Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have found many different solutions to this questions here on Chegg, and all of them give different answers, so I am very confused, as

I have found many different solutions to this questions here on Chegg, and all of them give different answers, so I am very confused, as to how an accurate solution of this question would look. Could you explain why there are so many different solutions as well?

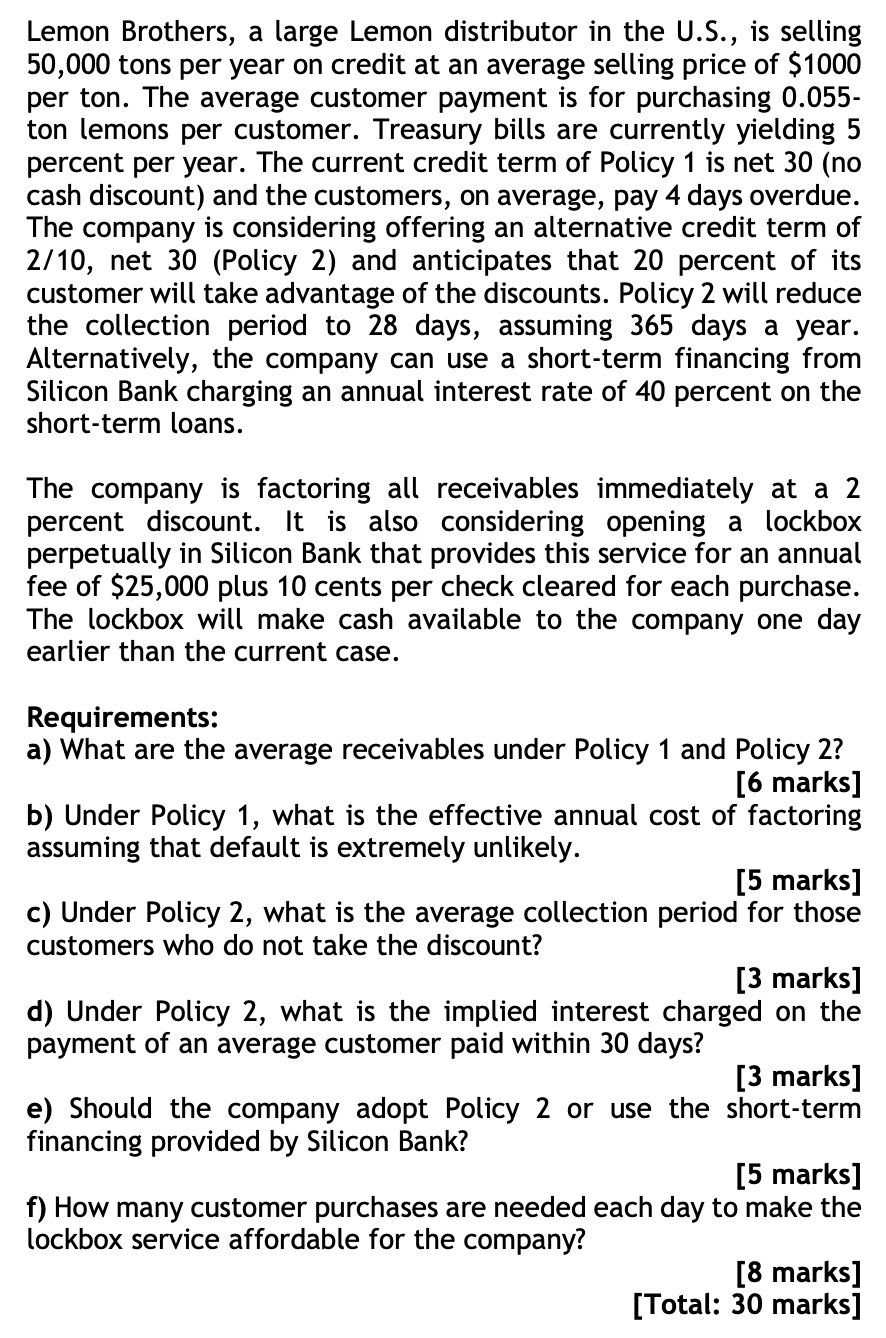

Lemon Brothers, a large Lemon distributor in the US is selling

tons per year on credit at an average selling price of $

per ton. The average customer payment is for purchasing

ton lemons per customer. Treasury bills are currently yielding

percent per year. The current credit term of Policy is net no

cash discount and the customers, on average, pay days overdue.

The company is considering offering an alternative credit term of

net Policy and anticipates that percent of its

customer will take advantage of the discounts. Policy will reduce

the collection period to days, assuming days a year.

Alternatively, the company can use a shortterm financing from

Silicon Bank charging an annual interest rate of percent on the

shortterm loans.

The company is factoring all receivables immediately at a

percent discount. It is also considering opening a lockbox

perpetually in Silicon Bank that provides this service for an annual

fee of $ plus cents per check cleared for each purchase.

The lockbox will make cash available to the company one day

earlier than the current case.

Requirements:

a What are the average receivables under Policy and Policy

marks

b Under Policy what is the effective annual cost of factoring

assuming that default is extremely unlikely.

marks

c Under Policy what is the average collection period for those

customers who do not take the discount?

marks

d Under Policy what is the implied interest charged on the

payment of an average customer paid within days?

marks

e Should the company adopt Policy or use the shortterm

financing provided by Silicon Bank?

marks

f How many customer purchases are needed each day to make the

lockbox service affordable for the company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started