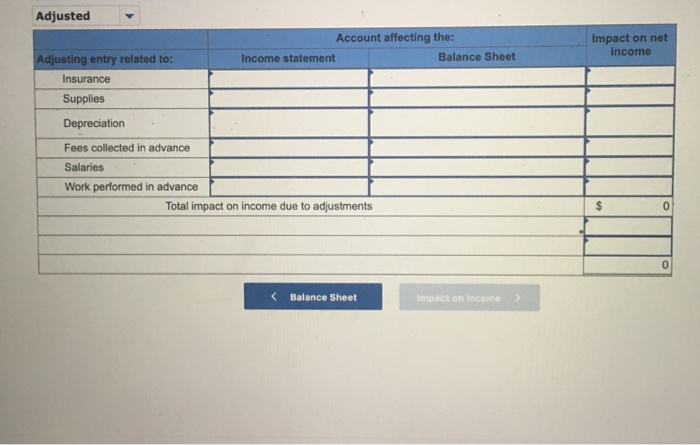

i have done all requirments, i just need help to complete the last part which is the impact on income...look through to see if there is any mistake and help complete impact on income... thanks

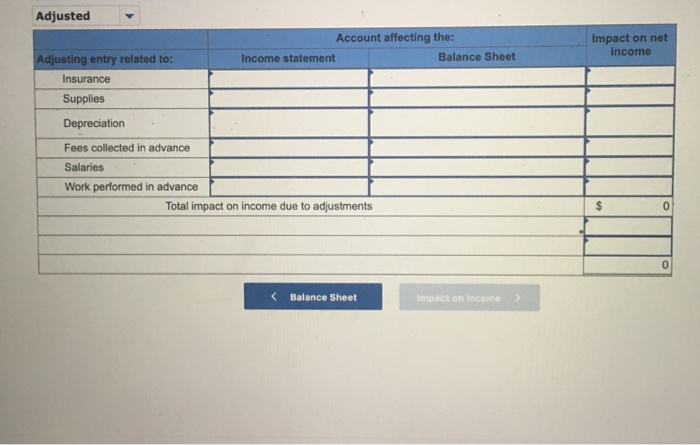

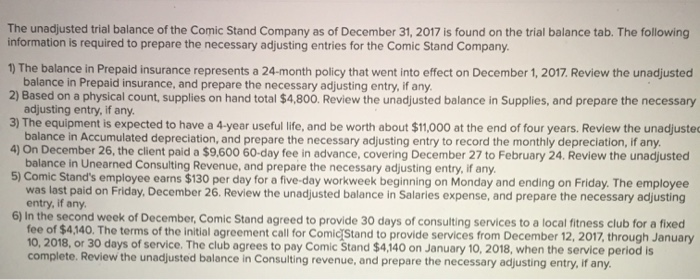

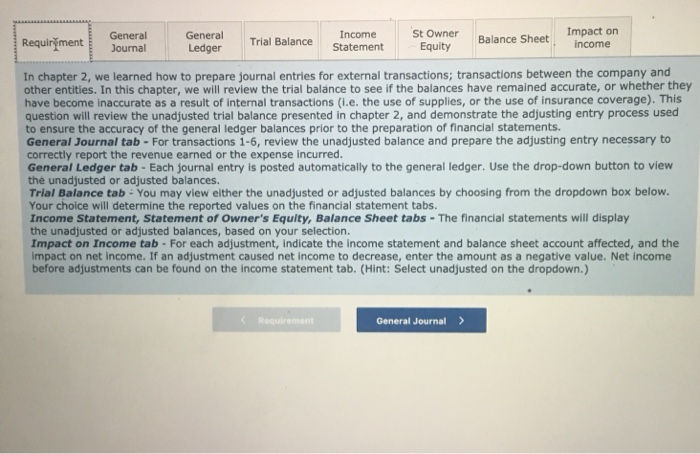

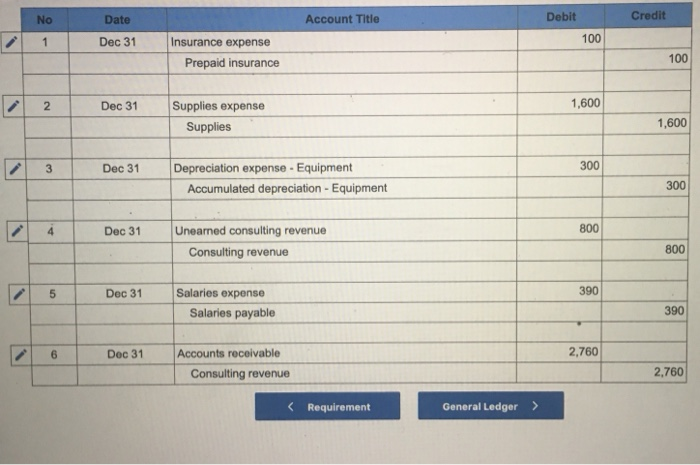

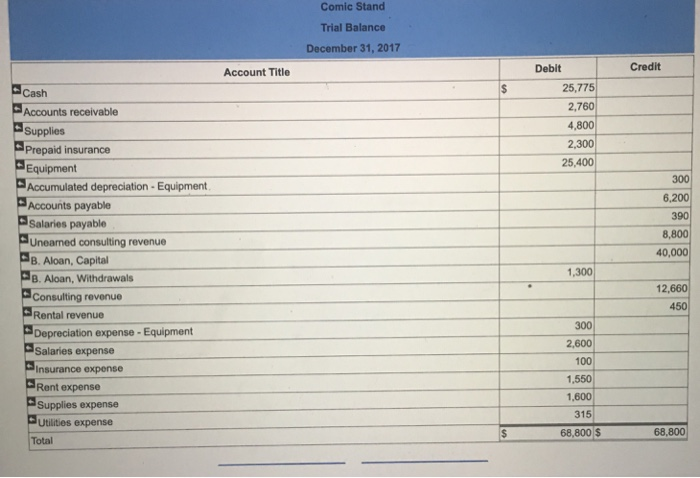

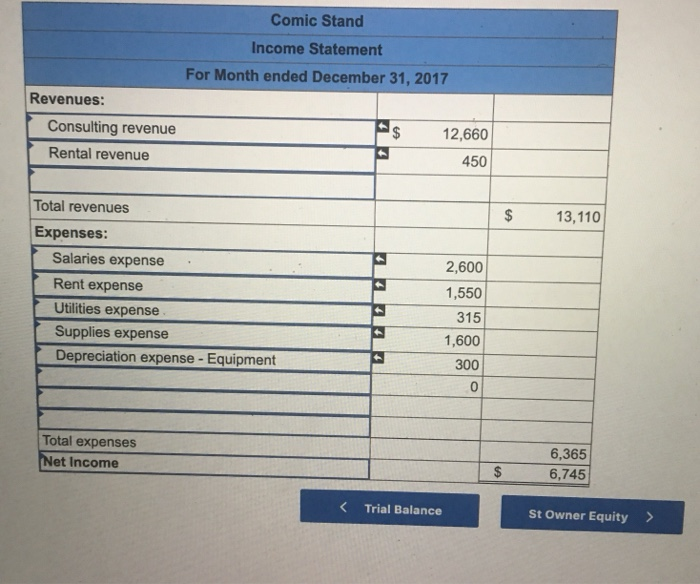

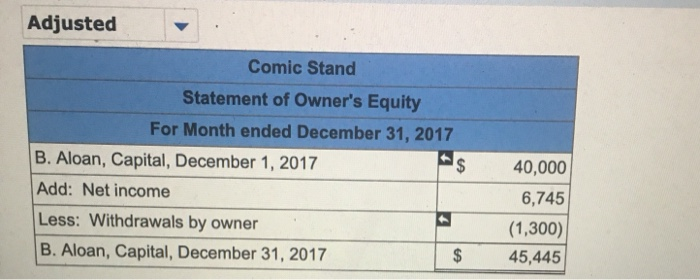

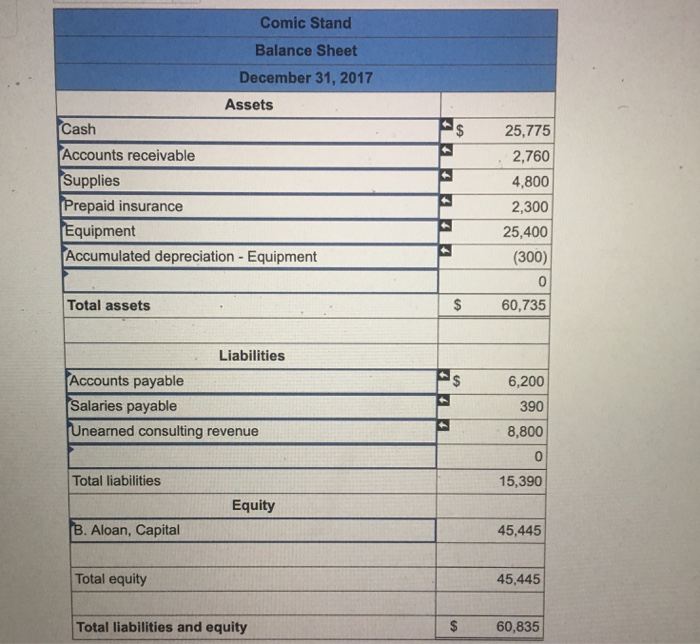

The unadjusted trial balance of the Comic Stand Company as of December 31, 2017 is found on the trial balance tab. The following information is required to prepare the necessary adjusting entries for the Comic Stand Company 1) The balance in Prepaid insurance represents a 24-month policy that went into effect on December 1, 2017. Review the unadjusted balance in Prepaid insurance, and prepare the necessary adjusting entry, if any. 2) Based on a physical count, supplies on hand total $4,800. Review the unadjusted balance in Supplies, and prepare the necessary adjusting entry, if any. 3) The equipment is expected to have a 4-year useful life, and be worth about $11,000 at the end of four years. Review the unadjuste balance in Accumulated depreciation, and prepare the necessary adjusting entry to record the monthly depreciation, if any. 4) On December 26, the client paid a $9,600 60-day fee in advance, covering December 27 to February 24. Review the unadjusted balance in Unearned Consulting Revenue, and prepare the necessary adjusting entry, if any. 5) Comic Stand's employee earns $130 per day for a five-day workweek beginning on Monday and ending on Friday. The employee was last paid on Friday, December 26. Review the unadjusted balance in Salaries expense, and prepare the necessary adjusting entry, if any. 6) In the second week of December, Comic Stand agreed to provide 30 days of consulting services to a local fitness club for a fixed fee of $4,140. The terms of the initial agreement call for Comic Stand to provide services