I have no idea how to attach the tables

I have no idea how to attach the tables

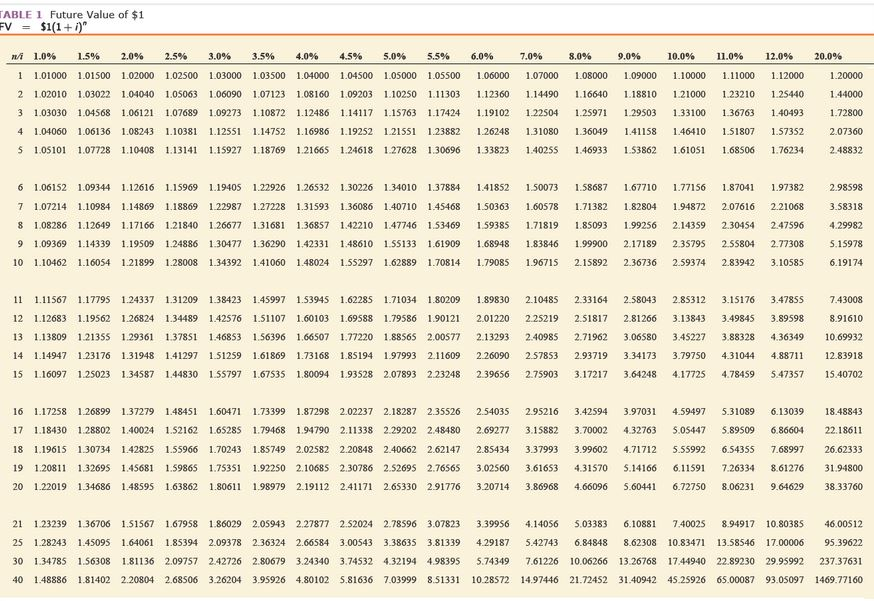

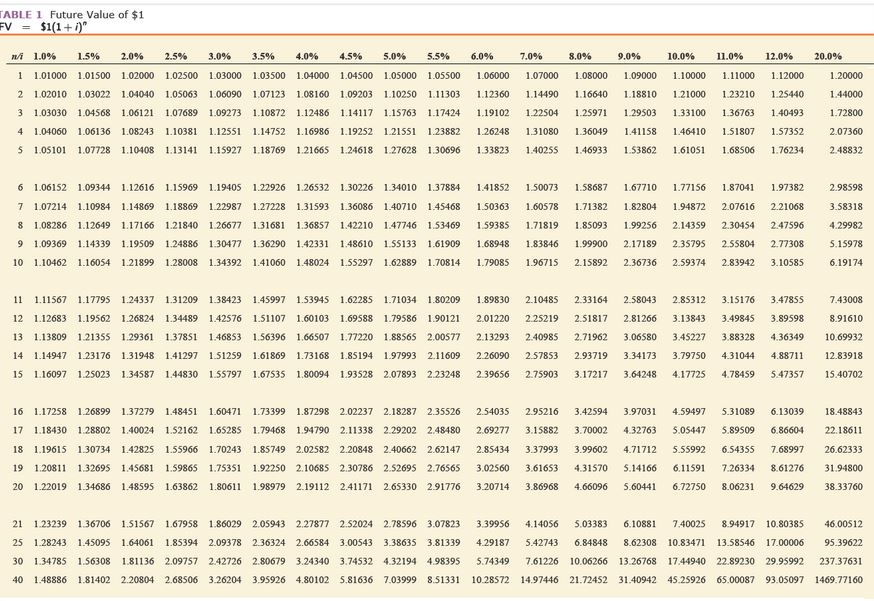

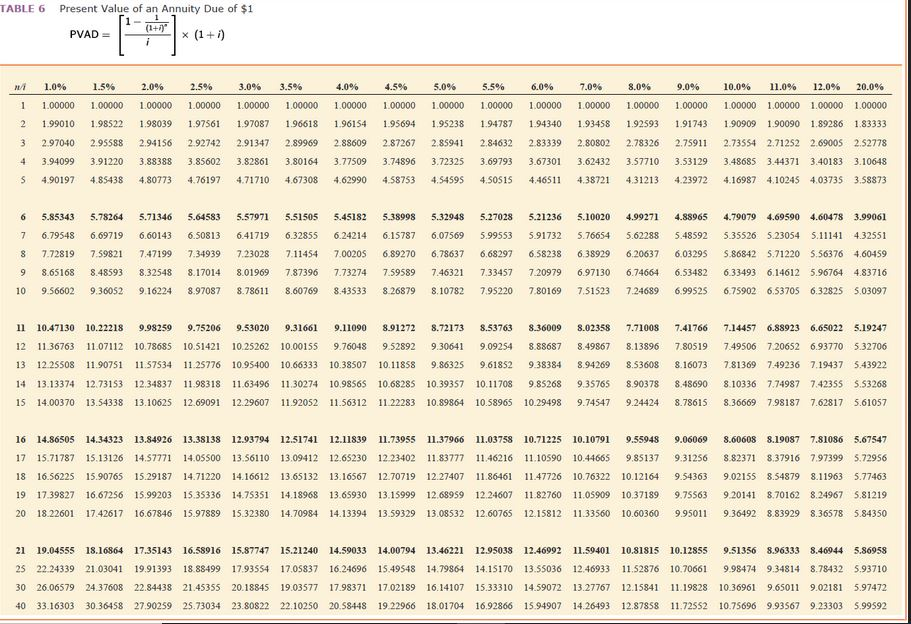

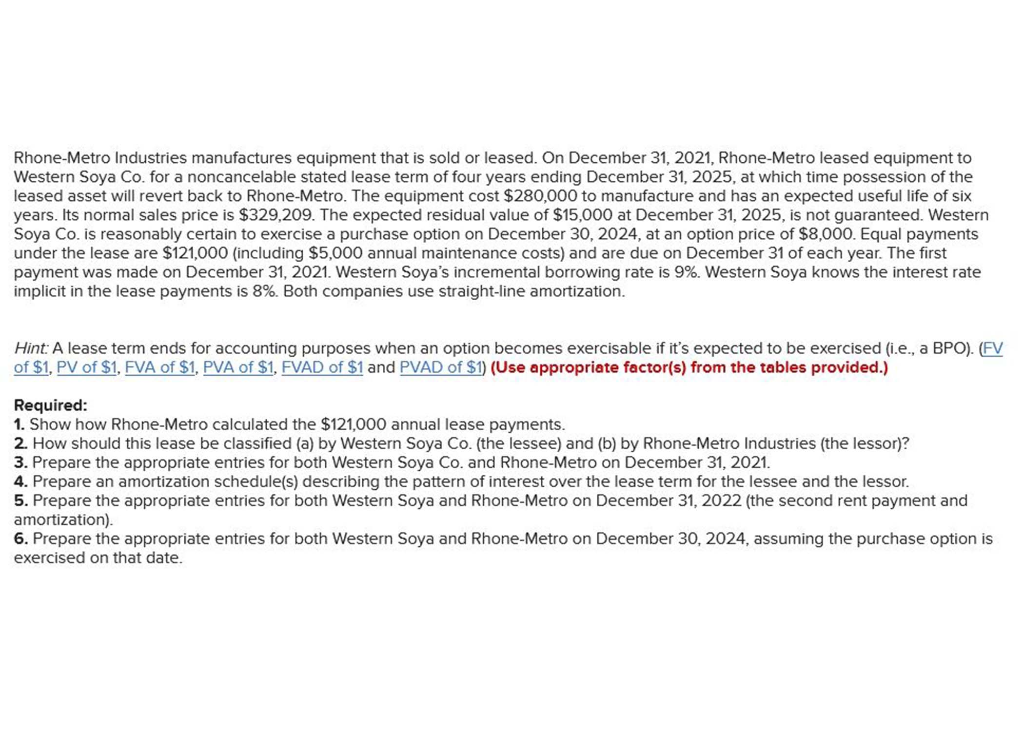

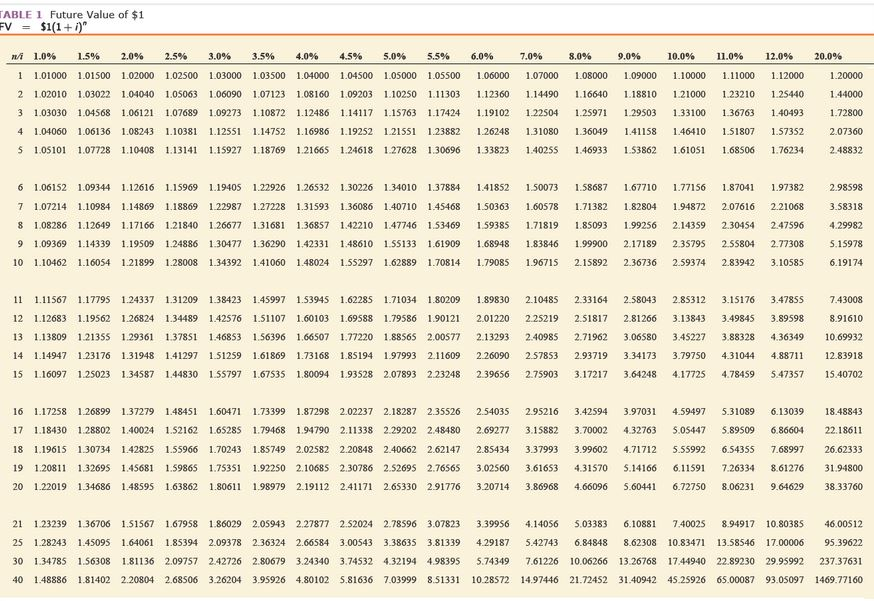

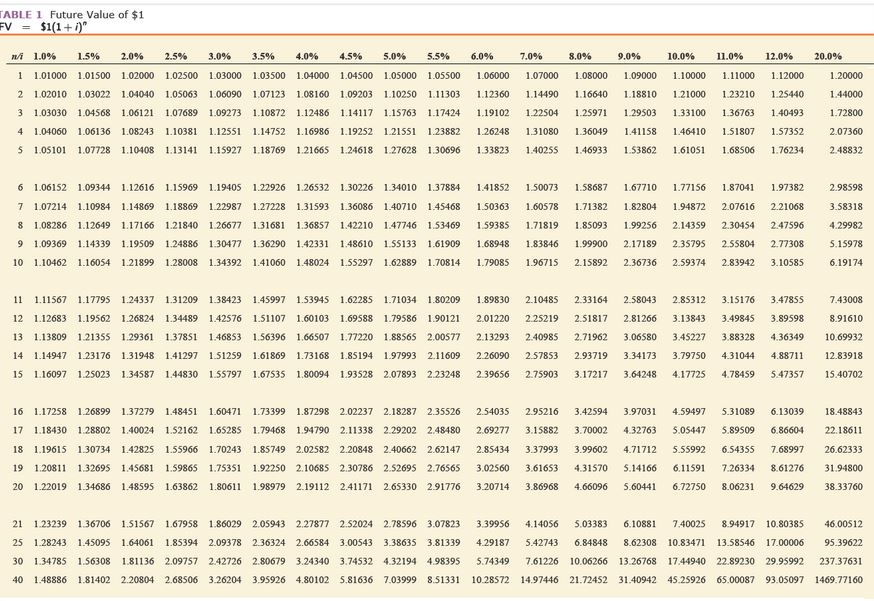

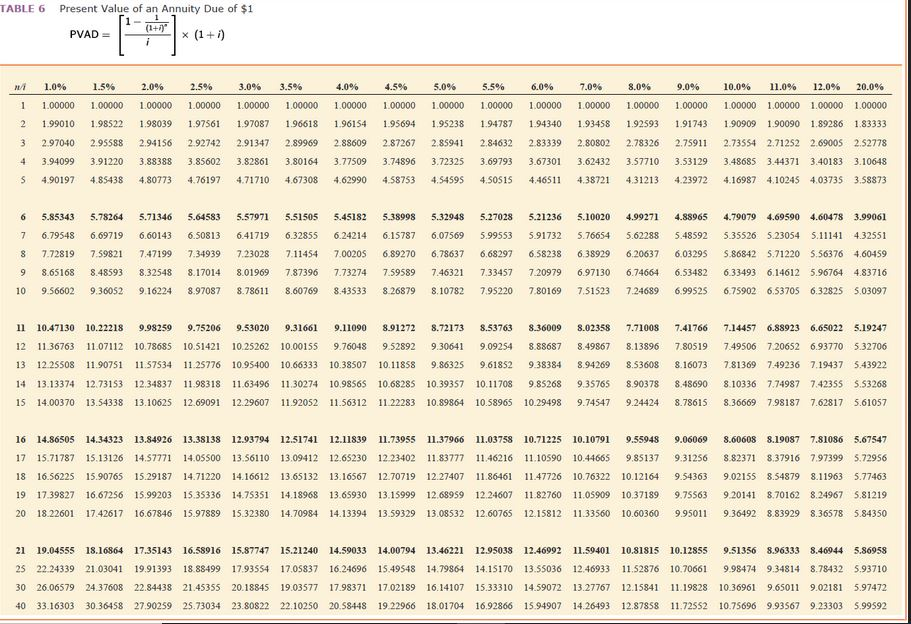

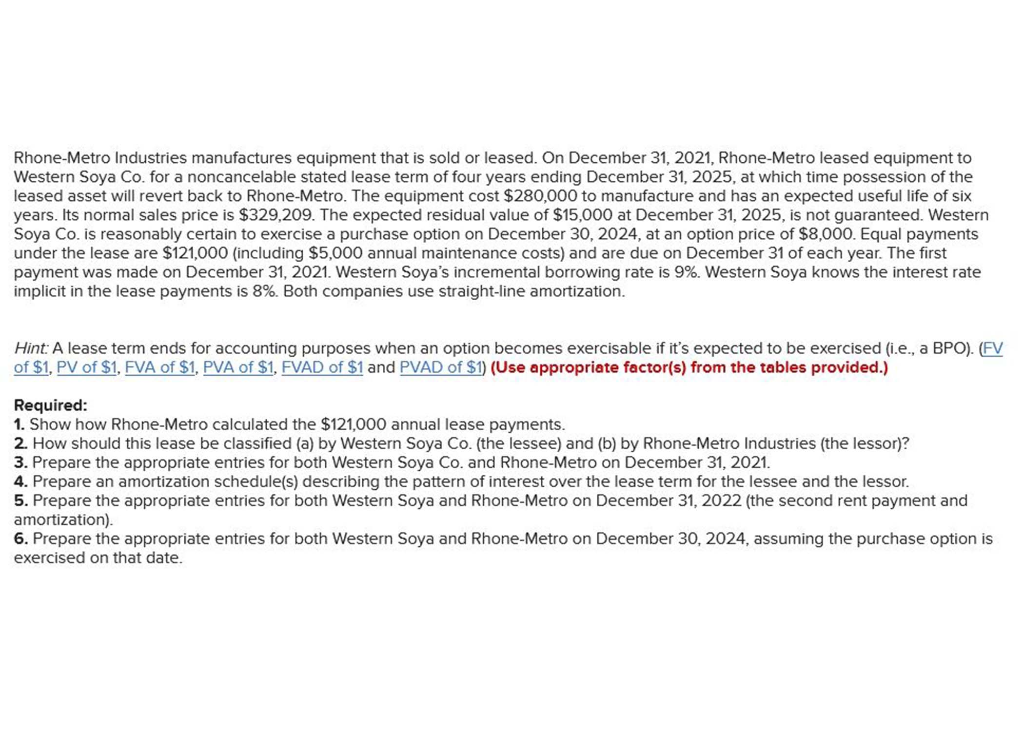

TABLE 1 Future Value of $1 FV = $1(1+1) 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 6.0% 1.06000 7.0% 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.25440 1.20000 1.44000 1.14490 1.16640 1.18810 1.21000 ni 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 1.04000 1.04500 1.05000 1.05500 2 1.02010 1.03022 1.04040 1.05063 1.06090 1.07123 1.08160 1.09203 1.10250 1.11303 3 1.03030 1.04568 1.06121 1.07689 1.09273 1.10872 1.12486 1.14117 1.15763 1.17424 4 1.04060 1.06136 1.08243 1.10381 1.12551 1.14752 1.16986 1.19252 1.21551 1.23882 S 1.05101 1.07728 1.10408 1.13141 1.15927 1.18769 1.21665 1.24618 1.27628 1.30696 1.12360 1.19102 1.23210 1.36763 1.22504 1.25971 1.29503 1.33100 1.40493 1.72800 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 2.07360 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 2.48832 6 1.06152 1.09344 1.12616 1.15969 1.19405 1.22926 1.26532 1.30226 1.34010 1.37884 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 2.98598 1.50363 1.60578 1.71382 1.82804 1.94872 2.21068 3.58318 2.07616 2.30454 1.59385 1.71819 1.85093 1.99256 2.14359 2.47596 4.29982 7 1.07214 1.10984 1.14869 1.18869 1.22987 1.27228 1.31593 1.36086 1.40710 1.45468 8 1.08286 1.12649 1.17166 1.21840 1.26677 1.31681 1.36857 1.42210 1.47746 1.53469 9 1.09369 1.14339 1.19509 1.24886 1.30477 1.36290 1.42331 1.48610 1.55133 1.61909 10 1.10462 1.16054 1.21899 1.28008 1.34392 1.41060 1.48024 1.55297 1.62889 1.70814 1.68948 1.83846 1.99900 2.17189 2.35795 2 55804 2.77308 5.15978 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 6.19174 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 7.43008 2.01220 2.25219 2.51817 2.81266 3.13843 3.49845 3.89598 8.91610 11 1.11567 1.17795 1.24337 1.31209 1.38423 1.45997 1.53945 1.62285 1.71034 1.80209 12 1.12683 1.19562 1.26824 1.34489 1.42576 1.51107 1.60103 1.69588 1.79586 1.90121 13 1.13809 1.21355 1.29361 1.37851 1.46853 1.56396 1.66507 1.77220 1.88565 2.00577 14 1.14947 1.23176 1.31948 1.41297 1.51259 1.61869 1.73168 1.85194 1.979932.11609 15 1.16097 1.25023 1.34587 1.44830 1.55797 1.67535 1.80094 1.93528 2.07893 2.23248 2.13293 2.40985 2.71962 3.06580 3.45227 3.88328 4.36349 10.69932 2.26090 2.57853 2.93719 3.79750 4.31044 4.88711 12.83918 3.34173 3.64248 2.39656 2.75903 3.17217 4.17725 4.78459 5.47357 15.40702 2.54035 3.42594 3.97031 4.59497 5.31089 18.48843 16 1.17258 1.26899 1.37279 1.48451 1.60471 1.73399 17 1.18430 1.28802 1.40024 1.52162 1.65285 1.79468 1.87298 2.02237 2.18287 2.35526 1.94790 2.11338 2.29202 2.48480 2.95216 3.15882 6.13039 6.86604 2.69277 4.32763 5.05447 5.89509 22.18611 3.70002 3.99602 18 1.19615 1.85749 2.02582 2.20848 2.40662 2.62147 2.85434 3.37993 4.71712 5.55992 6.54355 7.68997 26.62333 1.30734 1.42825 1.55966 1.70243 1.32695 1.45681 1.59865 1.75351 19 