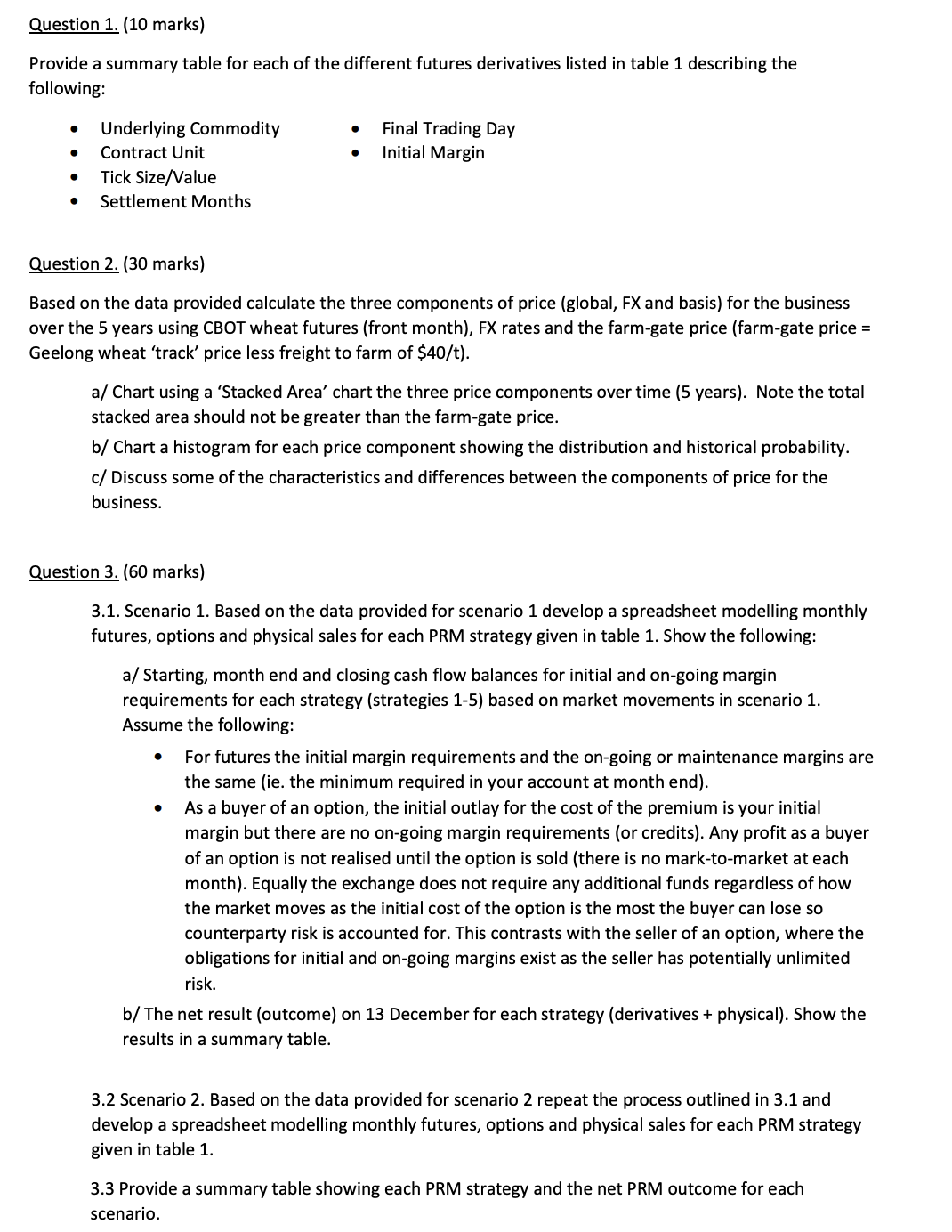

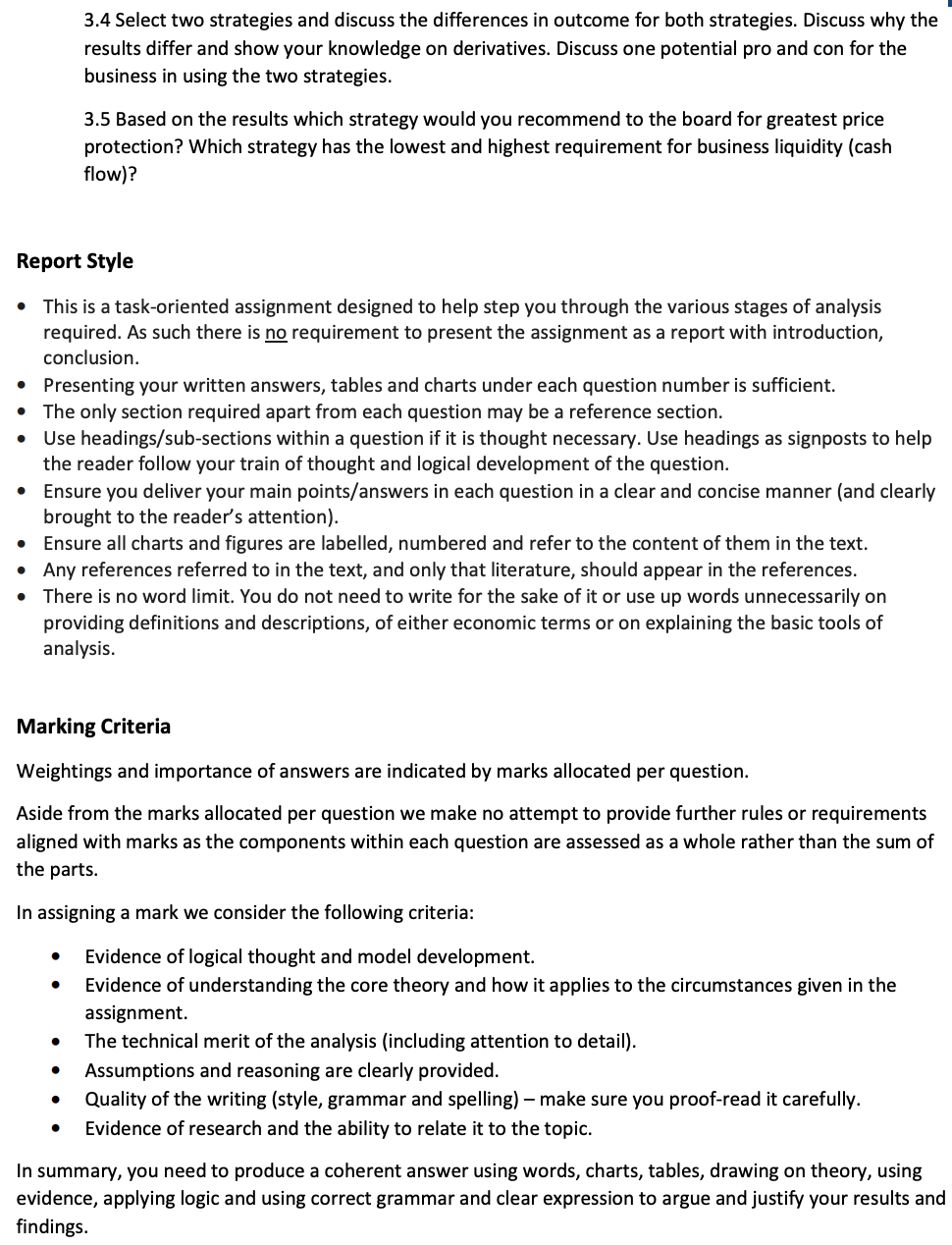

Assignment 1 Price Risk Management Derivative Strategies You are the CEO of a corporate farm (and own 30% of the company) in Australia. The business is near Horsham in Victoria's Wimmera region. The company board has asked you to explore a number of derivative markets and strategies available to achieve some price certainty within the business. Answer the following questions to help you and the board start to develop a price risk management (PRM) strategy. Assignment 1 is worth 20% of total subject marks. Assignment 1 is due midnight Friday 25 September 2020. Submit all answers in a word document (show excel calculations/models as a screen capture into word). Further Information. The business is a broadacre winter cropping farm with 10,000 hectares of arable land which is fully sown each yea r. Wheat is the main crop grown (planted early May, harvested in early to mid-December) and represents 75% of the total farm cropping area. The budget and assumptions for production set at the start of each new crop year is 4 tonnes/hectare of wheat (average yield). The board has already decided that to spread out sales and to coincide with volatility create by uncertainty in northern hemisphere grain production the business will initiate some form of PRM for 40% of expected wheat production (average yield) on 15 May and another 40% of expected wheat production on 30 June. The PRM strategies are closed out on 13 December each year coinciding with all newly harvested physical wheat (100% of forecast production) sold at the same time. You are required to test the following ideas/markets (I' able 1) for effectiveness (price certainty relative to May/June derivative prices and the nal physical sale price) and cash flow (initial and on-going/variation margin) requirements against two hypothetical outcomes by December this year. The objective of your price risk management strategy using each of the different derivative products (table 1) is to reduce price risk or volatility. Table 1. Derivatives Market] Level of Pricing Initiated Contract Month Price Risk Management Strategy in May and June (Settlement) 1. No PRM in May/June Nil N/A 2. ASX Futures Eastern Aust Wheat AUD/t (ASX only) Jan 2021 3. CBOT Futures - Wheat Usc/bu (US futures only) Dec 2020 4. Kansas Futures - Wheat Usc/bu (US futures only) Dec 2020 5. CBOT Put Option ATM Wheat Usc/bu (US option only)' Dec 2020 'For simplicity assume options are only exercisedlsettled on 15 December (at the corresponding futures