i have limitted time plz ansewer to this questions plz

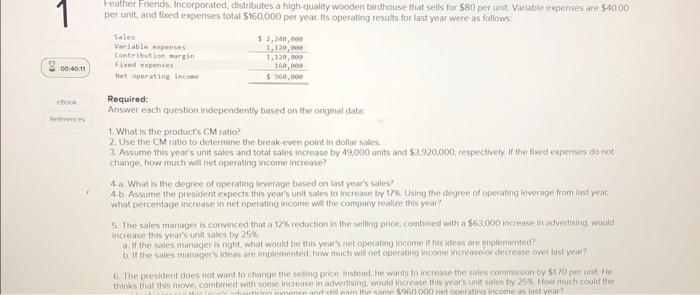

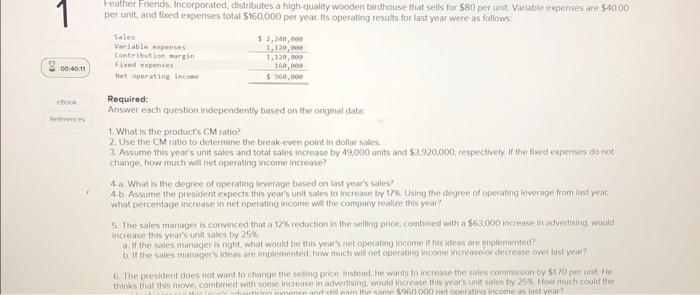

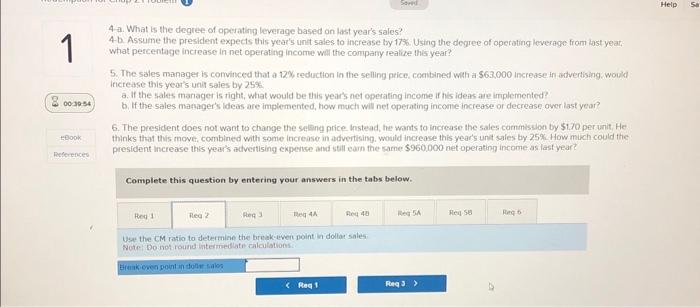

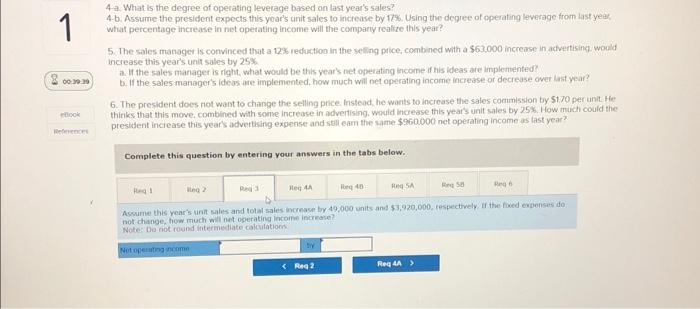

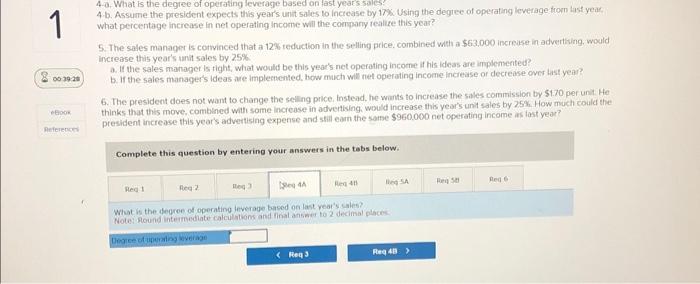

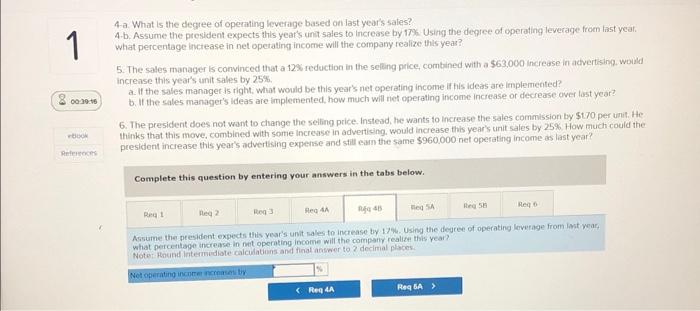

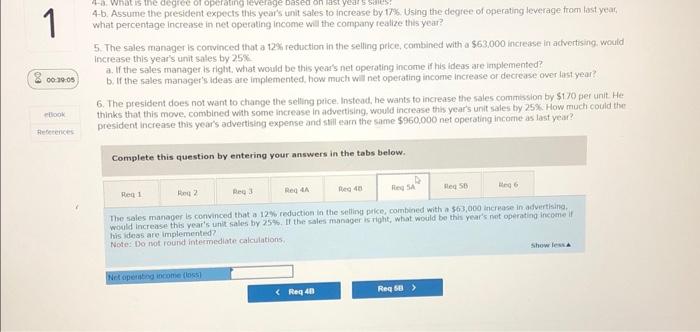

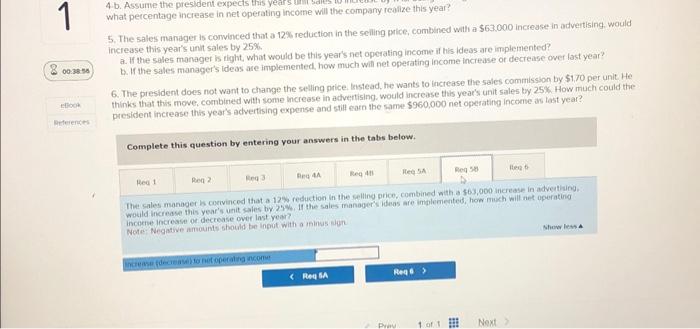

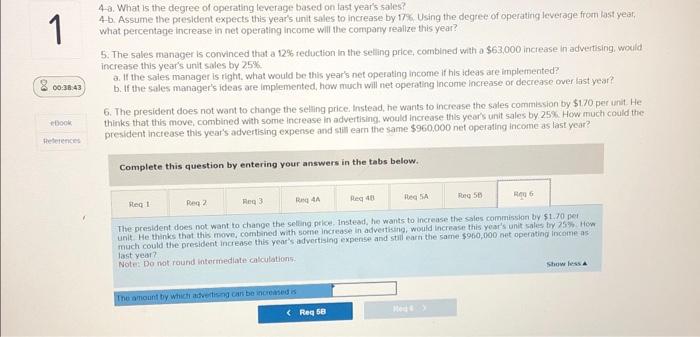

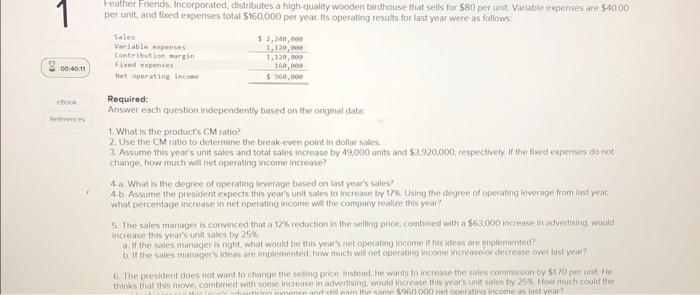

4.b. Assume the president expects 5. The sales manager is convinced that a 12% reduction in the seling price, combined with a $63,000 increase in advertising. would increase this year's unit sales by 25%. a. If the sales manager is tight, what would be this year's net operating income if his ideas are implemented? b. If the sales manager's ideas ase implemented, how much with net operating income increase or decrease over last year? 6. The president does not want to change the selling price. Instead, he wants to inctease the sales commission by $1,70 per unit He thinks that this move, combined with some increase in advertising. would increase this year's unit sales by 25% How much could the president increase this year's advertising expense and stil earo the same $960,000 net operating income as last year? Complete this question by entering your answers in the tabs below. The cales manager bs corvinced that a 12% reduction in the selling prico, combined with a 563,000 increase in advertiung. incoene increase or decrease over last year? Nete: Negatwe amounts should be input with o minus sign. 4-a. What is the degree of operating leverage based on last ycar's sales? 4-b. Assume the president expects this year's unit sales to increase by 17%. Using the degree of operating loverage from last yeat, what percentage increase in net operating income wil the company realize this year? 5. The sales manager is comvinced that a 12% reduction in the selling peice, cocnbined with a $63,000 increase in antvertising. woukd inctease this year's unit sales by 25% : a. If the sales manager is tight, what would be this vear's net operating income if his ideas are implemented? b, If the sales marsager's ideas are implemented, how much will net operating income increase or decrease over last year? 6. The president does not want to change the seling price instead, he wants to increase the sales carnmission by 51 .70 per init, He thinks that this move, comblned with some increase in advertising. would increase this year's unit sales by 25%. How mich could the president increase this year's advertising experse and still earn the same $960.000 net operating income as last year? Complete this question by entering vour answers in the tabs below. Use the CM ratio to determine the break-ever noint in dollar sales: Note Do not round intermed late calaulations: 4. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this yoar's anit sales to increase by 17%. Using the degree of operating leverage from last yee, what percentage increase in net opetating income will the company realize this year? 5. The sales manager is convinced that a 12% reduction in the seling price, combined with a $63,000 increase in acfvertising . would increase this year's unit sales by 25%. a. If the sales manager is right, what would be this year's net operating income if his ideas are implemented? b. If the sales manager's ideos are implemented, how much will net operating income increase or decrease ower last year? 6. The president does not want to change the selling price. Instead, he