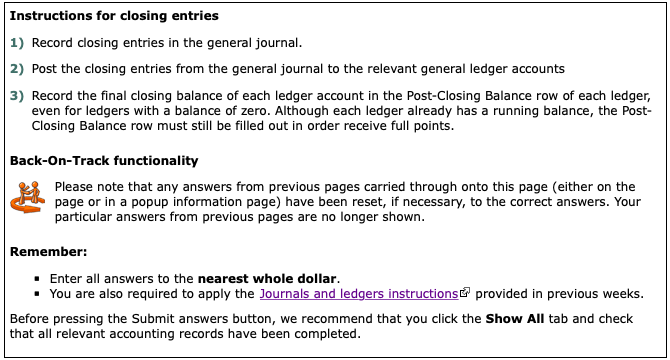

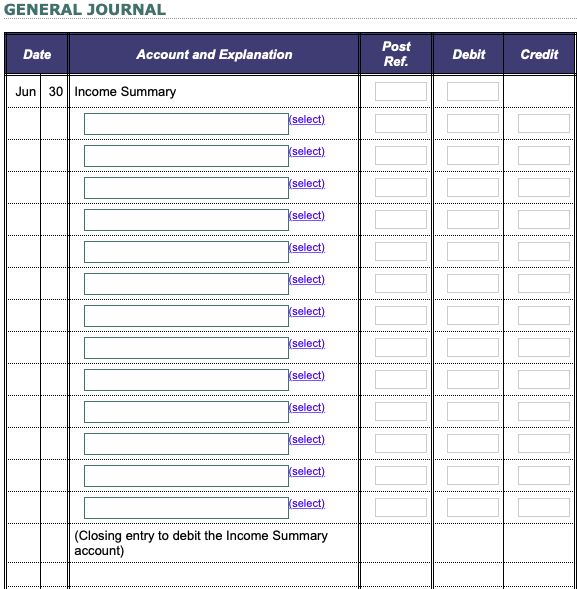

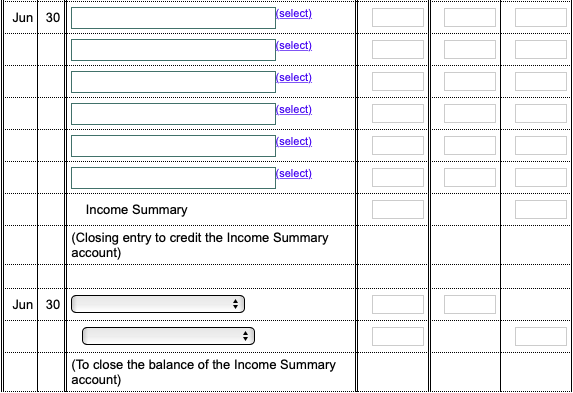

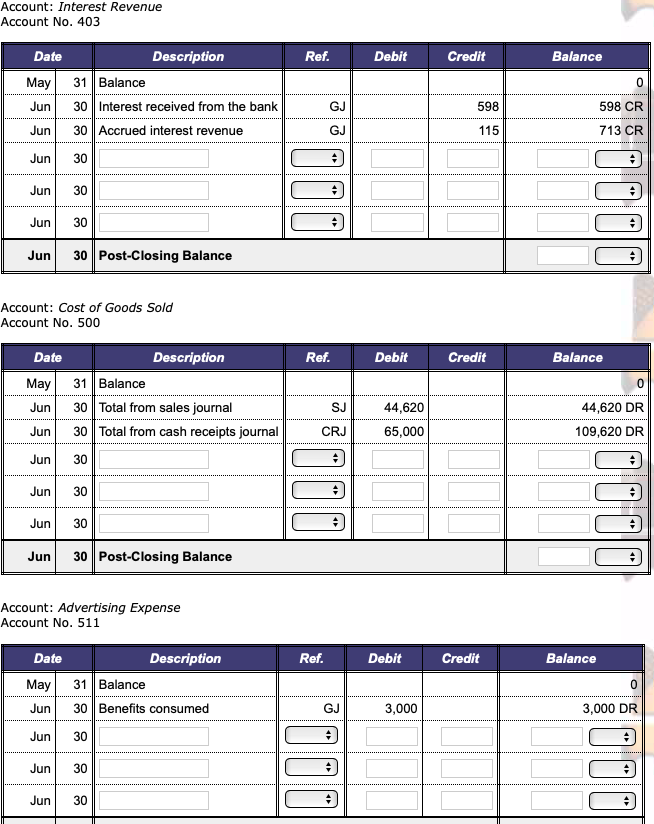

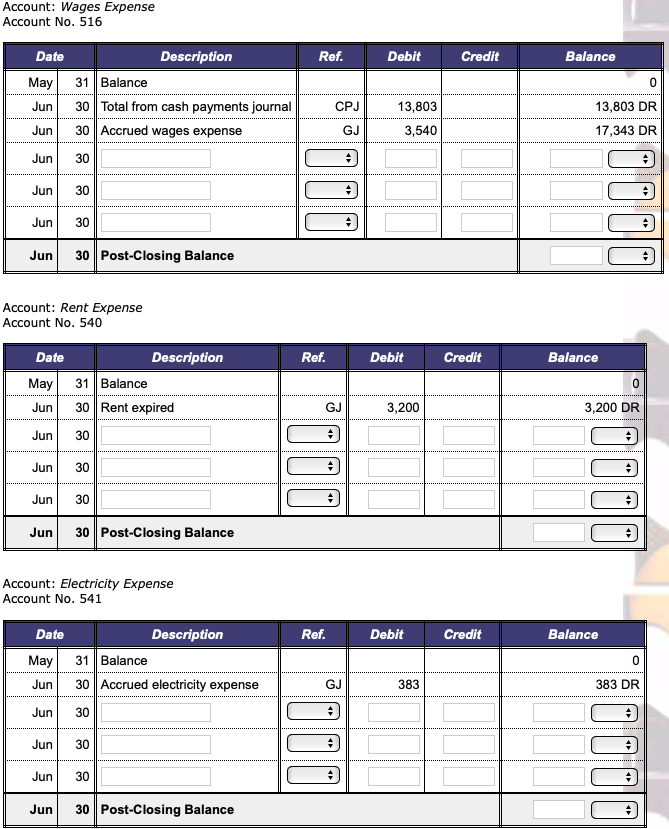

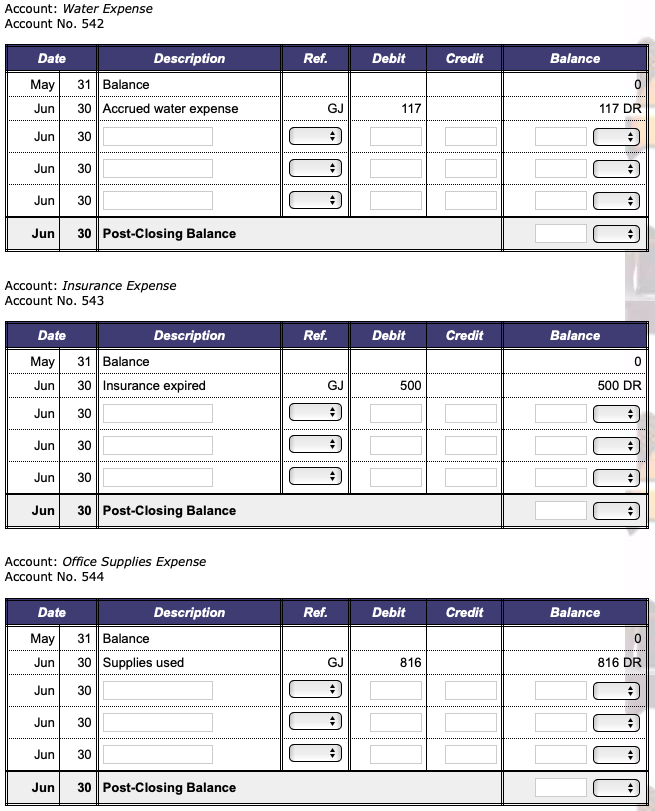

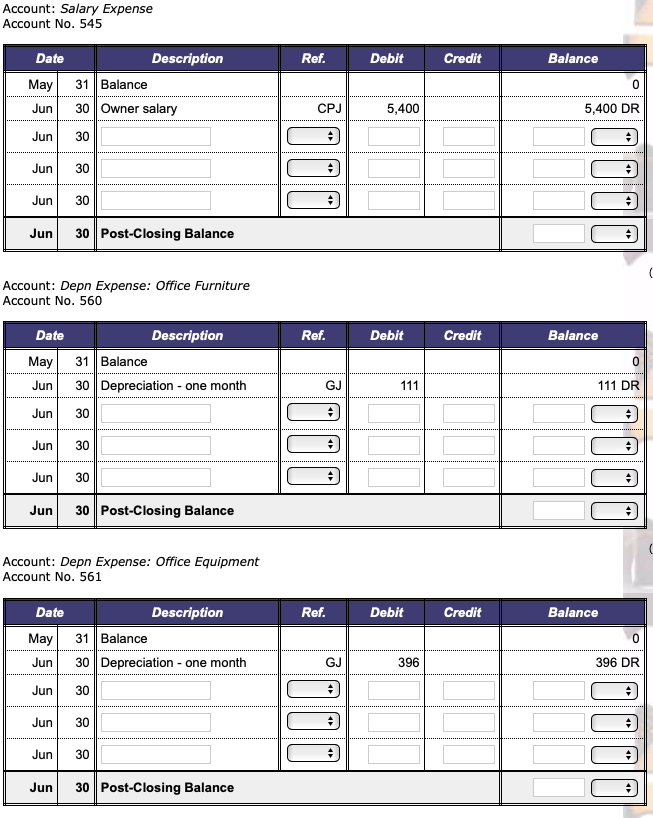

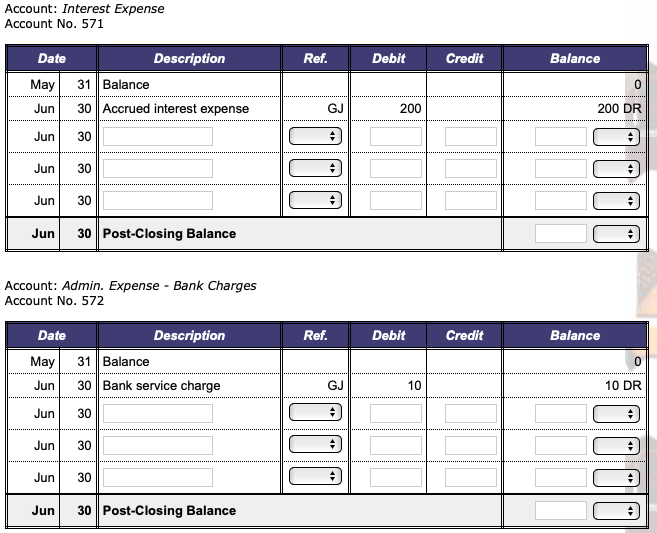

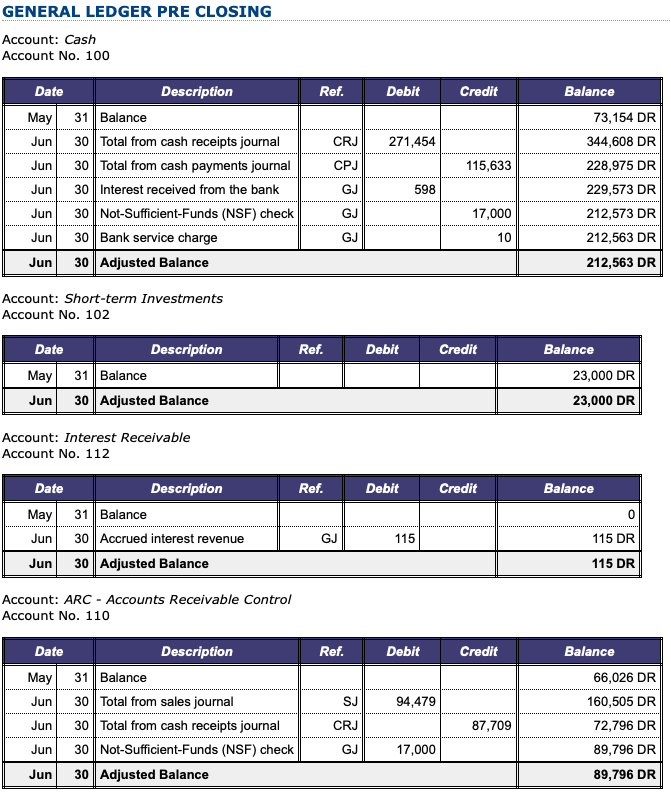

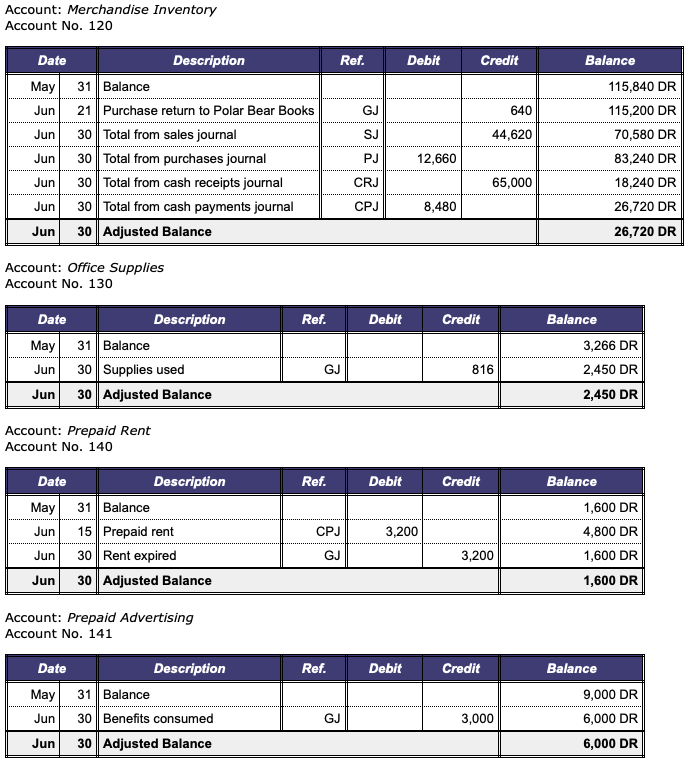

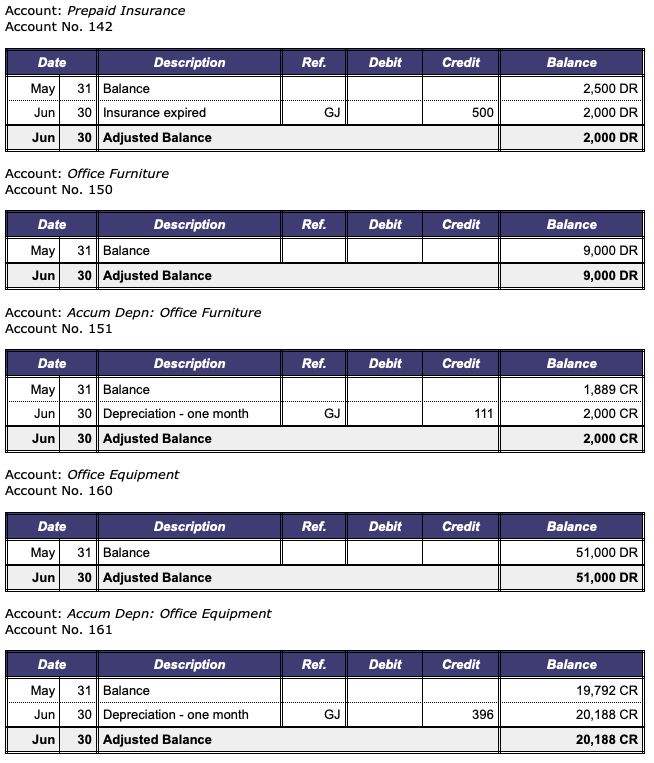

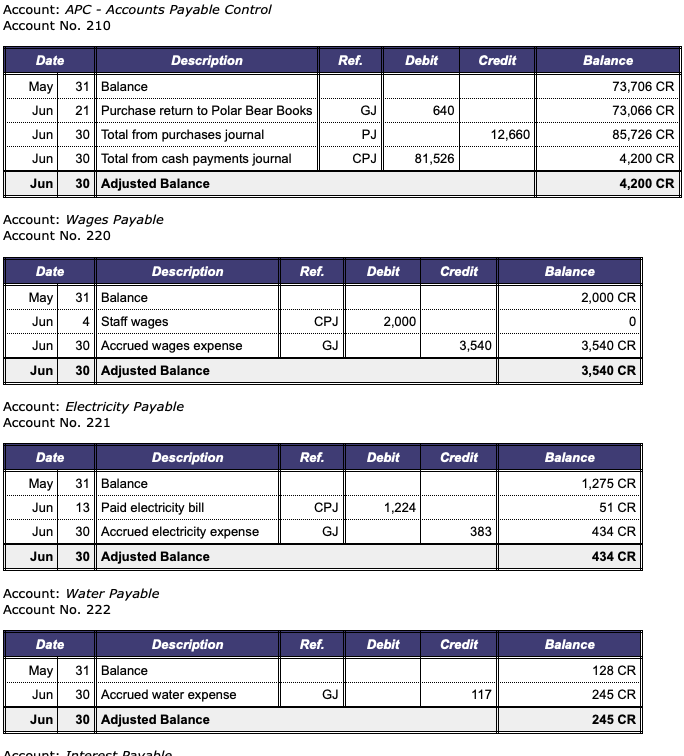

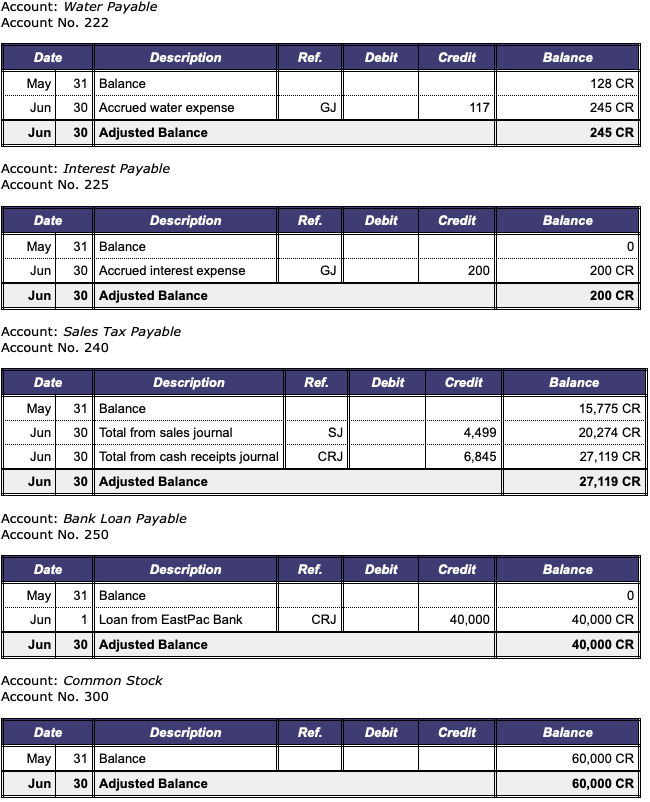

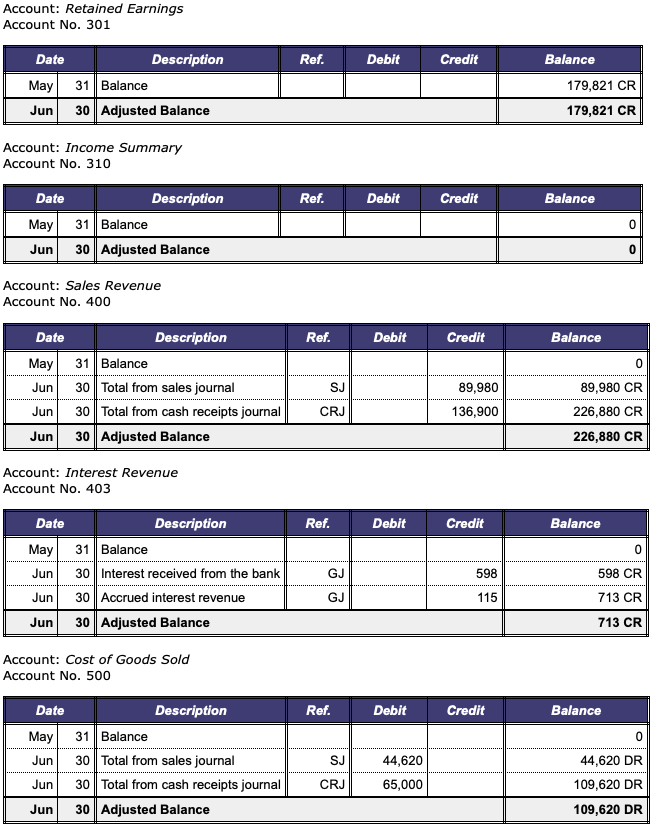

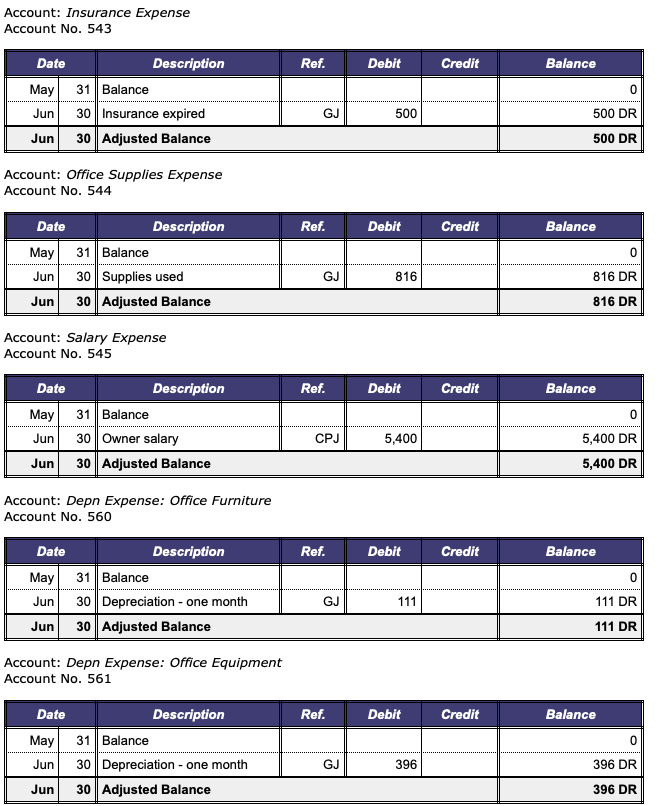

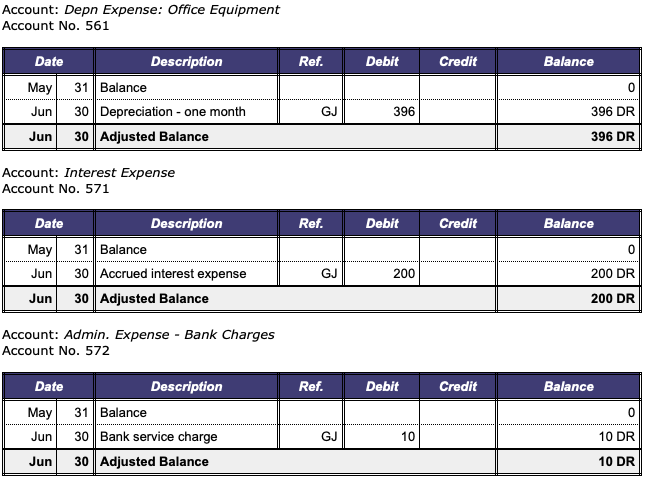

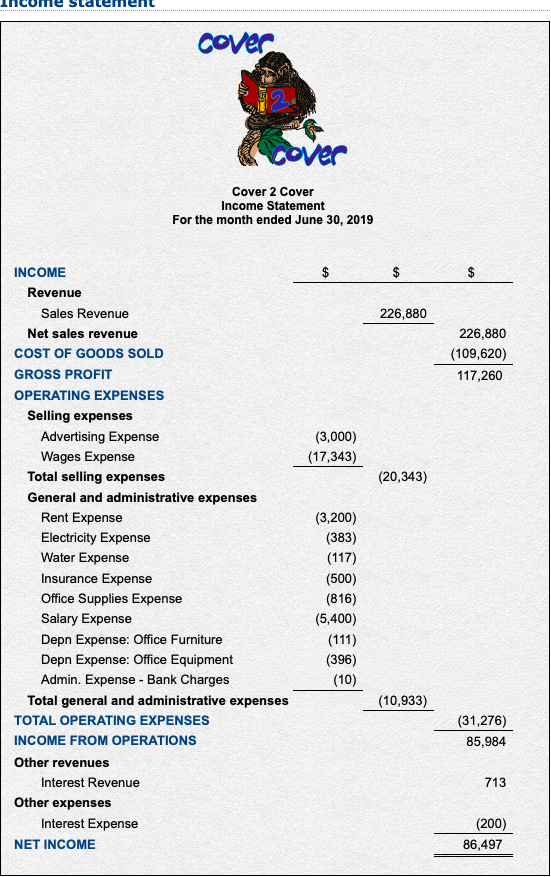

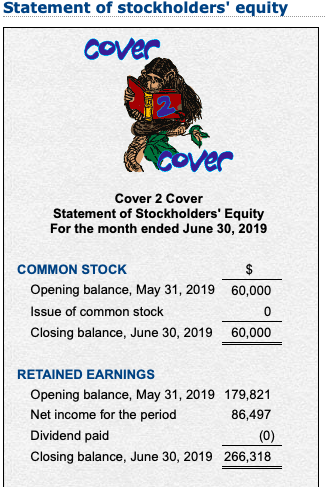

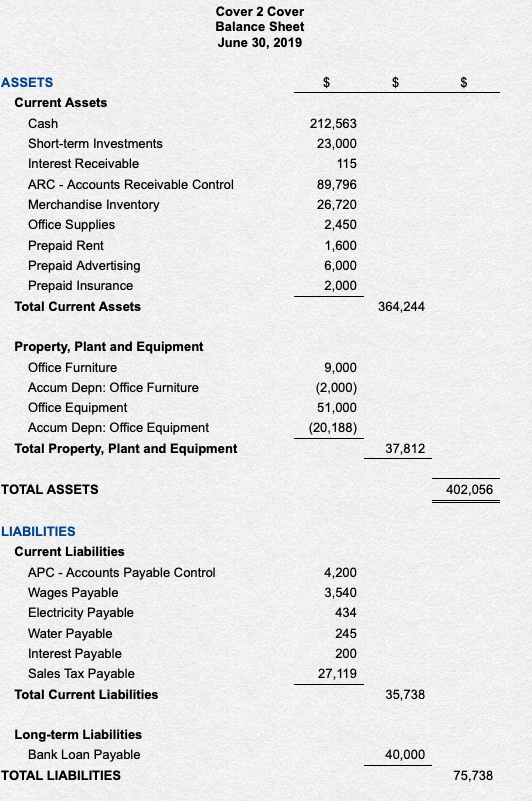

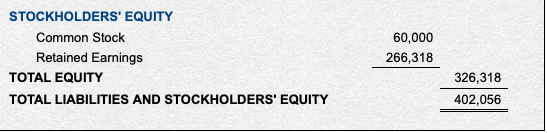

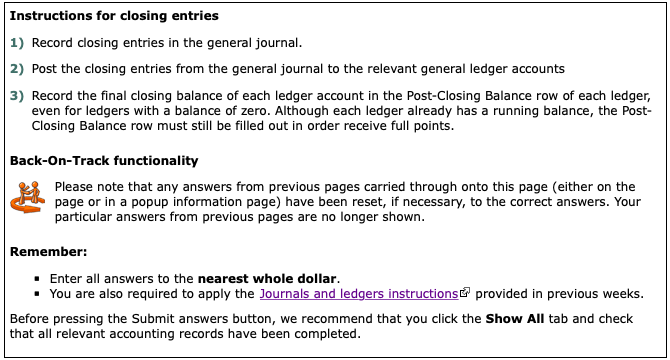

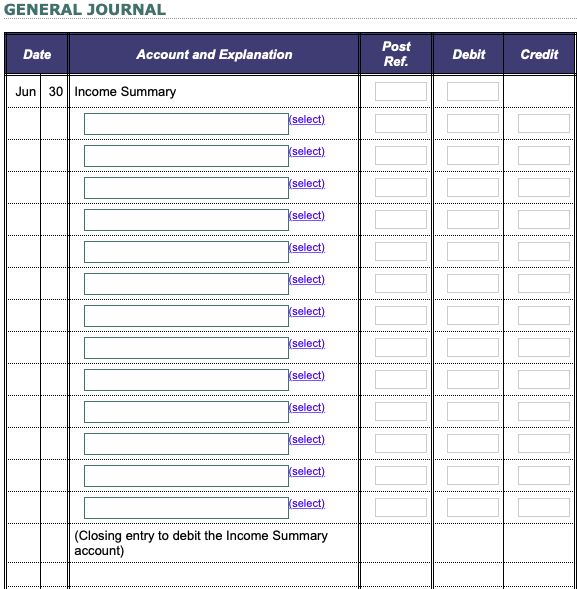

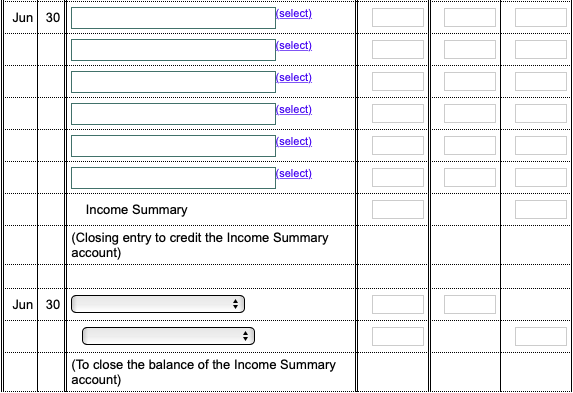

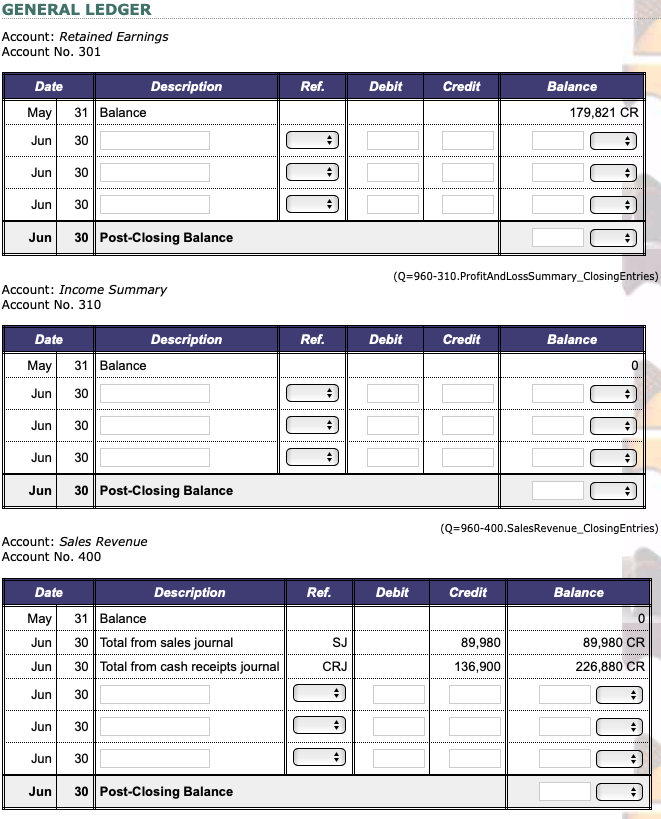

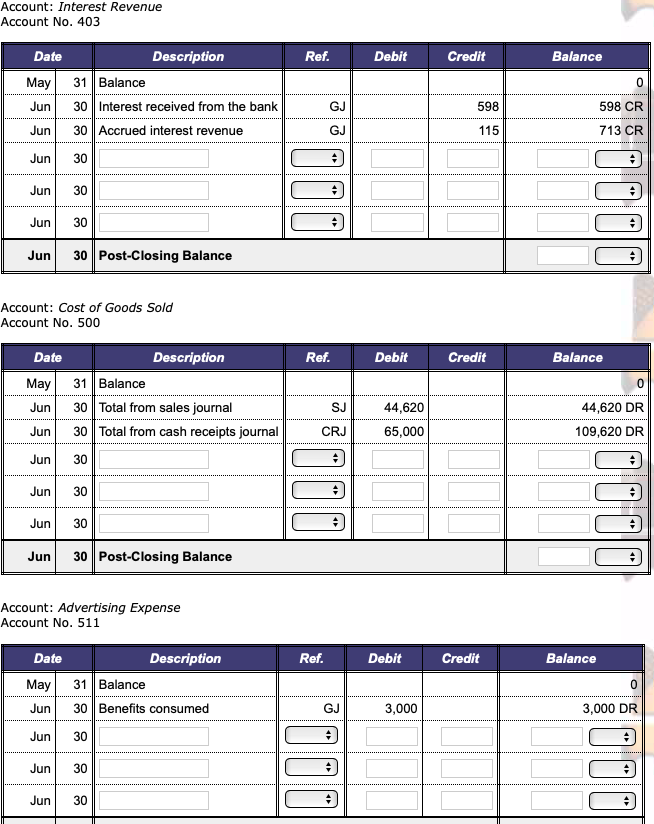

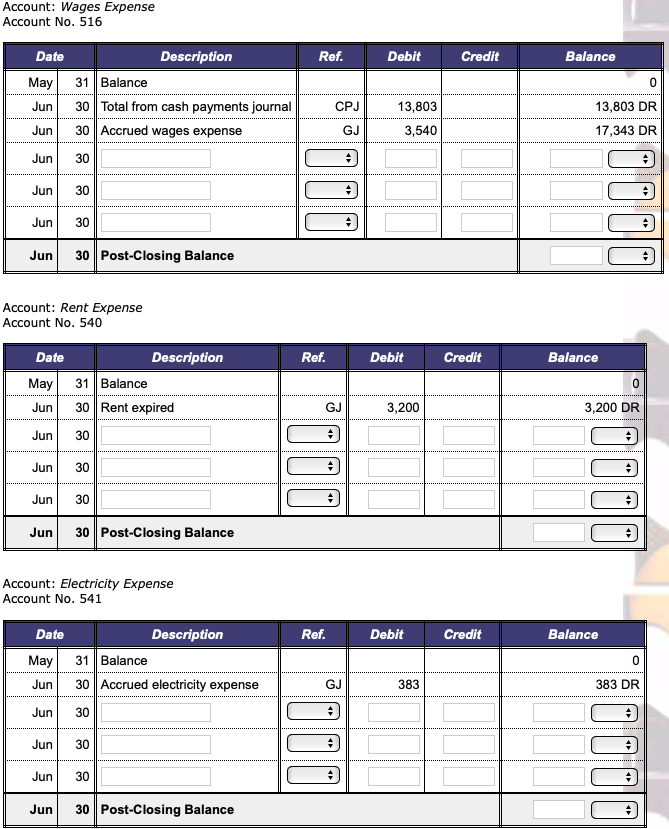

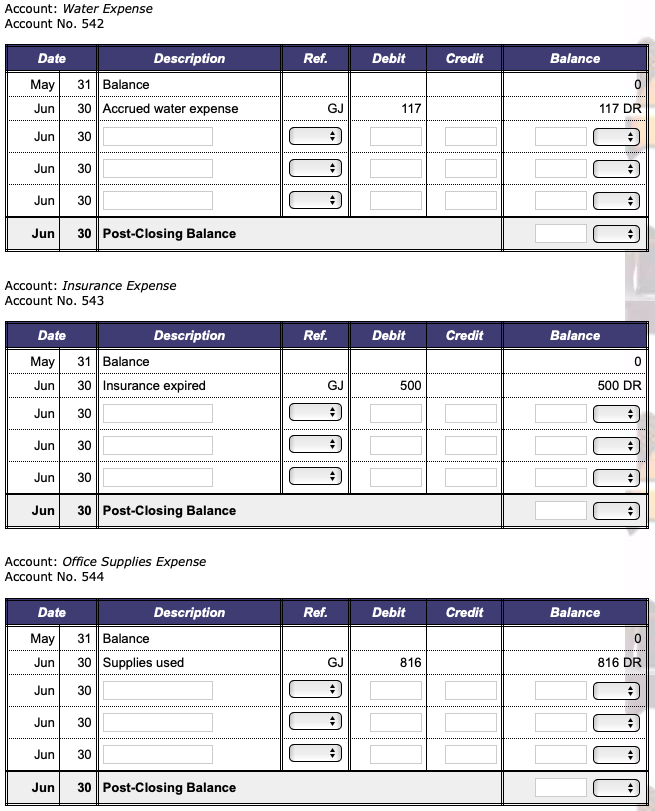

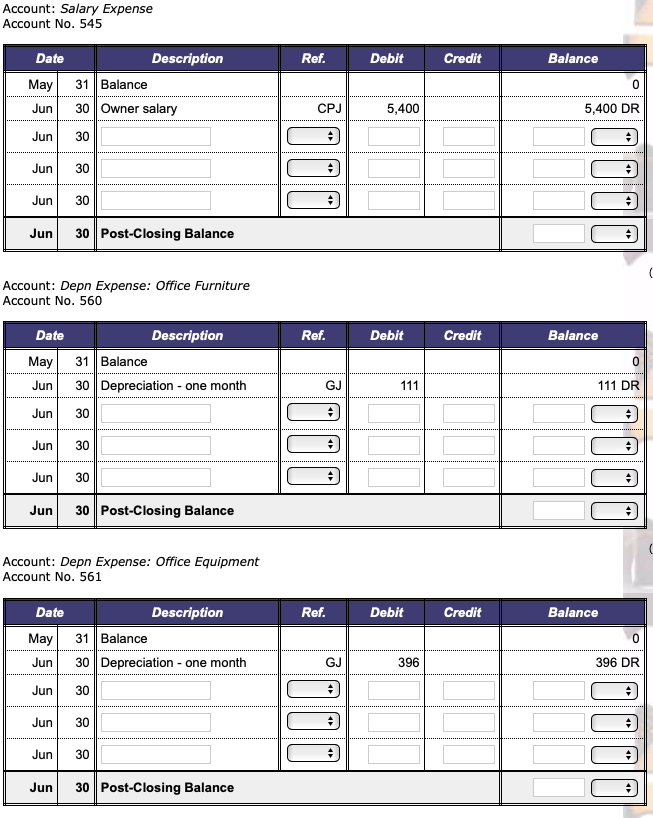

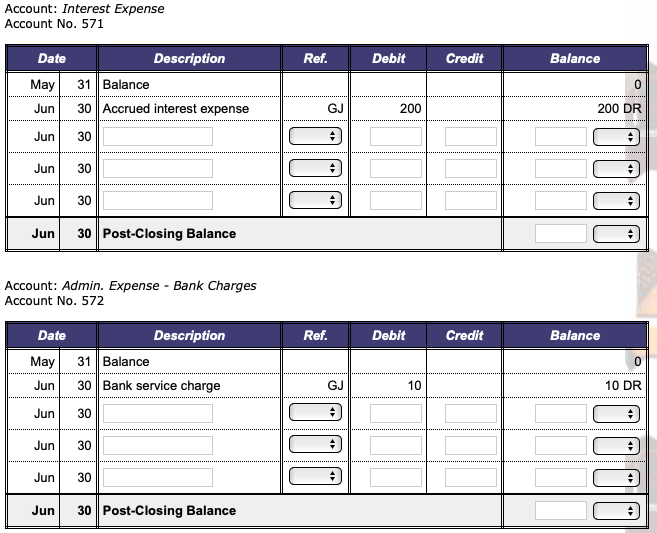

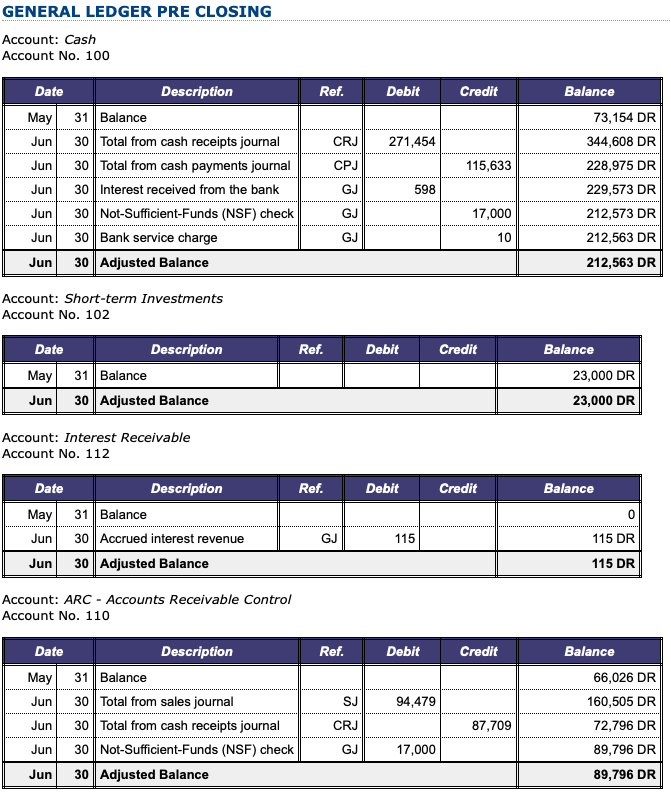

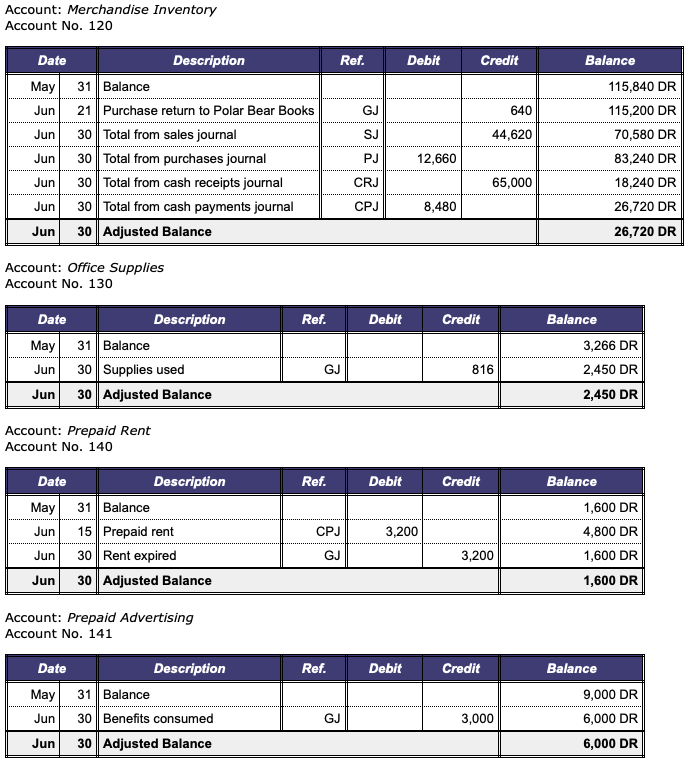

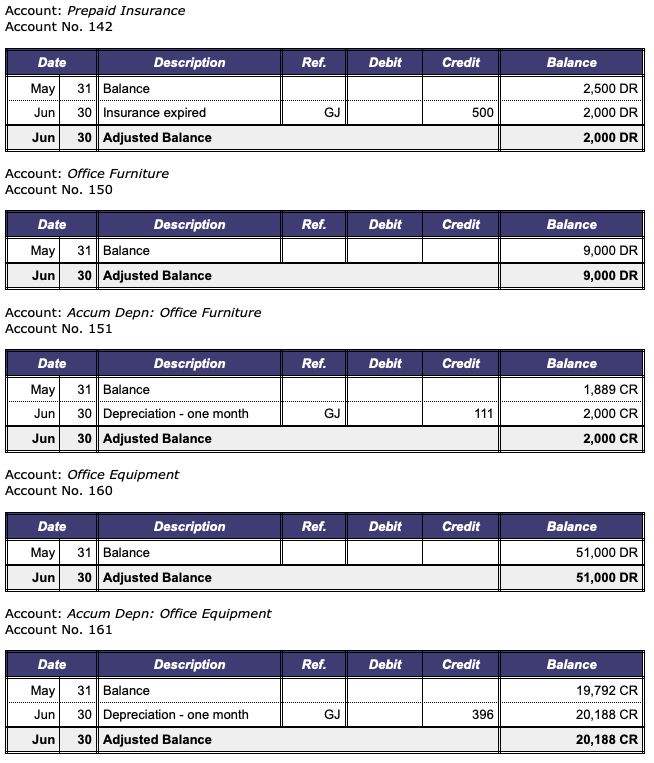

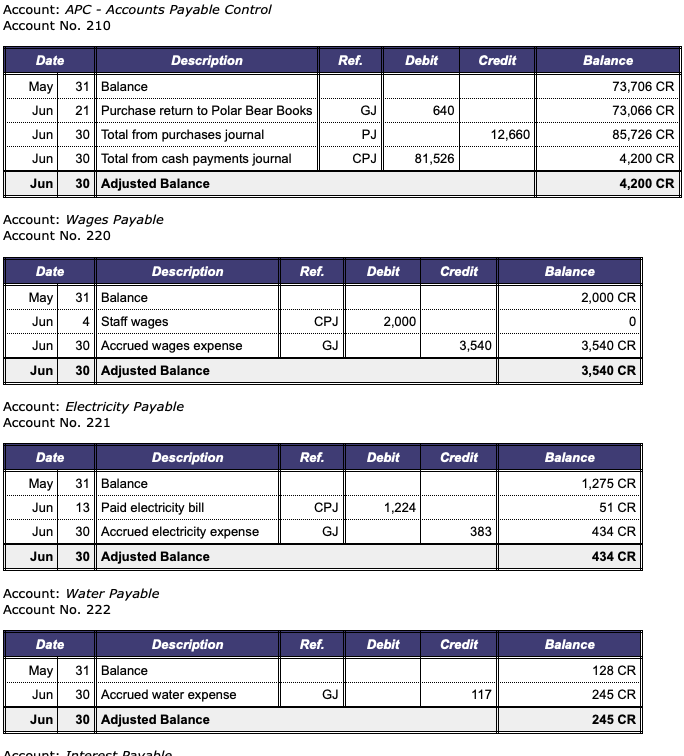

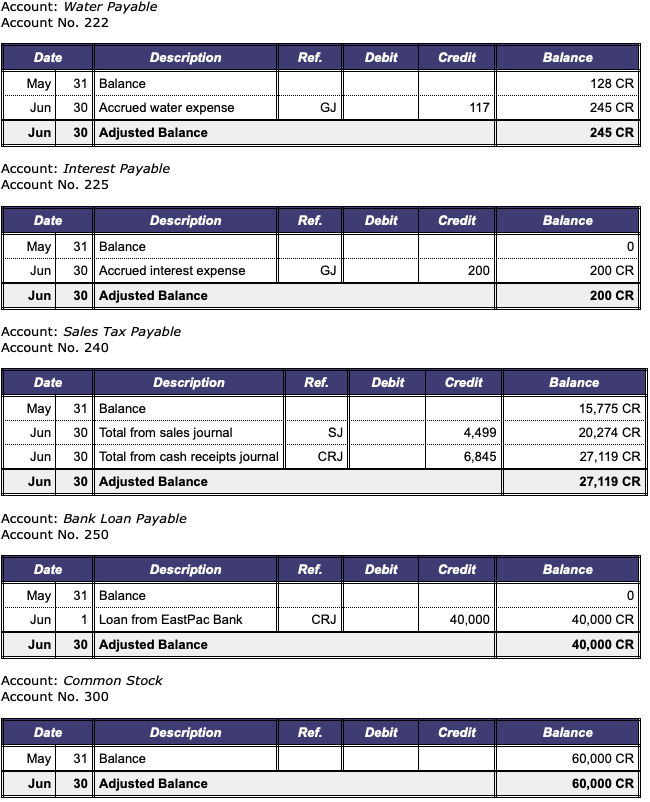

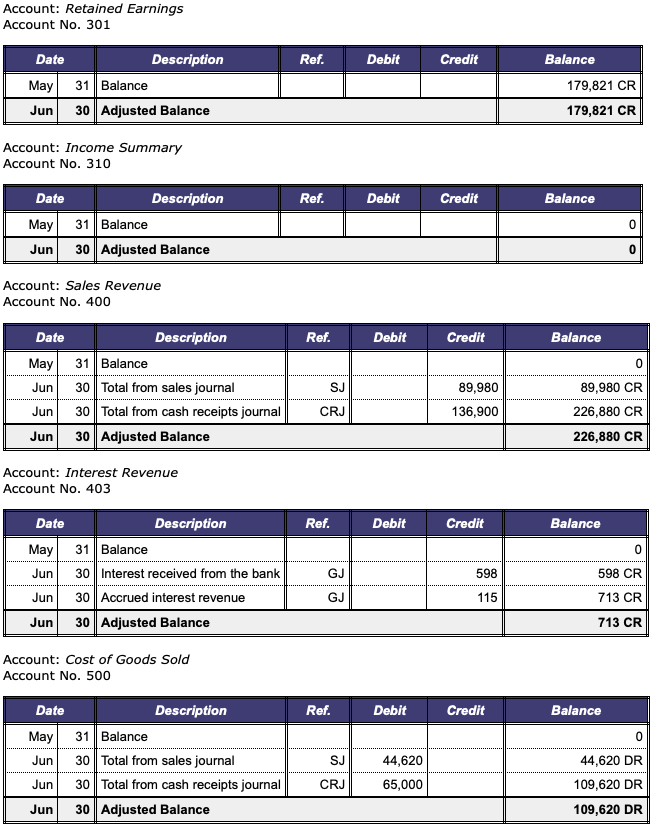

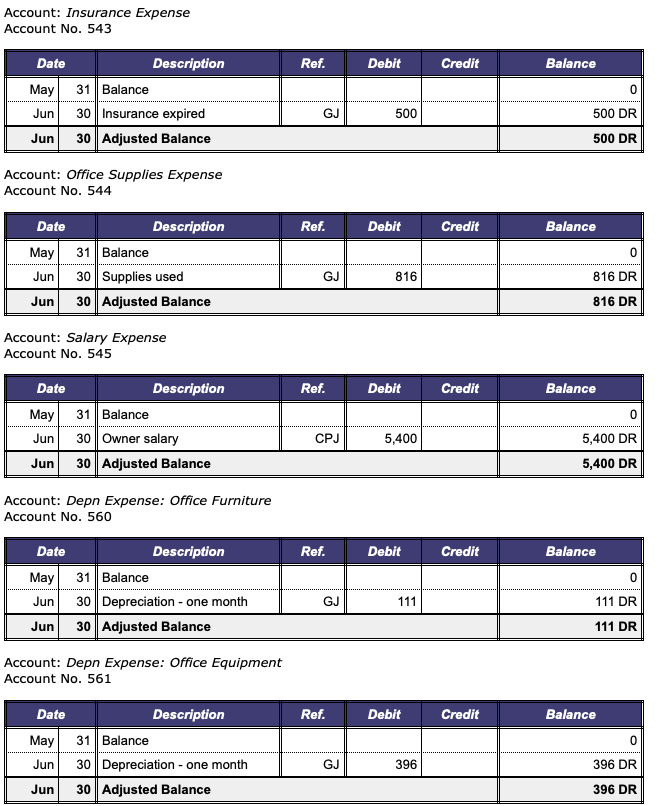

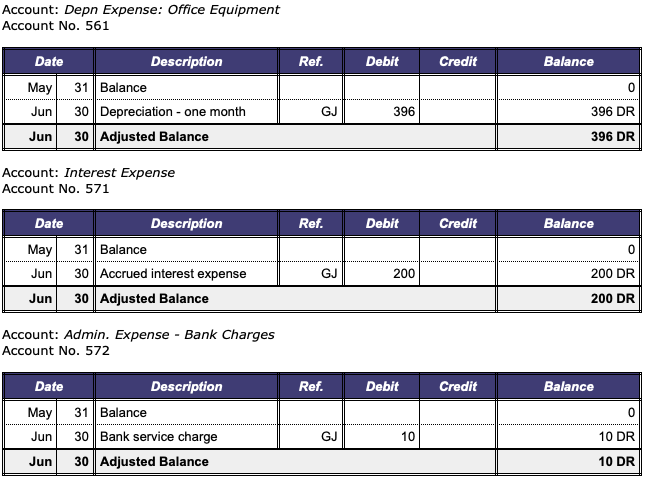

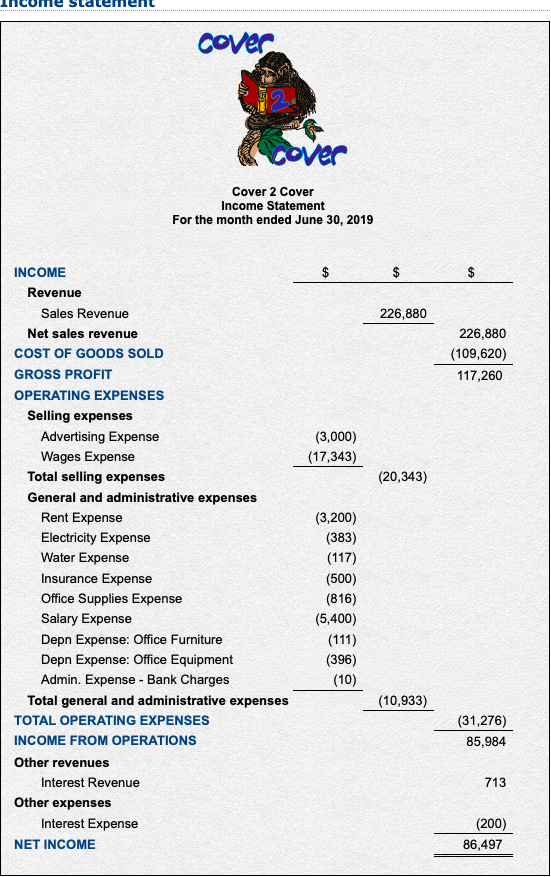

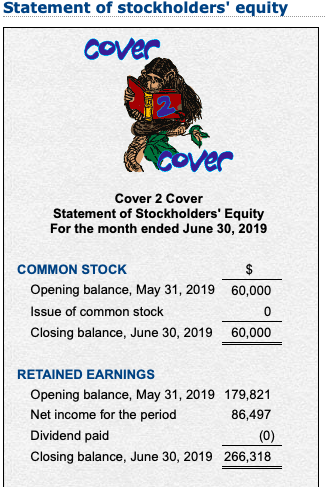

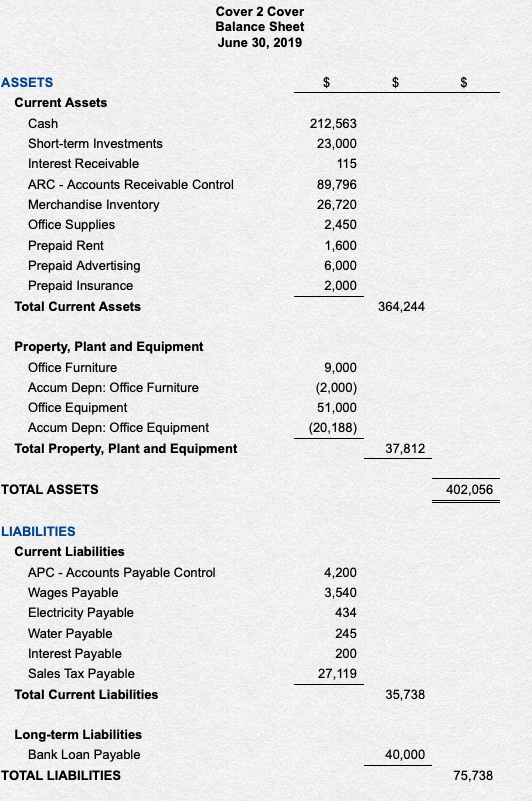

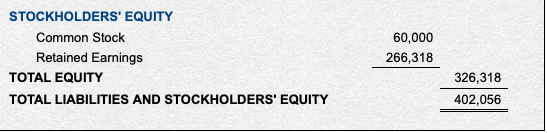

Instructions for closing entries 1) Record closing entries in the general journal. 2) Post the closing entries from the general journal to the relevant general ledger accounts 3) Record the final closing balance of each ledger account in the Post-Closing Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Post- Closing Balance row must still be filled out in order receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. . You are also required to apply the Journals andledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. GENERAL JOURNAL Post Ref Debit Credit Date Account and Explanation Jun 30 Income Summary select) select) select) select) select) select) select) select) select) select) select) select) select) (Closing entry to debit the Income Summary account) Jun 30 select) select) select) select) select) select) Income Summary (Closing entry to credit the Income Summary account) Jun 30 To close the balance of the Income Summary account) GENERAL LEDGER Account: Retained Earnings Account No. 301 Date May 31 Balance Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance 179,821 CR (Q 960-310.ProfitAndLossSummary_ ClosingEntries) Account: Income Summary Account No. 310 Description Balance Date May 31 Balance Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit (Q 960-400.SalesRevenue ClosingEntries) Account: Sales Revenue Account No. 400 Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance SJ 89,980 89,980 CR CRJ 136,900 226,880 CR Account: Interest Revenue Account No. 403 Date May 31 Balance Jun 30 Interest