I have completed the general journal, purchases, cash receipts, cash disbursements, and sales journal but I need help with completing the ledgers and the 10 column worksheet. Please explain how to fill in the ledgers and 10 column worksheet and where you got the numbers. We start posting at number 26.

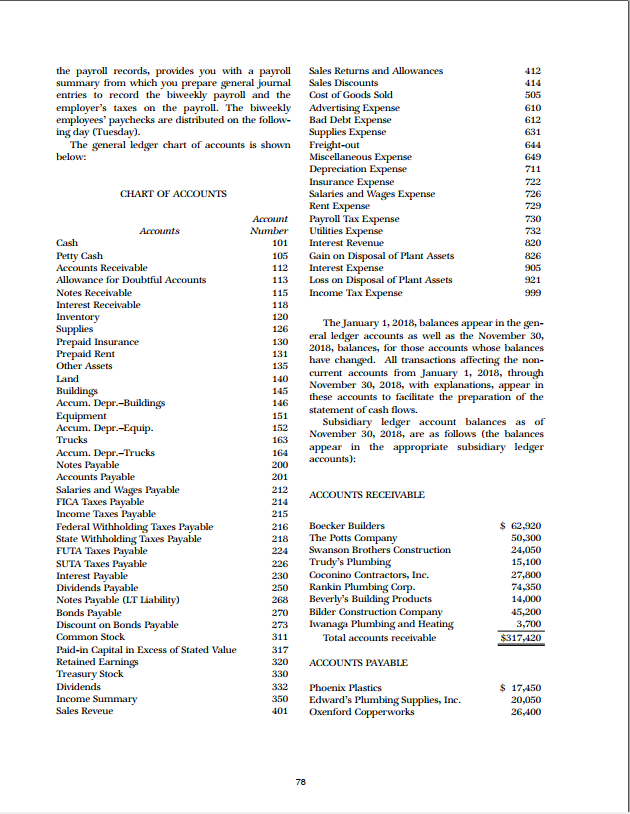

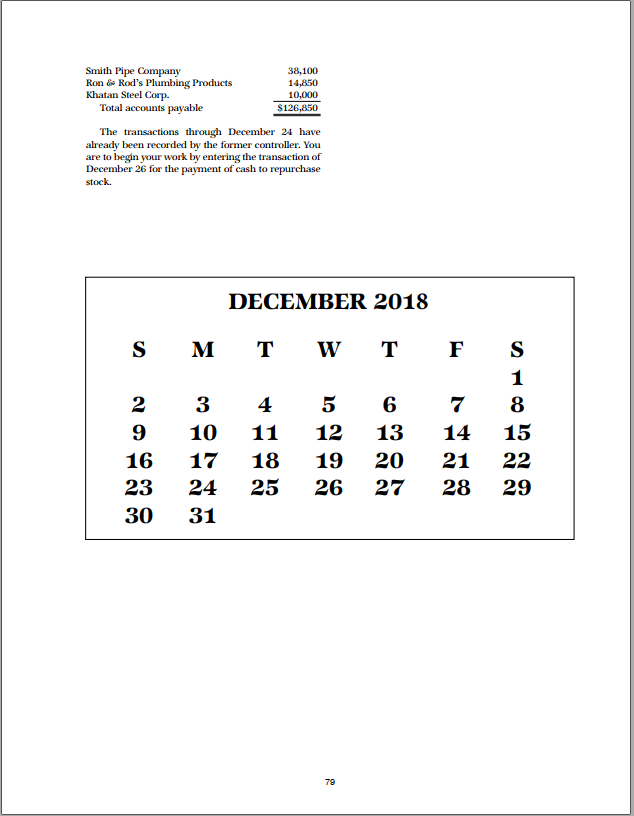

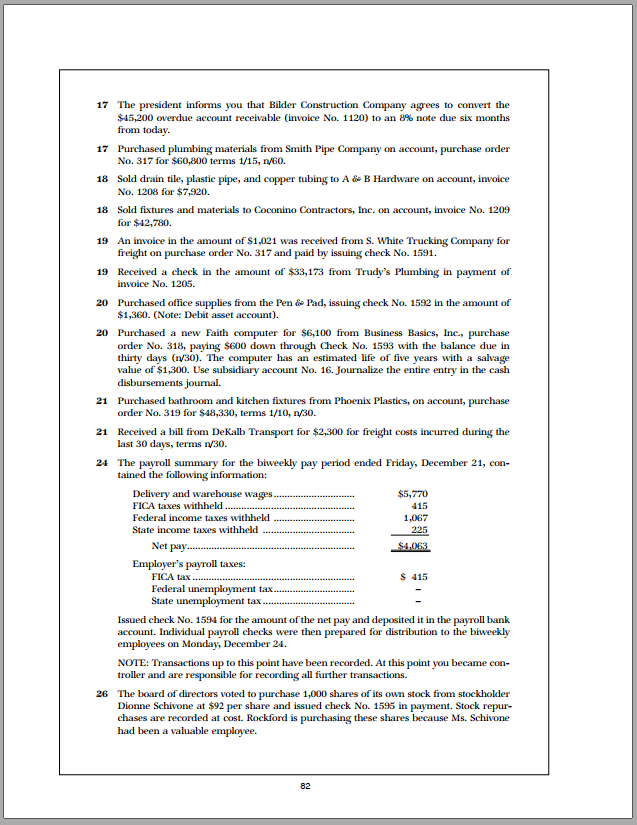

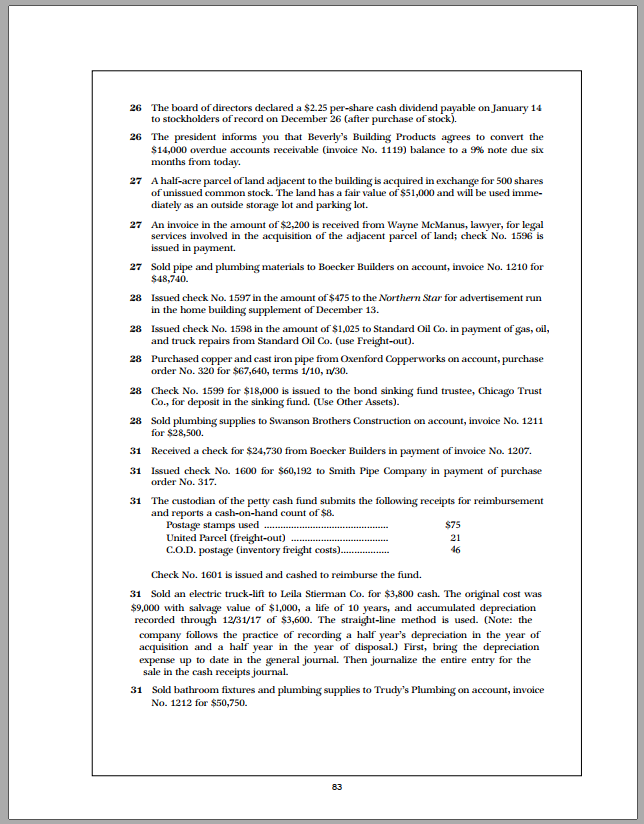

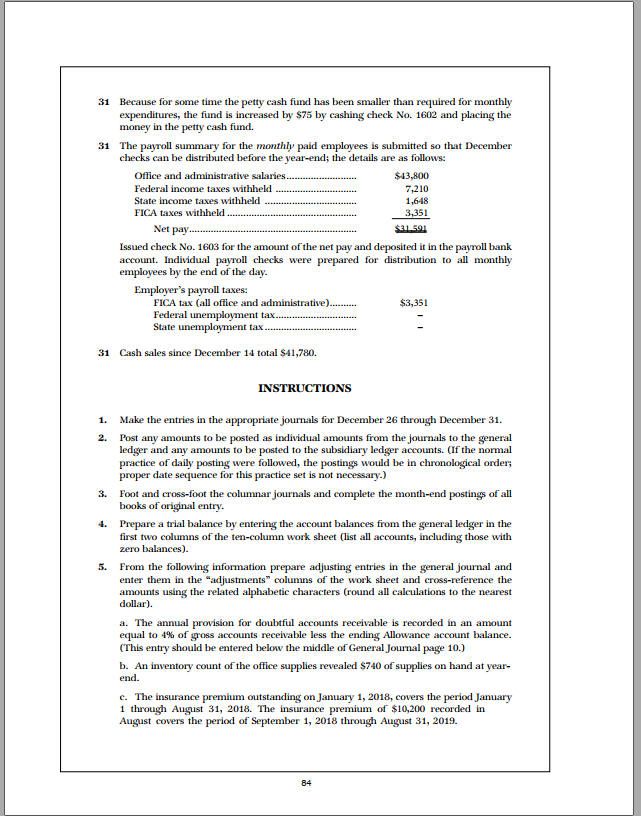

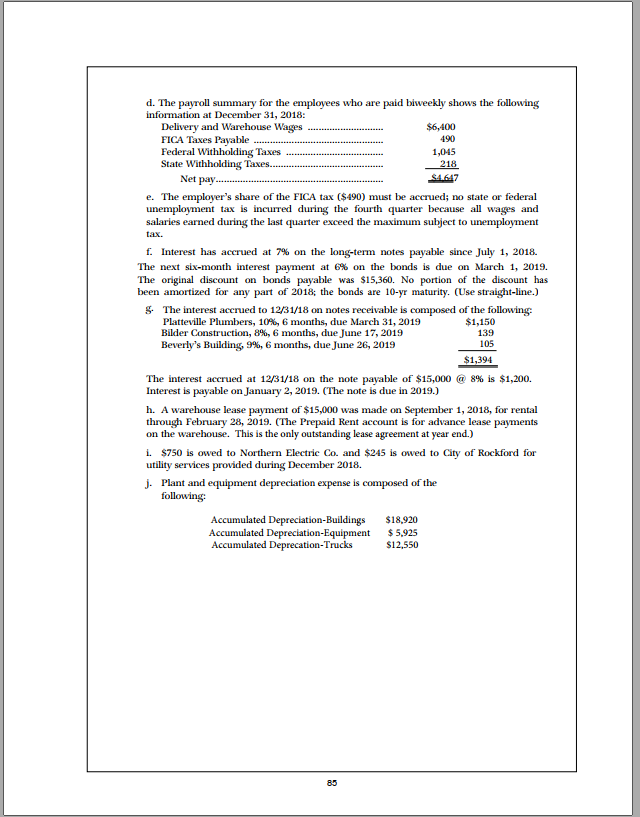

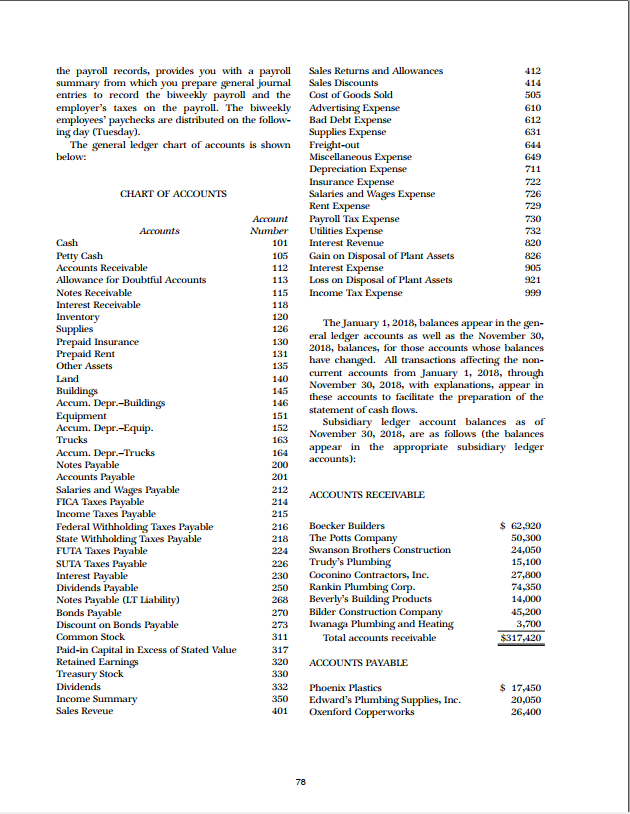

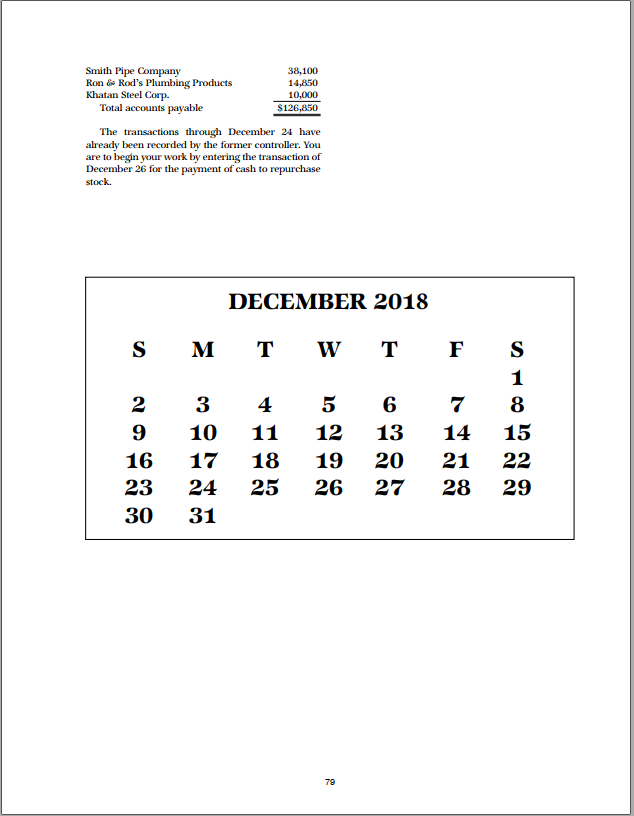

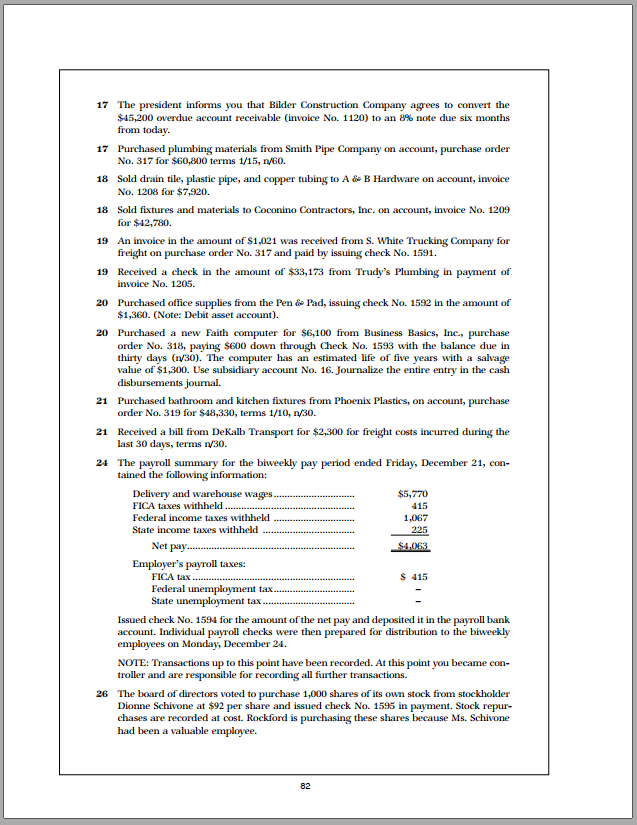

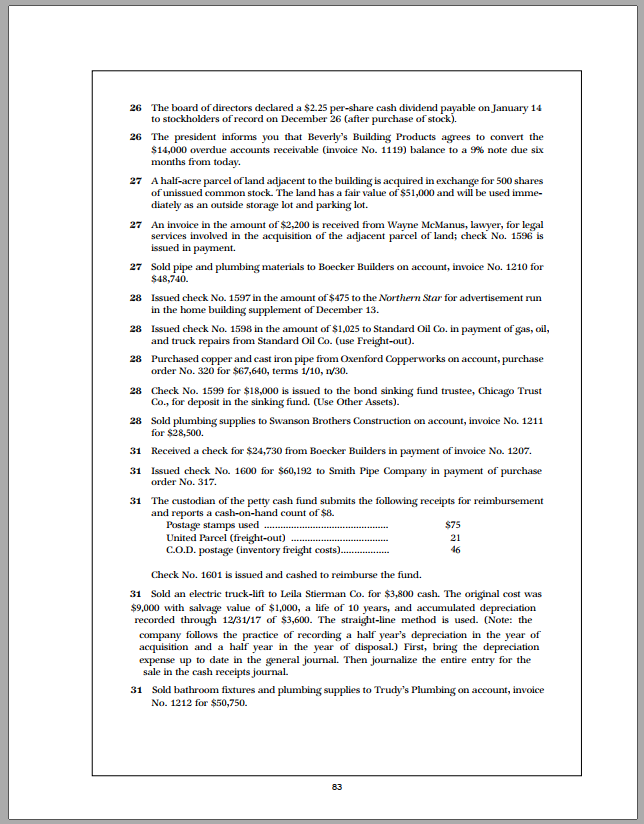

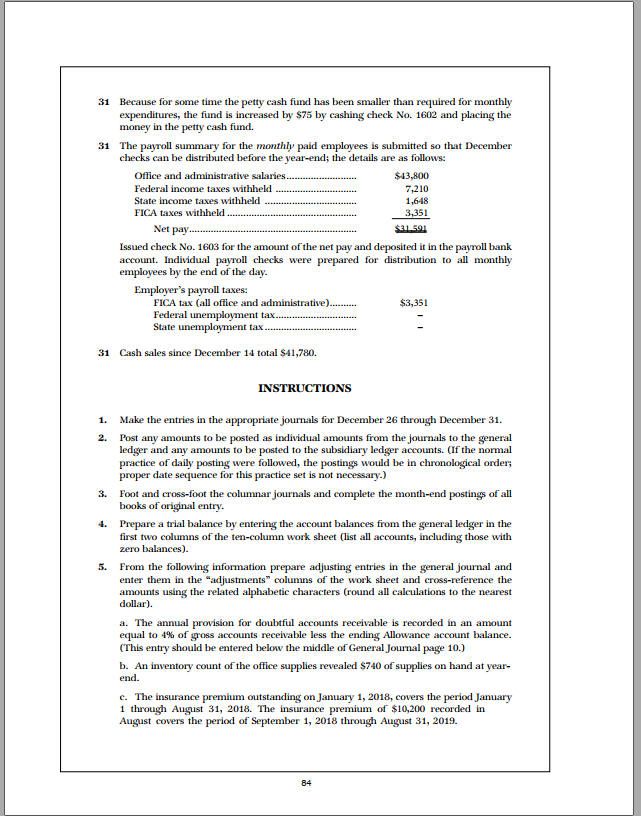

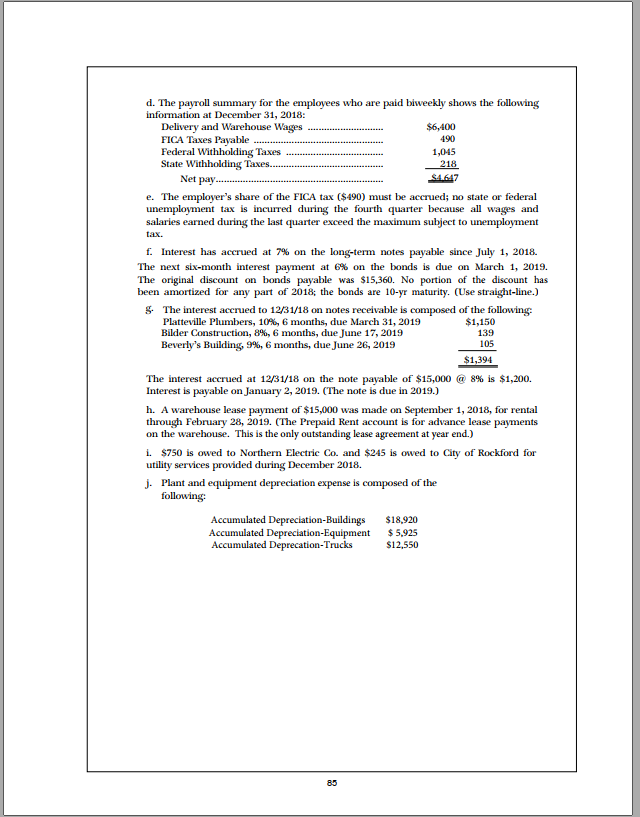

ROCKFORD CORPORATION A PRACTICE SET TO ACCOMPANY Intermediate Accounting, by Kieso, Weygandt, and Warfield PERPETUAL INVENTORY Narrative and Instructions corporation uses the f Rockford Corporation is a wholesale plumbing sup- ply distributor. The corporation was organized in 1981, under the laws of the State of Illinois, with an of 10,000 shares of no-par common stock with a stated value of $30 per share. 1. A sales journal (S-to record sales of merchandise The common stock is sold ower the counter in the local area. You have been hired as of Wednesday, 2. A purchases journal (P)-to record purchases of December 26, 2018, to replace the controller, who has resigned. As controller, you are responsible for 3. A cash receipts journal (CR)-to record all cash on account of the financial statements, safeguarding the corpo- 4. A cash disbursements journal (CD to record all rate assets, and providing management with finan- cial information to set prices and to monitor and 5. A general journal )-to record all transactions that cannot be recorded in the other journals. perpetual inventory. There is an inventory sub- sidiary ledger that is posted to daily for purchases and sales. This ledger is not included in this prac- tice set. The corporation secretary maintains the LEDGERS 1. A general 3. An accounts payable subsidiary ledger acts as the petty cashier financial statements quarterly. Adjusting entries are posted to the gener- be posted on the day of the sale directly to the al ledger only at year-end; at the end of the first, customer's account in the subsidiary ledger, using second, and third qur the adjustments are the invoice number as the posting reference number entered only on a ten-column work sheet, not in the in the subsidiary account. Also, cash receipts from general ledger. Therefore, the adjusting entries to customers should be posted to the subsidiary ledger be reconded on December 31 are annual adjust- on the day they are received. The purchase order ments that you must journalize and then post to the number should be used as the posting reference general ledger accounts before preparing the finan- number in the subsidiary ledger for purchases on cial statements. Rockford Corporation maintains a peretual and payments to them should be posted daily. All year to adjust the inventory carrying amount. the month-end. Account numbers should be used Purchases are recorded at the gross amount as posting reference numbers in the journals. (discounts taken are recognized at the date of payment) of the supplier's invoice, and the terms ees and are paid monthly on the last day of each vary with each supplier. Sales on account are month. The delivery truck