I have no Idea how to solve this, would appreciate any help, thanks!

Edit: here is the extra information

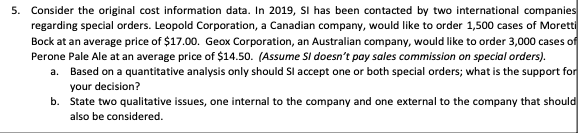

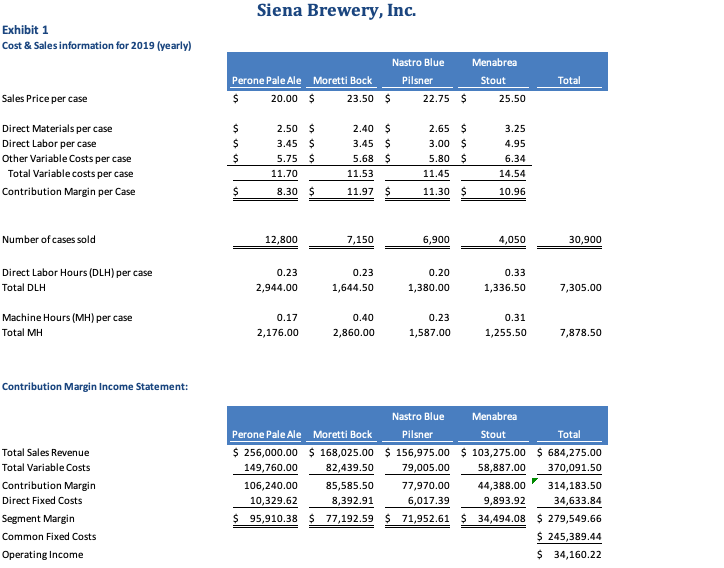

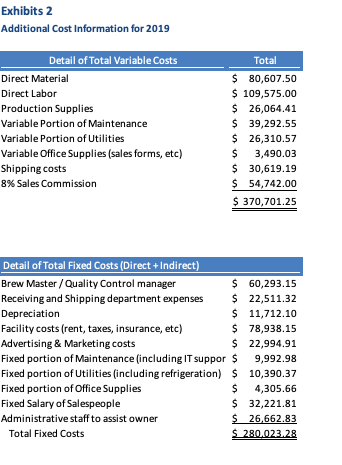

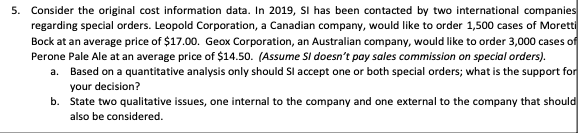

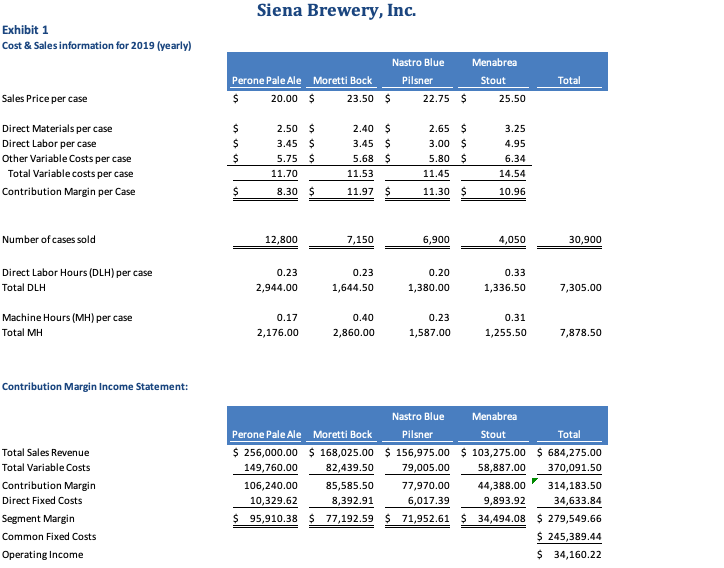

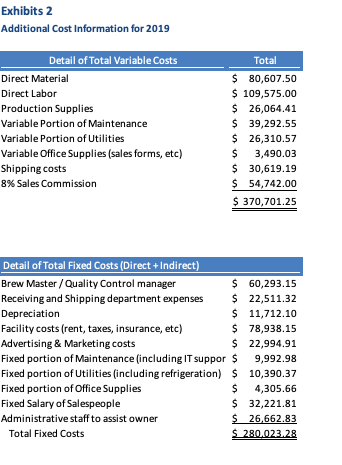

5. Consider the original cost information data. In 2019, Si has been contacted by two international companies regarding special orders. Leopold Corporation, a Canadian company, would like to order 1,500 cases of Moretti Bock at an average price of $17.00. Geox Corporation, an Australian company, would like to order 3,000 cases of Perone Pale Ale at an average price of $14.50. Assume Si doesn't pay sales commission on special orders). a. Based on a quantitative analysis only should I accept one or both special orders; what is the support for your decision? b. State two qualitative issues, one internal to the company and one external to the company that should also be considered. Siena Brewery, Inc. Exhibit 1 Cost & Sales information for 2019 (yearly) Nastro Blue Perone Pale Ale Moretti Bock Pilsner $ 20.00 $ 23.50 $ 22.75 $ Menabrea Stout Total Sales Price per case 25.50 Direct Materials per case Direct Labor per case Other Variable Costs per case Total Variable costs per case Contribution Margin per Case $ $ $ 2.50 $ 3.45 $ 5.75 $ 11.70 8.30 $ 2.40 $ 3.45 $ 5.68 $ 11.53 11.97 $ 2.65 $ 3.00 $ 5.80 $ 11.45 11.30 $ 3.25 4.95 6.34 14.54 $ 10.96 Number of cases sold 12,800 7,150 6,900 4,050 30,900 Direct Labor Hours (DLH) per case Total DLH 0.23 2,944.00 0.23 1,644.50 0.20 1,380.00 0.33 1,336.50 7,305.00 Machine Hours (MH) per case Total MH 0.17 2,176.00 0.40 2,860.00 0.23 1,587.00 0.31 1,255.50 7,878.50 Contribution Margin Income Statement: Total Sales Revenue Total Variable costs Contribution Margin Direct Fixed Costs Segment Margin Common Fixed Costs Operating Income Nastro Blue Menabrea Perone Pale Ale Moretti Bock Pilsner Stout Total $ 256,000.00 $ 168,025.00 $ 156,975.00 $ 