received from the bank Jun 30 Accrued interest revenue Jun 30 Jun 30 Jun 30 Description Ref, Debit Credit Balance GJ 598 598 CR GJ 115 713 CR Jun 30 Post-Closing Balance Account: Cost of Goods Sold Account No. 500 Description Debit Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Credit Balance SJ 44,620 44,620 DR CRJ 65,000 109,620 DR Account: Advertising Expense Account No. 511 Date May 31 Balance Jun 30Benefits consumed Jun 30 Jun 30 Jun 30 Description Ref, Debit Credit Balance GJ 3,000 3,000 DR Account: Wages Expense Account No. 516 Date May 31 Balance Jun 30 Total from cash payments journal Jun30 Accrued wages expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance CPJ 13,803 3,540 13,803 DR GJ 17,343 DR Account: Rent Expense Account No. 540 Description Date May Jun 30 Rent expired Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit Balance 31 Balance GJ 3,200 3,200 DR Account: Electricity Expense Account No. 541 Date May 31 Balance Jun30Accrued electricity expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance GJ 383 383 DR Account: Water Expense Account No. 542 Date May 31 Balance Jun 30 Accrued water expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Balance GJ 117 DR Account: Insurance Expense Account No. 543 Description Balance Date May 31 Balance Jun 30 Insurance expired Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit GJ 500 500 DR Account: Office Supplies Expense Account No. 544 Date May 31 Balance Jun 30 Supplies used Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance GJ 816 816 DR Account: Salary Expense Account No. 545 Date May 31 Balance Jun 30Owner salary Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance CPJ 5,400 5,400 DR Account: Depn Expense: Office Furniture Account No. 560 Description Balance Date May 31 Balance Jun 30ciation one month Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit GJ 111 DR Account: Depn Expense: Office Equipment Account No. 561 Date May 31 Balance Jun30 Depreciation- one month Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance GJ 396 396 DR Account: Interest Expense Account No. 571 Date May 31 Balance Jun 30 Accrued interest expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance 0 GJ 200 200 DR Account: Admin. Expense Bank Charges Account No. 572 Description Balance Date May 31 Balance Jun 30 Bank service charge Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit GJ 10 10 DR GENERAL LEDGER PRE CLOSING Account: Cash Account No. 100 Description Balance Date May31 Balance Jun 30 Total from cash receipts journal Jun30 Total from cash payments journal Jun 30 Interest received from the bank Jun 30Not-Sufficient-Funds (NSF) check Jun 30 Bank service charge Jun 30 Adjusted Balance Ref. Debit Credit 73,154 DR 344,608 DR 228,975 DR 229,573 DR 212,573 DR 212,563 DR 212,563 DR CRJI 271.454 CPJ GJ GJ GJ 115,633 598 17,000 10 Account: Short-term Investments Account No. 102 Description Date May 31 Balance Jun 30 Adjusted Balance Debit Credit Balance 23,000 DR 23,000 DR Account: Interest Receivable Account No. 112 Date May 31 Balance Jun 30 Accrued interest revenue Jun | 301 Adjusted Balance Description Debit Credit Balance GJ 115 115 DR 115 DR Account: ARC -Accounts Receivable Control Account No. 110 Description Balance Date