1.20811 1.92250 2.10685 2.30786 2.52695 2.76565 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 31.94800 20 1.22019 1.34686 1.48595 1.63862 1.80611 1.98979 2.19112 2.41171 2.65330 2.91776 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 38.33760 21 1.23239 1.36706 1.51567 1.67958 1.86029 2.05943 2.27877 2.52024 2.78596 3.07823 3.39956 4.14056 5.03383 6.10881 7.40025 8.94917 10.80385 46.00512 95.39622 25 1.28243 1.45095 1.64061 1.85394 2.09378 2.36324 2.66584 3.00543 3.38635 3.81339 30 1.34785 1.56308 1.81136 2.09757 2.42726 2.806793.24340 3.74532 4.32194 4.98395 40 1.48886 1.81402 2.20804 2.68506 3.26204 3.95926 4.80102 5.81636 7.03999 8.51331 4.29187 5.74349 5.42743 6.84848 8.62308 10.83471 13.58546 17.00006 7.61226 10.06266 13.26768 17.44940 22.89230 29.95992 237.37631 10.28572 14.97446 21.72452 31.40942 45.25926 65.00087 93.05097 1469.77160 TABLE 1 Future Value of $1 FV = $1(1+1) 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 6.0% 1.06000 7.0% 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.25440 1.20000 1.44000 1.14490 1.16640 1.18810 1.21000 ni 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 1.04000 1.04500 1.05000 1.05500 2 1.02010 1.03022 1.04040 1.05063 1.06090 1.07123 1.08160 1.09203 1.10250 1.11303 3 1.03030 1.04568 1.06121 1.07689 1.09273 1.10872 1.12486 1.14117 1.15763 1.17424 4 1.04060 1.06136 1.08243 1.10381 1.12551 1.14752 1.16986 1.19252 1.21551 1.23882 S 1.05101 1.07728 1.10408 1.13141 1.15927 1.18769 1.21665 1.24618 1.27628 1.30696 1.12360 1.19102 1.23210 1.36763 1.22504 1.25971 1.29503 1.33100 1.40493 1.72800 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 2.07360 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 2.48832 6 1.06152 1.09344 1.12616 1.15969 1.19405 1.22926 1.26532 1.30226 1.34010 1.37884 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 2.98598 1.50363 1.60578 1.71382 1.82804 1.94872 2.21068 3.58318 2.07616 2.30454 1.59385 1.71819 1.85093 1.99256 2.14359 2.47596 4.29982 7 1.07214 1.10984 1.14869 1.18869 1.22987 1.27228 1.31593 1.36086 1.40710 1.45468 8 1.08286 1.12649 1.17166 1.21840 1.26677 1.31681 1.36857 1.42210 1.47746 1.53469 9 1.09369 1.14339 1.19509 1.24886 1.30477 1.36290 1.42331 1.48610 1.55133 1.61909 10 1.10462 1.16054 1.21899 1.28008 1.34392 1.41060 1.48024 1.55297 1.62889 1.70814 1.68948 1.83846 1.99900 2.17189 2.35795 2 55804 2.77308 5.15978 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 6.19174 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 7.43008 2.01220 2.25219 2.51817 2.81266 3.13843 3.49845 3.89598 8.91610 11 1.11567 1.17795 1.24337 1.31209 1.38423 1.45997 1.53945 1.62285 1.71034 1.80209 12 1.12683 1.19562 1.26824 1.34489 1.42576 1.51107 1.60103 1.69588 1.79586 1.90121 13 1.13809 1.21355 1.29361 1.37851 1.46853 1.56396 1.66507 1.77220 1.88565 2.00577 14 1.14947 1.23176 1.31948 1.41297 1.51259 1.61869 1.73168 1.85194 1.979932.11609 15 1.16097 1.25023 1.34587 1.44830 1.55797 1.67535 1.80094 1.93528 2.07893 2.23248 2.13293 2.40985 2.71962 3.06580 3.45227 3.88328 4.36349 10.69932 2.26090 2.57853 2.93719 3.79750 4.31044 4.88711 12.83918 3.34173 3.64248 2.39656 2.75903 3.17217 4.17725 4.78459 5.47357 15.40702 2.54035 3.42594 3.97031 4.59497 