Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please base answer to number 1 based on 3.2.9 solution 1) You take out a 30 year, $300,000 mortgage with constant payments at the end

Please base answer to number 1 based on 3.2.9 solution

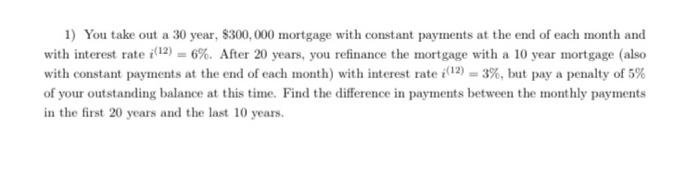

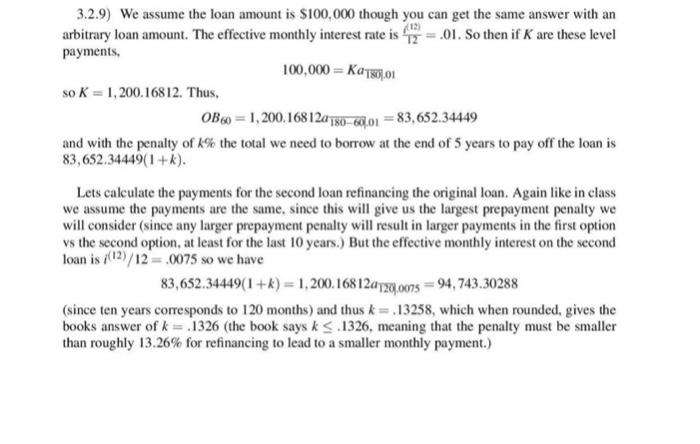

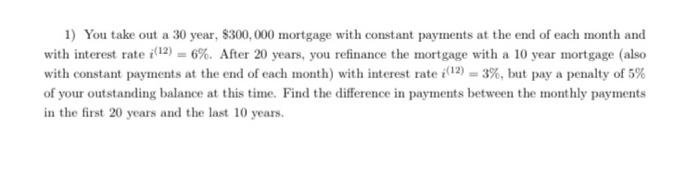

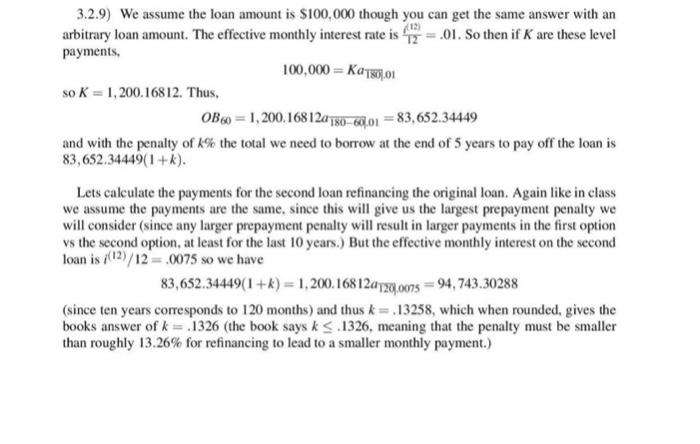

1) You take out a 30 year, $300,000 mortgage with constant payments at the end of each month and with interest rate i(12)=6%. After 20 years, you refinance the mortgage with a 10 year mortgage (also with constant payments at the end of each month) with interest rate i(12)=3%, but pay a penalty of 5% of your outstanding balance at this time. Find the difference in payments between the monthly payments in the first 20 years and the last 10 years. 3.2.9) We assume the loan amount is $100,000 though you can get the same answer with an arbitrary loan amount. The effective monthly interest rate is 12(12)=.01. So then if K are these level payments, 100,000=Ka1801,01 so K=1,200.16812. Thus, OB60=1,200.16812a18060.01=83,652.34449 and with the penalty of k% the total we need to borrow at the end of 5 years to pay off the loan is 83,652.34449(1+k) Lets calculate the payments for the second loan refinancing the original loan. Again like in class we assume the payments are the same, since this will give us the largest prepayment penalty we will consider (since any larger prepayment penalty will result in larger payments in the first option vs the second option, at least for the last 10 years.) But the effective monthly interest on the second loan is i(12)/12=.0075 so we have 83,652.34449(1+k)=1,200.16812a120.0075=94,743.30288 (since ten years corresponds to 120 months) and thus k=.13258, which when rounded, gives the books answer of k=.1326 (the book says k.1326, meaning that the penalty must be smaller than roughly 13.26% for refinancing to lead to a smaller monthly payment.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started