drivers and warehouse subject to terms of 2/10, n/30. Discounts are taken employees are hourly wage employees and are paid and granted only when the terms are met. The cost biweekly. Each biweekly pay period ends Friday. On of all inventory sold in December was 80% of the the following Monday your assistant, who maintains Officers and office personnel are salaried employ the payroll records, provides you with a payroll Sales Returns and Allowances entries to record the biweekly payroll and the employer's taxes on the payroll. The biweekly employees' paychecks are distributed on the follow- Cost of Goods Sold Advertising Expense Bad Debt Expense The general ledger chart of accounts is shown Freight-out CHART OF ACCOUNTS Allowance for Doubtful Accounts 113 Loss on Disposal of Plant Assets The January 1, 2018, balances appear in the gen- eral ledger accounts as well as the November 30, 2018, balances, for those accounts whose balances these accounts to facilitate the November 30, 2018, are as follows (the balances Federal Withholding Taxes Payable State Withholding Taxes Payable Notes Payable (LT Liability) Discount on Bonds Payable Paid-in Capital in Excess of Stated Value 350 Edward's Plumbing Supplies, Inc. Smith Pipe Company Ron Rod's Plumbing Products Khatan Steel Corp. 38,100 14,850 10,000 $126,850 Total accounts payable The transactions through December 24 have already been recorded byw the former controller. You are to begin your work by entering the transaction of December 26 for the payment of cash to repurchase stock DECEMBER 2018 2 3 456 9 10 1112 13 14 15 16 17 18 19 20 21 22 23 24 25 26 2728 29 30 31 78 79 17 The president informs t Bilder Construction Company agrees you tha to convert the $45,200 overdue account receivable (invoice No. 1120) to an 8% note due six months from today. plumbing materials from Smith Pipe Company on account, purchase order No. 317 for $60,800 terms 1/15, n/60. Sold drain tile, plastic pipe, and copper tubing to A No. 1208 for $7,920. Sold fixtures and materials to Coconino Contractors, Inc. on account, invoice No. 1209 for $42,780. 18 Hardware on account, invoice 18 19 An invoice in the amount of $1,021 was received from S. White Trucking Company for 19 Received a check in the amount of $33,173 from Trudy's Plumbing in payment of 20 Purchased office supplies from the Pen & Pad, issuing check No. 1592 in the amount of 20 Purchased a new Faith computer for $6,100 from Business Basics, Inc., purchase freight on purchase order No. 317 and paid by issuing check No. 1591 invoice No. 1205. $1,360 (Note: Debit asset account) order No. 318, paying $600 down through Check No. 1593 with the balance due in thirty days (V30). The computer has an estimated life of five years with a salvage value of $1.300. Use subsidiary account No. 16. Journalize the entire entry in the cash disbursements journal. 21 Purchased bathroom and kitchen fixtures from Phoenix Plastics, on account, purchase order No. 319 for $48,330, terms 1/10, n/30 21 Received a bill from DeKalb Transport for $2,300 for freight costs incurred during the last 30 days, terms ny30. 