Answered step by step

Verified Expert Solution

Question

1 Approved Answer

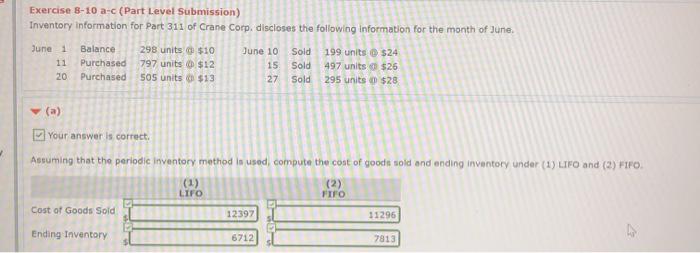

I have figured out A, looking for help for both parts B and C please! Exercise 8-10 a-c (Part Level Submission) Inventory Information for Part

I have figured out A, looking for help for both parts B and C please!

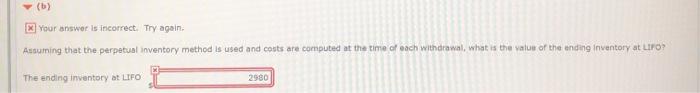

Exercise 8-10 a-c (Part Level Submission) Inventory Information for Part 311 of Crane Corp. discloses the following information for the month of June. June 1 Balance 298 units $10 June 10 Sold 199 units $24 11 Purchased 797 units $12 15 Sold 497 units $26 20 Purchased 505 units $13 27 Sold 295 units $28 (a) Your answer is correct. Asuming that the periodic Inventory method is used, compute the cost of goods sold and ending inventory under (1) LIFO and (2) FIFO. (1) (2) FIFO LIFO Cost of Goods Sold 12397 11296 Ending Inventory 6712 7813 x your answer is incorrect. Try again. Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the value of the ending Inventory at LIFO? The ending inventory at LIFO 2580 (b) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the value of the ending inventory at LIFO? (0) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the gross profit if the inventory is valued at FIFO? (d) Why is it stated that LIFO usually produces a lower gross profit than FIFO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started