Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have found the Cov and Corr for Stocks A and B, I need help with stock's C&D and E&F - I dont feel as

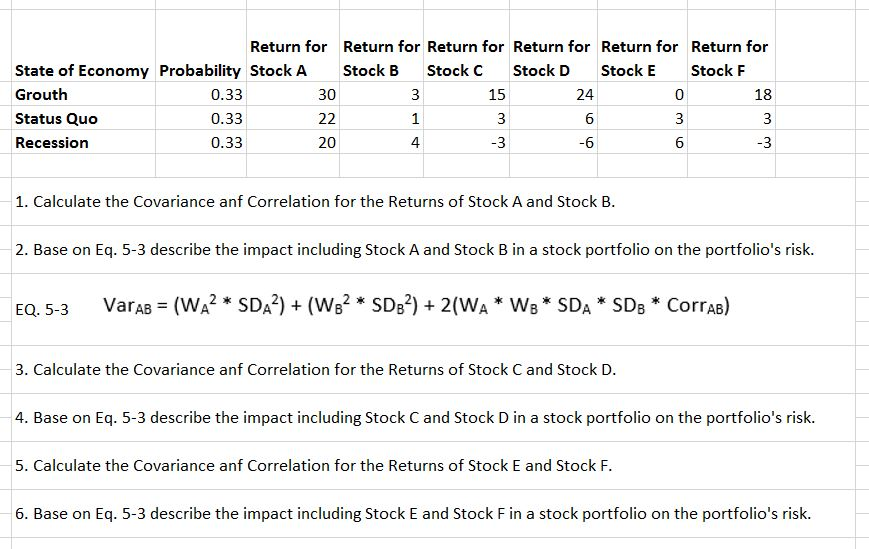

I have found the Cov and Corr for Stocks A and B, I need help with stock's C&D and E&F - I dont feel as if my answers are correct. As well as the questions 2, 4 & 6 - I'm not sure what its asking for or how to answer it.

Please help, Thank you in advance.

Return for Return for Return for Return for Return for Return for State of Economy Probability Stock A Stock B Stock C Stock D Stock E Stock F Grouth 0.33 30 3 15 24 0 18 Status Quo 0.33 22 1 3 6 3 Recession 0.33 20 -3 -6 6 -3 aw 1. Calculate the Covariance anf Correlation for the Returns of Stock A and Stock B. 2. Base on Eq. 5-3 describe the impact including Stock A and Stock B in a stock portfolio on the portfolio's risk. EQ.5-3 Varab = (WA* SD23) + (W62 * SDB2) + 2(WA* W3* SDA * SDE * Corral) 3. Calculate the Covariance anf Correlation for the Returns of Stock C and Stock D. 4. Base on Eq. 5-3 describe the impact including Stock C and Stock D in a stock portfolio on the portfolio's risk. 5. Calculate the Covariance anf Correlation for the Returns of Stock E and Stock F. 6. Base on Eq. 5-3 describe the impact including Stock E and Stock Fin a stock portfolio on the portfolio's risk. Return for Return for Return for Return for Return for Return for State of Economy Probability Stock A Stock B Stock C Stock D Stock E Stock F Grouth 0.33 30 3 15 24 0 18 Status Quo 0.33 22 1 3 6 3 Recession 0.33 20 -3 -6 6 -3 aw 1. Calculate the Covariance anf Correlation for the Returns of Stock A and Stock B. 2. Base on Eq. 5-3 describe the impact including Stock A and Stock B in a stock portfolio on the portfolio's risk. EQ.5-3 Varab = (WA* SD23) + (W62 * SDB2) + 2(WA* W3* SDA * SDE * Corral) 3. Calculate the Covariance anf Correlation for the Returns of Stock C and Stock D. 4. Base on Eq. 5-3 describe the impact including Stock C and Stock D in a stock portfolio on the portfolio's risk. 5. Calculate the Covariance anf Correlation for the Returns of Stock E and Stock F. 6. Base on Eq. 5-3 describe the impact including Stock E and Stock Fin a stock portfolio on the portfolio's riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started