from December 12, 2017, through January 10, 2018, or 30 days of service. The club agrees to pay Comic Stand $4,140 on January 10, 2018, when the service period is complete. Review the unadjusted balance in Consulting revenue, and prepare the necessary adjusting entry. If any. Requirment General Journal General Ledger Trial Balance Income Statement St Owner Equity Balance Sheet Impact on income In chapter 2, we learned how to prepare journal entries for external transactions; transactions between the company and other entities. In this chapter, we will review the trial balance to see if the balances have remained accurate, or whether they have become inaccurate as a result of internal transactions (l.e. the use of supplies, or the use of insurance coverage). This question will review the unadjusted trial balance presented in chapter 2, and demonstrate the adjusting entry process used to ensure the accuracy of the general ledger balances prior to the preparation of financial statements. General Journal tab - For transactions 1-6, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurred. General Ledger tab - Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted or adjusted balances. Trial Balance tab - You may view either the unadjusted or adjusted balances by choosing from the dropdown box below. Your choice will determine the reported values on the financial statement tabs. Income Statement, Statement of Owner's Equity, Balance Sheet tabs - The financial statements will display the unadjusted or adjusted balances, based on your selection, Impact on Income tab - For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the dropdown.) Requirement General Journal > Account Title Credit No 1 Date Dec 31 Debit 100 Insurance expense Prepaid insurance 2 Dec 31 1,600 Supplies expense Supplies 1,600 3 Dec 31 300 Depreciation expense - Equipment Accumulated depreciation - Equipment 300 Dec 31 800 Unearned consulting revenue Consulting revenue 800 Dec 31 390 Salaries expense Salaries payable 390 26 Dec 31 Dec 31 2,760 Accounts receivable Consulting revenue 2,760 Comic Stand Trial Balance