Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have been stuck on this question for awhile!!! please help me with explainations and sample coding would be greatly appreciated! BY THE WAY THIS

I have been stuck on this question for awhile!!! please help me with explainations and sample coding would be greatly appreciated! BY THE WAY THIS IS MATLAB CODING!

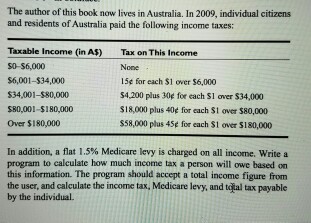

The author of this book now lives in Australia. In 2009, individual citizens and residents of Australia paid the following income taxes: Taxable Income (in A5) S0-$6,000 $6,001-$34,000 $34,001-$80,000 $80,001-$180,000 Over $180,000 Tax on This Income None 15 for each $1 over se,000 $4,200 plus 30e for each S1 over $34,000 18,000 plus 40 for each $1 over S80.000 $58,000 plus 45 for each $1 over S 180,000 In addition, a flat 1.5% Medicare levy is charged on all income, write a program to calculate how much income tax a person will owe based on this information. The program should accept a total income figure from the user, and calculate the income tax. Medicare levy, and tal tax payable by the individualStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started