__________________________________________ I have calculated (not sure if it's correct): 2019 ROE 3.74% 2018 ROE -19.85% 2019 RONA 1.91% 2019 NOPM 7.74% 2019 NOAT 24.62% 2018

__________________________________________

I have calculated (not sure if it's correct):

| 2019 ROE | 3.74% |

| 2018 ROE | -19.85% |

| 2019 RONA | 1.91% |

| 2019 NOPM | 7.74% |

| 2019 NOAT | 24.62% |

| 2018 RONA | -9.91% |

| 2018 NOPM | -39.04% |

| 2018 NOAT | 25.39% |

_______________________________________________

1. Compare ROE and RNOA for the 2 years.

Discuss how operating and nonoperating activities of your company contributed to each years shareholders overall return, ROE.

How did current years Net Operating Profit Margin (NOPM) change from last year? Identify several items that can explain the change.

How did current years Net Operating Asset Turnover (NOAT) change from last year? Identify several items that can explain the change.

2. Compute Altman Z-score of your company for the recent 2 years (see Ch. 4 slide # 21 for the Z-score formula). How did your companys bankruptcy probability change according to your computed Z-scores? For Market Value of Equity for the 2 years, use the numbers presented in the cover page of the most recent 2 years 10-K reports.

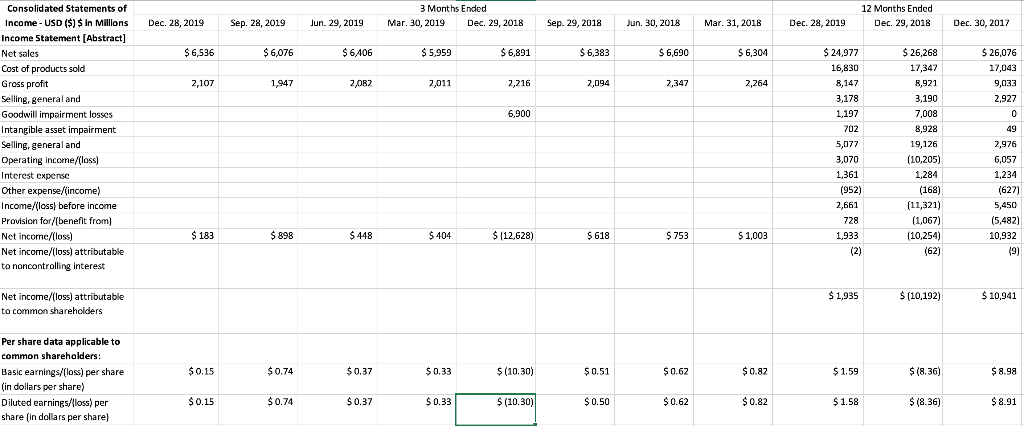

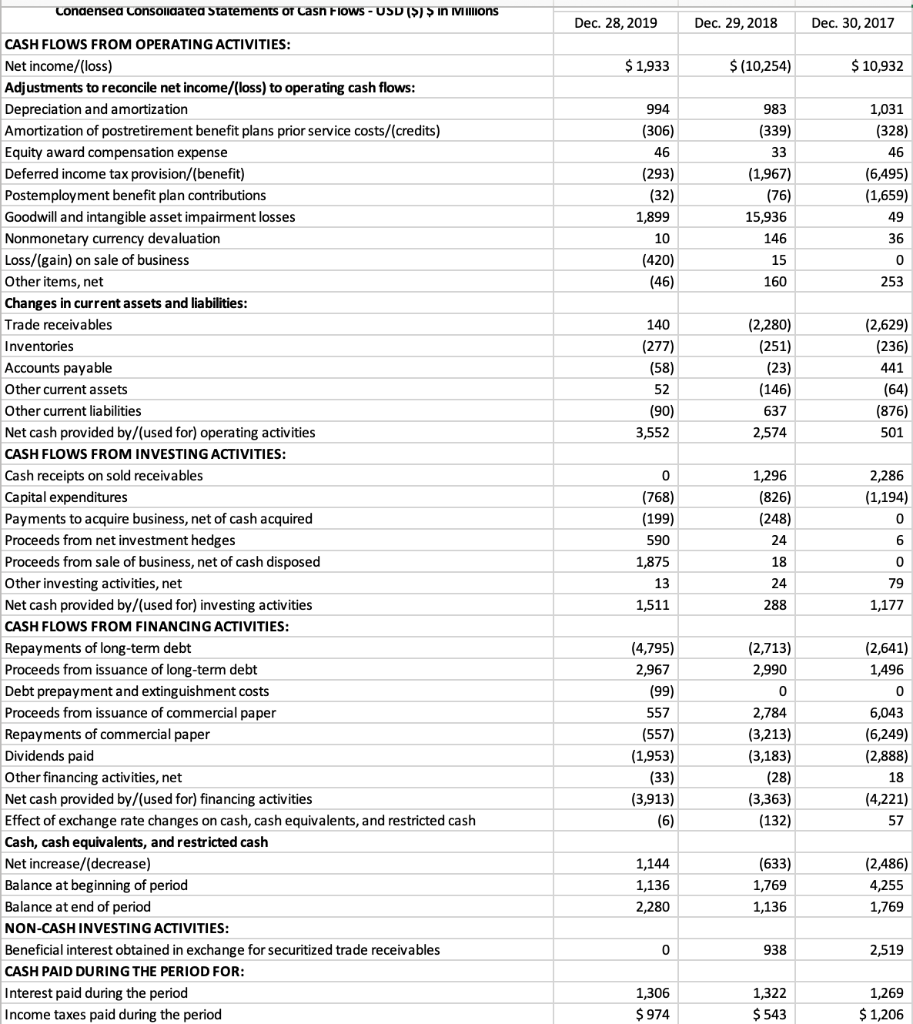

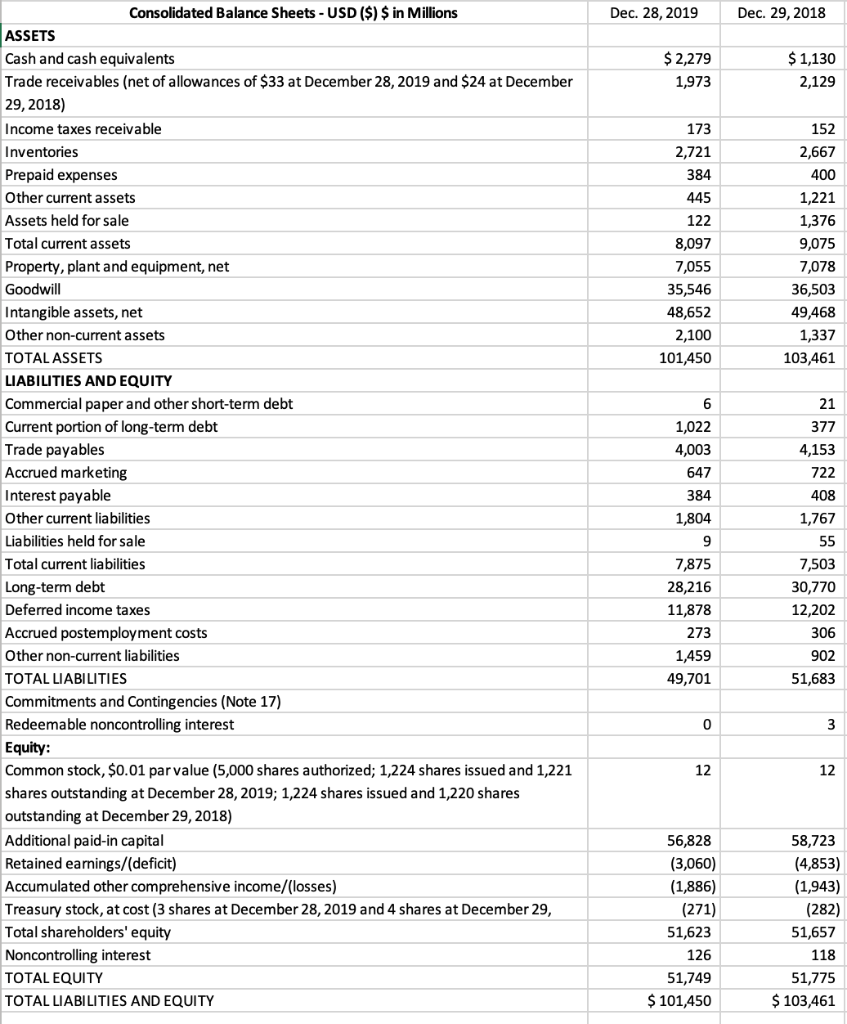

3 Months Ended Mar. 30, 2019 Dec. 29, 2018 12 Months Ended Dec. 29, 2018 Dec. 28, 2019 Sep. 28, 2019 Jun. 29, 2019 Sep. 29, 2018 Jun 30, 2018 Mar. 31, 2018 Dec. 28, 2019 Dec. 30, 2017 $6,536 $ 6,076 $ 6406 $5,959 $6,891 $ 6,383 $ 6,690 $ 6,304 $ 24,977 16,830 8,147 2,107 1,947 2,082 2,011 2,216 2,094 2,347 2,264 6,900 Consolidated Statements of Income - USD ($) $ In Millions Income Statement (Abstract) Net sales Cost of products sold Gross profit Selling, general and Goodwill impairment losses Intangible asset impairment Selling, general and Operating income/(loss) Interest expense Other expense/(income) Income/(loss) before income Provision for/(benefit from) Net income/(loss) Net income/(loss) attributable to noncontrolling interest 3,178 1,197 702 5,077 3,070 1.361 (952) $ 26,268 17,347 8,921 3,190 7,008 8,928 19,126 (10,205) 1,284 (168) (11,321) (1,067) (10,254) (62) $ 26,076 17,043 9,033 2.927 0 49 49 2,976 6,057 1,234 (627) 5,450 (5,482) 10,932 19) $ 183 $ 898 2,661 728 1.933 (2) $ 448 $ 404 $ (12,628) $ 618 $ 753 $ 1,003 $ 1.935 $ (10,192) $ 10,941 Net income/(loss) attributable to common shareholders $0.15 $ 0.74 $ 0.37 $ 0.33 $(10.30) $0.51 $0.62 $ 0.82 $ 1.59 $(8.36) $8.98 Per share data applicable to common shareholders: Basic earnings/(loss) per share (in dollars per share) Diluted earnings//loss) per share (in dollars per share) $ 0.15 $ 0.74 $ 0.37 $ 0.33 $(10.30) $ 0.50 $ 0.62 $ 0.82 $ 1.58 $(8.36) $8.91 Condensed consolidated Statements or Cash FIOWS - USD ($ in Villions Dec. 28, 2019 Dec. 29, 2018 Dec. 30, 2017 $ 1,933 $ (10,254) $ 10,932 994 (306) 46 (293) (32) 1,899 10 (420) (46) 983 (339) 33 (1,967) (76) 15,936 146 15 160 1,031 (328) 46 (6,495) (1,659) 49 36 0 253 140 (277) (58) (2,280) (251) (23) (146) 637 2,574 (2,629) (236) 441 (64) (876) 501 52 (90) 3,552 0 CASH FLOWS FROM OPERATING ACTIVITIES: Net income/(loss) Adjustments to reconcile net income/(loss) to operating cash flows: Depreciation and amortization Amortization of postretirement benefit plans prior service costs/(credits) Equity award compensation expense Deferred income tax provision/(benefit) Postemployment benefit plan contributions Goodwill and intangible asset impairment losses Nonmonetary currency devaluation Loss/(gain) on sale of business Other items, net Changes in current assets and liabilities: Trade receivables Inventories Accounts payable Other current assets Other current liabilities Net cash provided by/(used for) operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Cash receipts on sold receivables Capital expenditures Payments to acquire business, net of cash acquired Proceeds from net investment hedges Proceeds from sale of business, net of cash disposed Other investing activities, net Net cash provided by/(used for) investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Repayments of long-term debt Proceeds from issuance of long-term debt Debt prepayment and extinguishment costs Proceeds from issuance of commercial paper Repayments of commercial paper Dividends paid Other financing activities, net Net cash provided by/(used for financing activities Effect of exchange rate changes on cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash Net increase/(decrease) Balance at beginning of period Balance at end of period NON-CASH INVESTING ACTIVITIES: Beneficial interest obtained in exchange for securitized trade receivables CASH PAID DURING THE PERIOD FOR: Interest paid during the period Income taxes paid during the period 1,296 (826) (248) 24 2,286 (1,194) 0 6 (768) (199) 590 1,875 13 1,511 18 0 24 79 1,177 288 (4,795) 2,967 (99) 557 (557) (1,953) (33) (3,913) (6) (2,713) 