24 The payroll summary for the biweekly pay period ended Friday, December 21, con- tained the following information: Delivery and warehouse wages FICA taxes withheld Federal income taxes withheld State income taxes withheld $5,770 415 1,067 225 Net pay Employer's payroll taxes: FICA tax S 415 State unemployment tax Issued check No. 1594 for the amoun payroll bank account. Individual payroll checks were then prepared for distribution to the biweekly employees on Monday, December 24. t of the net pay and deposited it in the NOTE: Transactions up to this point have been recorded. At this point you became con- troller and are responsible for recording all further transactions 26 The board of directors voted to purchase 1,000 shares of its own stock from stockholder Dionne Schivone at $92 per share and issued check No. 1595 in payment. Stock repur- chases are recorded at cost. Rockford is purchasing these shares because Ms. Schivone had been a valuable employee. 82 26 The board of directors declared a $2.25 per-share cash dividend payable on January 14 to stockholders of record on December 26 (after purchase of stock). 26 The president informs you that Beverly's Building Products agrees to convert the $14,000 overdue accounts receivable (invoice No. 1119) balance to a 9% note due six months from today. 27 Ahalf-acre parcel of land adjacent to the building is acquired in exchange for 500 shares of unissued common stock The land has a fair value of $51,000 and will be used imme diately as an outside storage lot and parking lot. 27 An invoice in the amount of $2,200 is received from Wayne McManus, lawyer, for legal services involved in the acquisition of the adjacent parcel of land; check No. 1596 is issued in payment 27 Sold pipe and plumbing materials to Boecker Builders on account, invoice No. 1210 for $48,740. 28 Issued check No. 1597 in the amount of $475 to the Northern Star for advertisement run in the home building supplement of December 13. Issued check No. 1598 in the amount of $1,025 to Standard Oil Co. in payment of gas, oil, and truck repairs from Standad Oil Co. (use Freight-out Purchased copper and cast iron pipe from Oxenford Copperworks on account, purchase order No. 320 for $67,640, terms 1/10, n/30. 28 28 28 Check No. 1599 for $18,000 is issued to the bond sinking fund trustee, Chicago Trust 28 Sold plumbing supplies to Swanson Brothers Construction on account, invoice No. 1211 31 Received a check for $24,730 from Boecker Builders in payment of invoice No. 1207. Co., for deposit in the sinking fund. (Use Other Assets). for $28,500 31 Issued check No. 1600 for $60,192 to Smith Pipe Company in payment of purchase order No. 317 31 The custodian of the petty cash fund submits the following receipts for and reports a cash-on-hand count of $8. Postage stamps used United Parcel (freight-out) C.O.D. postage (inventory freight costs). $75 21 46 Check No. 1601 is issued and cashed to reimburse the fund 31 Sold an electric truck-lift to Leila Stierman Co. for $3,800 cash. The original cost was $9,000 with salvage value of $1,000, a life of 10 years, and accumulated depreciation recorded through 12/31/17 of $3,600. The straight-line method is used. (Note: the company follows the practice of recording a half year's depreciation in the year of acquisition and a half year in the year of disposal.) First, bring the depreciation expense up to date in the general journal. Then journalize the entire entry for the sale in the cash receipts journal. 