May31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30Not-Sufficient-Funds (NSF) check Jun 30 Adjusted Balance Ref. Debit Credit SJ CRJ GJ 66,026 DR 160,505 DR 72,796 DR 89,796 DR 89,796 DR 94,479 87,709 17,000 Account: Merchandise Inventory Account No. 120 Description Date May 31 Balance Jun 21 Purchase return to Polar Bear Books Jun 30 Total from sales journal Jun 30 Total from purchases journal Jun30 Total from cash receipts journal Jun30 Total from cash payments journal Jun 30 Adjusted Balance Ref, Debit Credit Balance GJ SJ PJ CRJ CPJ 115,840 DR 115,200 DR 70,580 DR 83,240 DR 18,240 DR 26,720 DR 26,720 DR 640 44,620 12,660 65,000 8,480 Account: Office Supplies Account No. 130 Description Date May 31 Balance Jun 30 Supplies used Jun 30 Adjusted Balance Debit Credit Balance 3,266 DR 2,450 DR 2,450 DR GJ 816 Account: Prepaid Rent Account No. 140 Date Description Debit Credit Balance 1,600 DR 4,800 DR 1,600 DR 1,600 DR 31 Balance Jun15 Prepaid rent Jun 30Rent expired Jun 30 Adjusted Balance CPJ 3,200 GJ 3,200 Account: Prepaid Advertising Account No. 141 Date May 31 Balance Jun 30 Benefits consumed Jun 30 Adjusted Balance Description Debit Credit Balance 9,000 DR 6,000 DR 6,000 DR GJ 3,000 Account: Prepaid Insurance Account No. 142 Date May 31 Balance Jun 30 Insurance expired Jun 30 Adjusted Balance Description Debit Credit Balance 2,500 DR 2,000 DR 2,000 DR GJ 500 Account: Office Furniture Account No. 150 Date May 31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance 9,000 DR 9,000 DR Account: Accum Depn: Office Furniture Account No. 151 Description Ref Date May 31 Balance Jun 30Depreciation one month Jun 30 Adjusted Balance Debit Credit Balance 1,889 CR 2,000 CR 2,000 CR GJ Account: Office Equipment Account No. 160 Date May 31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance 51,000 DR 51,000 DR Account: Accum Depn: Office Equipment Account No. 161 Date May 31 Balance Jun 30Depreciation one month Jun 30 Adjusted Balance Description Debit Credit Balance 19,792 CR 20,188 CR 20,188 CR GJ 396 Account: APC - Accounts Payable Control Account No. 210 Date May 31 Balance Jun 21 Purchase return to Polar Bear Books Jun 30 Total from purchases journal Jun30 Total from cash payments journal Jun 30 Adjusted Balance Description Ref, Debit Credit Balance 73,706 CR 73,066 CR 85,726 CR 4,200 CR 4,200 CR 640 GJ PJ CPJ 12,660 81,526 count: Wages Payable Account No. 220 Ac Description Date May 31 Balance Jun 4 Staff wages Jun 30Accrued wages expense Jun 30 Adjusted Balance Debit Credit Balance 2,000 CR CPJ 2,000 GJ 3,540 3,540 CR 3,540 CR Account: Electricity Payable Account No. 221 Date Description Debit Credit Balance 1,275 CR 51 CR 434 CR 434 CR 31 Balance Jun 13 Paid electricity bill Jun30Accrued electricity expense Jun 30 Adjusted Balance CPJ 1,224 GJ 383 Account: Water Payable Account No. 222 Date May 31 Balance Jun | 301 Accrued water expense Jun 30 Adjusted Balance Description Debit Credit Balance 128 CR 245 CR 245 CR GJ Account: Water Payable Account No. 222 Date Description Debit Credit Balance 31 Balance 128 CR 245 CR 245 CR Jun 30 Accrued water expense GJ Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date May 31 Balance Jun 30 Accrued interest expense Jun 30 Adjusted Balance Description Debit Credit