I have posted this question before and part d was wrong. please pay more attention.

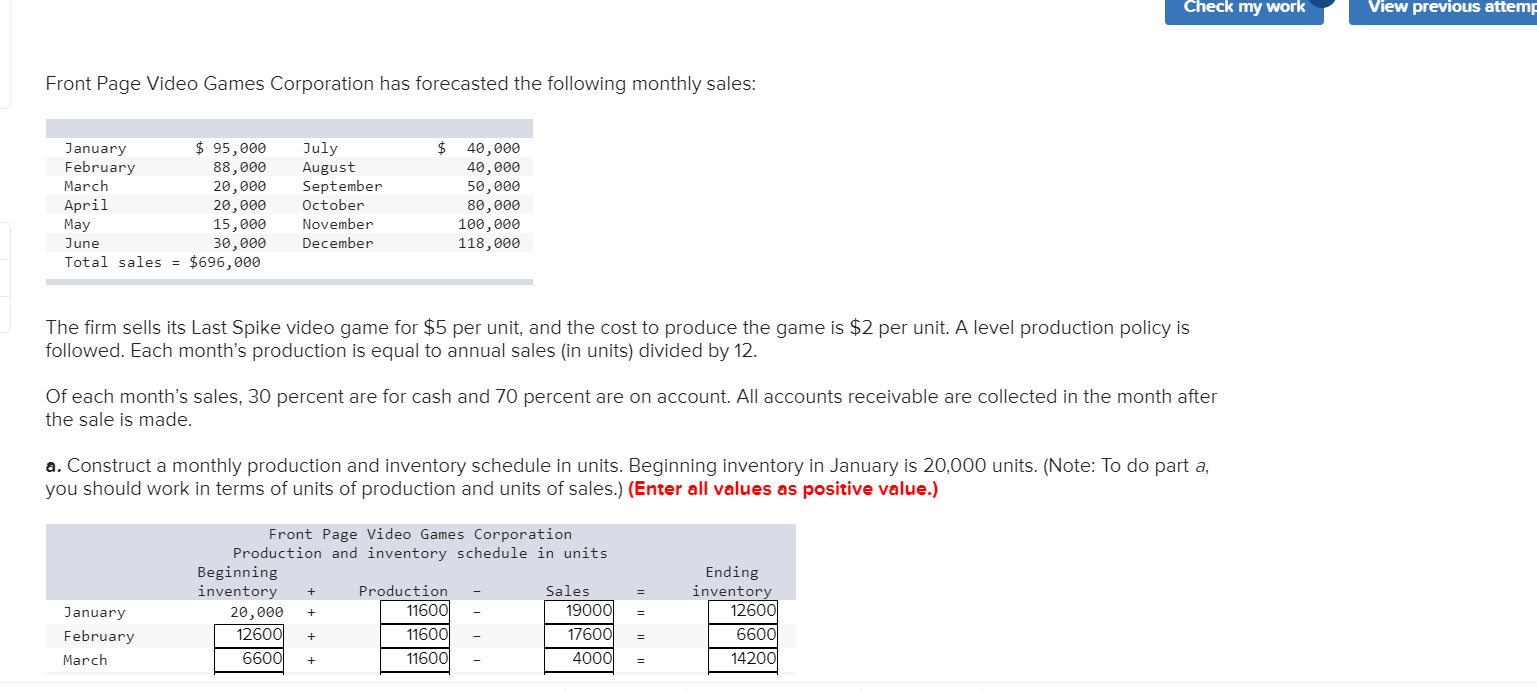

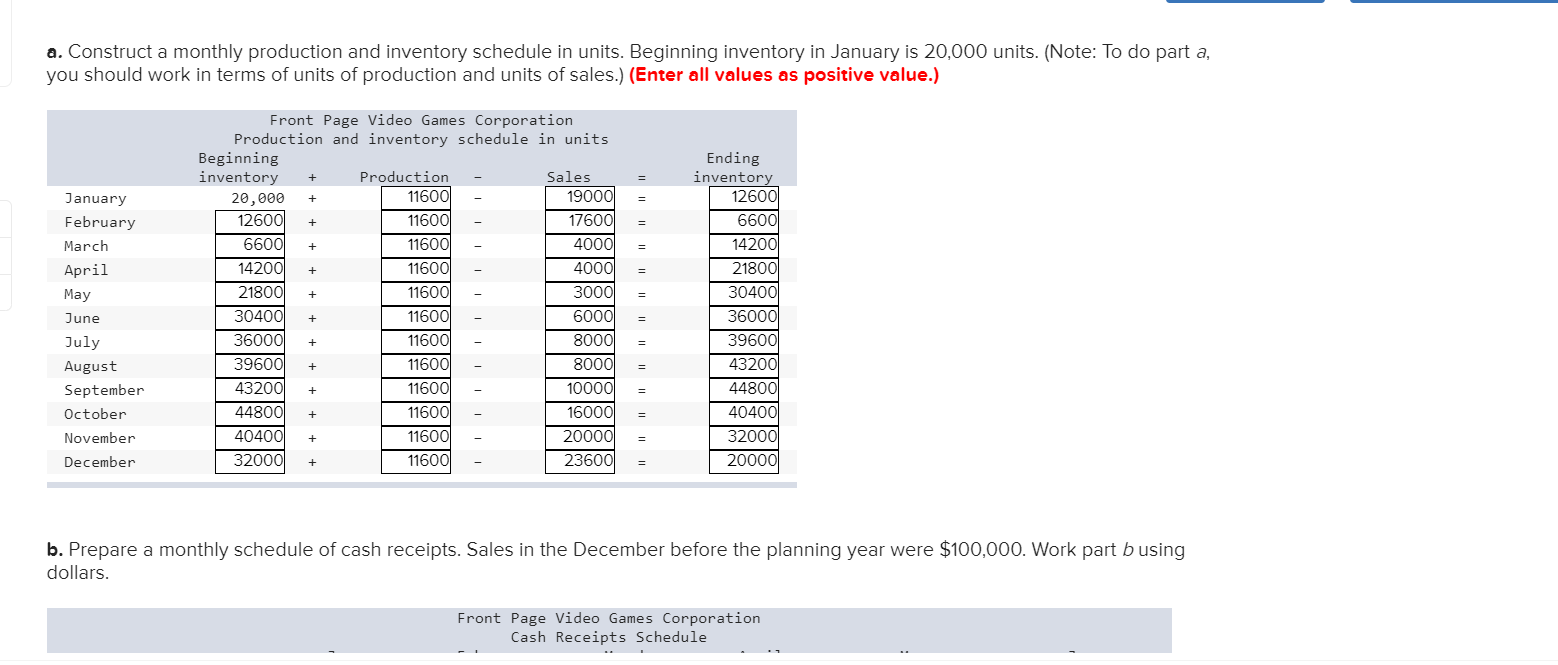

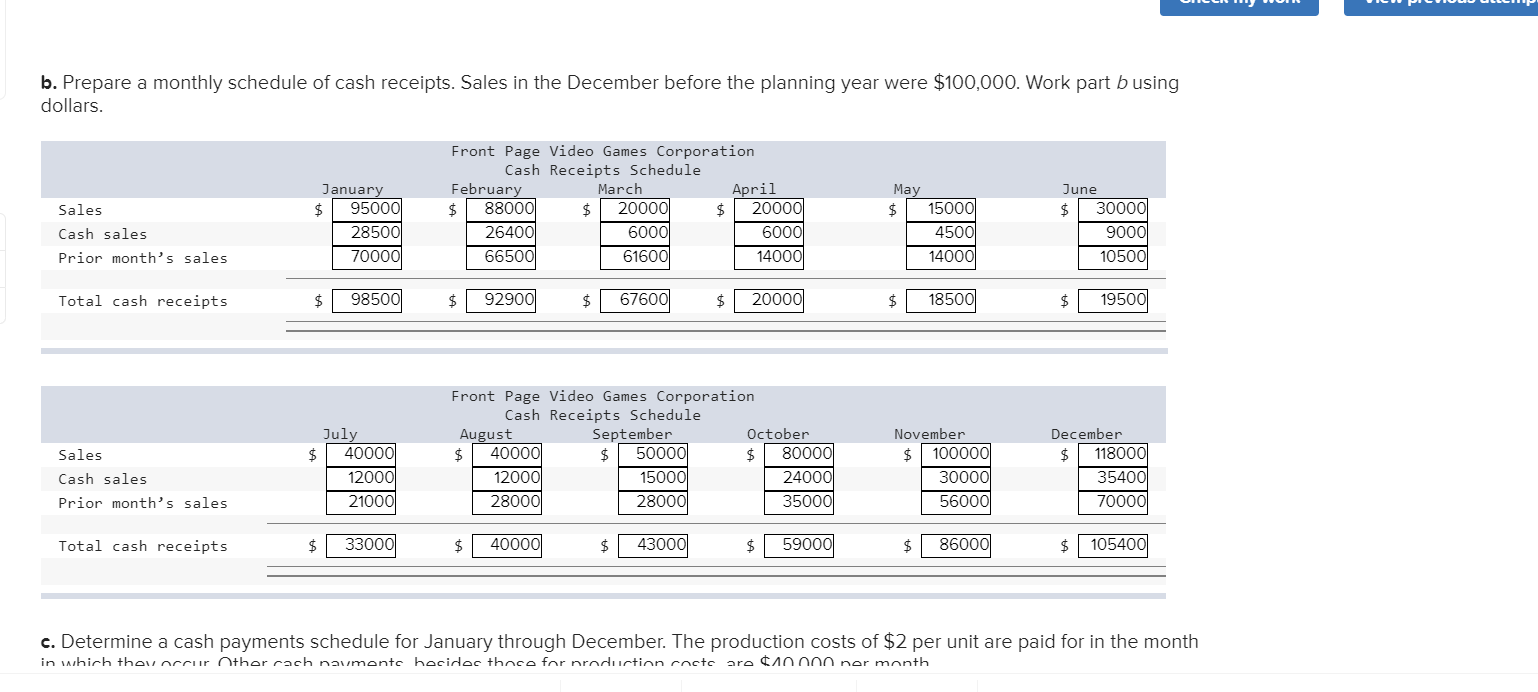

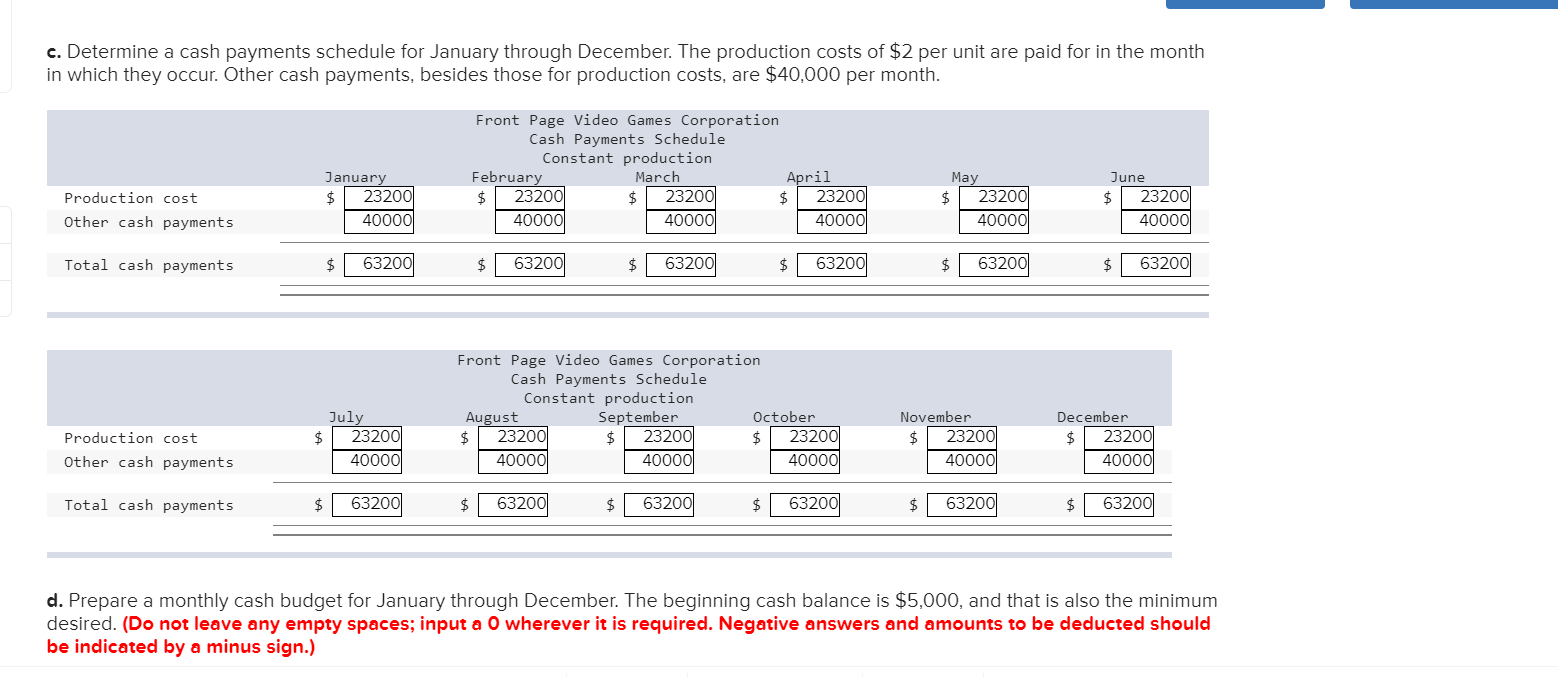

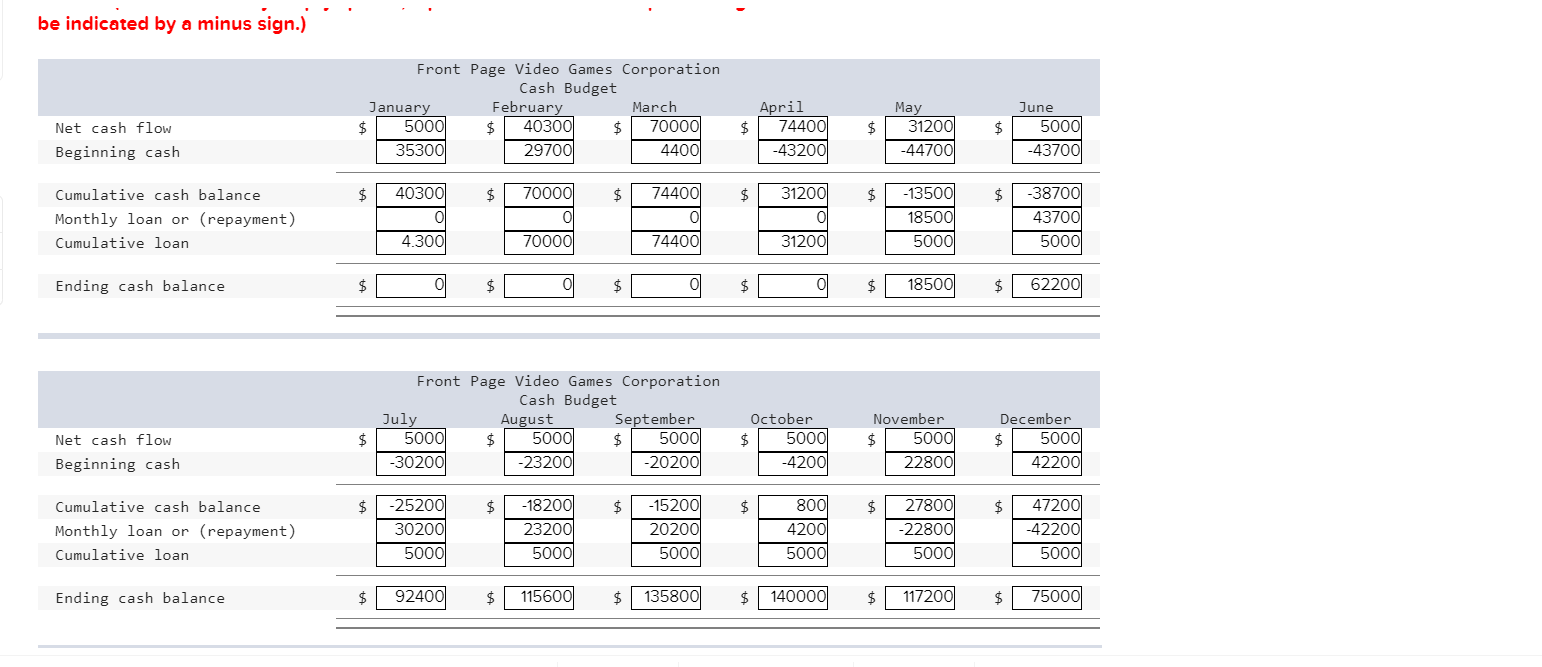

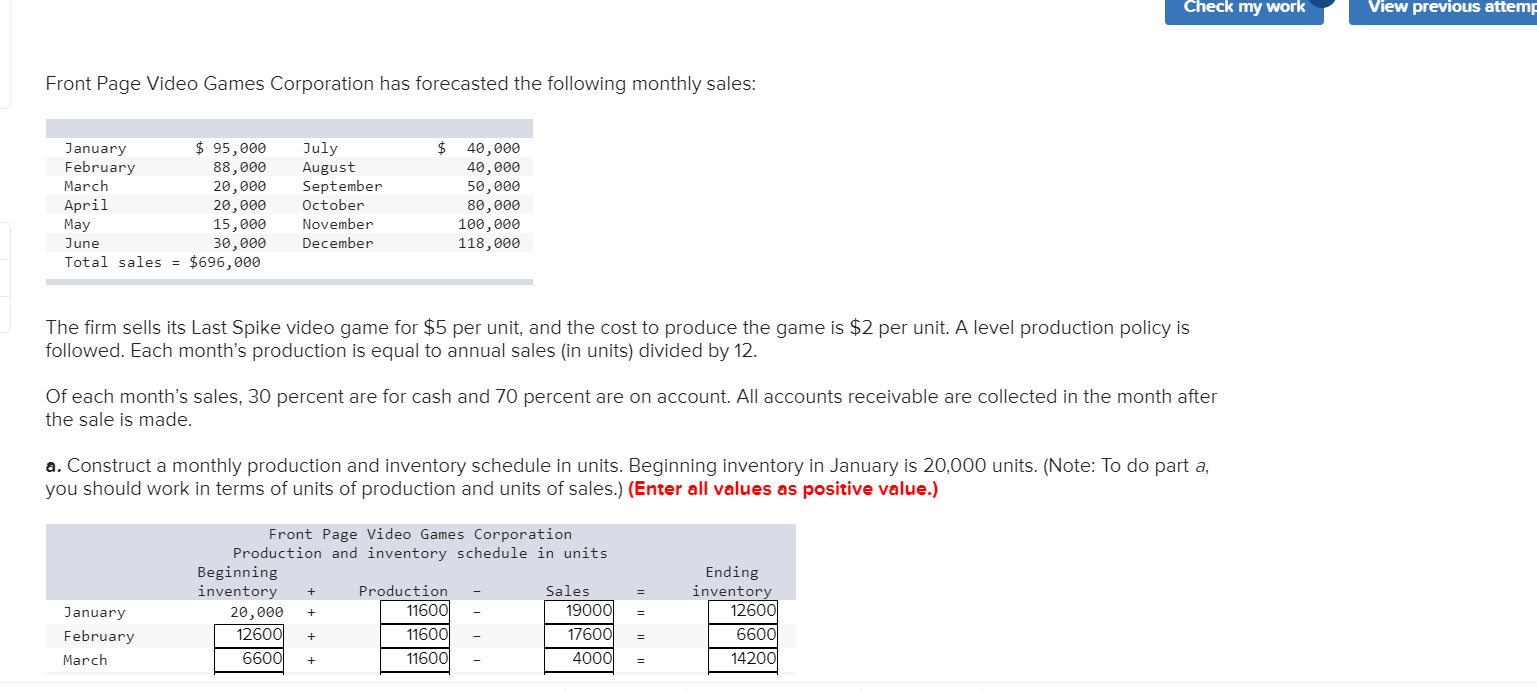

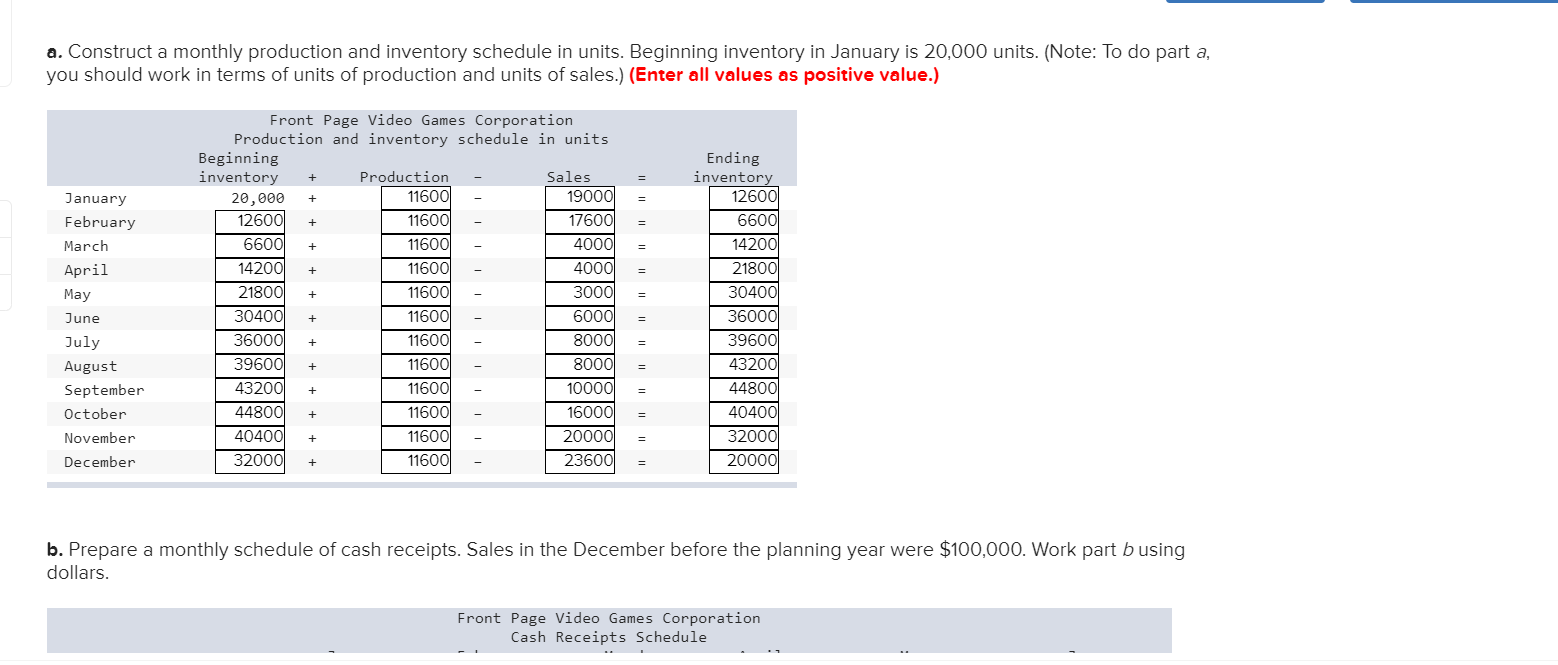

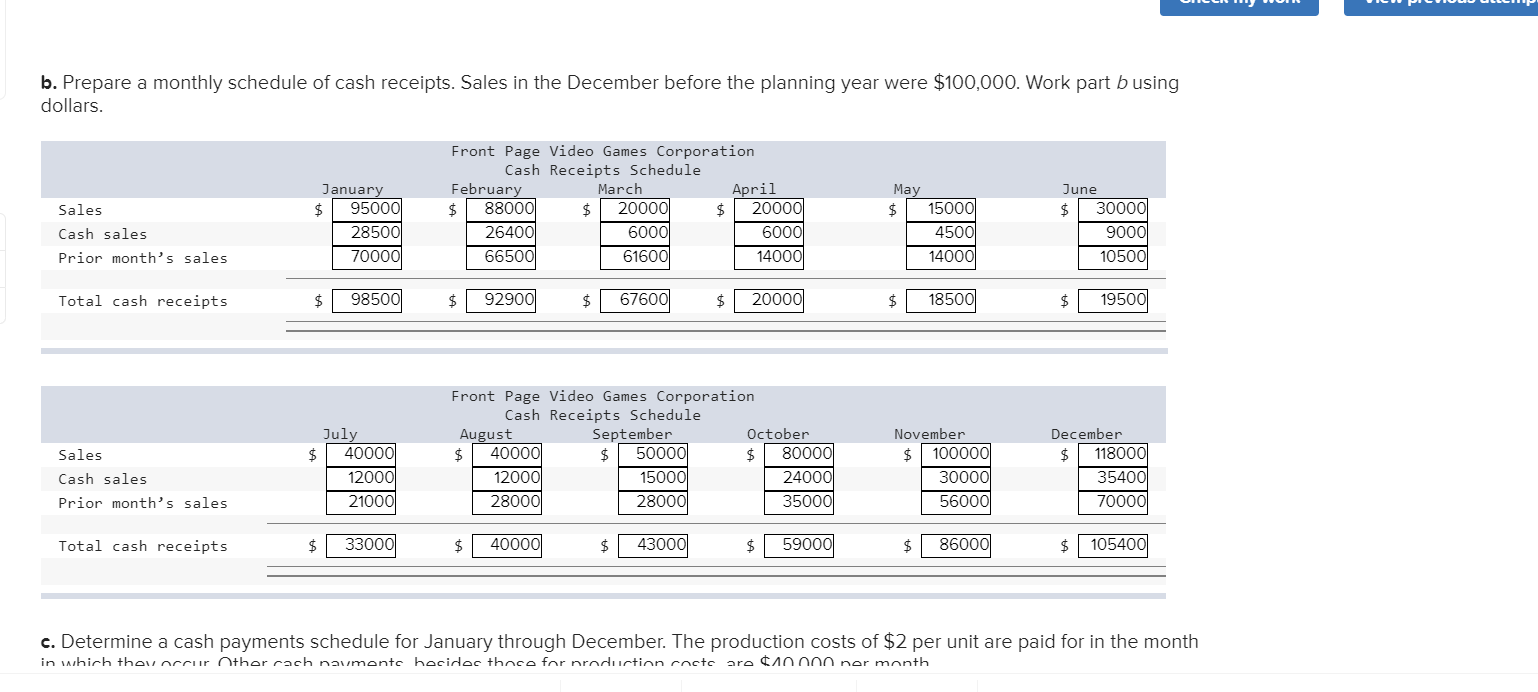

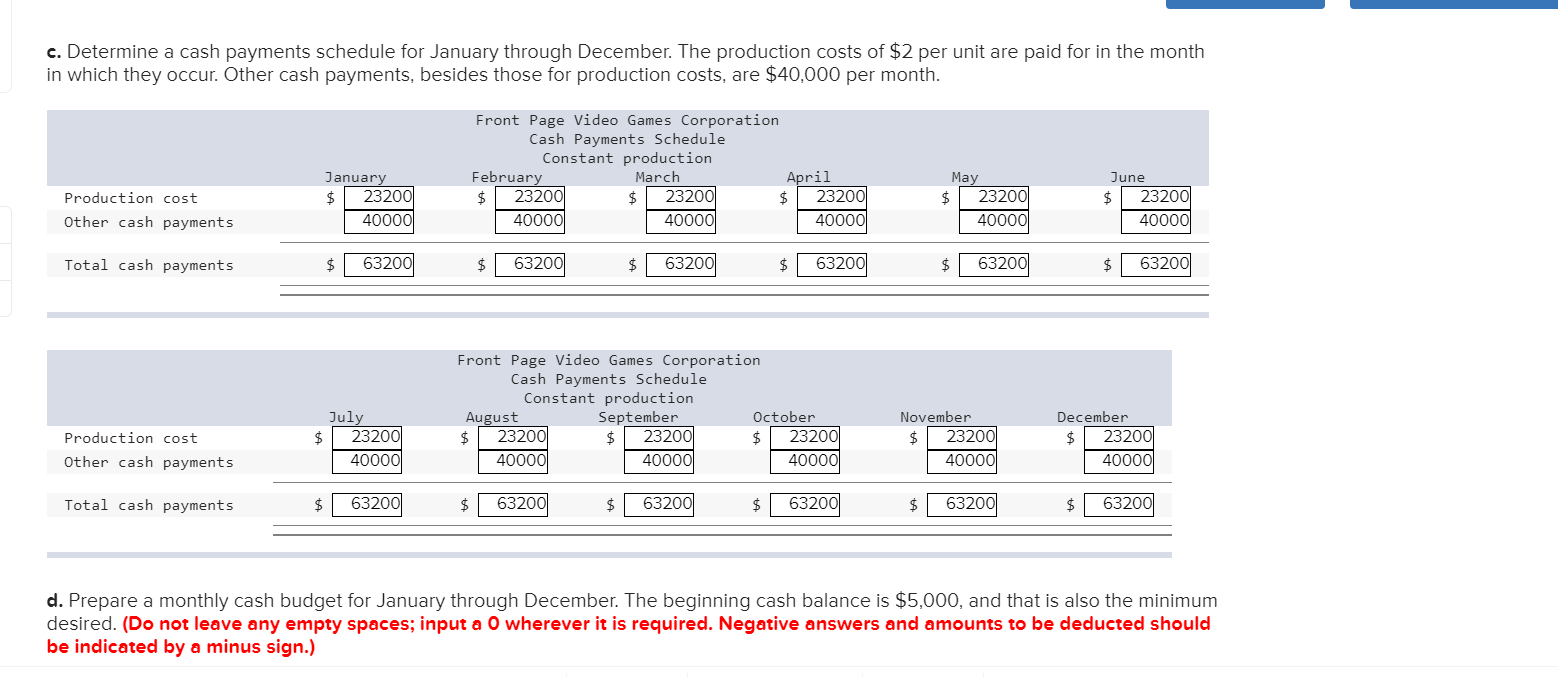

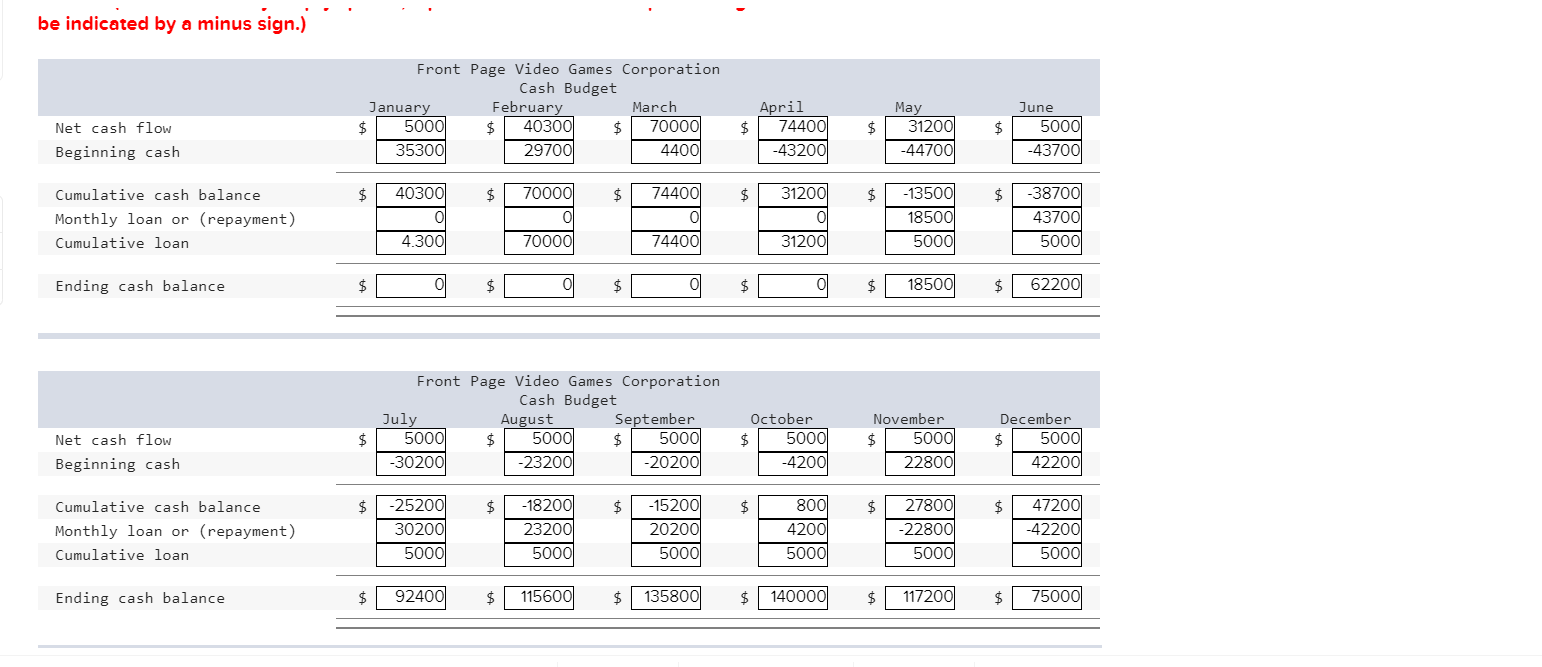

