Question

I have done Parts 1-3 but don't know what to do next. Here is the assignment: MBA Excel Project The project consists of two spreadsheets,

I have done Parts 1-3 but don't know what to do next. Here is the assignment:

MBA Excel Project

The project consists of two spreadsheets, each containing a separate problem. These problems are meant to get you some experience using the basic financial functions in Excel as well as familiarizing yourself with Excel help/resources. In addition to Excels help and documentation, youll find many resources available on the internet to help you. For instance, if you search YouTube for naming cells in Excel youll discover how to refer to cells using names you assign instead of referencing the row and column of the cell (this is problem #1).

As you work through both problems, keep in mind that:

A. Every function/calculation should link to a cell. Never type a value into a function/calculation or you wont receive credit. As an example, dont type =PV(.1,5,-10)but instead type =PV(A1, A2, A3)where the cells A1, A2, and A3 contain the relevant values needed for the present value function.

B. If a cell is named, use the name in the reference. For instance, if A1is named Rate then the present value formula should be written as =PV(Rate, A2, A3).D.You should format cells according to their values (percentages, dollars, decimals, etcetera). Make certain that only two decimals are shown and that the thousands separator (numbers should display as 1,000 and not 1000).

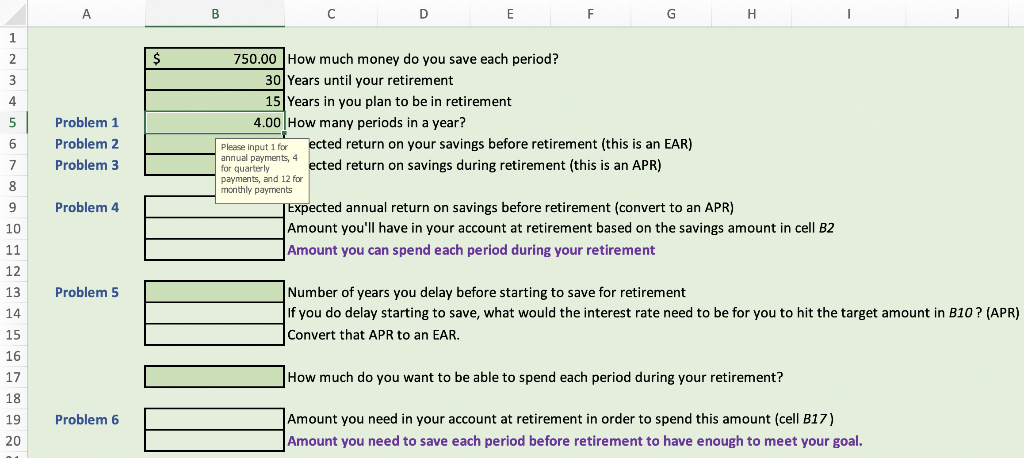

Retirement Planning Worksheet: 50 points

In this problem, we want to estimate someones income in retirement based on several variables: the amount of money being saved, the number of years they plan to save, and the number of years they plan to be in retirement. These retirement calculations require the user to provide information. Wed like to restrict what values can be entered.

1. For cell B5, use the Data Validation tool found in the Data tab to: (3 points)

a. Display the message Please input 1 for annual payments, 4 for quarterly payments, and 12 for monthly payments when the cell is selected.

b. Only allow the values 1, 4, and 12 in this cell (look under Settings, in the Allow drop down box select Custom, and use the OR function in Formula. Note that an error message will display if the OR function returns the value FALSE.)

c. Display the error message You must choose annual, quarterly or monthly payments if a value is entered that returns the value FALSE (that is, if anything other than 1, 4, or 12 is entered).

2. For cell B6, use the Data Validation tool found in the Data tab to: (3 points)

a. Display the message Please input the expected annual return on your savings while youre working and saving for retirement when the cell is selected.

b. Restrict the values that can be entered into this cell to be a decimal between 0.05 and 0.25 (5% and 25%). NOTE: be certain to format this cell to display as a percent (%).

c. Display the error message The return must be between 5% and 25% (0.05 and 0.25) if a value is entered that is outside this range.

3. For cell B7, use the Data Validation tool found in the Data tab to:(3 points)

a. Display the message Please input the expected annual return on your savings during retirement when the cell is selected.

b. Restrict the values that may be selected to the list Ive provided in Column Q (Look under Settings. In the Allow drop down box, select List. Use Source to select those cells in Column Q).

c. Now hide Column Q (right-click on the column heading, Q). Now calculate what someone will be able to spend in retirement given how much they are saving (B2), how often theyre saving (B5), how long they save (B3), how long theyll be in retirement (B4), and the return on their investments both prior to and during retirement (B6/B9 and B7).