2,990 0 2,784 (3,213) (3,183) (28) (3,363) (132) (2,641) 1,496 0 6,043 (6,249) (2,888) 18 (4,221) 57 1,144 1,136 2,280 (633) 1,769 1,136 (2,486) 4,255 1,769 0 938 2,519 1,306 $ 974 1,322 $ 543 1,269 $ 1,206 Dec. 28, 2019 Dec. 29, 2018 $2,279 1,973 $ 1,130 2,129 173 2,721 384 445 122 8,097 7,055 35,546 48,652 152 2,667 400 1,221 1,376 9,075 7,078 36,503 49,468 1,337 103,461 2,100 101,450 6 21 377 4,153 722 Consolidated Balance Sheets - USD ($) $ in Millions ASSETS Cash and cash equivalents Trade receivables (net of allowances of $33 at December 28, 2019 and $24 at December 29, 2018) Income taxes receivable Inventories Prepaid expenses Other current assets Assets held for sale Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Other non-current assets TOTAL ASSETS LIABILITIES AND EQUITY Commercial paper and other short-term debt Current portion of long-term debt Trade payables Accrued marketing Interest payable Other current liabilities Liabilities held for sale Total current liabilities Long-term debt Deferred income taxes Accrued postemployment costs Other non-current liabilities TOTAL LIABILITIES Commitments and Contingencies (Note 17) Redeemable noncontrolling interest Equity: Common stock, $0.01 par value (5,000 shares authorized; 1,224 shares issued and 1,221 shares outstanding at December 28, 2019; 1,224 shares issued and 1,220 shares outstanding at December 29, 2018) Additional paid-in capital Retained earnings/(deficit) Accumulated other comprehensive income/(losses) Treasury stock, at cost (3 shares at December 28, 2019 and 4 shares at December 29, Total shareholders' equity Noncontrolling interest TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 1,022 4,003 647 384 1,804 9 7,875 28,216 11,878 273 1,459 49,701 408 1,767 55 7,503 30,770 12,202 306 902 51,683 0 3 12 12 56,828 (3,060) (1,886) (271) 51,623 126 51,749 $ 101,450 58,723 (4,853) (1,943) (282) 51,657 118 51,775 $ 103,461 3 Months Ended Mar. 30, 2019 Dec. 29, 2018 12 Months Ended Dec. 29, 2018 Dec. 28, 2019 Sep. 28, 2019 Jun. 29, 2019 Sep. 29, 2018 Jun 30, 2018 Mar. 31, 2018 Dec. 28, 2019 Dec. 30, 2017 $6,536 $ 6,076 $ 6406 $5,959 $6,891 $ 6,383 $ 6,690 $ 6,304 $ 24,977 16,830 8,147 2,107 1,947 2,082 2,011 2,216 2,094 2,347 2,264 6,900 Consolidated Statements of Income - USD ($) $ In Millions Income Statement (Abstract) Net sales Cost of products sold Gross profit Selling, general and Goodwill impairment losses Intangible asset impairment Selling, general and Operating income/(loss) Interest expense