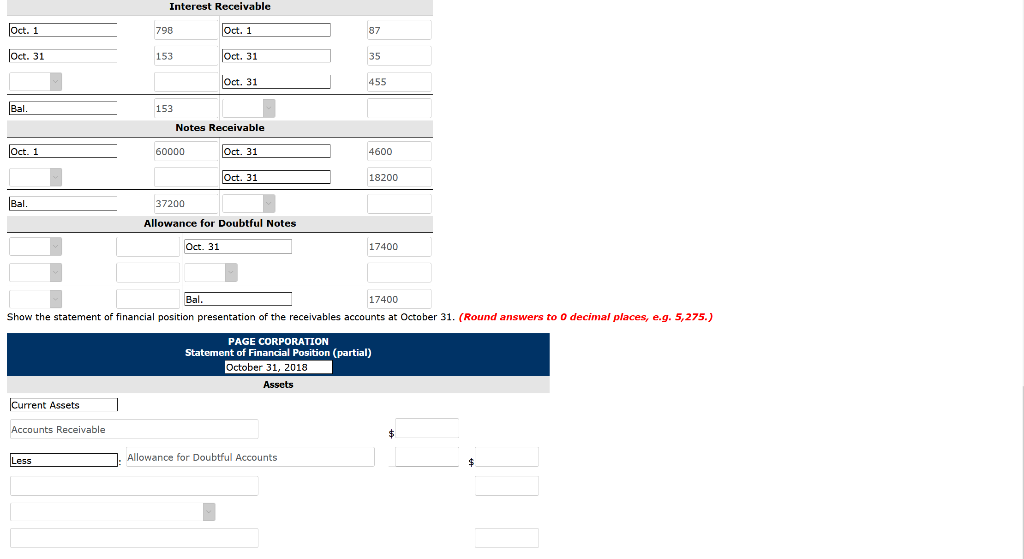

| I have done most part of this homework but I am stuck on the last part, could you please help me understand and answer the statement of financial position section?

