Question

I have few different answers, I have researched how to do the calculations but it seems like there are few different methods. Could you please

I have few different answers, I have researched how to do the calculations but it seems like there are few different methods. Could you please explain?

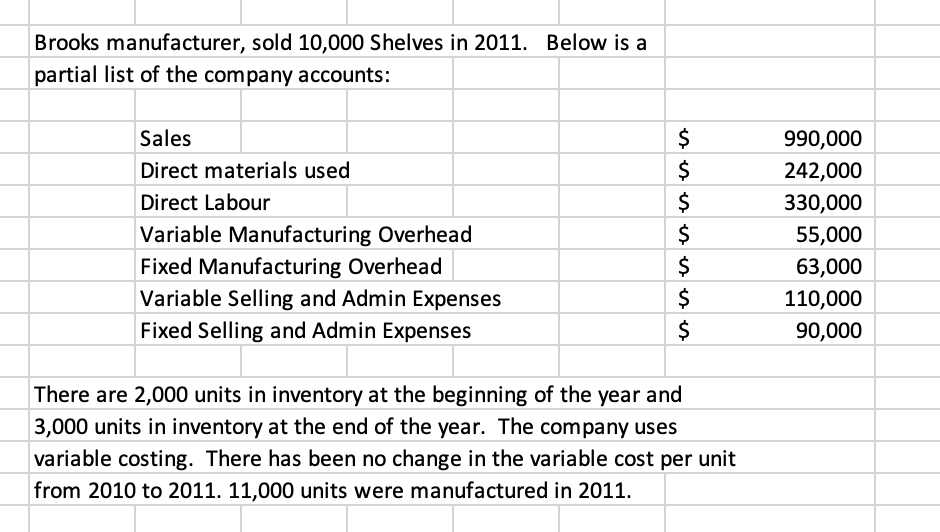

A) What is the variable cost of goods manufactured cost per unit? (2) answers 57 or 67

B) What is the Contribution Ratio?

990,000/990,000= .31

C)What is the Contribution Per Unit? 99-57= 42

D)What is the Break Even Point in Units?

E)What is the Break Even Point in Sales Dollars?

F)How many units need to be sold to realize a net income of $150,000? 7,214

G) What is the cost per unit under absorption costing for 2011?

H) What amount will the ending inventory on the balance sheet be in dollars?

Brooks manufacturer, sold 10,000 Shelves in 2011. Below is a partial list of the company accounts: Sales Direct materials used Direct Labour Variable Manufacturing Overhead Fixed Manufacturing Overhead Variable Selling and Admin Expenses Fixed Selling and Admin Expenses 990,000 242,000 330,000 55,000 63,000 110,000 90,000 There are 2,000 units in inventory at the beginning of the year and 3,000 units in inventory at the end of the year. The company uses variable costing. There has been no change in the variable cost per unit from 2010 to 2011. 11,000 units were manufactured in 2011Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started