Other expense/(income) Income/(loss) before income Provision for/(benefit from) Net income/(loss) Net income/(loss) attributable to noncontrolling interest 3,178 1,197 702 5,077 3,070 1.361 (952) $ 26,268 17,347 8,921 3,190 7,008 8,928 19,126 (10,205) 1,284 (168) (11,321) (1,067) (10,254) (62) $ 26,076 17,043 9,033 2.927 0 49 49 2,976 6,057 1,234 (627) 5,450 (5,482) 10,932 19) $ 183 $ 898 2,661 728 1.933 (2) $ 448 $ 404 $ (12,628) $ 618 $ 753 $ 1,003 $ 1.935 $ (10,192) $ 10,941 Net income/(loss) attributable to common shareholders $0.15 $ 0.74 $ 0.37 $ 0.33 $(10.30) $0.51 $0.62 $ 0.82 $ 1.59 $(8.36) $8.98 Per share data applicable to common shareholders: Basic earnings/(loss) per share (in dollars per share) Diluted earnings//loss) per share (in dollars per share) $ 0.15 $ 0.74 $ 0.37 $ 0.33 $(10.30) $ 0.50 $ 0.62 $ 0.82 $ 1.58 $(8.36) $8.91 Condensed consolidated Statements or Cash FIOWS - USD ($ in Villions Dec. 28, 2019 Dec. 29, 2018 Dec. 30, 2017 $ 1,933 $ (10,254) $ 10,932 994 (306) 46 (293) (32) 1,899 10 (420) (46) 983 (339) 33 (1,967) (76) 15,936 146 15 160 1,031 (328) 46 (6,495) (1,659) 49 36 0 253 140 (277) (58) (2,280) (251) (23) (146) 637 2,574 (2,629) (236) 441 (64) (876) 501 52 (90) 3,552 0 CASH FLOWS FROM OPERATING ACTIVITIES: Net income/(loss) Adjustments to reconcile net income/(loss) to operating cash flows: Depreciation and amortization Amortization of postretirement benefit plans prior service costs/(credits) Equity award compensation expense Deferred income tax provision/(benefit) Postemployment benefit plan contributions Goodwill and intangible asset impairment losses Nonmonetary currency devaluation Loss/(gain) on sale of business Other items, net Changes in current assets and liabilities: Trade receivables Inventories Accounts payable Other current assets Other current liabilities Net cash provided by/(used for) operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Cash receipts on sold receivables Capital expenditures Payments to acquire business, net of cash acquired Proceeds from net investment hedges Proceeds from sale of business, net of cash disposed Other investing activities, net Net cash provided by/(used for) investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Repayments of long-term debt Proceeds from issuance of long-term debt Debt prepayment and extinguishment costs Proceeds from issuance of commercial paper Repayments of commercial paper Dividends paid Other financing activities, net Net cash provided by/(used for financing activities