Answered step by step

Verified Expert Solution

Question

1 Approved Answer

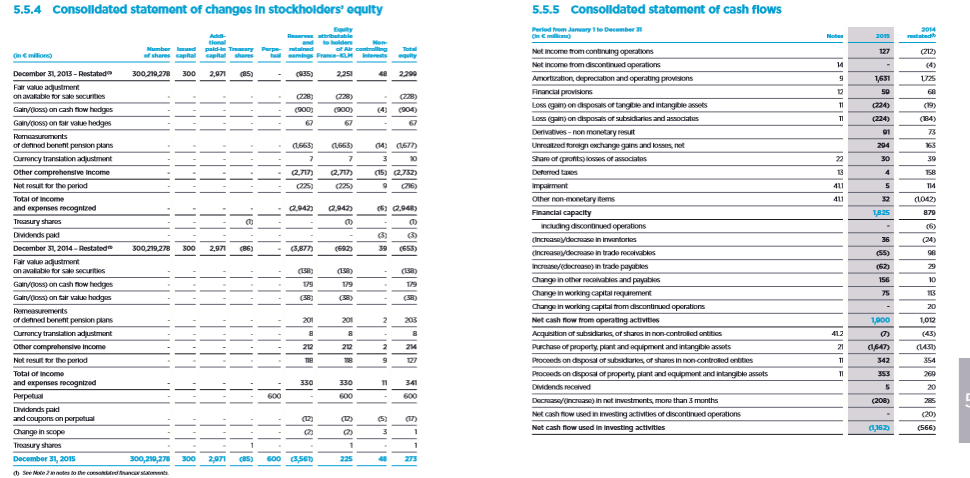

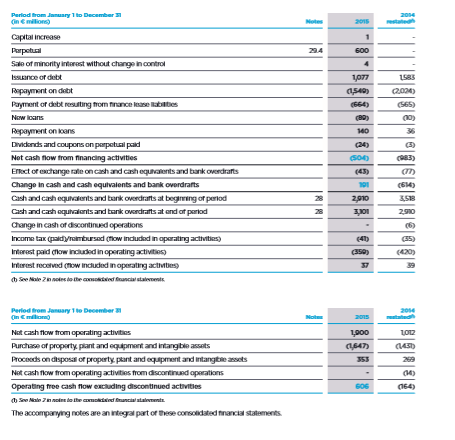

I have included the financial information. thanks Air France-KLM Cas LO16-11@IFRS ARERANC. , Page 964 Real World Flnanclals Air France-KLM (AF), a Franco-Dutch company,

