Please answer this question and its entirety, there are 11 entires, A-K. Thank you so much in advanced, I will be sure to leave a like and comment.

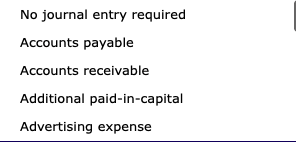

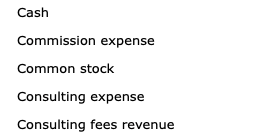

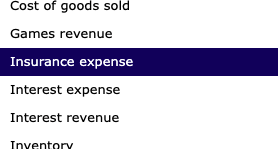

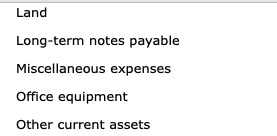

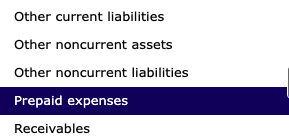

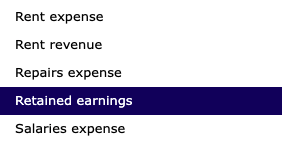

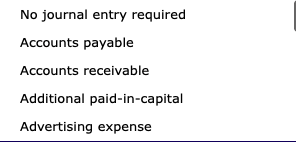

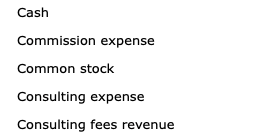

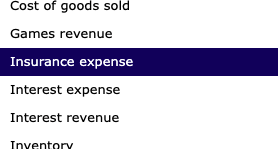

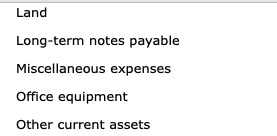

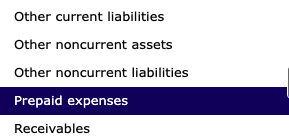

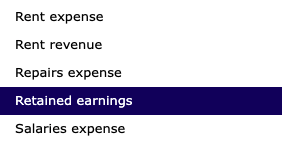

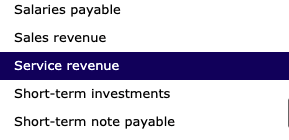

These are the possible answers for the blanks:

