I have completed all questions except for the last one (question 3.3)

Can you please help with solving the levered average WACC and the levered NPV?

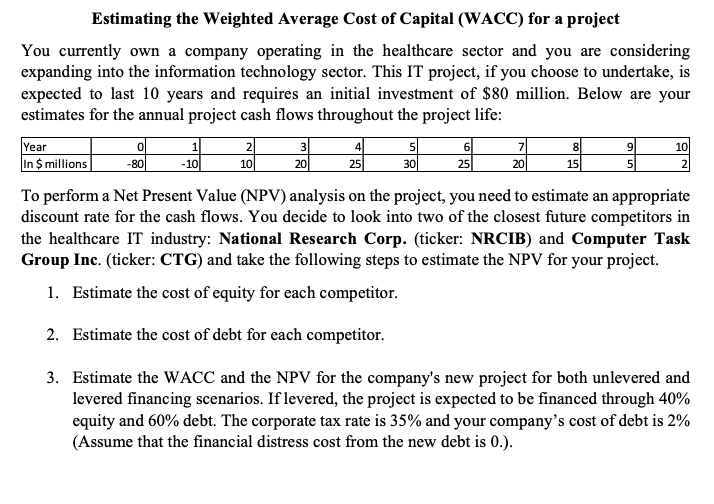

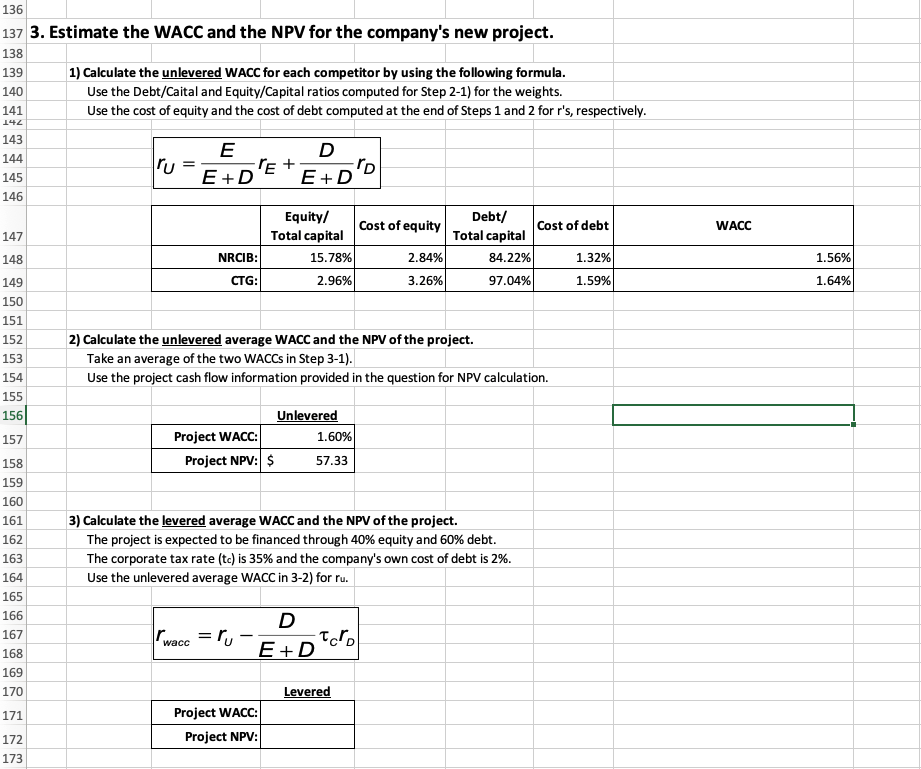

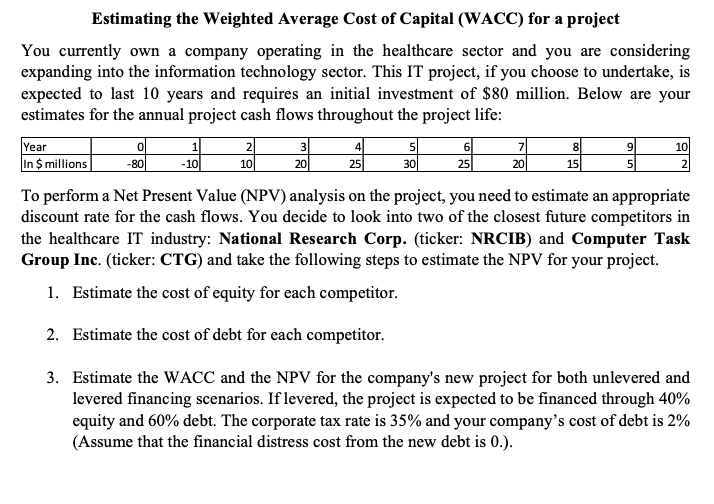

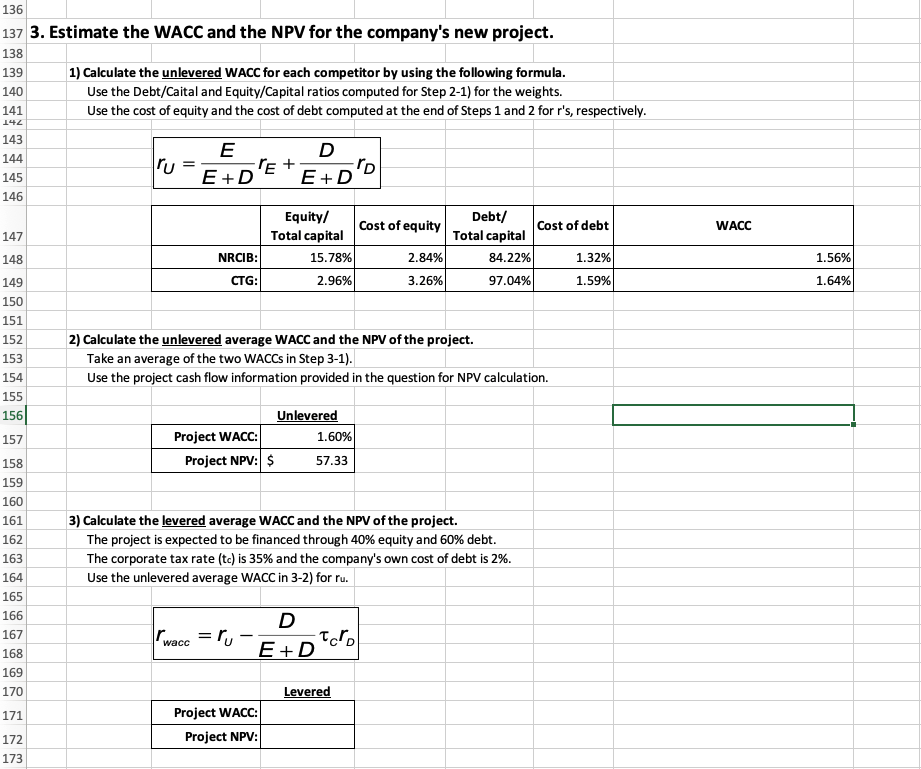

Estimating the Weighted Average Cost of Capital (WACC) for a project You currently own a company operating in the healthcare sector and you are considering expanding into the information technology sector. This IT project, if you choose to undertake, is expected to last 10 years and requires an initial investment of $80 million. Below are your estimates for the annual project cash flows throughout the project life: Year 1 2 3 45 in $ millions -80 -10 10 20 25 30 20 15s To perform a Net Present Value (NPV) analysis on the project, you need to estimate an appropriate discount rate for the cash flows. You decide to look into two of the closest future competitors in the healthcare IT industry: National Research Corp. (ticker: NRCIB) and Computer Task Group Inc. (ticker: CTG) and take the following steps to estimate the NPV for your project. 1. Estimate the cost of equity for each competitor. 2. Estimate the cost of debt for each competitor. 3. Estimate the WACC and the NPV for the company's new project for both unlevered and levered financing scenarios. If levered, the project is expected to be financed through 40% equity and 60% debt. The corporate tax rate is 35% and your company's cost of debt is 2% (Assume that the financial distress cost from the new debt is 0.). 136 137 3. Estimate the WACC and the NPV for the company's new project. 