December 31, 2017 Credit Account Title Cash Debit 25,775 2,760 4,800 2,300 25,400 300 6,200 390 8,800 40,000 - Accounts receivable Supplies Prepaid insurance - Equipment Accumulated depreciation - Equipment - Accounts payable Salaries payable Uneamed consulting revenue B. Aloan, Capital B. Aloan, Withdrawals Consulting revenue - Rental revenue Depreciation expense - Equipment - Salaries expense Insurance expense Rent expense Supplies expense Utilities expense Total 1,300 12,660 450 300 2,600 100 1,550 1,600 315 68,800 $ 68,800 Comic Stand Income Statement For Month ended December 31, 2017 Revenues: Consulting revenue 12,660 Rental revenue 450 13, 110 1 . Total revenues Expenses: Salaries expense . Rent expense Utilities expense Supplies expense Depreciation expense - Equipment 2,600 1,550 315 1,600 300 Total expenses Net Income 6,365 6,745 Trial Balance St Owner Equity > Adjusted Comic Stand Statement of Owner's Equity For Month ended December 31, 2017 B. Aloan, Capital, December 1, 2017 Add: Net income Less: Withdrawals by owner B. Aloan, Capital, December 31, 2017 $ 40,000 6,745 (1,300) 45,445 Comic Stand Balance Sheet December 31, 2017 Assets Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment 25,775 2,760 4,800 2,300 25,400 (300) Total assets $ 60,735 Liabilities Accounts payable Salaries payable Unearned consulting revenue 6,200 390 8,800 Total liabilities 15,390 Equity B. Aloan, Capital 45,445 Total equity 45,445 Total liabilities and equity $ 60,835 Adjusted Account affecting the: Income statement Balance Sheet Impact on net income Adjusting entry related to: Insurance Supplies Depreciation Fees collected in advance Salaries Work performed in advance Total impact on income due to adjustments

i have done all requirments, i just need help to complete the last part which is the impact on income...look through to see if there is any mistake and help complete impact on income... thanks

i have done all requirments, i just need help to complete the last part which is the impact on income...look through to see if there is any mistake and help complete impact on income... thanks