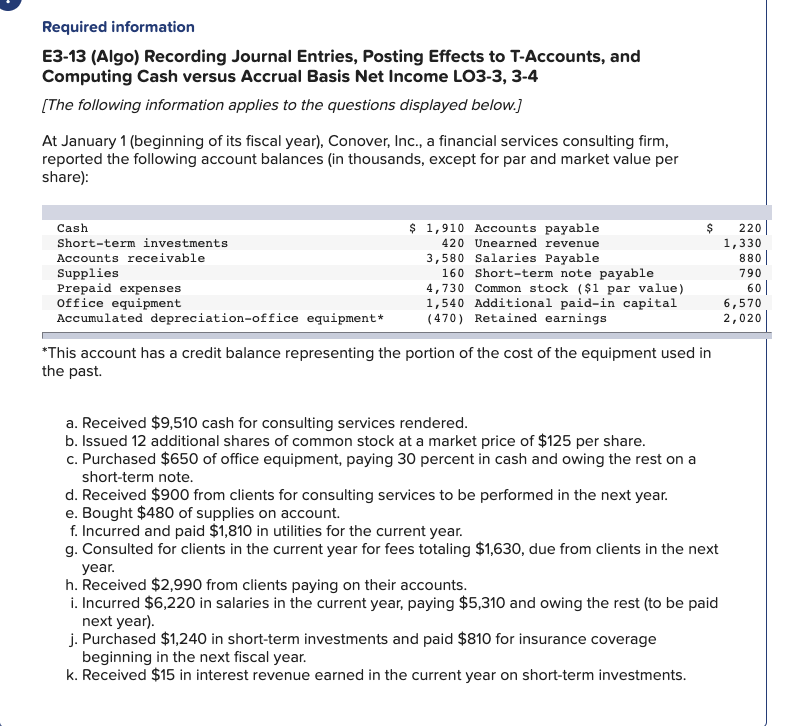

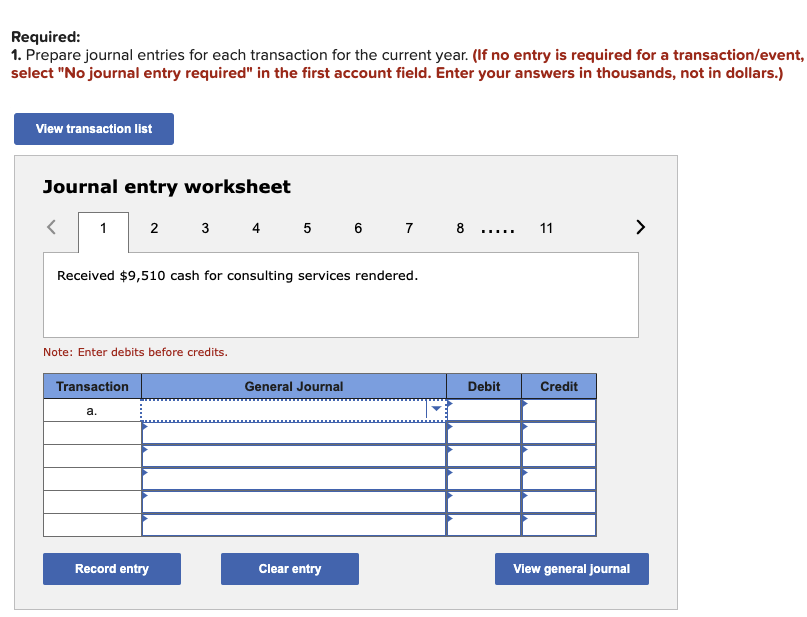

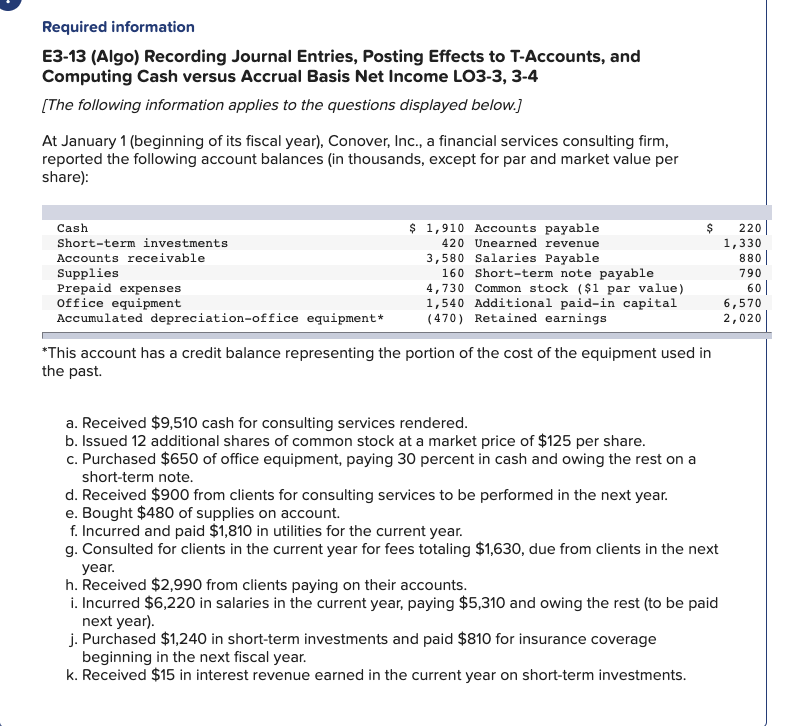

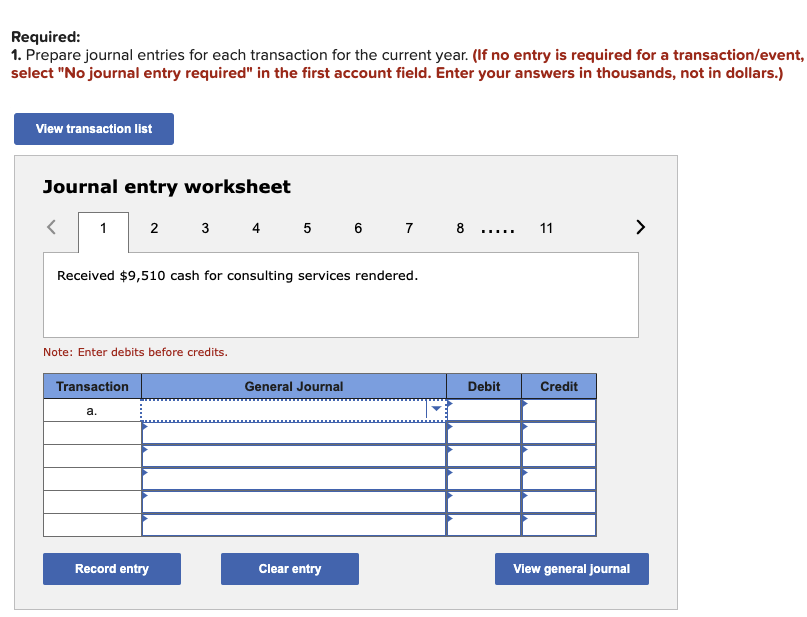

Required information E3-13 (Algo) Recording Journal Entries, Posting Effects to T-Accounts, and Computing Cash versus Accrual Basis Net Income LO3-3, 3-4 [The following information applies to the questions displayed below.] At January 1 (beginning of its fiscal year), Conover, Inc., a financial services consulting firm, reported the following account balances (in thousands, except for par and market value per share): $ Cash Short-term investments Accounts receivable Supplies Prepaid expenses Office equipment Accumulated depreciation-office equipment $ 1,910 Accounts payable 420 Unearned revenue 3,580 Salaries Payable 160 Short-term note payable 4,730 Common stock ($1 par value) 1,540 Additional paid-in capital (470) Retained earnings 220 1,330 880 790 60 6,570 2,020 *This account has a credit balance representing the portion of the cost of the equipment used in the past. a. Received $9,510 cash for consulting services rendered. b. Issued 12 additional shares of common stock at a market price of $125 per share. c. Purchased $650 of office equipment, paying 30 percent in cash and owing the rest on a short-term note. d. Received $900 from clients for consulting services to be performed in the next year. e. Bought $480 of supplies on account. f. Incurred and paid $1,810 in utilities for the current year. g. Consulted for clients in the current year for fees totaling $1,630, due from clients in the next year. h. Received $2,990 from clients paying on their accounts. i. Incurred $6,220 in salaries in the current year, paying $5,310 and owing the rest (to be paid next year). j. Purchased $1,240 in short-term investments and paid $810 for insurance coverage beginning in the next fiscal year. k. Received $15 in interest revenue earned in the current year on short-term investments. Required: 1. Prepare journal entries for each transaction for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands, not in dollars.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 . 11 > Received $9,510 cash for consulting services rendered. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general Journal No journal entry required Accounts payable Accounts receivable Additional paid-in-capital Advertising expense Cash Commission expense Common stock Consulting expense Consulting fees revenue Cost of goods sold Games revenue Insurance expense Interest expense Interest revenue Inventory Land Long-term notes payable Miscellaneous expenses Office equipment Other current assets Other current liabilities Other noncurrent assets Other noncurrent liabilities Prepaid expenses Receivables Rent expense Rent revenue Repairs expense Retained earnings Salaries expense Salaries payable Sales revenue Service revenue Short-term investments Short-term note payable