I have completed parts 1-8, and I am looking for assistance on parts 9-10

I have completed parts 1-8, and I am looking for assistance on parts 9-10

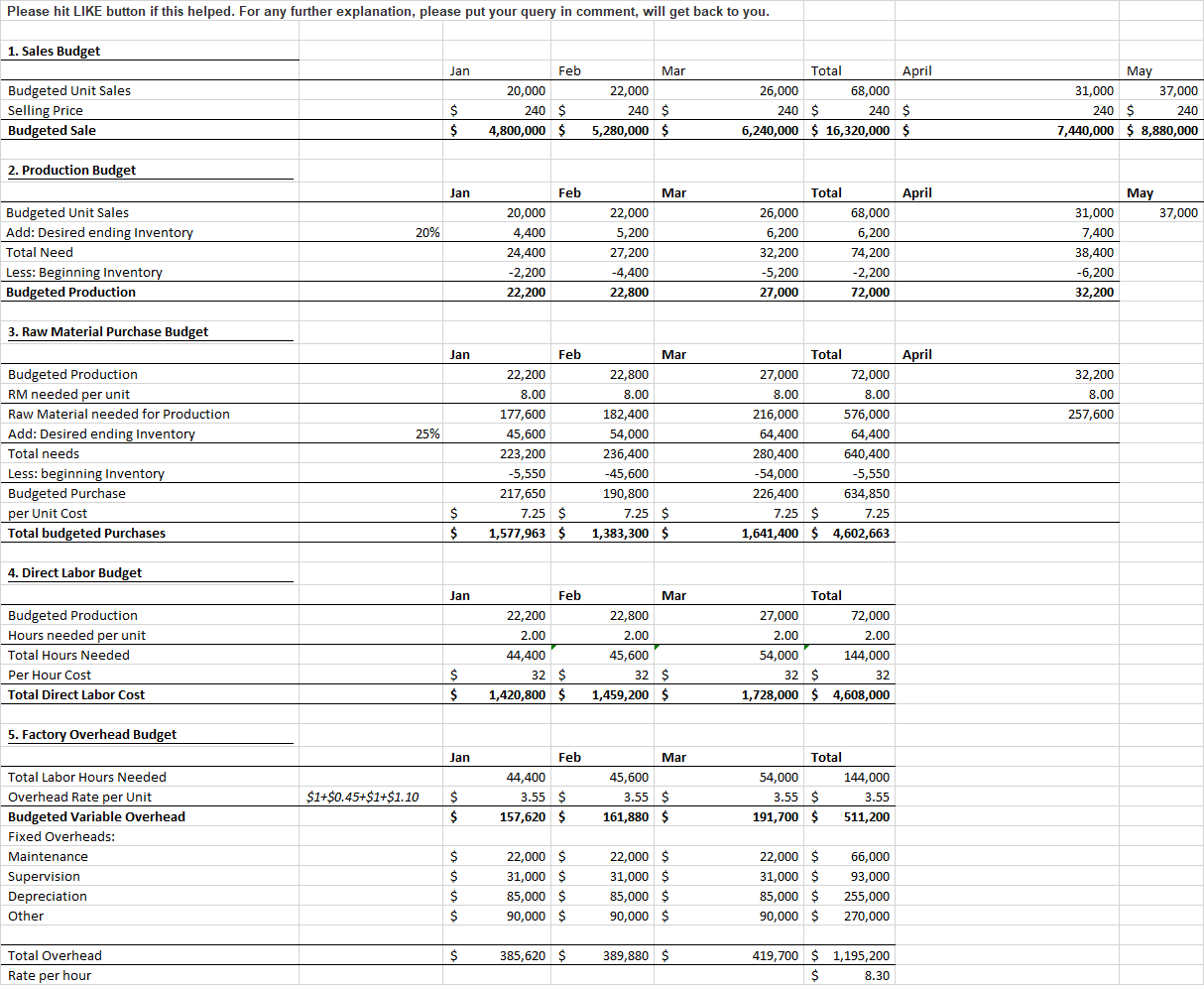

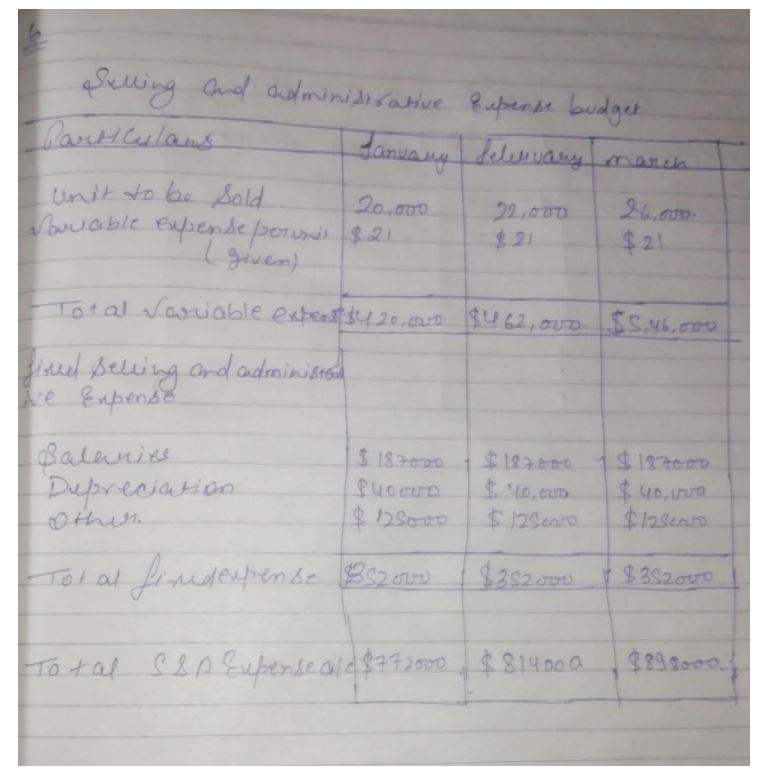

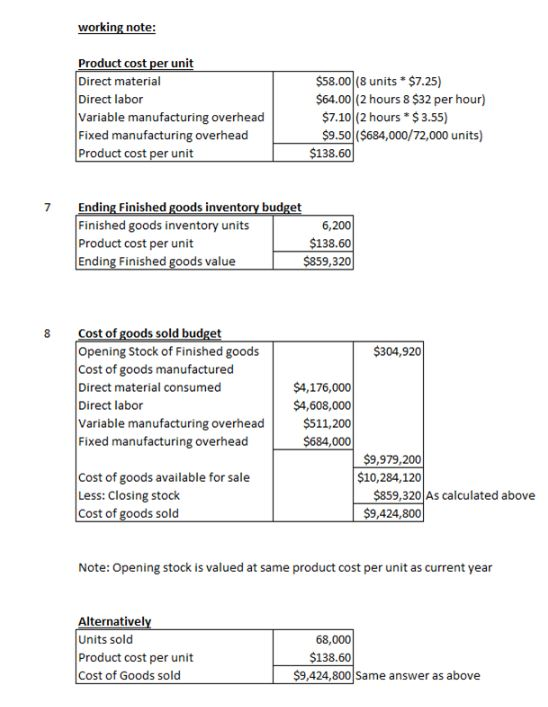

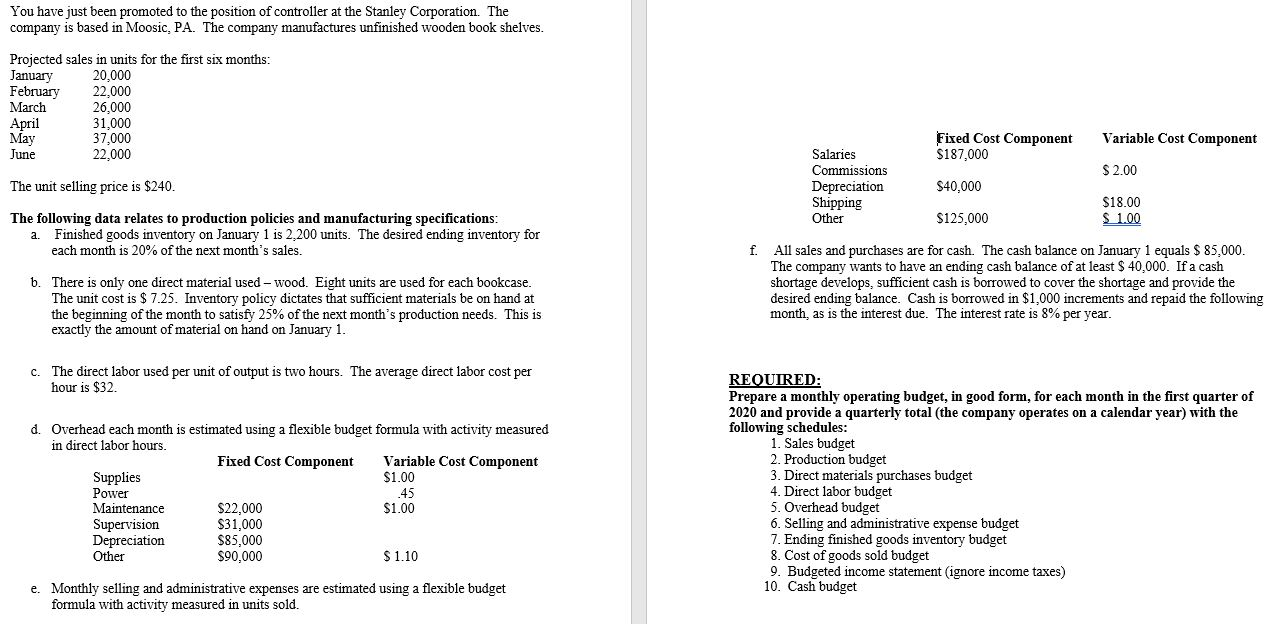

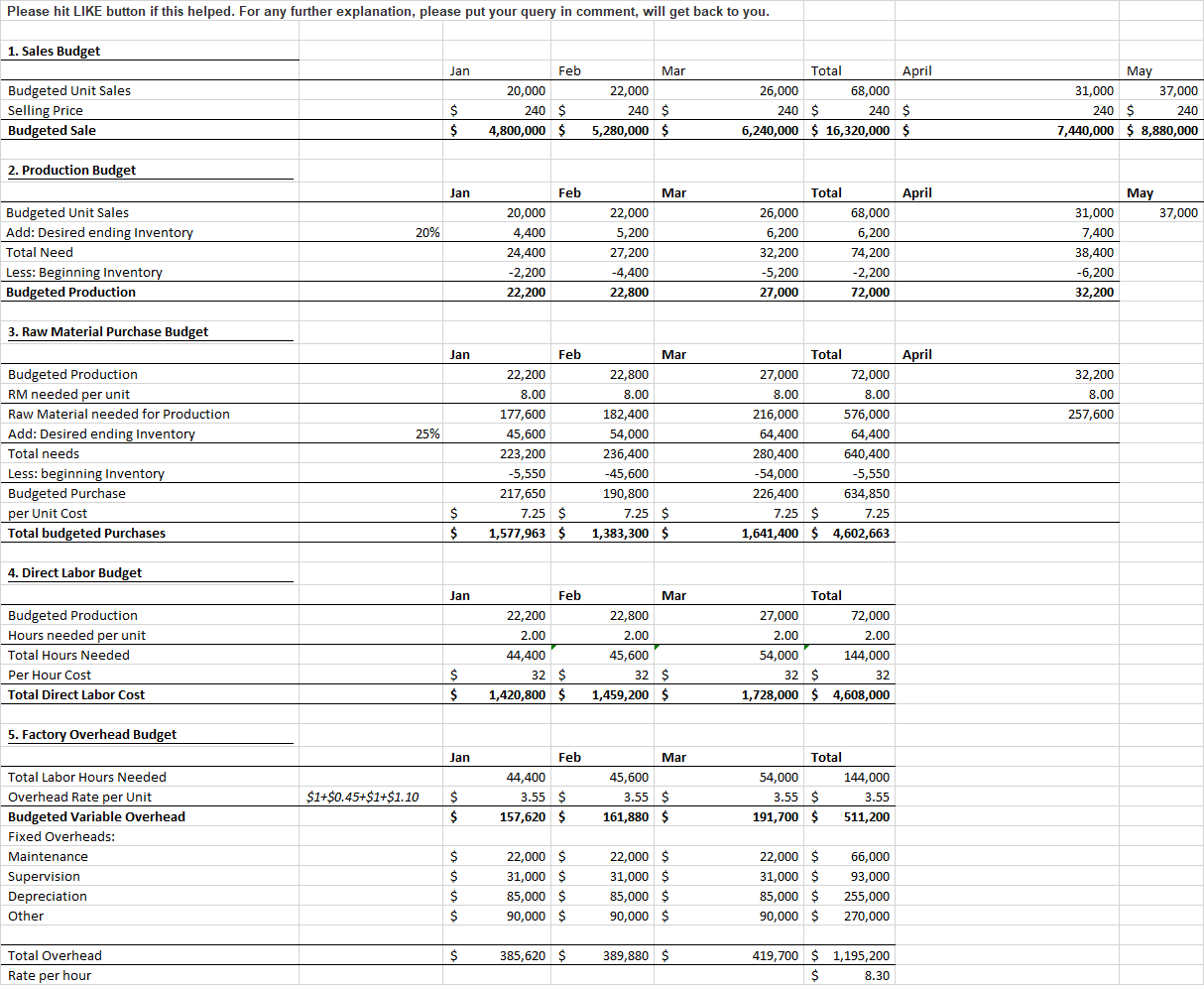

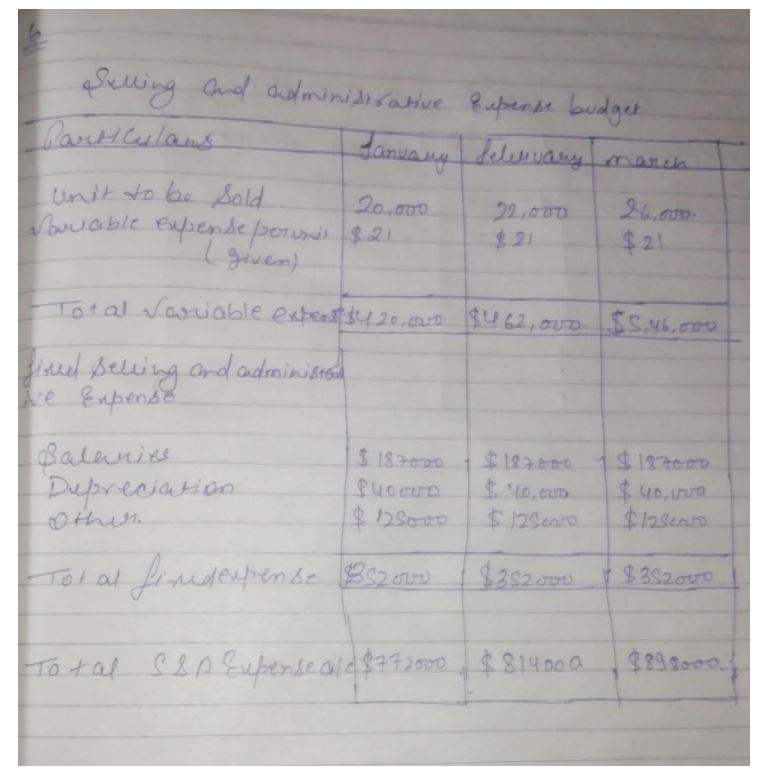

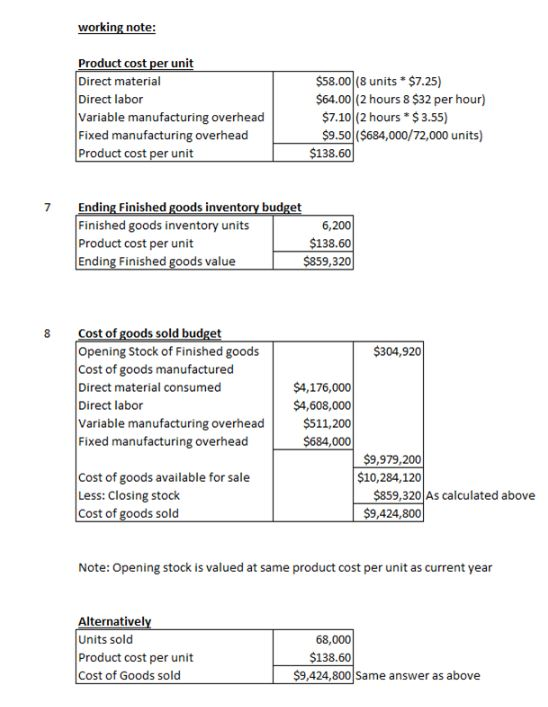

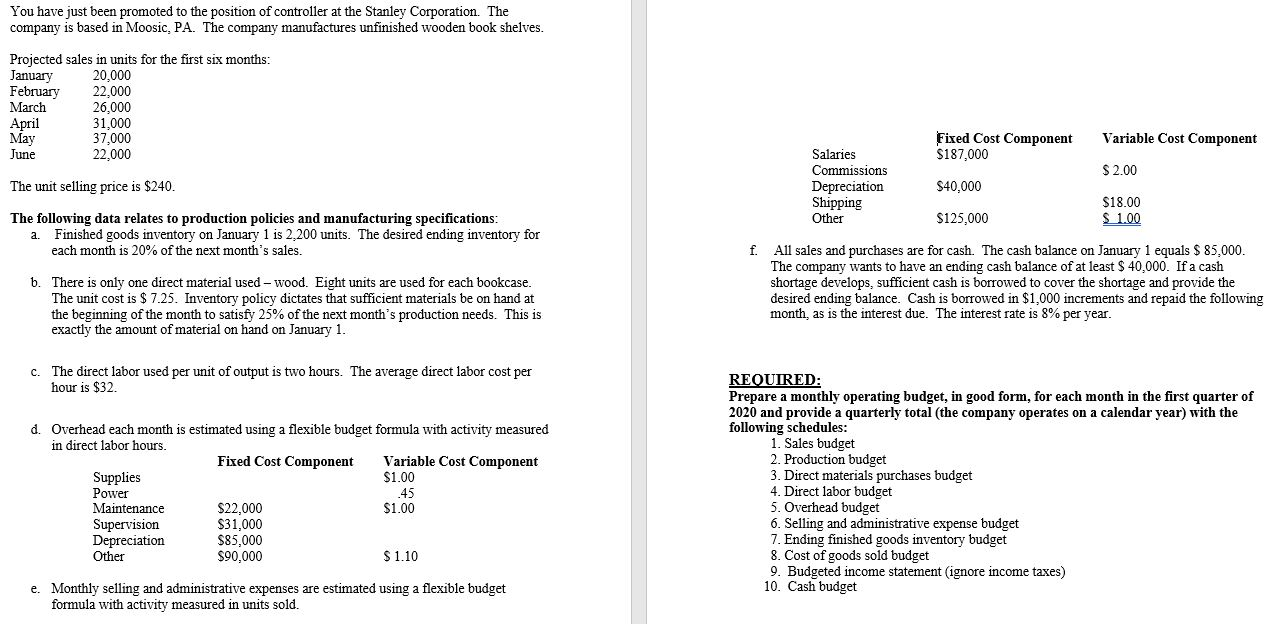

You have just been promoted to the position of controller at the Stanley Corporation. The company is based in Moosic, PA. The company manufactures unfinished wooden book shelves. Projected sales in units for the first six months: January 20,000 February 22,000 March 26,000 April 31,000 May June 22,000 37,000 Fixed Cost Component $187,000 Variable Cost Component $ 2.00 The unit selling price is $240. Salaries Commissions Depreciation Shipping Other $40,000 $125,000 $18.00 S 1.00 The following data relates to production policies and manufacturing specifications: Finished goods inventory