Balance GJ 200 200 CR 200 CR Account: Sales Tax Payable Account No. 240 Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Adjusted Balance Description Ref. Debit Credit Balance 15,775 CR 20,274 CR 27,119 CR 27,119 CR SJ 4,499 CRJ 6,845 Account: Bank Loan Payable Account No. 250 Date Description Debit Credit Balance 31 Balance Jun 1 Loan from EastPac Bank CRJ 40,000 40,000 CR Jun 30 Adjusted Balance 40,000 CR Account: Common Stock Account No. 300 Date May 31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance 60,000 CR 60,000 CR Account: Retained Earnings Account No. 301 Description Date May31 Balance Jun | 301 Adjusted Balance Debit Credit Balance 179,821 CR 179,821 CR Account: Income Summary Account No. 310 Date May31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance Account: Sales Revenue Account No. 400 Date Description Ref. Debit Credit Balance 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Adjusted Balance 89,980 89,980 CR 226,880 CR 226,880 CR SJ CRJ 136,900 Account: Interest Revenue Account No. 403 Description Balance Date May 31 Balance Jun 30 Interest received from the bank Jun 30 Accrued interest revenue Jun 30 Adjusted Balance Ref Debit Credit 0 598 CR 713 CR 713 CR GJ 598 GJ 115 Account: Cost of Goods Sold Account No. 500 Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Adjusted Balance Description Ref. Balance 44,620 44,620 DR 109,620 DR 109,620 DR SJ CRJ 65,000 Account: Depn Expense: Office Equipment Account No. 561 Description Date May 31 Balance Jun 30Depreciation one month Jun 30 Adjusted Balance Ref, Debit Credit Balance GJ 396 396 DR 396 DR Account: Interest Expense Account No. 571 Description Date May31 Balance Jun 30 Accrued interest expense Jun 30 Adjusted Balance Ref, Debit Credit Balance GJ 200 200 DR 200 DR Account: Admin. Expense - Bank Charges Account No. 572 Date May 31 Balance Jun 30 Bank service charge Jun 30 Adjusted Balance Description Ref, Debit Credit Balance GJ 10 10 DR 10 DR cover Cover 2 Cover Income Statement For the month ended June 30, 2019 INCOME Revenue Sales Revenue Net sales revenue COST OF GOODS SOLD 226,880 226,880 (109,620) 117,260 GROSS PROFIT OPERATING EXPENSES Selling expenses Advertising Expense Wages Expense (3,000) (17,343) (20,343) Total selling expenses General and administrative expenses (3,200) (383) (117) (500) Rent Expense Electricity Expense Water Expense Insurance Expense Office Supplies Expense Salary Expense Depn Expense: Office Furniture Depn Expense: Office Equipment Admin. Expense Bank Charges (5,400) (396) (10) (10,933) Total general and administrative expenses TOTAL OPERATING EXPENSES INCOME FROM OPERATIONS Other revenues (31,276) 85,984 Interest Revenue 713 Other expenses (200) 86,497 Interest Expense NET INCOME Statement of stockholders' equity Cover Cover 2 Cover Statement of Stockholders' Equity For the month ended June 30, 2019 COMMON STOCK Opening balance, May 31, 201960,000 Issue of common stock Closing balance, June 30, 2019 60,000 RETAINED EARNINGS Opening balance, May 31, 2019 179,821 Net income for the period Dividend paid Closing balance, June 30, 2019 266,318 86,497 Cover 2 Cover Balance Sheet June 30, 2019 ASSETS Current Assets Cash Short-term Investments Interest Receivable ARC - Accounts Receivable Control