Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have figured out the answer by using excel, When my instructor wants me to do it by hand or a financial calculator can someone

I have figured out the answer by using excel, When my instructor wants me to do it by hand or a financial calculator can someone help please

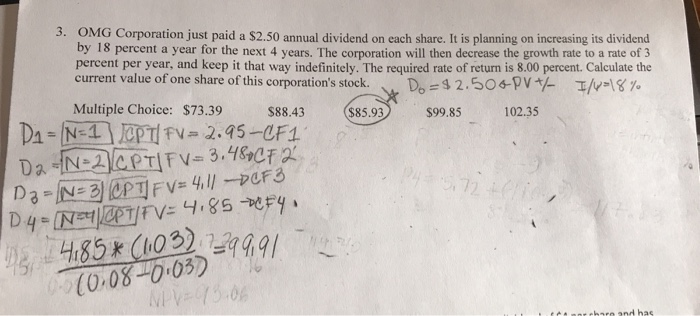

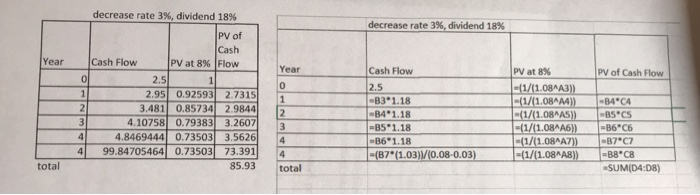

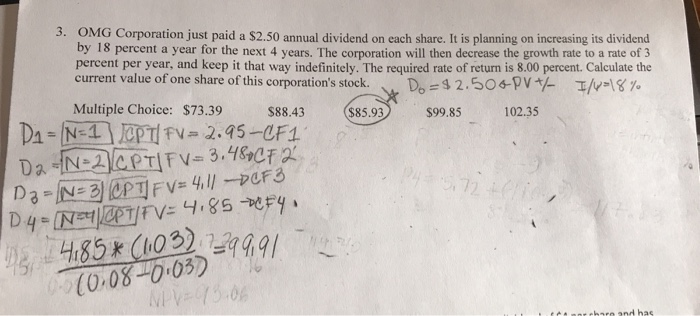

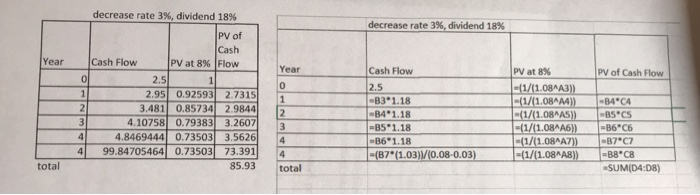

3. OMG Corporation just paid a $2.50 annual dividend on each share. It is planning on increasing its dividend by 18 percent a year for the next 4 years. The corporation will then decrease the growth rate to a rate of 3 percent per year, and keep it that way indefinitely. The required rate of return is 8.00 percent. Calculate the current value of one share of this corporation's stock. D=92.506 PV - Il-18%. Multiple Choice: $73.39 $88.43 $85.93 $99.85 102.35 Da=N=1 CPT FV = 2.95-CF1 Do Da -IN-2CPT FV= 3.48CF 2 D2 - N= 3) (OPTFV=4ill -D0F3 D4- N TFV=4.85 -deF4. 4185* (1103) 299.91 10.08-0.03) MPV that decrease rate 3%, dividend 18% decrease rate 3%, dividend 18% PV of Cash Flow Year Cash Flow PV at 8% Cash Flow PV of Cash Flow ol 2.51 2.5 1 2 3 4 4 total 2 .95 0.92593 2.7315 3 .481 0.85734 2.9844 4 .10758 0.79383 3.2607 4 .8469444 0.73503 3.5626 99.84705464 0.73503 73.391 85.93 -B3 1.18 341.18 -B5*1.18 -861.18 -(B7" (1.03)/(0.08-0.03) PV at 8% (1/(1.081A3)) -(1/(1.08AM) -(1/(1.084AS)) -(1/(1.08AA6)) -(1/(1.0BAAZ)) -(1/(1.08AA8)) -34C4 -B5CS -36C6 -37C -B8C8 -SUMID4:08) total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started