Check my work View previous attemp Front Page Video Games Corporation has forecasted the following monthly sales: $ January $ 95,000 February 88,000 March 20,000 April 20,000 May 15,000 June 30,000 Total sales = $696,000 July August September October November December 40,000 40,000 50,000 80,000 100,000 118,000 The firm sells its Last Spike video game for $5 per unit, and the cost to produce the game is $2 per unit. A level production policy is followed. Each month's production is equal to annual sales in units) divided by 12. Of each month's sales, 30 percent are for cash and 70 percent are on account. All accounts receivable are collected in the month after the sale is made. a. Construct a monthly production and inventory schedule in units. Beginning inventory in January is 20,000 units. (Note: To do part a, you should work in terms of units of production and units of sales.) (Enter all values as positive value.) Front Page Video Games Corporation Production and inventory schedule in units Beginning inventory + Production - Sales 20,000 + 11600 19000 12600 11600 17600 66001 116001 40001 January February March Ending inventory 12600 6600 14200 + + a. Construct a monthly production and inventory schedule in units. Beginning inventory in January is 20,000 units. (Note: To do part a, you should work in terms of units of production and units of sales.) (Enter all values as positive value.) + + + Front Page Video Games Corporation Production and inventory schedule in units Beginning inventory + Production - Sales 20,000 + 11600 19000 12600 11600 17600 6600 116001 4000 142001 11600 4000 21800 11600 3000 304001 11600 6000 36000 11600 8000 39600 11600 8000 43200 11600 10000 44800 11600 16000 40400 11600 20000 32000 116000 23600 + January February March April