Merchandise Inventory Office Supplies Prepaid Rent Prepaid Advertising Prepaid Insurance 212,563 23,000 115 89,796 26,720 2,450 1,600 6,000 2,000 Total Current Assets 364,244 Property, Plant and Equipment Office Furniture Accum Depn: Office Furniture Office Equipment Accum Depn: Office Equipment 9,000 (2,000) 51,000 (20,188) Total Property, Plant and Equipment 37,812 TOTAL ASSETS 402,056 LIABILITIES Current Liabilities APC Accounts Payable Control Wages Payable Electricity Payable Water Payable Interest Payable Sales Tax Payable 4,200 3,540 434 245 200 27,119 Total Current Liabilities 35,738 Long-term Liabilities Bank Loan Payable 40,000 TOTAL LIABILITIES 75,738 STOCKHOLDERS' EQUITY Common Stock Retained Earnings 60,000 266,318 TOTAL EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 326,318 402,056 Instructions for closing entries 1) Record closing entries in the general journal. 2) Post the closing entries from the general journal to the relevant general ledger accounts 3) Record the final closing balance of each ledger account in the Post-Closing Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Post- Closing Balance row must still be filled out in order receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. . You are also required to apply the Journals andledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. GENERAL JOURNAL Post Ref Debit Credit Date Account and Explanation Jun 30 Income Summary select) select) select) select) select) select) select) select) select) select) select) select) select) (Closing entry to debit the Income Summary account) Jun 30 select) select) select) select) select) select) Income Summary (Closing entry to credit the Income Summary account) Jun 30 To close the balance of the Income Summary account) GENERAL LEDGER Account: Retained Earnings Account No. 301 Date May 31 Balance Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance 179,821 CR (Q 960-310.ProfitAndLossSummary_ ClosingEntries) Account: Income Summary Account No. 310 Description Balance Date May 31 Balance Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit (Q 960-400.SalesRevenue ClosingEntries) Account: Sales Revenue Account No. 400 Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance SJ 89,980 89,980 CR CRJ 136,900 226,880 CR Account: Interest Revenue Account No. 403 Date May 31 Balance Jun 30 Interest received from the bank Jun 30 Accrued interest revenue Jun 30 Jun 30 Jun 30 Description Ref, Debit Credit Balance GJ 598 598 CR GJ 115 713 CR Jun 30 Post-Closing Balance Account: Cost of Goods Sold Account No. 500 Description Debit Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Credit Balance SJ 44,620 44,620 DR CRJ 65,000 109,620 DR Account: Advertising Expense Account No. 511 Date May 31 Balance Jun 30Benefits consumed Jun 30 Jun 30 Jun 30 Description Ref, Debit Credit Balance GJ 3,000 3,000 DR Account: Wages Expense Account No. 516 Date May 31 Balance Jun 30 Total from cash payments journal Jun30 Accrued wages expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance CPJ 13,803 3,540 13,803 DR GJ 17,343 DR Account: Rent Expense Account No. 540 Description Date May Jun 30 Rent expired Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit Balance 31 Balance GJ 3,200 3,200 DR Account: Electricity Expense Account No. 541 Date May 31 Balance Jun30Accrued electricity expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance GJ 383 383 DR Account: Water Expense Account No. 542 Date May 31 Balance Jun 30 Accrued water expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Balance GJ 117 DR Account: Insurance Expense Account No. 543 Description Balance Date May 31 Balance Jun 30 Insurance expired Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit GJ 500 500 DR Account: Office Supplies Expense Account No. 544 Date May 31 Balance Jun 30 Supplies used Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance GJ 816 816 DR Account: Salary Expense Account No. 545 Date May 31 Balance Jun 30Owner salary Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance CPJ 5,400 5,400 DR Account: Depn Expense: Office Furniture Account No. 560 Description Balance Date May 31 Balance Jun 30ciation one month Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit GJ 111 DR Account: Depn Expense: Office Equipment Account No. 561 Date May 31 Balance Jun30 Depreciation- one month Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance GJ 396 396 DR Account: Interest Expense Account No. 571 Date May 31 Balance Jun 30 Accrued interest expense Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Description Ref, Debit Credit Balance 0 GJ 200 200 DR Account: Admin. Expense Bank Charges Account No. 572 Description Balance Date May 31 Balance Jun 30 Bank service charge Jun 30 Jun 30 Jun 30 Jun 30 Post-Closing Balance Ref, Debit Credit GJ 10 10 DR GENERAL LEDGER PRE CLOSING Account: Cash Account No. 100 Description Balance Date May31 Balance Jun 30 Total from cash receipts journal Jun30 Total from cash payments journal Jun 30 Interest received from the bank Jun 30Not-Sufficient-Funds (NSF) check Jun 30 Bank service charge Jun 30 Adjusted Balance Ref. Debit Credit 73,154 DR 344,608 DR 228,975 DR 229,573 DR 212,573 DR 212,563 DR 212,563 DR CRJI 271.454 CPJ GJ GJ GJ 115,633 598 17,000 10 Account: Short-term Investments Account No. 102 Description Date May 31 Balance Jun 30 Adjusted Balance Debit Credit Balance 23,000 DR 23,000 DR Account: Interest Receivable Account No. 112 Date May 31 Balance Jun 30 Accrued interest revenue Jun | 301 Adjusted Balance Description Debit Credit Balance GJ 115 115 DR 115 DR Account: ARC -Accounts Receivable Control Account No. 110 Description Balance Date May31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30Not-Sufficient-Funds (NSF) check Jun 30 Adjusted Balance Ref. Debit Credit SJ CRJ GJ 66,026 DR 160,505 DR 72,796 DR 89,796 DR 89,796 DR 94,479 87,709 17,000 Account: Merchandise Inventory Account No. 120 Description Date May 31 Balance Jun 21 Purchase return to Polar Bear Books Jun 30 Total from sales journal Jun 30 Total from purchases journal Jun30 Total from cash receipts journal Jun30 Total from cash payments journal Jun 30 Adjusted Balance Ref, Debit Credit Balance GJ SJ PJ CRJ CPJ 115,840 DR 115,200 DR 70,580 DR 83,240 DR 18,240 DR 26,720 DR 26,720 DR 640 44,620 12,660 65,000 8,480 Account: Office Supplies Account No. 130 Description Date May 31 Balance Jun 30 Supplies used Jun 30 Adjusted Balance Debit Credit Balance 3,266 DR 2,450 DR 2,450 DR GJ 816 Account: Prepaid Rent Account