i have no idea with this question

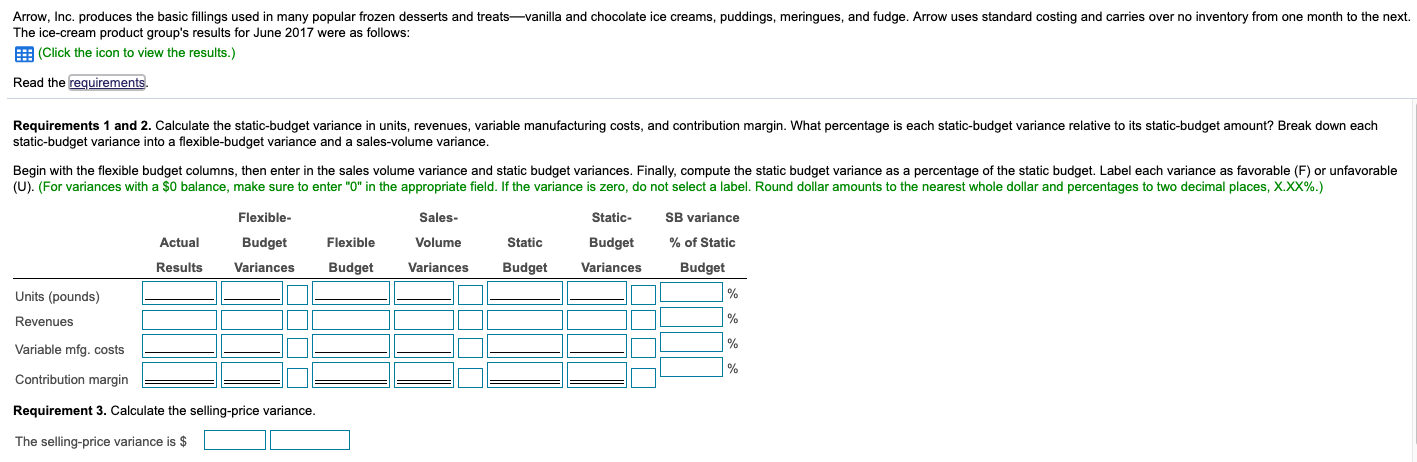

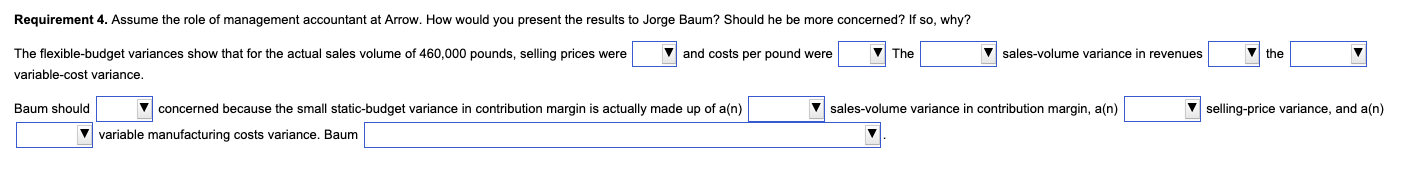

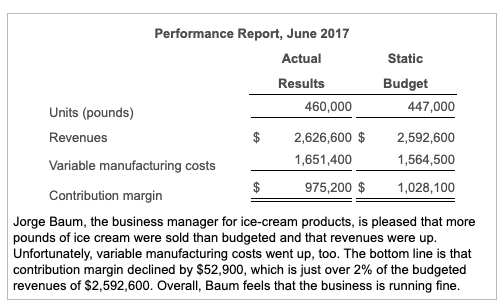

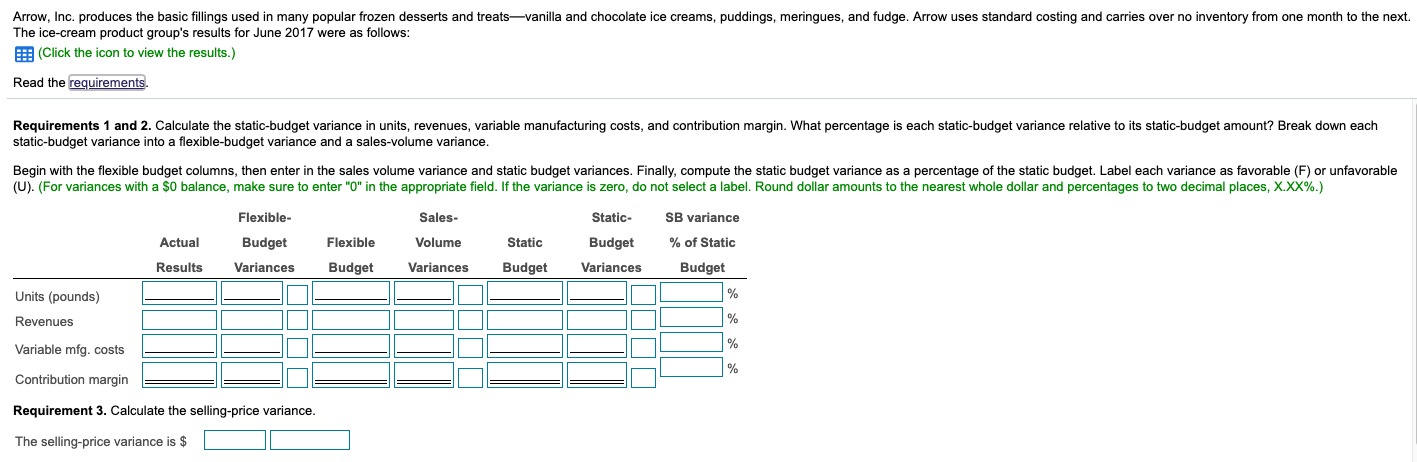

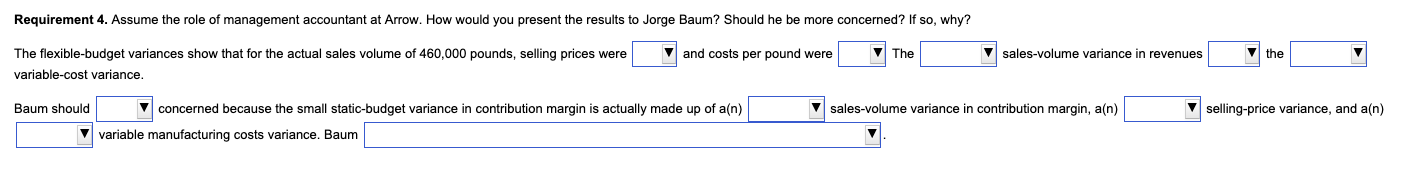

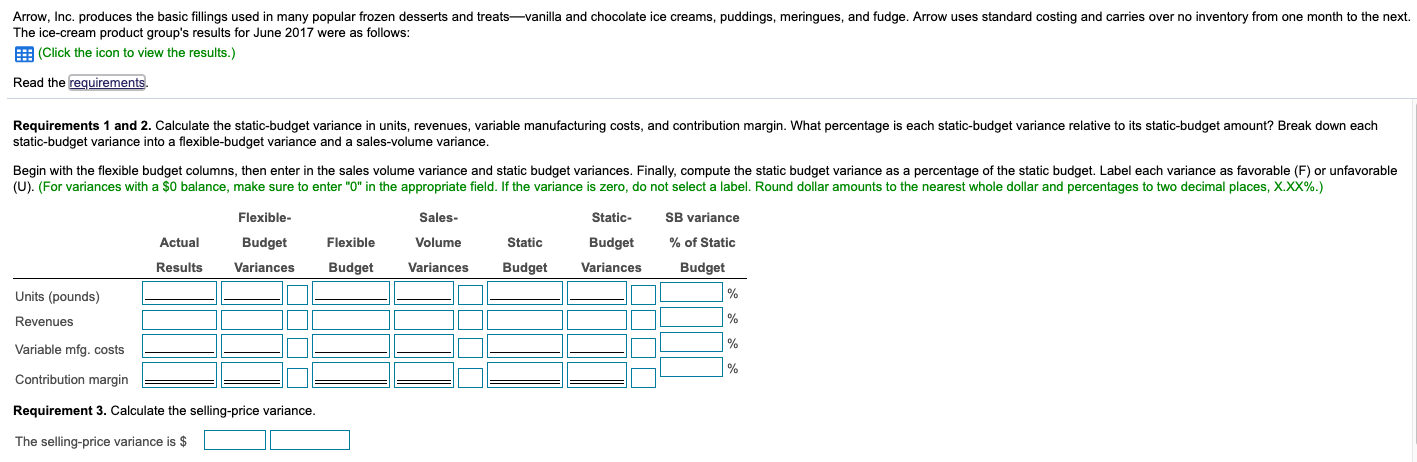

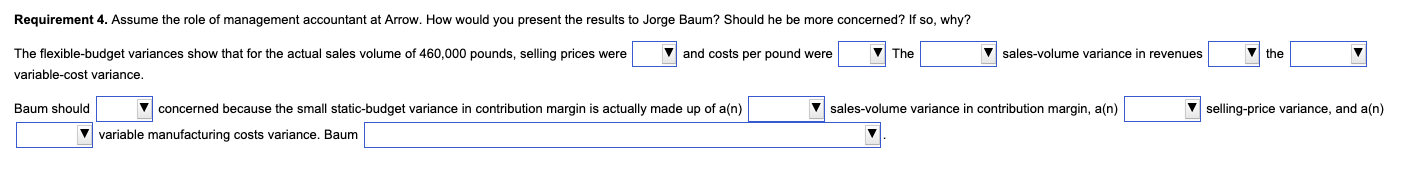

Performance Report, June 2017 Actual Static Results Budget Units (pounds) 460,000 447,000 Revenues $ 2,626,600 $ 2,592,600 Variable manufacturing costs 1,651,400 1,564,500 Contribution margin 975,200 1,028,100 Jorge Baum, the business manager for ice-cream products, is pleased that more pounds of ice cream were sold than budgeted and that revenues were up. Unfortunately, variable manufacturing costs went up, too. The bottom line is that contribution margin declined by $52,900, which is just over 2% of the budgeted revenues of $2,592,600. Overall, Baum feels that the business is running fine.1. Calculate the static-budget variance in units, revenues, variable manufacturing costs, and contribution margin. What percentage is each static-budget variance relative to its static-budget amount? 