1) Calculate the unlevered WACC for each competitor by using the following formula. Use the Debt/Caital and Equity/Capital ratios computed for Step 2-1) for the weights. Use the cost of equity and the cost of debt computed at the end of Steps 1 and 2 for r's, respectively. 143 Dr 144 145 UED'E E+D'O Cost of debt WACC Equity/ Total capital 15.78% 2.96% Debt/ Total capital 84.22% 97.04% Cost of equity 2.84% 3.26% NRCIB: CTG: 1.56% 1.32% 1.59% 1.64% 149 150 152 153 154 2) Calculate the unlevered average WACC and the NPV of the project. Take an average of the two WACCs in Step 3-1). Use the project cash flow information provided in the question for NPV calculation. 156 Unlevered Project WACC: 1.60% Project NPV: $ 57.33 159 160 3) Calculate the levered average WACC and the NPV of the project. The project is expected to be financed through 40% equity and 60% debt. The corporate tax rate (tc) is 35% and the company's own cost of debt is 2%. Use the unlevered average WACC in 3-2) for ru. 163 164 167 wacc = Pu-ED D 168 170 Levered 171 Project WACC: Project NPV: 173 Estimating the Weighted Average Cost of Capital (WACC) for a project You currently own a company operating in the healthcare sector and you are considering expanding into the information technology sector. This IT project, if you choose to undertake, is expected to last 10 years and requires an initial investment of $80 million. Below are your estimates for the annual project cash flows throughout the project life: Year 1 2 3 45 in $ millions -80 -10 10 20 25 30 20 15s To perform a Net Present Value (NPV) analysis on the project, you need to estimate an appropriate discount rate for the cash flows. You decide to look into two of the closest future competitors in the healthcare IT industry: National Research Corp. (ticker: NRCIB) and Computer Task Group Inc. (ticker: CTG) and take the following steps to estimate the NPV for your project. 