Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have posted 2 times but every time the solution excludes an entire date and the entire answer is wrong as a result. Thank you

I have posted 2 times but every time the solution excludes an entire date and the entire answer is wrong as a result. Thank you for the help!

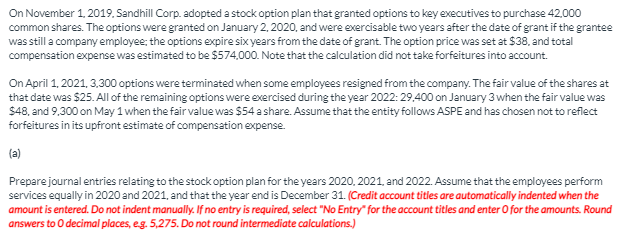

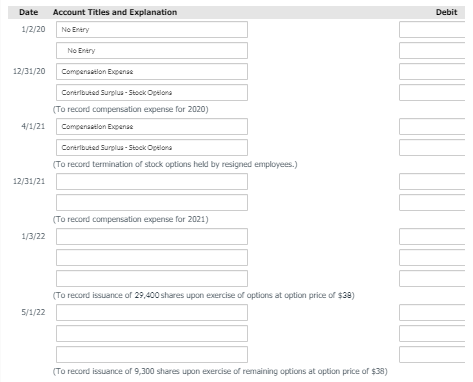

On November 1, 2019. Sandhill Corp. adopted a stock option plan that granted options to key executives to purchase 42.000 common shares. The options were granted on January 2, 2020, and were exercisable two years after the date of grant if the grantee was still a company employee: the options expire six years from the date of grant. The option price was set at $38, and total compensation expense was estimated to be $574.000. Note that the calculation did not take forfeitures into account. On April 1, 2021, 3.300 options were terminated when some employees resigned from the company. The fair value of the shares at that date was $25. All of the remaining options were exercised during the year 2022:29.400 on January 3 when the fair value was $48. and 9.300 on May 1 when the fair value was $54 a share. Assume that the entity follows ASPE and has chosen not to reflect forfeitures in its upfront estimate of compensation expense. (a) Prepare journal entries relating to the stock option plan for the years 2020.2021, and 2022. Assume that the employees perform services equally in 2020 and 2021, and that the year end is December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to O decimal places, eg. 5,275. Do not round intermediate calculations.) Debit Date 1/2/20 Account Titles and Explanation No Enery No Entry 12/31/20 Compenzon Expanse Contributed Surplus - Stock Oplona (To record compensation expense for 2020) Compensation Expense 4/1/21 Contributed Surplus - Stock Option (To record termination of stock options held by resigned employees.) 12/31/21 (To record compensation expense for 2021) 1/3/22 (To record issuance of 29,400 shares upon exercise of options at option price of $29) 5/1/22 (To record issuance of 9,300 shares upon exercise of remaining options at option price of $38)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started