Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have chegg subscription and can see the available answers. Do not copy paste as I think the answer available is wrong otherwise I will

I have chegg subscription and can see the available answers. Do not copy paste as I think the answer available is wrong otherwise I will give a thumbs down.

Answer the following question. Zoom in the picture is clear.

see the picture below

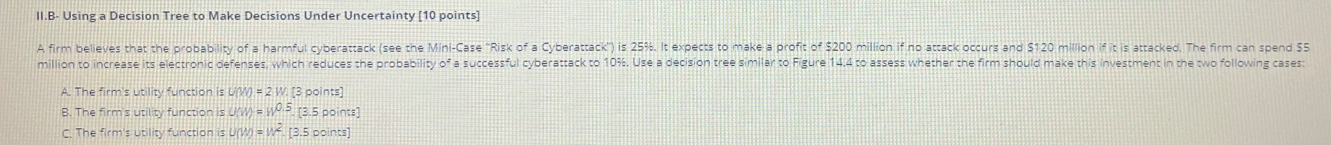

II.B - Using a Decision Tree to Make Decisions Under Uncertainty (10 points] A firm believes that the probability of a harmful cyberattack (see the Mini-Case "Risk of a Cyberattack) is 2596. It expects to make a profit of $200 million if no attack occurs and 5120 million is attacked. The firm can spend 55 million to increase its electronic defenses, which reduces the probability of a successful cyberattack to 106. Use a decision tree similar to Figure 14.4 to assess whether the firm should make this investment in the two following cases: A. The firm s utility function is W = 2 W. (3 points) B. The firms utility function is UW) = W0.5 (2.5 points) C. The firm's utility function is uw = W4 [3.5 points] A firm believes that the probability of a harmful cyberattack is 25%.It expects to make a profit of $200 million if not attach occurs and $120 million if attack occurs. The form can spend $5 million to increase its electronic defence which reduces the probability of a successful cyberattack to -0%.Use a decision to tree to access that whether the form should use the investment in the following two cases A: The firms utility function is U(W)=2 B: The firm's utility function is U(W) = W^0.5 C: The firm's utility function is U(W) = W^2 = = II.B - Using a Decision Tree to Make Decisions Under Uncertainty (10 points] A firm believes that the probability of a harmful cyberattack (see the Mini-Case "Risk of a Cyberattack) is 2596. It expects to make a profit of $200 million if no attack occurs and 5120 million is attacked. The firm can spend 55 million to increase its electronic defenses, which reduces the probability of a successful cyberattack to 106. Use a decision tree similar to Figure 14.4 to assess whether the firm should make this investment in the two following cases: A. The firm s utility function is W = 2 W. (3 points) B. The firms utility function is UW) = W0.5 (2.5 points) C. The firm's utility function is uw = W4 [3.5 points] A firm believes that the probability of a harmful cyberattack is 25%.It expects to make a profit of $200 million if not attach occurs and $120 million if attack occurs. The form can spend $5 million to increase its electronic defence which reduces the probability of a successful cyberattack to -0%.Use a decision to tree to access that whether the form should use the investment in the following two cases A: The firms utility function is U(W)=2 B: The firm's utility function is U(W) = W^0.5 C: The firm's utility function is U(W) = W^2 = =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started