\

\

I have included the financial information. thanks

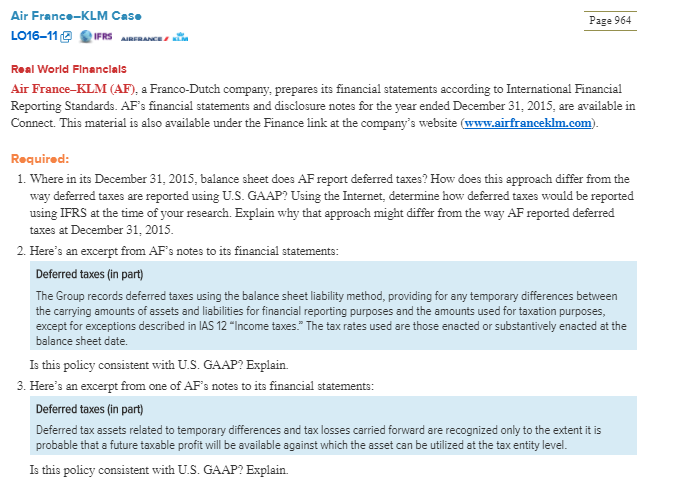

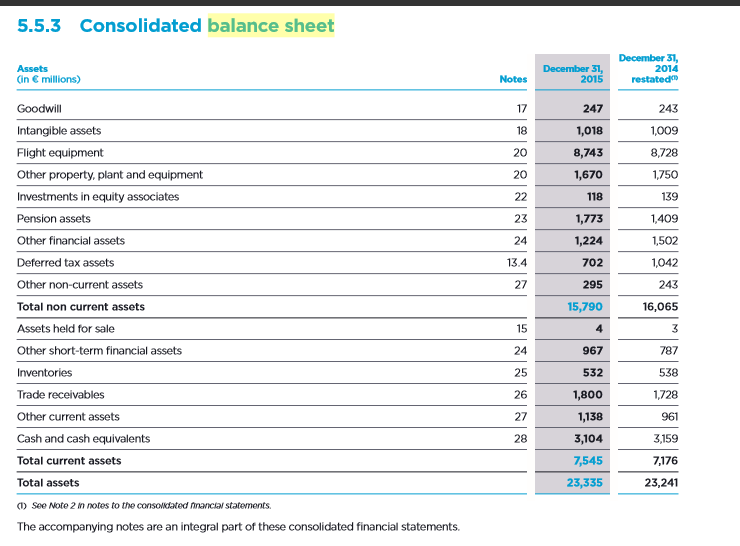

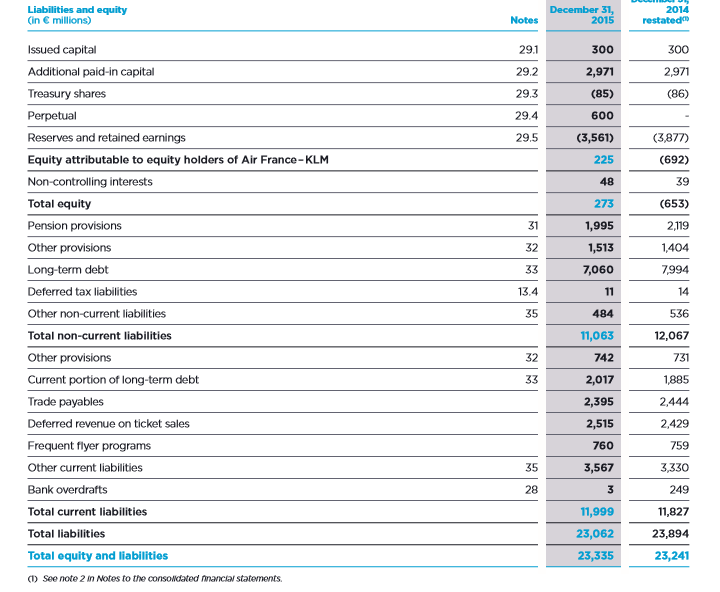

Air France-KLM Cas LO16-11@IFRS ARERANC. , Page 964 Real World Flnanclals Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF's financial statements and disclosure notes for the year ended December 31, 2015, are available in Connect. This material is also available under the Finance link at the company's website (www.airfranceklm.com). Required: 1. Where in its December 31, 2015, balance sheet does AF report deferred taxes? How does this approach differ from the way deferred taxes are reported using U.S. GAAP? Using the Internet, determine how deferred taxes would be reported using IFRS at the time of your research. Explain why that approach might differ from the way AF reported deferred taxes at December 31, 2015. 2. Here's an excerpt from AF's notes to its financial statements: Deferred taxes (in part) The Group records deferred taxes using the balance sheet liability method, providing for any temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes, except for exceptions described in IAS 12 "Income taxes." The tax rates used are those enacted or substantively enacted at the balance sheet date. Is this policy consistent with U.S. GAAP? Explain. . Here's an excerpt from one of AF's notes to its financial statements: Deferred taxes (in part) Deferred tax assets related to temporary differences and tax losses carried forward are recognized only to the extent it is probable that a future taxable profit will be available against which the asset can be utilized at the tax entity level. Is this policy consistent with U.S. GAAP? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started