No. 140 Date Description Debit Credit Balance 1,600 DR 4,800 DR 1,600 DR 1,600 DR 31 Balance Jun15 Prepaid rent Jun 30Rent expired Jun 30 Adjusted Balance CPJ 3,200 GJ 3,200 Account: Prepaid Advertising Account No. 141 Date May 31 Balance Jun 30 Benefits consumed Jun 30 Adjusted Balance Description Debit Credit Balance 9,000 DR 6,000 DR 6,000 DR GJ 3,000 Account: Prepaid Insurance Account No. 142 Date May 31 Balance Jun 30 Insurance expired Jun 30 Adjusted Balance Description Debit Credit Balance 2,500 DR 2,000 DR 2,000 DR GJ 500 Account: Office Furniture Account No. 150 Date May 31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance 9,000 DR 9,000 DR Account: Accum Depn: Office Furniture Account No. 151 Description Ref Date May 31 Balance Jun 30Depreciation one month Jun 30 Adjusted Balance Debit Credit Balance 1,889 CR 2,000 CR 2,000 CR GJ Account: Office Equipment Account No. 160 Date May 31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance 51,000 DR 51,000 DR Account: Accum Depn: Office Equipment Account No. 161 Date May 31 Balance Jun 30Depreciation one month Jun 30 Adjusted Balance Description Debit Credit Balance 19,792 CR 20,188 CR 20,188 CR GJ 396 Account: APC - Accounts Payable Control Account No. 210 Date May 31 Balance Jun 21 Purchase return to Polar Bear Books Jun 30 Total from purchases journal Jun30 Total from cash payments journal Jun 30 Adjusted Balance Description Ref, Debit Credit Balance 73,706 CR 73,066 CR 85,726 CR 4,200 CR 4,200 CR 640 GJ PJ CPJ 12,660 81,526 count: Wages Payable Account No. 220 Ac Description Date May 31 Balance Jun 4 Staff wages Jun 30Accrued wages expense Jun 30 Adjusted Balance Debit Credit Balance 2,000 CR CPJ 2,000 GJ 3,540 3,540 CR 3,540 CR Account: Electricity Payable Account No. 221 Date Description Debit Credit Balance 1,275 CR 51 CR 434 CR 434 CR 31 Balance Jun 13 Paid electricity bill Jun30Accrued electricity expense Jun 30 Adjusted Balance CPJ 1,224 GJ 383 Account: Water Payable Account No. 222 Date May 31 Balance Jun | 301 Accrued water expense Jun 30 Adjusted Balance Description Debit Credit Balance 128 CR 245 CR 245 CR GJ Account: Water Payable Account No. 222 Date Description Debit Credit Balance 31 Balance 128 CR 245 CR 245 CR Jun 30 Accrued water expense GJ Jun 30 Adjusted Balance Account: Interest Payable Account No. 225 Date May 31 Balance Jun 30 Accrued interest expense Jun 30 Adjusted Balance Description Debit Credit Balance GJ 200 200 CR 200 CR Account: Sales Tax Payable Account No. 240 Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Adjusted Balance Description Ref. Debit Credit Balance 15,775 CR 20,274 CR 27,119 CR 27,119 CR SJ 4,499 CRJ 6,845 Account: Bank Loan Payable Account No. 250 Date Description Debit Credit Balance 31 Balance Jun 1 Loan from EastPac Bank CRJ 40,000 40,000 CR Jun 30 Adjusted Balance 40,000 CR Account: Common Stock Account No. 300 Date May 31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance 60,000 CR 60,000 CR Account: Retained Earnings Account No. 301 Description Date May31 Balance Jun | 301 Adjusted Balance Debit Credit Balance 179,821 CR 179,821 CR Account: Income Summary Account No. 310 Date May31 Balance Jun 30 Adjusted Balance Description Debit Credit Balance Account: Sales Revenue Account No. 400 