4. Based on the amount being saved each period, estimate how much can be spent each period in retirement. (12 points)

a.In cell B9, use the function NOMINAL to convert the expected return on your savings prior to retirement into an APR. Note that if you pick monthly payments (12 payments per year), then the APR needs to be based on monthly compounding, so youll need to link to cells B5and B6.

b. In cell B10, use the function FV to calculate the how much money will be in the account at retirement. As with all the calculations, this should be linked to other cells; dont input the values. c.In cell B11, use the PMT function to calculate the retirement annuity based on the savings at retirement in B10, (how much money you can live off of each period during retirement given savings at retirement).

5. Assume that this individual intends to save nothing for the first few years, which is common for young workers. (12 points)

a. Use the RATE function in cell B14to calculate what you would need the return to be in order to have the same amount of money at retirement as in Problem 4 (cell B10) given the delay entered in cell B13. Report this rate as an APR.

b. Use the EFFECT function in cell B15 to convert this APR into an EAR.

c. Use the IF ERROR function in cell B14 and B15 to return the message "You never save any money! if the worker delays saving (cell B13) for more years than there are years until retirement (cell B3). In the same cells, B14 and B15, change the cells alignment formatting so the text shrinks to fit in the cell when/if the error message is displayed.Now calculate the amount that should be saved each period to attain a target retirement income (B17) based on the frequency of savings (B5), the number of years (B3 and B4), and the return on the investments (B7 and B9).

6. Based on the desired income in retirement (B17), estimate how much should be saved each period before retirement. (8 points)

a. In cell B19, use the PV function to calculate the how much money is needed at retirement to provide the desired income in B17.

b. In cell B20, use the amount in B19 and the PMT function to calculate how much money must be saved each period.

7. To give a sense of how interest rates (B6) and the years of savings (B3) impact the funds available in retirement (B11), create a two-way data table and allow the interest rate to vary from 2% to 12% in increments of 1%, and the years of savings from 10 years to 50 years in increments of 5. The start of the table should be in cell B23, and the table should be formatted (use colors, borders, etc. to make the data table readable). (5 points)

8. Protect the worksheet Retirement Problem so that only the dark green (input) cells values may be changed. Do NOT password protect the sheet. (4 points)

A B D E F G H 1 1 $ 2 3 4 5 6 7 Problem 1 Problem 2 Problem 3 750.00 How much money do you save each period? 30 Years until your retirement 15 Years in you plan to be in retirement 4.00 How many periods in a year? Please Input 1 for ected return on your savings before retirement (this is an EAR) annual payments, 4 for quarterly ected return on savings during retirement (this is an APR) payments, and 12 for monthly payments Expected annual return on savings before retirement (convert to an APR) Amount you'll have in your account at retirement based on the savings amount in cell B2 Amount you can spend each period during your retirement 8 9 Problem 4 10 11 12 Problem 5 13 14 15 Number of years you delay before starting to save for retirement If you do delay starting to save, what would the interest rate need to be for you to hit the target amount in B10? (APR) Convert that APR to an EAR. 16 17 18 How much do you want to be able to spend each period during your retirement? Probleme 19 Problem 6 Amount you need in your account at retirement in order to spend this amount (cell B17) Amount you need to save each period before retirement to have enough to meet your goal. 20 A B D E F G H 1 1 $ 2 3 4 5 6 7 Problem 1 Problem 2 Problem 3 750.00 How much money do you save each period? 30 Years until your retirement 15 Years in you plan to be in retirement 4.00 How many periods in a year? Please Input 1 for ected return on your savings before retirement (this is an EAR) annual payments, 4 for quarterly ected return on savings during retirement (this is an APR) payments, and 12 for monthly payments Expected annual return on savings before retirement (convert to an APR) Amount you'll have in your account at retirement based on the savings amount in cell B2 Amount you can spend each period during your retirement 8 9 Problem 4 10 11 12 Problem 5 13 14 15 Number of years you delay before starting to save for retirement If you do delay starting to save, what would the interest rate need to be for you to hit the target amount in B10? (APR) Convert that APR to an EAR. 16 17 18 How much do you want to be able to spend each period during your retirement? Probleme 19 Problem 6 Amount you need in your account at retirement in order to spend this amount (cell B17) Amount you need to save each period before retirement to have enough to meet your goal. 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started