|

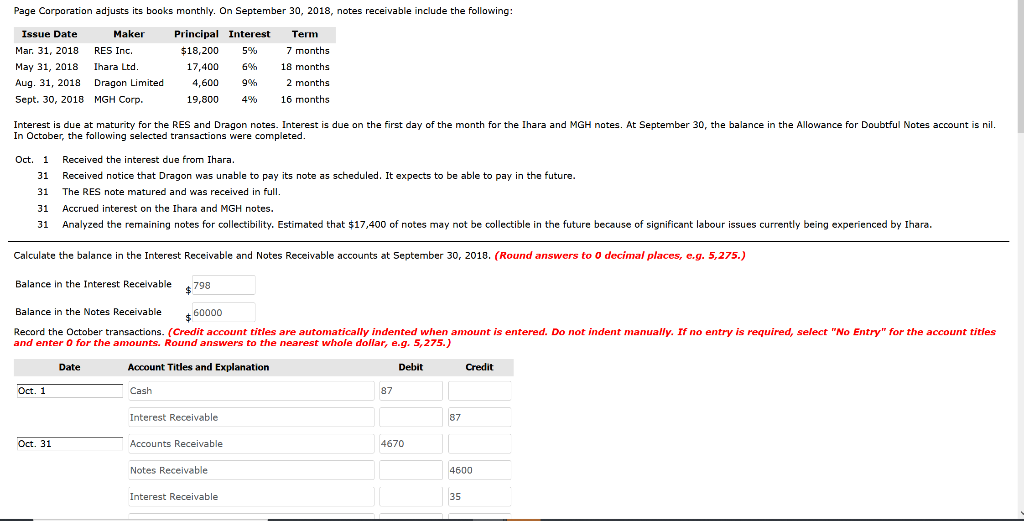

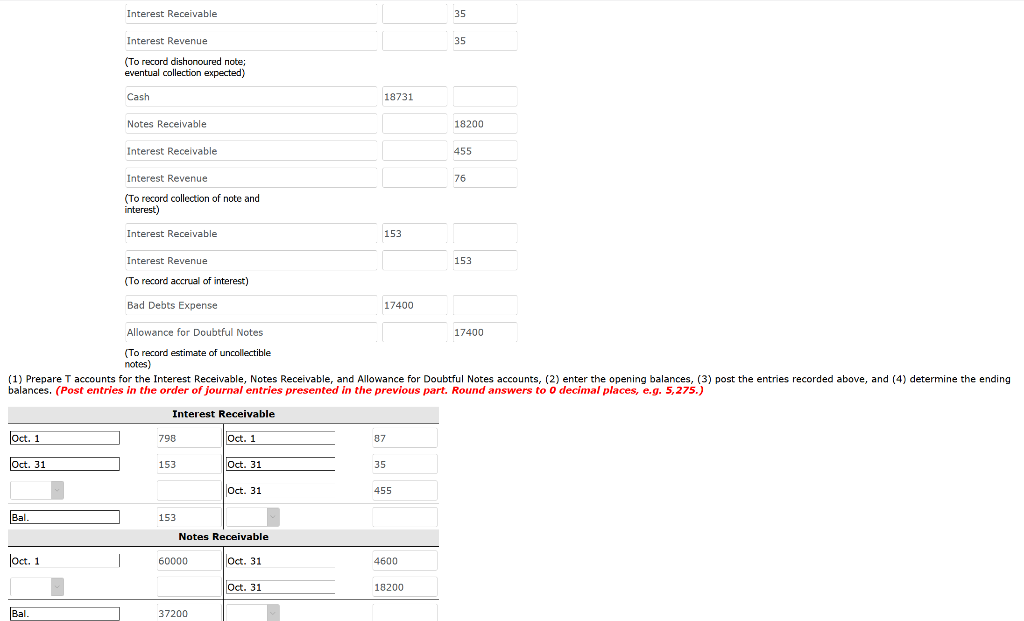

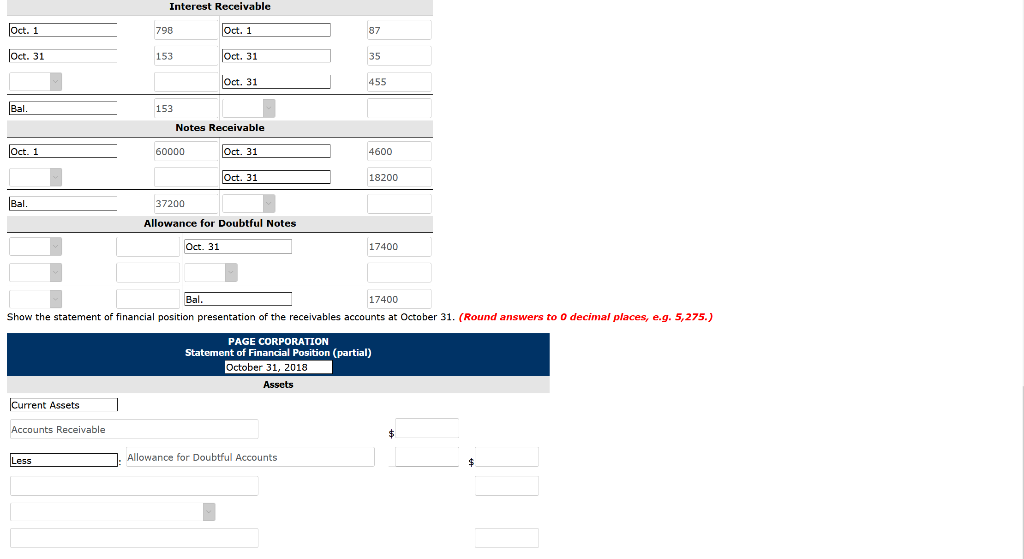

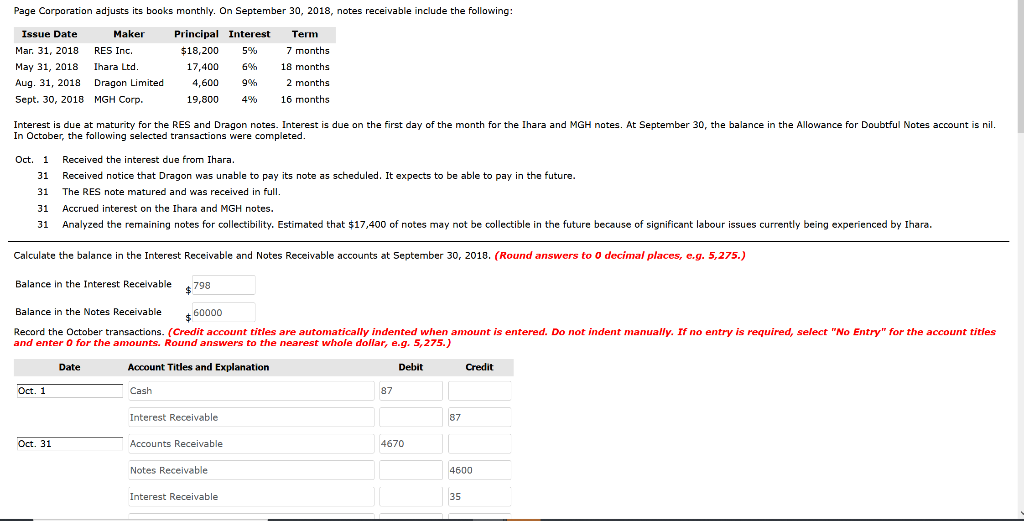

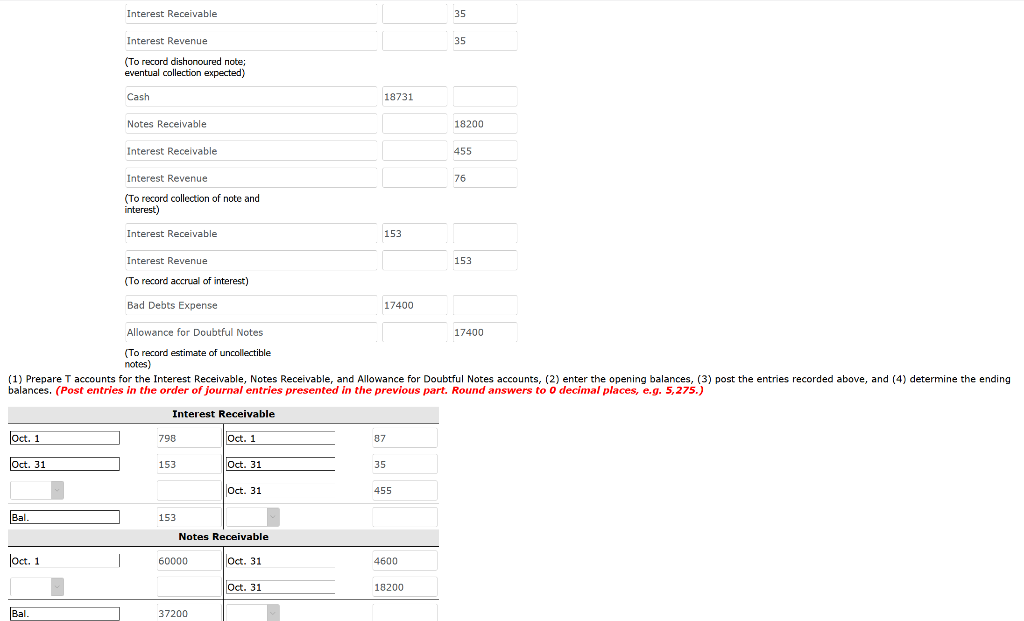

Page Corporation adjusts its books monthly. On September 30, 2018, notes receivable include the following: Issue Date Maker Mar 31, 2018 RES Inc. May 31, 2018 Ihara Ltd. Aug. 31, 2018 Dragon Limited Sept. 30, 2018 MGH Corp. Principal Interest $18,200 5% 17,400 6% 4,600 9% 19,800 4% Term 7 months 18 months 2 months 16 months Interest is due at maturity for the RES and Dragon notes. Interest is due on the first day of the month for the Ihara and MGH notes. At September 30, the balance in the Allowance for Doubtful Notes account is nil. In October, the following selected transactions were completed. Oct. 1 Received the interest due from Ihara. 31 Received notice that Dragon was unable to pay its note as scheduled. It expects to be able to pay in the future. 31 The RES note matured and was received in full. 31 Accrued interest on the Ihara and MGH notes. 31 Analyzed the remaining notes for collectibility. Estimated that $17,400 of notes may not be collectible in the future because of significant labour issues currently being experienced by Ihara. Calculate the balance in the Interest Receivable and Notes Receivable accounts at September 30, 2018. (Round answers to decimal places, e.g. 5,275.) Balance in the Interest Receivable $798 $ 60000 Balance in the Notes Receivable Record the October transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to the nearest