Answered step by step

Verified Expert Solution

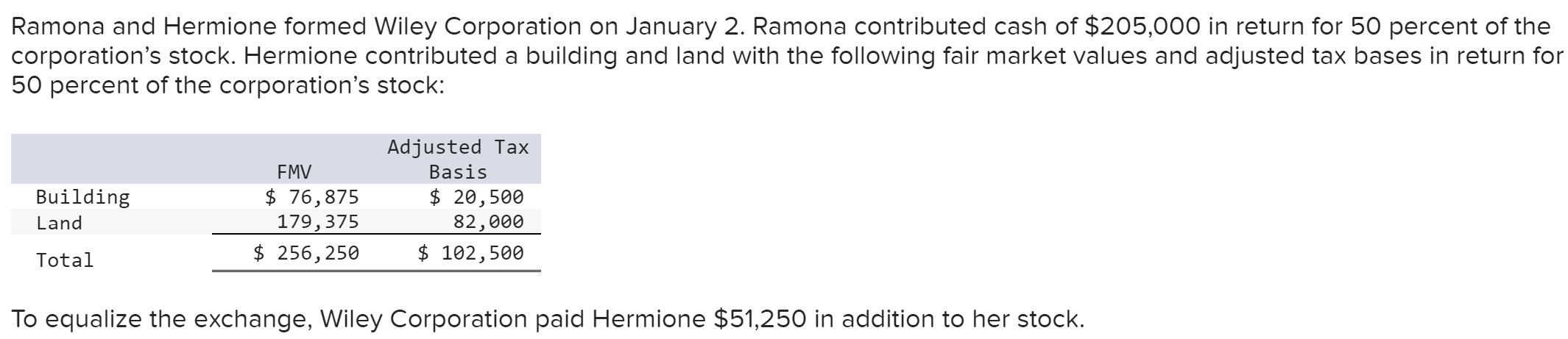

Question

1 Approved Answer

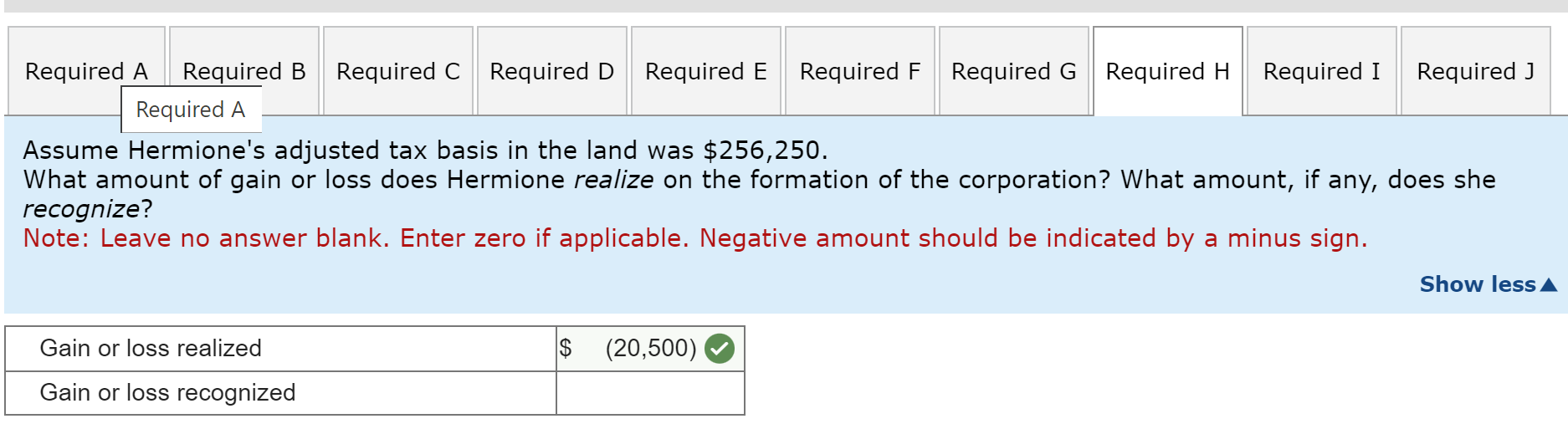

I have figured out the loss realized, but cannot for the life of me figure out the loss or gain recognized. Can you post step

I have figured out the loss realized, but cannot for the life of me figure out the loss or gain recognized. Can you post step by step how you get your answer? I have already tried entering 0 as the recognized amount but that is not correct. I have also posted this question once before and the person who responded only reiterated the problem to me and gave no steps or answers. PLEASE HELP!

I have figured out the loss realized, but cannot for the life of me figure out the loss or gain recognized. Can you post step by step how you get your answer? I have already tried entering 0 as the recognized amount but that is not correct. I have also posted this question once before and the person who responded only reiterated the problem to me and gave no steps or answers. PLEASE HELP!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started