5.31089 18.48843 16 1.17258 1.26899 1.37279 1.48451 1.60471 1.73399 17 1.18430 1.28802 1.40024 1.52162 1.65285 1.79468 1.87298 2.02237 2.18287 2.35526 1.94790 2.11338 2.29202 2.48480 2.95216 3.15882 6.13039 6.86604 2.69277 4.32763 5.05447 5.89509 22.18611 3.70002 3.99602 18 1.19615 1.85749 2.02582 2.20848 2.40662 2.62147 2.85434 3.37993 4.71712 5.55992 6.54355 7.68997 26.62333 1.30734 1.42825 1.55966 1.70243 1.32695 1.45681 1.59865 1.75351 19 1.20811 1.92250 2.10685 2.30786 2.52695 2.76565 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 31.94800 20 1.22019 1.34686 1.48595 1.63862 1.80611 1.98979 2.19112 2.41171 2.65330 2.91776 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 38.33760 21 1.23239 1.36706 1.51567 1.67958 1.86029 2.05943 2.27877 2.52024 2.78596 3.07823 3.39956 4.14056 5.03383 6.10881 7.40025 8.94917 10.80385 46.00512 95.39622 25 1.28243 1.45095 1.64061 1.85394 2.09378 2.36324 2.66584 3.00543 3.38635 3.81339 30 1.34785 1.56308 1.81136 2.09757 2.42726 2.806793.24340 3.74532 4.32194 4.98395 40 1.48886 1.81402 2.20804 2.68506 3.26204 3.95926 4.80102 5.81636 7.03999 8.51331 4.29187 5.74349 5.42743 6.84848 8.62308 10.83471 13.58546 17.00006 7.61226 10.06266 13.26768 17.44940 22.89230 29.95992 237.37631 10.28572 14.97446 21.72452 31.40942 45.25926 65.00087 93.05097 1469.77160 TABLE 6 Present Value of an Annuity Due of $1 (1+) PVAD = X (1+i) 1 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 7.0% 8.0% 9.0% 5.5% 1.00000 6.0% 1.00000 10.0% 11.0% 12.0% 20.0% 1.00000 100000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.99010 1.00000 1.98522 1.00000 1.98039 1.00000 1.97561 1.00000 1.97087 1.00000 1.96618 1.00000 1.96154 1.00000 1.95694 1.00000 1.95238 2 1.94787 1.94340 1.93458 1.92593 1.91743 1.90909 1.90090 1.89286 1.83333 3 2.970-40 2.95588 2.94156 2.92742 2.91347 2.89969 2.88609 2.87267 2.85941 2.84632 2.83339 2.80802 2.78326 2.75911 2.73554 2.71252 2.69005 2.52778 3.48685 3.44371 3.40183 3.10648 4 3.94099 3.91220 3.88388 3.85602 3.82861 3.80164 3.77509 3.74896 3.72325 3.67301 3.62432 3.57710 3.53129 3.69793 4.S0S15 S 4.90197 4.85438 4.80773 4.76197 4.71710 4.67308 4.62990 4.58753 4.54595 4.46511 4.38721 4.31213 4.23972 4.169874.10245 4.03735 3.58873 6 5.78264 5.71346 5.64583 5.57971 5.51505 5.45182 5.32948 5.27028 5.10020 4.88965 5.85343 6.79548 5.38998 6.15787 5.21236 5.91732 4.99271 5.62288 7 6.69719 6.60143 6.50813 6.41719 6.32855 6.07569 5.99553 5.76654 5.48592 6.24214 7.00205 4.79079 4.69590 4.60478 3.99061 5.35526 5.23054 5.111414.32551 5.86842 5.71220 5.56376 4.60459 6.33493 6.14612 5.96764 4.83716 8 7.72819 7.59821 7.47199 7.34939 7.23028 7.11454 6.78637 6.68297 6,38929 6,20637 6,03295 6.89270 7.59589 6.58238 7.20979 9 8.65168 8.48593 8.32548 8.17014 7.46321 7.33457 6.97130 6.53482 8.01969 8.78611 7.87396 8.60769 7.73274 8.43533 6.74664 7.24689 10 9.56602 9.36052 9.16224 8.97087 8.26879 8.10782 7.95220 7.80169 7.51523 6.99525 6.75902 6.53705 6.328255.03097 11 10.47130 10.22218 7.71008 8.02358 8.49867 7.41766 7.80519 7.14457 6.88923 6.650225.19247 7.49506 7.20652 6.93770 532706 12 11.36763 11.07112 8.13896 13 12 25508 11.90751 9.98259 9.75206 9.53020 9.31661 9.11090 8.91272 8.72173 8.53763 8.36009 10.78685 