whole dollar, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Oct. 1 Cash 87 Interest Receivable 87 Oct. 31 Accounts Receivable 4670 Notes Receivable 4600 Interest Receivable 35 Interest Receivable 35 35 Interest Revenue (To record dishonoured note; eventual collection expected) Cash 18731 Notes Receivable 18200 Interest Receivable 455 76 Interest Revenue (To record collection of note and interest) Interest Receivable 153 153 Interest Revenue (To record accrual of interest) Bad Debts Expense 17400 Allowance for Doubtful Notes 17400 (To record estimate of uncollectible notes) (1) Prepare T accounts for the Interest Receivable, Notes Receivable, and Allowance for Doubtful Notes accounts, (2) enter the opening balances, (3) post the entries recorded above, and (4) determine the ending balances. (Post entries in the order of journal entries presented in the previous part. Round answers to 0 decimal places, e.g. 5,275.) Interest Receivable Oct. 1 798 Oct. 1 87 Oct. 31 153 Oct. 31 35 Oct. 31 455 Bal. 153 Notes Receivable Joct. 1 60000 Oct. 31 4600 Oct. 31 18200 Bal. 37200 Interest Receivable Oct. 1 798 Oct. 1 87 oct. 31 153 Oct. 31 35 Oct. 31 455 Bal. 153 Notes Receivable Oct. 1 60000 Oct. 31 4600 Oct. 31 18200 Bal 37200 Allowance for Doubtful Notes Oct. 31 17400 Ball 17400 Show the statement of financial position presentation of the receivables accounts October 31. (Round answers to D decimal places, e.g. 5,275.) PAGE CORPORATION Statement of Financial Position (partial) October 31, 2018 Assets Current Assets Accounts Receivable Less Allowance for Doubtful Accounts