Answered step by step

Verified Expert Solution

Question

1 Approved Answer

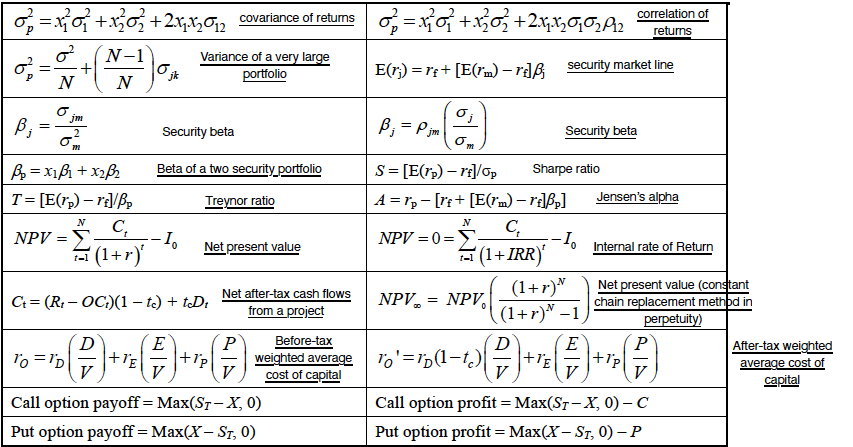

I have attempted to label these formulas for Principles of Finance. I need help with checking over whether I have labelled it correctly and what

I have attempted to label these formulas for Principles of Finance. I need help with checking over whether I have labelled it correctly and what the ones that I have not labelled are. Any other comments and extra detail would be great too. Thank you

0 = x (1 + x3o +2x7,2302 covariance of retums 0=xo1 + x262 +2x722002212 correlation of returns N-1 + N N Variance of a very large portfolio security market line jk E(ry)=rf+[E(rm) - rdB Oj jm 2 B; = Pjim N N B; Security beta Security beta om B = x1B1 + x2B Beta of a two security portfolio S=[E(rp) - rf]/op Sharpe ratio T=[E(rp) - relB Treynor ratio A=rp - [ri + [E(rm) - r]B] Jensen's alpha C c NPV 1. NPV = 0= Net present value -1 Internal rate of Return +(1+r)' = (1+IRR)' Net after-tax cash flows (1+r) Net present value (constant Ct = (R: -OC)(1 t) + t.D. NPV = NPV chain replacement methbd in from a project (1+r)^-1 perpetuity) D E P Before-tax D E After-tax weighted Yo = 7D weighted average 70'=ro(1-t.) average cost of V V V cost of capital V V V capital Call option payoff = Max(ST-X,0) Call option profit = Max(S1-X, 0)-C Put option payoff = Max(X-S1, 0) Put option profit = Max(X-ST, 0)-P +TE +1'p +18 +1'pStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started