10.51421 10.25262 10.00155 9.76048 9.52892 9.30641 9.09254 8.88687 11.57534 11.25776 10.95400 10.66333 10.38507 10.11858 9.86325 9.61852 9.38384 12.34837 11.98318 11.63496 11.30274 10.9856S 10.68285 10.39357 10.11708 9.85268 13.10625 12.69091 12.29607 11.92052 11.56312 11.22283 10.89864 10.58965 10.29498 8.94269 8.53608 8.16073 7.813697.49236 7.19437 5.43922 8.48690 13.13374 14.00370 12.73153 13.54338 9.35765 9.74547 8.90378 9.24424 8.10336 7.74987 7.42355 5.53268 8.36669 7.98187 7.62817 5.61057 15 8.78615 16 14.86505 14.34323 13.84926 13.38138 12.93794 12.51741 12.11839 11.73955 11.37966 11.03758 10.71225 10.10791 9.55948 9.06069 8.60608 8.19087 7.81086 5.67547 17 15.71787 9.31256 15.13126 14.57771 14.05500 13.56110 15.90765 15.29187 14.71220 14.16612 13.09412 12.65230 12 23402 13.65132 13.16567 12.70719 11.83777 11.46216 11.10590 10.44665 9.85137 12.27407 11.86461 11.47726 10.76322 10.12164 8.82371 8.37916 7.97399 5.72956 9.02155 8.54879 8.11963 5.77463 9.54363 18 16.56225 19 17.39827 9.75563 9.20141 8.70162 8.24967 5.81219 16.67256 15.99203 15.35336 14.75351 17.42617 16.67846 15.97889 15.32380 14.18968 13.65930 13.15999 14.70984 14.13394 13.59329 12.68959 12.24607 11.82760 11.05909 10.37189 13.08532 12.60765 12.15812 11.33560 10.60360 20 18.22601 9.95011 9.36492 8.83929 8.36578 5.84350 9.51356 8.96333 8.46944 5.86958 21 19.04555 18.16864 17.35143 16.58916 15.87747 15.21240 14.59033 14.00794 13.46221 12.95038 12.46992 11.59401 10.81815 10.12855 25 22 24339 21.03041 19.91393 18.88499 17.93554 17.05837 16.24696 15.49548 14.79864 14.15170 13.55036 12.46933 11.52876 10.70661 30 26.06579 24.37608 22.84438 21.45355 20.18845 19.03577 17.98371 17.02189 16.14107 15.33310 14.59072 13.27767 12.15841 11.19828 40 33.16303 30.36458 27.90259 25.73034 23.80822 22.10250 20.58448 19.22966 18.01704 16.92866 15.94907 14.26493 12.87858 11.72552 9.98474 9.34814 8.78432 5.93710 10.36961 9.65011 9.02181 5.97472 10.75696 9.93567 9.23303 5.99592 Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2021, Rhone-Metro leased equipment to Western Soya Co. for a noncancelable stated lease term of four years ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $280,000 to manufacture and has an expected useful life of six years. Its normal sales price is $329,209. The expected residual value of $15,000 at December 31, 2025, is not guaranteed. Western Soya Co. is reasonably certain to exercise a purchase option on December 30, 2024, at an option price of $8,000. Equal payments under the lease are $121,000 (including $5,000 annual maintenance costs) and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 9%. Western Soya knows the interest rate implicit in the lease payments is 8%. Both companies use straight-line amortization. Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (.e., a BPO). (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $121,000 annual lease payments. 2. How should this lease be classified (a) by Western Soya Co.(the lessee) and (b) by Rhone-Metro Industries (the lessor)? Prepare appropriate entries oth Western Soya Co. Rhor December 31, 2021. 4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor. 5. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second rent payment and amortization). 6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 30, 2024, assuming the purchase option is exercised on that date. TABLE 1 Future Value of $1 FV = $1(1+1) 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 6.0% 1.06000 7.0% 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.25440 1.20000 1.44000 1.14490 1.16640 1.18810 1.21000 ni 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 1.04000 1.04500 1.05000 1.05500 2 1.02010 1.03022 1.04040 1.05063 1.06090 1.07123 1.08160 1.09203 1.10250 1.11303 3 1.03030 1.04568 1.06121 1.07689 1.09273 1.10872 1.12486 1.14117 1.15763 1.17424 4 1.04060 1.06136 1.08243 1.10381 1.12551 1.14752 1.16986 1.19252 1.21551 1.23882 S 1.05101 1.07728 1.10408 1.13141 1.15927 1.18769 1.21665 1.24618 1.27628 1.30696 1.12360 1.19102 1.23210 1.36763 1.22504 1.25971 1.29503 1.33100 1.40493 1.72800 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 2.07360 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 2.48832 6 1.06152 1.09344 1.12616 1.15969 1.19405 1.22926 1.26532 1.30226 1.34010 1.37884 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 2.98598 1.50363 1.60578 1.71382 1.82804 1.94872 2.21068 3.58318 2.07616 2.30454 1.59385 1.71819 1.85093 1.99256 2.14359 2.47596 4.29982 7 1.07214 1.10984 1.14869 1.18869 1.22987 1.27228 1.31593 1.36086 1.40710 1.45468 8 1.08286 1.12649 1.17166 1.21840 1.26677 1.31681 1.36857 1.42210 1.47746 1.53469 9 1.09369 1.14339 1.19509 1.24886 1.30477 1.36290 1.42331 1.48610 1.55133 1.61909 10 1.10462 1.16054 1.21899 1.28008 1.34392 1.41060 1.48024 1.55297 1.62889 1.70814 1.68948 1.83846 1.99900 2.17189 2.35795 2 55804 2.77308 5.15978 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 6.19174 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 7.43008 2.01220 2.25219 2.51817 2.81266 3.13843 3.49845 3.89598 8.91610 11 1.11567 1.17795 1.24337 1.31209 1.38423 1.45997 1.53945 1.62285 1.71034 1.80209 12 1.12683 1.19562 1.26824 1.34489 1.42576 1.51107 1.60103 1.69588 1.79586 1.90121 13 1.13809 1.21355 1.29361 1.37851 1.46853 1.56396 1.66507 1.77220 1.88565 2.00577 14 1.14947 1.23176 1.31948 1.41297 1.51259 1.61869 1.73168 1.85194 1.979932.11609 15 1.16097 1.25023 1.34587 1.44830 1.55797 1.67535 1.80094 1.93528 2.07893 2.23248 2.13293 2.40985 2.71962 3.06580 3.45227 3.88328 4.36349 10.69932 2.26090 2.57853 2.93719 3.79750 4.31044 4.88711 12.83918 3.34173 3.64248 2.39656 2.75903 3.17217 4.17725 4.78459 5.47357 15.40702 2.54035 3.42594 3.97031 4.59497 5.31089 18.48843 16 1.17258 1.26899 1.37279 1.48451 1.60471 1.73399 17 1.18430 1.28802 1.40024 1.52162 1.65285 1.79468 1.87298 2.02237 2.18287 2.35526 1.94790 2.11338 2.29202 2.48480 2.95216 3.15882 6.13039 6.86604 2.69277 4.32763 5.05447 5.89509 22.18611 3.70002 3.99602 18 1.19615 1.85749 2.02582 2.20848 2.40662 2.62147 2.85434 3.37993 4.71712 5.55992 6.54355 7.68997 26.62333 1.30734 1.42825 1.55966 1.70243 1.32695 1.45681 1.59865 1.75351 19 1.20811 1.92250 2.10685 2.30786 2.52695 2.76565 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 31.94800 20 1.22019 1.34686 1.48595 1.63862 1.80611 1.98979 2.19112 2.41171 2.65330 2.91776 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 