31 Sold bathroom fixtures and plumbing supplies to Trudy's Plumbing on account, invoice No. 1212 for $50,750 83 been smaller than required for monthly 31 Because for some time the petty cash fund has expenditures, the fund is increased by $75 by cashing check No. 1602 and placing the money in the petty cash fund. y submitted so that 31 The payroll summary f for the monthly paid employees is December checks can be distributed before the year-end; the details are as follows: $43,800 7,210 1,648 51 Federal income taxes withheld State income taxes withheld FICA taxes withheld Net pay Issued check No. 1603 for the amoun t of the net pay and deposited it in the payroll bank account. Individual payroll checks were prepared for distribution to all monthly employees by the end of the day. Employer's payroll taxes: FICA tax (all office and administrative) Federal unemployment State unemployment tax $3,351 31 Cash sales since December 14 total $41,780. INSTRUCTIONS 1. Make the entries in the appropriate journals forDecember 26 through December 31. 2. Post any amounts to be posted as individual amounts from the journals to the general ledger and any amounts to be posted to the subsidiary ledger accounts. (If the nomal practice of daily posting were followed, the postings would be in chronological order, proper date sequence for this practice set is not necessary.) 3. Foot and cross-foot the columnar journals and complete the month-end postings of all books of original entry Prepare a trial balance by entering the account balances from the general ledger in the first two columns of the ten-column work sheet (list all accounts, including those with zero balances) 4. 5. From the following information prepare adjusting entries in the general journal and enter them in the adjustments columns of the work sheet and cross-reference the amounts using the related alphabetic characters (round all calculations to the nearest dollar) a. The annual provision for doubtful accounts receivable is recorded in an amount equal to 4% of gross accounts receivable less the ending Allowance account balance. (This entry should be entered below the middle of General Journal page 10.) b. An inventory count of the office supplies revealed $740 of supplies on hand at year- end. c. The insurance premium outstanding on January 1, 2018, covers the period January 1 through August 31, 2018. The insurance premium of $10,200 recorded in August covers the period of September 1, 2018 through August 31, 2019. 84 d. The payroll summary for the employees who are paid biweekly shows the following information at December 31, 2018: Warehouse Wages Delivery and $6,400 490 1,045 FICA Taxes Payable Federal Withholding Taxes State Withholding Net pay e. The employer's share of the FICA tax ($490) must be accrued no state or federal unemployment tax is incurred during the fourth quarter because all wages and salaries earned during the last quarter exceed the maximum subject to unemployment ax. f. Interest has accrued at 7% on the long-term notes payable since July 1, 2018. The next six-month interest payment at 6% on the bonds is due on March 1, 2019. The original discount on bonds payable was $15,360. No portion of the discount has been amortized for any part of 2018; the bonds are 10-yr maturity. (Use straight-line.) S The interest accrued to 12/31/18 on notes receivable is composed of the following $1,150 139 105 Platteville Plumbers, 10%, 6 months, due March 31, 2019 Bilder Construction, 8%, 6 months, due June 17, 2019 Beverly's Building, 9%, 6 months, due June 26, 2019 $1,394 The interest accrued at 12/31/18 on the note payable of $15,000 @ 8% is $1.200. Interest is payable on January 2, 2019. (The note is due in 2019.) h. A warehouse lease payment of $15,000 was made on September 1, 2018, for rental through February 28, 2019. (The Prepaid Rent account is for advance lease payments