on January 1 is 2.200 units. The desired ending inventory for each month is 20% of the next month's sales. a b. There is only one direct material used - wood. Eight units are used for each bookcase. The unit cost is $ 7.25. Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 25% of the next month's production needs. This is exactly the amount of material on hand on January 1. f. All sales and purchases are for cash. The cash balance on January 1 equals $ 85,000. The company wants to have an ending cash balance of at least $ 40,000. If a cash shortage develops, sufficient cash is borrowed to cover the shortage and provide the desired ending balance. Cash is borrowed in $1,000 increments and repaid the following month, as is the interest due. The interest rate is 8% per year. c. The direct labor used per unit of output is two hours. The average direct labor cost per hour is $32. d. Overhead each month is estimated using a flexible budget formula with activity measured in direct labor hours. Fixed Cost Component Variable Cost Component Supplies $1.00 Power 45 Maintenance $22,000 $1.00 Supervision $31,000 Depreciation $85,000 Other $90,000 $ 1.10 REQUIRED: Prepare a monthly operating budget, in good form, for each month in the first quarter of 2020 and provide a quarterly total (the company operates on a calendar year) with the following schedules: 1. Sales budget 2. Production budget 3. Direct materials purchases budget 4. Direct labor budget 5. Overhead budget 6. Selling and administrative expense budget 7. Ending finished goods inventory budget 8. Cost of goods sold budget 9. Budgeted income statement (ignore income taxes) 10. Cash budget e. Monthly selling and administrative expenses are estimated using a flexible budget formula with activity measured in units sold. Please hit LIKE button if this helped. For any further explanation, please put your query in comment, will get back to you. 1. Sales Budget Jan 68,000 Budgeted Unit Sales Selling Price Budgeted Sale Feb 20,000 240 $ 4,800,000 $ Mar 22,000 240 $ 5,280,000 $ Total April 26,000 240 $ 240 $ 6,240,000 $ 16,320,000 $ May 31,000 37,000 240 $ 240 7,440,000 $ 8,880,000 $ $ 2. Production Budget Jan Feb Mar April May 37,000 20% Budgeted Unit Sales Add: Desired ending Inventory Total Need Less: Beginning Inventory Budgeted Production 20,000 4,400 24,400 -2,200 22,200 22,000 5,200 27,200 -4,400 22,800 26,000 6,200 32,200 -5,200 27,000 Total 68,000 6,200 74,200 -2,200 72,000 31,000 7,400 38,400 -6,200 32,200 3. Raw Material Purchase Budget Jan Mar April 32,200 8.00 257,600 25% Budgeted Production RM needed per unit Raw Material needed for Production Add: Desired ending Inventory Total needs Less: beginning Inventory Budgeted Purchase per Unit Cost Total budgeted Purchases Feb 22,200 8.00 177,600 45,600 223,200 -5,550 217,650 7.25 $ 1,577,963 $ 22,800 8.00 182,400 54,000 236,400 -45,600 190,800 7.25 $ 1,383,300 $ Total 27,000 72,000 8.00 8.00 216,000 576,000 64,400 64,400 280,400 640,400 -54,000 -5,550 226,400 634,850 7.25 $ 7.25 1,641,400 $ 4,602,663 $ $ 4. Direct Labor Budget Jan Mar Budgeted Production Hours needed per unit Total Hours Needed Per Hour Cost Total Direct Labor Cost Feb 22,200 2.00 44,400 32 $ 1,420,800 $ 22,800 2.00 45,600 32 $ 1,459,200 $ Total 27,000 72,000 2.00 2.00 54,000 144,000 32 $ 32 1,728,000 $4,608,000 $ $ 5. Factory Overhead Budget Jan Feb 44,400 3.55 $ 157,620 $ Mar 45,600 3.55 $ 161,880 $ Total 54,000 144,000 3.55 $ 3.55 191,700 $ 511,200 $1+$0.45+$1+$1.10 $ $ Total Labor Hours Needed Overhead Rate per Unit Budgeted Variable Overhead Fixed Overheads: Maintenance Supervision Depreciation Other $ $ $ $ 22,000 $ 31,000 $ 85,000 $ 90,000 $ 22,000 $ 31,000 $ 85,000 $ 90,000 $ 22,000 $ 31,000 $ 85,000 $ 90,000 $ 66,000 93,000 255,000 270,000 $ 385,620 $ 389,880 $ Total Overhead Rate per hour 419,700 $ 1,195,200 $ 8.30 Selling and administrative Euperbe budget Part Clans January delovany manca unit to be sold darable expense/sorunes $21. $ 21 26.01 22.000 $21 I given) Total Narviable expenstje 20.000 $462,000 $5.46.com psed selling and administ he Expense Salaries Depreciation PUOD 30.D $197.00 $ 1870 70 $ 40.00 $12 Sonne $12Sean Tot at findexpense 2000 $382.22 $35200 Total Sin Expense ale $772000 / $81400 a working note: Product cost per unit Direct material Direct labor Variable manufacturing overhead Fixed manufacturing overhead Product cost per unit $58.00(8 units * $7.25) $64.00 (2 hours 8 $32 per hour) $7.10(2 hours * $3.55) $9.50 ($684,000/72,000 units) $138.60 7 Ending Finished goods inventory budget Finished goods inventory units 6,200 Product cost per unit $138.60 Ending Finished goods value $859,320 8 $304,920 Cost of goods sold budget Opening Stock of Finished goods Cost of goods manufactured Direct material consumed Direct labor Variable manufacturing overhead Fixed manufacturing overhead $4,176,000 $4,608,000 $511,200 $684,000 Cost of goods available for sale Less: Closing stock Cost of goods sold $9,979,200 $10,284,120 $859,320 As calculated above $9,424,800 Note: Opening stock is valued at same product cost per unit as current year Alternatively Units sold Product cost per unit Cost of Goods sold 68,000 $138.60 $9,424,800 Same answer as above

I have completed parts 1-8, and I am looking for assistance on parts 9-10

I have completed parts 1-8, and I am looking for assistance on parts 9-10