38.33760 21 1.23239 1.36706 1.51567 1.67958 1.86029 2.05943 2.27877 2.52024 2.78596 3.07823 3.39956 4.14056 5.03383 6.10881 7.40025 8.94917 10.80385 46.00512 95.39622 25 1.28243 1.45095 1.64061 1.85394 2.09378 2.36324 2.66584 3.00543 3.38635 3.81339 30 1.34785 1.56308 1.81136 2.09757 2.42726 2.806793.24340 3.74532 4.32194 4.98395 40 1.48886 1.81402 2.20804 2.68506 3.26204 3.95926 4.80102 5.81636 7.03999 8.51331 4.29187 5.74349 5.42743 6.84848 8.62308 10.83471 13.58546 17.00006 7.61226 10.06266 13.26768 17.44940 22.89230 29.95992 237.37631 10.28572 14.97446 21.72452 31.40942 45.25926 65.00087 93.05097 1469.77160 TABLE 1 Future Value of $1 FV = $1(1+1) 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 6.0% 1.06000 7.0% 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.25440 1.20000 1.44000 1.14490 1.16640 1.18810 1.21000 ni 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 1.04000 1.04500 1.05000 1.05500 2 1.02010 1.03022 1.04040 1.05063 1.06090 1.07123 1.08160 1.09203 1.10250 1.11303 3 1.03030 1.04568 1.06121 1.07689 1.09273 1.10872 1.12486 1.14117 1.15763 1.17424 4 1.04060 1.06136 1.08243 1.10381 1.12551 1.14752 1.16986 1.19252 1.21551 1.23882 S 1.05101 1.07728 1.10408 1.13141 1.15927 1.18769 1.21665 1.24618 1.27628 1.30696 1.12360 1.19102 1.23210 1.36763 1.22504 1.25971 1.29503 1.33100 1.40493 1.72800 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 2.07360 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 2.48832 6 1.06152 1.09344 1.12616 1.15969 1.19405 1.22926 1.26532 1.30226 1.34010 1.37884 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 2.98598 1.50363 1.60578 1.71382 1.82804 1.94872 2.21068 3.58318 2.07616 2.30454 1.59385 1.71819 1.85093 1.99256 2.14359 2.47596 4.29982 7 1.07214 1.10984 1.14869 1.18869 1.22987 1.27228 1.31593 1.36086 1.40710 1.45468 8 1.08286 1.12649 1.17166 1.21840 1.26677 1.31681 1.36857 1.42210 1.47746 1.53469 9 1.09369 1.14339 1.19509 1.24886 1.30477 1.36290 1.42331 1.48610 1.55133 1.61909 10 1.10462 1.16054 1.21899 1.28008 1.34392 1.41060 1.48024 1.55297 1.62889 1.70814 1.68948 1.83846 1.99900 2.17189 2.35795 2 55804 2.77308 5.15978 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 6.19174 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 7.43008 2.01220 2.25219 2.51817 2.81266 3.13843 3.49845 3.89598 8.91610 11 1.11567 1.17795 1.24337 1.31209 1.38423 1.45997 1.53945 1.62285 1.71034 1.80209 12 1.12683 1.19562 1.26824 1.34489 1.42576 1.51107 1.60103 1.69588 1.79586 1.90121 13 1.13809 1.21355 1.29361 1.37851 1.46853 1.56396 1.66507 1.77220 1.88565 2.00577 14 1.14947 1.23176 1.31948 1.41297 1.51259 1.61869 1.73168 1.85194 1.979932.11609 15 1.16097 1.25023 1.34587 1.44830 1.55797 1.67535 1.80094 1.93528 2.07893 2.23248 2.13293 2.40985 2.71962 3.06580 3.45227 3.88328 4.36349 10.69932 2.26090 2.57853 2.93719 3.79750 4.31044 4.88711 12.83918 3.34173 3.64248 2.39656 2.75903 3.17217 4.17725 4.78459 5.47357 15.40702 2.54035 3.42594 3.97031 4.59497 5.31089 18.48843 16 1.17258 1.26899 1.37279 1.48451 1.60471 1.73399 17 1.18430 1.28802 1.40024 1.52162 1.65285 1.79468 1.87298 2.02237 2.18287 2.35526 1.94790 2.11338 2.29202 2.48480 2.95216 3.15882 6.13039 6.86604 2.69277 4.32763 5.05447 5.89509 