on the warehouse. This is the only outstanding lease agreement at year end.) L. $750 is owed to Northern Electric Co and $245 is owed to City of Rockford for utility services provided during December 2018. j. Plant and equipment depreciation expense is composed of the following Accumulated Depreciation-Buildings $18,920 Accumulated Depreciation-Equipment 5,925 Accumulated Deprecation-Trucks S12,550 85 ROCKFORD CORPORATION A PRACTICE SET TO ACCOMPANY Intermediate Accounting, by Kieso, Weygandt, and Warfield PERPETUAL INVENTORY Narrative and Instructions corporation uses the f Rockford Corporation is a wholesale plumbing sup- ply distributor. The corporation was organized in 1981, under the laws of the State of Illinois, with an of 10,000 shares of no-par common stock with a stated value of $30 per share. 1. A sales journal (S-to record sales of merchandise The common stock is sold ower the counter in the local area. You have been hired as of Wednesday, 2. A purchases journal (P)-to record purchases of December 26, 2018, to replace the controller, who has resigned. As controller, you are responsible for 3. A cash receipts journal (CR)-to record all cash on account of the financial statements, safeguarding the corpo- 4. A cash disbursements journal (CD to record all rate assets, and providing management with finan- cial information to set prices and to monitor and 5. A general journal )-to record all transactions that cannot be recorded in the other journals. perpetual inventory. There is an inventory sub- sidiary ledger that is posted to daily for purchases and sales. This ledger is not included in this prac- tice set. The corporation secretary maintains the LEDGERS 1. A general 3. An accounts payable subsidiary ledger acts as the petty cashier financial statements quarterly. Adjusting entries are posted to the gener- be posted on the day of the sale directly to the al ledger only at year-end; at the end of the first, customer's account in the subsidiary ledger, using second, and third qur the adjustments are the invoice number as the posting reference number entered only on a ten-column work sheet, not in the in the subsidiary account. Also, cash receipts from general ledger. Therefore, the adjusting entries to customers should be posted to the subsidiary ledger be reconded on December 31 are annual adjust- on the day they are received. The purchase order ments that you must journalize and then post to the number should be used as the posting reference general ledger accounts before preparing the finan- number in the subsidiary ledger for purchases on cial statements. Rockford Corporation maintains a peretual and payments to them should be posted daily. All year to adjust the inventory carrying amount. the month-end. Account numbers should be used Purchases are recorded at the gross amount as posting reference numbers in the journals. (discounts taken are recognized at the date of payment) of the supplier's invoice, and the terms ees and are paid monthly on the last day of each vary with each supplier. Sales on account are month. The delivery truck drivers and warehouse subject to terms of 2/10, n/30. Discounts are taken employees are hourly wage employees and are paid and granted only when the terms are met. The cost biweekly. Each biweekly pay period ends Friday. On of all inventory sold in December was 80% of the the following Monday your assistant, who maintains Officers and office personnel are salaried employ the payroll records, provides