Effect of exchange rate changes on cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash Net increase/(decrease) Balance at beginning of period Balance at end of period NON-CASH INVESTING ACTIVITIES: Beneficial interest obtained in exchange for securitized trade receivables CASH PAID DURING THE PERIOD FOR: Interest paid during the period Income taxes paid during the period 1,296 (826) (248) 24 2,286 (1,194) 0 6 (768) (199) 590 1,875 13 1,511 18 0 24 79 1,177 288 (4,795) 2,967 (99) 557 (557) (1,953) (33) (3,913) (6) (2,713) 2,990 0 2,784 (3,213) (3,183) (28) (3,363) (132) (2,641) 1,496 0 6,043 (6,249) (2,888) 18 (4,221) 57 1,144 1,136 2,280 (633) 1,769 1,136 (2,486) 4,255 1,769 0 938 2,519 1,306 $ 974 1,322 $ 543 1,269 $ 1,206 Dec. 28, 2019 Dec. 29, 2018 $2,279 1,973 $ 1,130 2,129 173 2,721 384 445 122 8,097 7,055 35,546 48,652 152 2,667 400 1,221 1,376 9,075 7,078 36,503 49,468 1,337 103,461 2,100 101,450 6 21 377 4,153 722 Consolidated Balance Sheets - USD ($) $ in Millions ASSETS Cash and cash equivalents Trade receivables (net of allowances of $33 at December 28, 2019 and $24 at December 29, 2018) Income taxes receivable Inventories Prepaid expenses Other current assets Assets held for sale Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Other non-current assets TOTAL ASSETS LIABILITIES AND EQUITY Commercial paper and other short-term debt Current portion of long-term debt Trade payables Accrued marketing Interest payable Other current liabilities Liabilities held for sale Total current liabilities Long-term debt Deferred income taxes Accrued postemployment costs Other non-current liabilities TOTAL LIABILITIES Commitments and Contingencies (Note 17) Redeemable noncontrolling interest Equity: Common stock, $0.01 par value (5,000 shares authorized; 1,224 shares issued and 1,221 shares outstanding at December 28, 2019; 1,224 shares issued and 1,220 shares outstanding at December 29, 2018) Additional paid-in capital Retained earnings/(deficit) Accumulated other comprehensive income/(losses) Treasury stock, at cost (3 shares at December 28, 2019 and 4 shares at December 29, Total shareholders' equity Noncontrolling interest TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 1,022 4,003 647 384 1,804 9 7,875 28,216 11,878 273 1,459 49,701 408 1,767 55 7,503 30,770 12,202 306 902 51,683 0 3 12 12 56,828 (3,060) (1,886) (271) 51,623 126 51,749 $ 101,450 58,723 (4,853) (1,943) (282) 51,657 118 51,775 $ 103,461

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started