price). Question 1. (10 marks) Provide a summary table for each of the different futures derivatives listed in table 1 describing the following: o Underlying Commodity - Final Trading Day a Contract Unit 0 Initial Margin 0 Tick SizeNalue - Settlement Months Question 2. (30 marks) Based on the data provided calculate the three components of price (global, FX and basis) for the business over the 5 years using CBOT wheat futures (front month), FX rates and the farm-gate price (farm-gate price = Geelong wheat 'track' price less freight to farm of 54D/t). a/ Chart using a 'Stacked Area' chart the three price components overtime (5 years). Note the total stacked area should not be greater than the farm-gate price. b/ Chart a histogram for each price component showing the distribution and historical probability. c/ Discuss some of the characteristics and differences between the components of price for the business. Question 3. (60 marks) 3.1. Scenario 1. Based on the data provided for scenario 1 develop a spreadsheet modelling monthly futures, options and physical sales for each PRM strategy given in table 1. Show the following: a/ Starting, month end and closing cash flow balances for initial and on-going margin requirements for each strategy (strategies 1-5) based on market movements in scenario 1. Assume the following: 0 For futures the initial margin requirements and the on-going or maintenance margins are the same (ie. the minimum required in your account at month end). 0 As a buyer of an option, the initial outlay for the cost of the premium is your initial margin but there are no on-going margin requirements (or credits). Any profit as a buyer of an option is not realised until the option is sold (there is no mark-to-market at each month). Equally the exchange does not require any additional funds regardless of how the market moves as the initial cost ofthe option is the most the buyer can lose so counterparty risk is accounted for. This contrasts with the seller of an option, where the obligations for initial and on-going margins exist as the seller has potentially unlimited risk. b/ The net result (outcome) on 13 December for each strategy (derivatives + physical). Show the results in a summary table. 3.2 Scenario 2. Based on the data provided for scenario 2 repeat the process outlined in 3.1 and develop a spreadsheet modelling monthly futures, options and physical sales for each PRM strategy given in table 1. 3.3 Provide a summary table showing each PRM strategy and the net PRM outcome for each scenario. 