you with a payroll Sales Returns and Allowances entries to record the biweekly payroll and the employer's taxes on the payroll. The biweekly employees' paychecks are distributed on the follow- Cost of Goods Sold Advertising Expense Bad Debt Expense The general ledger chart of accounts is shown Freight-out CHART OF ACCOUNTS Allowance for Doubtful Accounts 113 Loss on Disposal of Plant Assets The January 1, 2018, balances appear in the gen- eral ledger accounts as well as the November 30, 2018, balances, for those accounts whose balances these accounts to facilitate the November 30, 2018, are as follows (the balances Federal Withholding Taxes Payable State Withholding Taxes Payable Notes Payable (LT Liability) Discount on Bonds Payable Paid-in Capital in Excess of Stated Value 350 Edward's Plumbing Supplies, Inc. Smith Pipe Company Ron Rod's Plumbing Products Khatan Steel Corp. 38,100 14,850 10,000 $126,850 Total accounts payable The transactions through December 24 have already been recorded byw the former controller. You are to begin your work by entering the transaction of December 26 for the payment of cash to repurchase stock DECEMBER 2018 2 3 456 9 10 1112 13 14 15 16 17 18 19 20 21 22 23 24 25 26 2728 29 30 31 78 79 17 The president informs t Bilder Construction Company agrees you tha to convert the $45,200 overdue account receivable (invoice No. 1120) to an 8% note due six months from today. plumbing materials from Smith Pipe Company on account, purchase order No. 317 for $60,800 terms 1/15, n/60. Sold drain tile, plastic pipe, and copper tubing to A No. 1208 for $7,920. Sold fixtures and materials to Coconino Contractors, Inc. on account, invoice No. 1209 for $42,780. 18 Hardware on account, invoice 18 19 An invoice in the amount of $1,021 was received from S. White Trucking Company for 19 Received a check in the amount of $33,173 from Trudy's Plumbing in payment of 20 Purchased office supplies from the Pen & Pad, issuing check No. 1592 in the amount of 20 Purchased a new Faith computer for $6,100 from Business Basics, Inc., purchase freight on purchase order No. 317 and paid by issuing check No. 1591 invoice No. 1205. $1,360 (Note: Debit asset account) order No. 318, paying $600 down through Check No. 1593 with the balance due in thirty days (V30). The computer has an estimated life of five years with a salvage value of $1.300. Use subsidiary account No. 16. Journalize the entire entry in the cash disbursements journal. 21 Purchased bathroom and kitchen fixtures from Phoenix Plastics, on account, purchase order No. 319 for $48,330, terms 1/10, n/30 21 Received a bill from DeKalb Transport for $2,300 for freight costs incurred during the last 30 days, terms ny30. 24 The payroll summary for the biweekly pay period ended Friday, December 21, con- tained the following information: Delivery and warehouse wages FICA taxes withheld Federal income taxes withheld State income taxes withheld $5,770 415 1,067 225 Net pay Employer's payroll taxes: FICA tax S 415 State unemployment tax Issued check No. 1594 for the amoun payroll bank account. Individual payroll checks were then prepared for distribution to the biweekly employees on Monday, December 24. t of the net pay and deposited it in the NOTE: Transactions up to this point have been recorded. At this point you became con- troller and are responsible for recording all further transactions 26 The board of directors voted to purchase 1,000 shares of its own stock from stockholder Dionne Schivone at $92 per share and issued check No. 1595 in payment. Stock repur- chases are recorded at cost. Rockford is purchasing these shares because Ms. Schivone had been a valuable employee. 