Date Description Ref. Debit Credit Balance 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Adjusted Balance 89,980 89,980 CR 226,880 CR 226,880 CR SJ CRJ 136,900 Account: Interest Revenue Account No. 403 Description Balance Date May 31 Balance Jun 30 Interest received from the bank Jun 30 Accrued interest revenue Jun 30 Adjusted Balance Ref Debit Credit 0 598 CR 713 CR 713 CR GJ 598 GJ 115 Account: Cost of Goods Sold Account No. 500 Date May 31 Balance Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 Adjusted Balance Description Ref. Balance 44,620 44,620 DR 109,620 DR 109,620 DR SJ CRJ 65,000 Account: Depn Expense: Office Equipment Account No. 561 Description Date May 31 Balance Jun 30Depreciation one month Jun 30 Adjusted Balance Ref, Debit Credit Balance GJ 396 396 DR 396 DR Account: Interest Expense Account No. 571 Description Date May31 Balance Jun 30 Accrued interest expense Jun 30 Adjusted Balance Ref, Debit Credit Balance GJ 200 200 DR 200 DR Account: Admin. Expense - Bank Charges Account No. 572 Date May 31 Balance Jun 30 Bank service charge Jun 30 Adjusted Balance Description Ref, Debit Credit Balance GJ 10 10 DR 10 DR cover Cover 2 Cover Income Statement For the month ended June 30, 2019 INCOME Revenue Sales Revenue Net sales revenue COST OF GOODS SOLD 226,880 226,880 (109,620) 117,260 GROSS PROFIT OPERATING EXPENSES Selling expenses Advertising Expense Wages Expense (3,000) (17,343) (20,343) Total selling expenses General and administrative expenses (3,200) (383) (117) (500) Rent Expense Electricity Expense Water Expense Insurance Expense Office Supplies Expense Salary Expense Depn Expense: Office Furniture Depn Expense: Office Equipment Admin. Expense Bank Charges (5,400) (396) (10) (10,933) Total general and administrative expenses TOTAL OPERATING EXPENSES INCOME FROM OPERATIONS Other revenues (31,276) 85,984 Interest Revenue 713 Other expenses (200) 86,497 Interest Expense NET INCOME Statement of stockholders' equity Cover Cover 2 Cover Statement of Stockholders' Equity For the month ended June 30, 2019 COMMON STOCK Opening balance, May 31, 201960,000 Issue of common stock Closing balance, June 30, 2019 60,000 RETAINED EARNINGS Opening balance, May 31, 2019 179,821 Net income for the period Dividend paid Closing balance, June 30, 2019 266,318 86,497 Cover 2 Cover Balance Sheet June 30, 2019 ASSETS Current Assets Cash Short-term Investments Interest Receivable ARC - Accounts Receivable Control Merchandise Inventory Office Supplies Prepaid Rent Prepaid Advertising Prepaid Insurance 212,563 23,000 115 89,796 26,720 2,450 1,600 6,000 2,000 Total Current Assets 364,244 Property, Plant and Equipment Office Furniture Accum Depn: Office Furniture Office Equipment Accum Depn: Office Equipment 9,000 (2,000) 51,000 (20,188) Total Property, Plant and Equipment 37,812 TOTAL ASSETS 402,056 LIABILITIES Current Liabilities APC Accounts Payable Control Wages Payable Electricity Payable Water Payable Interest Payable Sales Tax Payable 4,200 3,540 434 245 200 27,119 Total Current Liabilities 35,738 Long-term Liabilities Bank Loan Payable 40,000 TOTAL LIABILITIES 75,738 STOCKHOLDERS' EQUITY Common Stock Retained Earnings 60,000 266,318 TOTAL EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 326,318 402,056