1. Estimate the cost of equity for each competitor. 2. Estimate the cost of debt for each competitor. 3. Estimate the WACC and the NPV for the company's new project for both unlevered and levered financing scenarios. If levered, the project is expected to be financed through 40% equity and 60% debt. The corporate tax rate is 35% and your company's cost of debt is 2% (Assume that the financial distress cost from the new debt is 0.). 136 137 3. Estimate the WACC and the NPV for the company's new project. 1) Calculate the unlevered WACC for each competitor by using the following formula. Use the Debt/Caital and Equity/Capital ratios computed for Step 2-1) for the weights. Use the cost of equity and the cost of debt computed at the end of Steps 1 and 2 for r's, respectively. 143 Dr 144 145 UED'E E+D'O Cost of debt WACC Equity/ Total capital 15.78% 2.96% Debt/ Total capital 84.22% 97.04% Cost of equity 2.84% 3.26% NRCIB: CTG: 1.56% 1.32% 1.59% 1.64% 149 150 152 153 154 2) Calculate the unlevered average WACC and the NPV of the project. Take an average of the two WACCs in Step 3-1). Use the project cash flow information provided in the question for NPV calculation. 156 Unlevered Project WACC: 1.60% Project NPV: $ 57.33 159 160 3) Calculate the levered average WACC and the NPV of the project. The project is expected to be financed through 40% equity and 60% debt. The corporate tax rate (tc) is 35% and the company's own cost of debt is 2%. Use the unlevered average WACC in 3-2) for ru. 163 164 167 wacc = Pu-ED D 168 170 Levered 171 Project WACC: Project NPV: 173