82 26 The board of directors declared a $2.25 per-share cash dividend payable on January 14 to stockholders of record on December 26 (after purchase of stock). 26 The president informs you that Beverly's Building Products agrees to convert the $14,000 overdue accounts receivable (invoice No. 1119) balance to a 9% note due six months from today. 27 Ahalf-acre parcel of land adjacent to the building is acquired in exchange for 500 shares of unissued common stock The land has a fair value of $51,000 and will be used imme diately as an outside storage lot and parking lot. 27 An invoice in the amount of $2,200 is received from Wayne McManus, lawyer, for legal services involved in the acquisition of the adjacent parcel of land; check No. 1596 is issued in payment 27 Sold pipe and plumbing materials to Boecker Builders on account, invoice No. 1210 for $48,740. 28 Issued check No. 1597 in the amount of $475 to the Northern Star for advertisement run in the home building supplement of December 13. Issued check No. 1598 in the amount of $1,025 to Standard Oil Co. in payment of gas, oil, and truck repairs from Standad Oil Co. (use Freight-out Purchased copper and cast iron pipe from Oxenford Copperworks on account, purchase order No. 320 for $67,640, terms 1/10, n/30. 28 28 28 Check No. 1599 for $18,000 is issued to the bond sinking fund trustee, Chicago Trust 28 Sold plumbing supplies to Swanson Brothers Construction on account, invoice No. 1211 31 Received a check for $24,730 from Boecker Builders in payment of invoice No. 1207. Co., for deposit in the sinking fund. (Use Other Assets). for $28,500 31 Issued check No. 1600 for $60,192 to Smith Pipe Company in payment of purchase order No. 317 31 The custodian of the petty cash fund submits the following receipts for and reports a cash-on-hand count of $8. Postage stamps used United Parcel (freight-out) C.O.D. postage (inventory freight costs). $75 21 46 Check No. 1601 is issued and cashed to reimburse the fund 31 Sold an electric truck-lift to Leila Stierman Co. for $3,800 cash. The original cost was $9,000 with salvage value of $1,000, a life of 10 years, and accumulated depreciation recorded through 12/31/17 of $3,600. The straight-line method is used. (Note: the company follows the practice of recording a half year's depreciation in the year of acquisition and a half year in the year of disposal.) First, bring the depreciation expense up to date in the general journal. Then journalize the entire entry for the sale in the cash receipts journal. 31 Sold bathroom fixtures and plumbing supplies to Trudy's Plumbing on account, invoice No. 1212 for $50,750 83 been smaller than required for monthly 31 Because for some time the petty cash fund has expenditures, the fund is increased by $75 by cashing check No. 1602 and placing the money in the petty cash fund. y submitted so that 31 The payroll summary f for the monthly paid employees is December checks can be distributed before the year-end; the details are as follows: $43,800 7,210 1,648 51 Federal income taxes withheld State income taxes withheld FICA taxes withheld Net pay Issued check No. 1603 for the amoun t of the net pay and deposited it in the payroll bank account. Individual payroll checks were prepared for distribution to all monthly employees by the end of the day. Employer's payroll taxes: FICA tax (all office and administrative) Federal unemployment State unemployment tax $3,351 31 Cash sales since December 14 total $41,780. INSTRUCTIONS 1. Make the entries in the appropriate journals forDecember 26 through December 31. 