103,275.00 $ 684,275.00 149,760.00 82,439.50 79,005.00 58,887.00 370,091.50 106,240.00 85,585.50 77,970.00 44,388.00 314,183.50 10,329.62 8,392.91 6,017.39 9,893.92 34,633.84 $ 95,910.38 $ 77,192.59 $ 71,952.61 $ 34,494.08 $ 279,549.66 $ 245,389.44 $ 34,160.22 Exhibits 2 Additional Cost Information for 2019 Detail of Total Variable costs Direct Material Direct Labor Production Supplies Variable Portion of Maintenance Variable Portion of Utilities Variable Office Supplies (sales forms, etc) Shipping costs 8% Sales Commission Total $ 80,607.50 $ 109,575.00 $ 26,064.41 $ 39,292.55 $ 26,310.57 $ 3,490.03 $ 30,619.19 $ 54,742.00 $ 370,701.25 Detail of Total Fixed Costs (Direct + Indirect) Brew Master / Quality Control manager $ 60,293.15 Receiving and Shipping department expenses $ 22,511.32 Depreciation $ 11,712.10 Facility costs (rent, taxes, insurance, etc) $ 78,938.15 Advertising & Marketing costs $ 22,994.91 Fixed portion of Maintenance (including IT suppor $ 9,992.98 Fixed portion of Utilities (including refrigeration) $ 10,390.37 Fixed portion of Office Supplies $ 4,305.66 Fixed Salary of Salespeople $ 32,221.81 Administrative staff to assist owner $ 26,662.83 Total Fixed Costs 280.023.28 5. Consider the original cost information data. In 2019, Si has been contacted by two international companies regarding special orders. Leopold Corporation, a Canadian company, would like to order 1,500 cases of Moretti Bock at an average price of $17.00. Geox Corporation, an Australian company, would like to order 3,000 cases of Perone Pale Ale at an average price of $14.50. Assume Si doesn't pay sales commission on special orders). a. Based on a quantitative analysis only should I accept one or both special orders; what is the support for your decision? b. State two qualitative issues, one internal to the company and one external to the company that should also be considered. Siena Brewery, Inc. Exhibit 1 Cost & Sales information for 2019 (yearly) Nastro Blue Perone Pale Ale Moretti Bock Pilsner $ 20.00 $ 23.50 $ 22.75 $ Menabrea Stout