wants to increase the sales coamission by $1.70 per unit He thiriks that this move, combined with some increase in advertising. would increase this year's unit sales by 25\%. How much could the president increase this year's advettising expense and sell cam the same $960000 net operating income as last year? Complete this question by entering your answers in the tabs below. Ascume this year's unit sales and total sales increase by 49,000 units and 53,920,000, fespectrely. if the foxed erponses do not change, hiow much will net ogerating income increase? 4-b. Assume the president expects this year's unit sales to increase by 17%. Using the degree of operating teverage from last year, what percentage increase in net operating income wal the company realize this year? 5. The sales manager is corvinced that a 12% reduction in the selling price, combined with a $63,000 increase in actvertising. would increase this year's unit sales by 25% a. If the sales manager is right, what would be this year's net operating income if his idess are implemented? b. If the sales manager's ideas are implemented, how much will net operating income increase or deciease over lisst year? 6. The president does not want to change the selling ptice. Instead, he wants to increase the sales commission by $170 per unit. He thinks that this move, combined with some increase in advertising. would increase this year's unit sales by 25x. How much could the president increase this year's advertisting expense and still earn the same $960,000 net operating incorne as last year? Complete this question by entering your answers in the tabs below. De sales maneoer is convenced that a 12% reduction in the selling paike, combined with a 563,000 increase in advertising. would increase this vear's unit sales by 25%. It the sales manager is right, what would bo this year's not operating incerne if his ideas are implemented? Note: Do not round intermediate calculations. Feather Friends. Incorporated, distributes a high-quality wooden birdhouse that sells for $80 per unit. Variable expenses are $40.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Required: Answer each question independently based on the originat data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break even point in dollar sales 3. Assume this year's unit sales and total sales increase by 49,000 units and $3,920,000, respectively if the fixed expenses do not change, how much will net operating income increase? 4 a. What is the degree of operating leverape based on last year's sales? 4b. Assume the president expects this year's unit sales to inciease by 17%. Using the degree of operating loverage from last yeat. What percentage increase-in net operating income will the company realize this year? 5. The sales manager is convenced that a 12% reduction it the selling price, combined with a $63,000 increase in advertising wouka increase this year's una sales by 25% a. If the sales manager is right, What would be this years net operating income it his keas are inplemented? b. If the sales manager s ideas are irplenented. how much will net operating income increasoor dencrease owei last year? -0. What is the degree of operating leverage based on last years sares? b. Assume the president expects this year's unit sales lo inctease by 17%. Using the degtee of operating leverage from last year. what percentage increase in net operating income will the company realize this year? 5. The sales manager is cortvinced that a 12% reduction in the selling pice, combined