22.18611 3.70002 3.99602 18 1.19615 1.85749 2.02582 2.20848 2.40662 2.62147 2.85434 3.37993 4.71712 5.55992 6.54355 7.68997 26.62333 1.30734 1.42825 1.55966 1.70243 1.32695 1.45681 1.59865 1.75351 19 1.20811 1.92250 2.10685 2.30786 2.52695 2.76565 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 31.94800 20 1.22019 1.34686 1.48595 1.63862 1.80611 1.98979 2.19112 2.41171 2.65330 2.91776 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 38.33760 21 1.23239 1.36706 1.51567 1.67958 1.86029 2.05943 2.27877 2.52024 2.78596 3.07823 3.39956 4.14056 5.03383 6.10881 7.40025 8.94917 10.80385 46.00512 95.39622 25 1.28243 1.45095 1.64061 1.85394 2.09378 2.36324 2.66584 3.00543 3.38635 3.81339 30 1.34785 1.56308 1.81136 2.09757 2.42726 2.806793.24340 3.74532 4.32194 4.98395 40 1.48886 1.81402 2.20804 2.68506 3.26204 3.95926 4.80102 5.81636 7.03999 8.51331 4.29187 5.74349 5.42743 6.84848 8.62308 10.83471 13.58546 17.00006 7.61226 10.06266 13.26768 17.44940 22.89230 29.95992 237.37631 10.28572 14.97446 21.72452 31.40942 45.25926 65.00087 93.05097 1469.77160 TABLE 6 Present Value of an Annuity Due of $1 (1+) PVAD = X (1+i) 1 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 7.0% 8.0% 9.0% 5.5% 1.00000 6.0% 1.00000 10.0% 11.0% 12.0% 20.0% 1.00000 100000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.99010 1.00000 1.98522 1.00000 1.98039 1.00000 1.97561 1.00000 1.97087 1.00000 1.96618 1.00000 1.96154 1.00000 1.95694 1.00000 1.95238 2 1.94787 1.94340 1.93458 1.92593 1.91743 1.90909 1.90090 1.89286 1.83333 3 2.970-40 2.95588 2.94156 2.92742 2.91347 2.89969 2.88609 2.87267 2.85941 2.84632 2.83339 2.80802 2.78326 2.75911 2.73554 2.71252 2.69005 2.52778 3.48685 3.44371 3.40183 3.10648 4 3.94099 3.91220 3.88388 3.85602 3.82861 3.80164 3.77509 3.74896 3.72325 3.67301 3.62432 3.57710 3.53129 3.69793 4.S0S15 S 4.90197 4.85438 4.80773 4.76197 4.71710 4.67308 4.62990 4.58753 4.54595 4.46511 4.38721 4.31213 4.23972 4.169874.10245 4.03735 3.58873 6 5.78264 5.71346 5.64583 5.57971 5.51505 5.45182 5.32948 5.27028 5.10020 4.88965 5.85343 6.79548 5.38998 6.15787 5.21236 5.91732 4.99271 5.62288 7 6.69719 6.60143 6.50813 6.41719 6.32855 6.07569 5.99553 5.76654 5.48592 6.24214 7.00205 4.79079 4.69590 4.60478 3.99061 5.35526 5.23054 5.111414.32551 5.86842 5.71220 5.56376 4.60459 6.33493 6.14612 5.96764 4.83716 8 7.72819 7.59821 7.47199 7.34939 7.23028 7.11454 6.78637 6.68297 6,38929 6,20637 6,03295 6.89270 7.59589 6.58238 7.20979 9 8.65168 8.48593 8.32548 8.17014 7.46321 7.33457 6.97130 6.53482 8.01969 8.78611 7.87396 8.60769 7.73274 8.43533 6.74664 7.24689 10 9.56602 9.36052 9.16224 8.97087 8.26879 8.10782 7.95220 7.80169 7.51523 6.99525 6.75902 6.53705 6.328255.03097 11 10.47130 10.22218 7.71008 8.02358 8.49867 7.41766 7.80519 7.14457 6.88923 6.650225.19247 7.49506 7.20652 6.93770 532706 12 11.36763 11.07112 8.13896 13 12 25508 11.90751 9.98259 9.75206 9.53020 9.31661 9.11090 8.91272 8.72173 8.53763 8.36009 10.78685 10.51421 10.25262 10.00155 9.76048 9.52892 9.30641 9.09254 8.88687 11.57534 11.25776 10.95400 10.66333 10.38507 10.11858 9.86325 9.61852 9.38384 12.34837 11.98318 11.63496 11.30274 10.9856S 10.68285 10.39357 10.11708 9.85268 13.10625 12.69091 12.29607 