Total Sales Price per case 25.50 Direct Materials per case Direct Labor per case Other Variable Costs per case Total Variable costs per case Contribution Margin per Case $ $ $ 2.50 $ 3.45 $ 5.75 $ 11.70 8.30 $ 2.40 $ 3.45 $ 5.68 $ 11.53 11.97 $ 2.65 $ 3.00 $ 5.80 $ 11.45 11.30 $ 3.25 4.95 6.34 14.54 $ 10.96 Number of cases sold 12,800 7,150 6,900 4,050 30,900 Direct Labor Hours (DLH) per case Total DLH 0.23 2,944.00 0.23 1,644.50 0.20 1,380.00 0.33 1,336.50 7,305.00 Machine Hours (MH) per case Total MH 0.17 2,176.00 0.40 2,860.00 0.23 1,587.00 0.31 1,255.50 7,878.50 Contribution Margin Income Statement: Total Sales Revenue Total Variable costs Contribution Margin Direct Fixed Costs Segment Margin Common Fixed Costs Operating Income Nastro Blue Menabrea Perone Pale Ale Moretti Bock Pilsner Stout Total $ 256,000.00 $ 168,025.00 $ 156,975.00 $ 103,275.00 $ 684,275.00 149,760.00 82,439.50 79,005.00 58,887.00 370,091.50 106,240.00 85,585.50 77,970.00 44,388.00 314,183.50 10,329.62 8,392.91 6,017.39 9,893.92 34,633.84 $ 95,910.38 $ 77,192.59 $ 71,952.61 $ 34,494.08 $ 279,549.66 $ 245,389.44 $ 34,160.22 Exhibits 2 Additional Cost Information for 2019 Detail of Total Variable costs Direct Material Direct Labor Production Supplies Variable Portion of Maintenance Variable Portion of Utilities Variable Office Supplies (sales forms, etc) Shipping costs 8% Sales Commission Total $ 80,607.50 $ 109,575.00 $ 26,064.41 $ 39,292.55 $ 26,310.57 $ 3,490.03 $ 30,619.19 $ 54,742.00 $ 370,701.25 Detail of Total Fixed Costs (Direct + Indirect) Brew Master / Quality Control manager $ 60,293.15 Receiving and Shipping department expenses $ 22,511.32 Depreciation $ 11,712.10 Facility costs (rent, taxes, insurance, etc) $ 78,938.15 Advertising & Marketing costs $ 22,994.91 Fixed portion of Maintenance (including IT suppor $ 9,992.98 Fixed portion of Utilities (including refrigeration) $ 10,390.37 Fixed portion of Office Supplies $ 4,305.66 Fixed Salary of Salespeople $ 32,221.81 Administrative staff to assist owner $ 26,662.83 Total Fixed Costs 280.023.28