Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have limmited time plz i need quick help. The new equipment would be more efficient than the equipment that Antilles Refining has been using

i have limmited time plz i need quick help.

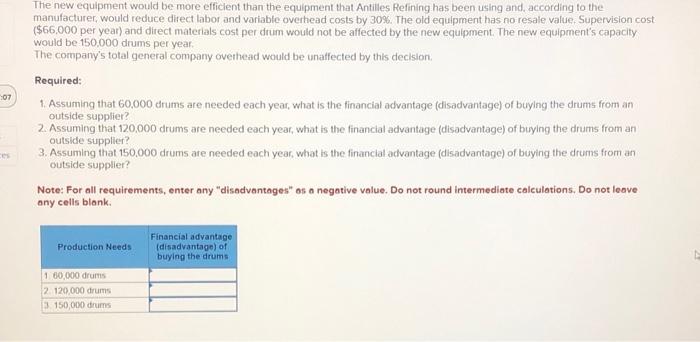

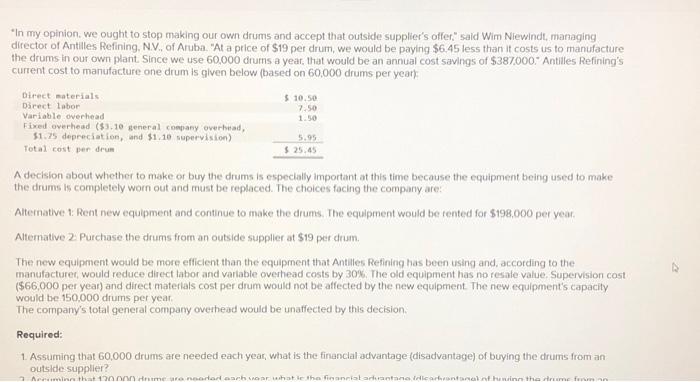

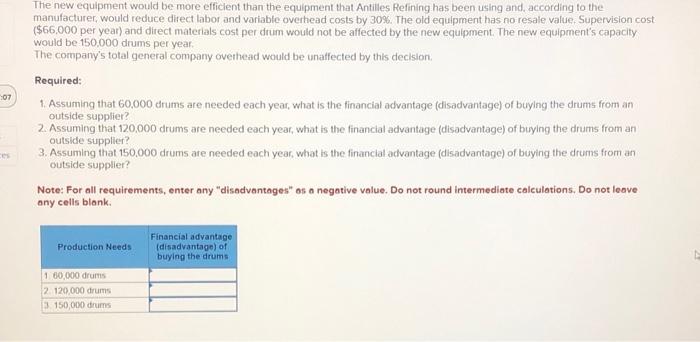

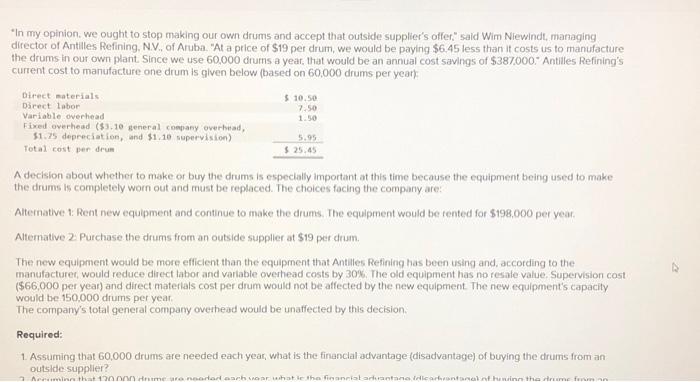

The new equipment would be more efficient than the equipment that Antilles Refining has been using and, according to the manufacturer, would reduce direct tabor and varlable overtiead costs by 30%. The old equipment has no resate vatue, Supervision cost. (\$66.000 per year) and direct materials cost per drum would not be affected by the new equipment. The new equipment's capacity would be 150,000 drums per year. The company's total general company overhead would be unaffected by this decision. Required: 1. Assuming that 60.000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 2. Assuming that 120,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 3. Assuming that 150,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? Note: For all requirements, enter any "disadvantages" os a negative value. Do not round intermediate calculations, Do not leave any cells blank. "In my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said Wim Niewindt, managing director of Antilles Refining, N.V., of Aruba. "At a price of $19 per drum, we would be paying $6.45 less than it costs us to manufacture the drums in our own plant. Since we use 60,000 drums a year, that would be an annual cost savings of $387,000 Antilles Refining's current cost to manufacture one drum is given below (based on 60,000 drums per year: A decision about whether to make or buy the drums is especially important at this time because the equipment being used to make the drums is completely worn out and must be replaced. The choices facing the compary are: Altemative 1 : Rent new equipment and continue to make the drums. The equipment would be tented for $198,000 per year. Altemative 2 Purchase the drums from an outside supplier at $19 per drum. The new equipment wout be more efficient than the equipment that Antiles Refining has been using and, according to the manufacturec, would reduce direct lator and varlable overhead costs by 30%. The old equipment has no resale value. Supervision cost ( $66,000 per year) and direct materials cost per drum would not be affected by the new equipment. The new equipment's capacity would be 150,000 drums per year. The company's total general company overhead would be unaffected by this decision. Required: 1. Assuming that 60,000 drums are needed each year, what is the financlal advantage (disadvantage) of buying the ctrums from an outside supplier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started