3.4 Select two strategies and discuss the differences in outcome for both strategies. Discuss why the results differ and show your knowledge on derivatives. Discuss one potential pro and con for the business in using the two strategies. 3.5 Based on the results which strategy would you recommend to the board for greatest price protection? Which strategy has the lowest and highest requirement for business liquidity (cash flow)? Report Style This is a task-oriented assignment designed to help step you through the various stages of analysis required. As such there is m requirement to present the assignment as a report with introduction, conclusion. Presenting your written answers, tables and charts under each question number is sufficient. The only section required apart from each question may be a reference section. Use headings/sub-sections within a question if it is thought necessary. Use headings as signposts to help the reader follow your train of thought and logical development of the question. Ensure you deliver your main points/answers in each question in a clear and concise manner (and clearly brought to the reader's attention]. Ensure all charts and gures are labelled, numbered and refer to the content of them in the text. Any references referred to in the text, and only that literature, should appear in the references. There is no word limit. You do not need to write for the sake of it or use up words unnecessarily on providing definitions and descriptions, of either economic terms or on explaining the basic tools of analysis. Marking Criteria Weightings and importance of answers are indicated by marks allocated per question. Aside from the marks allocated per question we make no attempt to provide further rules or requirements aligned with marks as the components within each question are assessed as a whole rather than the sum of the parts. In assigning a mark we consider the following criteria: 0 Evidence of logical thought and model development. 0 Evidence of understanding the core theory and how it applies to the circumstances given in the assignment. a The technical merit of the analysis (including attention to detail). 0 Assumptions and reasoning are clearly provided. 0 Quality of the writing (style, grammar and spelling) make sure you proof-read it carefully. 0 Evidence of research and the ability to relate it to the topic. In summary, you need to produce a coherent answer using words, charts, tables, drawing on theory, using evidence, applying logic and using correct grammar and clear expression to argue and justify your results and ndings