11.92052 11.56312 11.22283 10.89864 10.58965 10.29498 8.94269 8.53608 8.16073 7.813697.49236 7.19437 5.43922 8.48690 13.13374 14.00370 12.73153 13.54338 9.35765 9.74547 8.90378 9.24424 8.10336 7.74987 7.42355 5.53268 8.36669 7.98187 7.62817 5.61057 15 8.78615 16 14.86505 14.34323 13.84926 13.38138 12.93794 12.51741 12.11839 11.73955 11.37966 11.03758 10.71225 10.10791 9.55948 9.06069 8.60608 8.19087 7.81086 5.67547 17 15.71787 9.31256 15.13126 14.57771 14.05500 13.56110 15.90765 15.29187 14.71220 14.16612 13.09412 12.65230 12 23402 13.65132 13.16567 12.70719 11.83777 11.46216 11.10590 10.44665 9.85137 12.27407 11.86461 11.47726 10.76322 10.12164 8.82371 8.37916 7.97399 5.72956 9.02155 8.54879 8.11963 5.77463 9.54363 18 16.56225 19 17.39827 9.75563 9.20141 8.70162 8.24967 5.81219 16.67256 15.99203 15.35336 14.75351 17.42617 16.67846 15.97889 15.32380 14.18968 13.65930 13.15999 14.70984 14.13394 13.59329 12.68959 12.24607 11.82760 11.05909 10.37189 13.08532 12.60765 12.15812 11.33560 10.60360 20 18.22601 9.95011 9.36492 8.83929 8.36578 5.84350 9.51356 8.96333 8.46944 5.86958 21 19.04555 18.16864 17.35143 16.58916 15.87747 15.21240 14.59033 14.00794 13.46221 12.95038 12.46992 11.59401 10.81815 10.12855 25 22 24339 21.03041 19.91393 18.88499 17.93554 17.05837 16.24696 15.49548 14.79864 14.15170 13.55036 12.46933 11.52876 10.70661 30 26.06579 24.37608 22.84438 21.45355 20.18845 19.03577 17.98371 17.02189 16.14107 15.33310 14.59072 13.27767 12.15841 11.19828 40 33.16303 30.36458 27.90259 25.73034 23.80822 22.10250 20.58448 19.22966 18.01704 16.92866 15.94907 14.26493 12.87858 11.72552 9.98474 9.34814 8.78432 5.93710 10.36961 9.65011 9.02181 5.97472 10.75696 9.93567 9.23303 5.99592 Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2021, Rhone-Metro leased equipment to Western Soya Co. for a noncancelable stated lease term of four years ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $280,000 to manufacture and has an expected useful life of six years. Its normal sales price is $329,209. The expected residual value of $15,000 at December 31, 2025, is not guaranteed. Western Soya Co. is reasonably certain to exercise a purchase option on December 30, 2024, at an option price of $8,000. Equal payments under the lease are $121,000 (including $5,000 annual maintenance costs) and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 9%. Western Soya knows the interest rate implicit in the lease payments is 8%. Both companies use straight-line amortization. Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (.e., a BPO). (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $121,000 annual lease payments. 2. How should this lease be classified (a) by Western Soya Co.(the lessee) and (b) by Rhone-Metro Industries (the lessor)? Prepare appropriate entries oth Western Soya Co. Rhor December 31, 2021. 4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor. 5. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second rent payment and amortization). 6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 30, 2024, assuming the purchase option is exercised on that date

I have no idea how to attach the tables

I have no idea how to attach the tables