2. Post any amounts to be posted as individual amounts from the journals to the general ledger and any amounts to be posted to the subsidiary ledger accounts. (If the nomal practice of daily posting were followed, the postings would be in chronological order, proper date sequence for this practice set is not necessary.) 3. Foot and cross-foot the columnar journals and complete the month-end postings of all books of original entry Prepare a trial balance by entering the account balances from the general ledger in the first two columns of the ten-column work sheet (list all accounts, including those with zero balances) 4. 5. From the following information prepare adjusting entries in the general journal and enter them in the adjustments columns of the work sheet and cross-reference the amounts using the related alphabetic characters (round all calculations to the nearest dollar) a. The annual provision for doubtful accounts receivable is recorded in an amount equal to 4% of gross accounts receivable less the ending Allowance account balance. (This entry should be entered below the middle of General Journal page 10.) b. An inventory count of the office supplies revealed $740 of supplies on hand at year- end. c. The insurance premium outstanding on January 1, 2018, covers the period January 1 through August 31, 2018. The insurance premium of $10,200 recorded in August covers the period of September 1, 2018 through August 31, 2019. 84 d. The payroll summary for the employees who are paid biweekly shows the following information at December 31, 2018: Warehouse Wages Delivery and $6,400 490 1,045 FICA Taxes Payable Federal Withholding Taxes State Withholding Net pay e. The employer's share of the FICA tax ($490) must be accrued no state or federal unemployment tax is incurred during the fourth quarter because all wages and salaries earned during the last quarter exceed the maximum subject to unemployment ax. f. Interest has accrued at 7% on the long-term notes payable since July 1, 2018. The next six-month interest payment at 6% on the bonds is due on March 1, 2019. The original discount on bonds payable was $15,360. No portion of the discount has been amortized for any part of 2018; the bonds are 10-yr maturity. (Use straight-line.) S The interest accrued to 12/31/18 on notes receivable is composed of the following $1,150 139 105 Platteville Plumbers, 10%, 6 months, due March 31, 2019 Bilder Construction, 8%, 6 months, due June 17, 2019 Beverly's Building, 9%, 6 months, due June 26, 2019 $1,394 The interest accrued at 12/31/18 on the note payable of $15,000 @ 8% is $1.200. Interest is payable on January 2, 2019. (The note is due in 2019.) h. A warehouse lease payment of $15,000 was made on September 1, 2018, for rental through February 28, 2019. (The Prepaid Rent account is for advance lease payments on the warehouse. This is the only outstanding lease agreement at year end.) L. $750 is owed to Northern Electric Co and $245 is owed to City of Rockford for utility services provided during December 2018. j. Plant and equipment depreciation expense is composed of the following Accumulated Depreciation-Buildings $18,920 Accumulated Depreciation-Equipment 5,925 Accumulated Deprecation-Trucks S12,550 85