weth a $63,000 increuse in advertiving, would increase this year's unit sales by 25%. a. If the sales manager is tight, what would be this year's net operating income it his ideas are implemented? b. If the sales manager's ideas are implemented. how much will net operating income increase of decrease over hast year? 6. The president does not want to change the seiling price. Instead, he wants to increase the sales commission by $1.70 per unit. He thinks that this move, comblned with some increase in advertising. would increase this year's unit sales by 25%. How much could the president increase this year's advertising expense and still eam the same $960,000 net operating income as tast year? Complete this question by entering your answers in the tabs below. What is the degren of operating leverage based on last vear's sales? 4.3. What is the degree of operating leverage based on fast year's sales? 4b. Assume the president expects this year's unit sales to increase by 17% Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year? 5. The sales manager is convinced that a 12% teduction in the seling pice, combined with a $63,000 increase in advertising, would increase this year's unit sales by 25%. a. If the saies manager is right. what would be this year's net operating income if his ideas are inplemented? b. If the sales manager's ideas are implemented, how much will net operating incorre increase or decrease over iast year? 6. The president does not want to change the seling price. Instead, he wants to increase the sales commission by $1.70 per unit. He. thinks that this move, combined with some increase in advertising, would increase this year's unit sales, by 25%. How much could the president increase this year's advertising expense and still earn the same $960,000 net operating income as last vear? Complete this question by entering your answers in the tabs below. The president does not want to change the seling price. Instead, he wants to increase the sales commission by $1.70 pet much could the president increase this year's advertising expense and still earti the same $960,000 met operating income as. last year? Noter. Do not round intormediate calculations: 4-a. What is the dectee of operaning leverage based on last year's sales? 4.b. Assume the president expects this year's unit sales to increase by 17% Using the deqree of operating leverage from last yeat. what percentage inctease in net operating income will the company realize this yeas? 5. The sales manager is convinced that a 12% reduction in the seling price, combined with a 563,000 increase in actvertising. woild. increase this year's unit sales by 25%. a. If the sales manager is right. What would be this year's net operating income if this ideas are implemented? b. If the sales manager's ideas are implemented, how much will net operating income increase or decrease over tast ycar? 6. The president does not want to cluange the seling price. Instead, he wants fo increase the sales commission by $170 per unit. He thinks that this move, combined with some increase in adverticing. would increase this year's unit sales by 25%, How much could the pesident increase this year's advertising experise and still eam the same $960.000 net operating income as last year? Complete this question by entering your answers in the tabs below. Assume the president expects this vear's unit sales to increase by 17%. Using the degree of operating leverage from int weas what percentage increase in nit operating income will the company realize this year