2. Break down each static-budget variance into a flexible-budget variance and a sales-volume variance. 3. Calculate the selling-price variance. 4. Assume the role of management accountant at Arrow. How would you present the results to Jorge Baum? Should he be more concerned? If so, why?Arrow, Inc. produces the basic fillings used in many popular frozen desserts and treats-vanilla and chocolate ice creams, puddings, meringues, and fudge. Arrow uses standard costing and carries over no inventory from one month to the next. The ice-cream product group's results for June 2017 were as follows: (Click the icon to view the results.) Read the requirements. Requirements 1 and 2. Calculate the static-budget variance in units, revenues, variable manufacturing costs, and contribution margin. What percentage is each static-budget variance relative to its static-budget amount? Break down each static-budget variance into a flexible-budget variance and a sales-volume variance. Begin with the flexible budget columns, then enter in the sales volume variance and static budget variances. Finally, compute the static budget variance as a percentage of the static budget. Label each variance as favorable (F) or unfavorable (U). (For variances with a $0 balance, make sure to enter "0" in the appropriate field. If the variance is zero, do not select a label. Round dollar amounts to the nearest whole dollar and percentages to two decimal places, X.XX%.) Flexible- Sales- Static- SB variance Actual Budget Flexible Volume Static Budget of Static Results Variances Budget Variances Budget Variances Budget Units (pounds) % % Revenues % Variable mfg. costs 0% Contribution margin Requirement 3. Calculate the selling-price variance. The selling-price variance is $Requirement 4. Assume the role of management accountant at Arrow. How would you present the results to Jorge Baum? Should he be more concerned? If so, why? The flexible-budget variances show that for the actual sales volume of 460,000 pounds, selling prices were and costs per pound were The sales-volume variance in revenues |the variable-cost variance Baum should concerned because the small static-budget variance in contribution margin is actually made up of a(n) sales-volume variance in contribution margin, a(n) selling-price variance, and a(n) variable manufacturing costs variance. Baum