May June July August September October November December Ending inventory 12600 6600 14200 21800 304001 36000 39600 43200 44800 40400 32000 20000 + + + + + + + b. Prepare a monthly schedule of cash receipts. Sales in the December before the planning year were $100,000. Work part b using dollars. Front Page Video Games Corporation Cash Receipts Schedule b. Prepare a monthly schedule of cash receipts. Sales in the December before the planning year were $100,000. Work part b using dollars. Sales Cash sales Prior month's sales January $ 95000 28500 70000 Front Page Video Games Corporation Cash Receipts Schedule February March April $ 88000 $ 20000 $ 20000 26400 6000 6000 66500 61600 14000 May $ 15000 4500 14000 June $ 30000 9000 10500 Total cash receipts $ 98500 $ 92900 $ 67600 $ 20000 $ 18500 19500 Sales Cash sales Prior month's sales July | 40000 12000 21000 Front Page Video Games Corporation Cash Receipts Schedule August September October $ 40000 $ 50000 $ 80000 12000 15000 24000 28000 28000 35000 November $ 100000 30000 56000 December $ 118000 35400 70000 Total cash receipts $ 33000 40000 43000 $ 59000 $ 86000 $ 105400 c. Determine a cash payments schedule for January through December. The production costs of $2 per unit are paid for in the month in which they occur Other cach navmonte hacidec thace for nraduction cocte are cinnnn ner month c. Determine a cash payments schedule for January through December. The production costs of $2 per unit are paid for in the month in which they occur. Other cash payments, besides those for production costs, are $40,000 per month. Front Page Video Games Corporation Cash Payments Schedule Constant production February March April $ 23200 $ 23200 $ 23200 40000 40000 40000 January $ 23200 40000 Production cost Other cash payments May $ 232001 40000 June $ 23200 40000 Total cash payments $ 63200 $63200 $ 63200 $ 63200 $ 63200 $ 63200 Front Page Video Games Corporation Cash Payments Schedule Constant production August September October $ 23200 $ 23200 $ 232001 40000 40000 July 23200 40000 Production cost Other cash payments November $ 23200 40000 December $ 23200 40000 40000 Total cash payments $ 63200 $ 63200 $63200 $ 63200 $ 63200 $ 63200 d. Prepare a monthly cash budget for January through December. The beginning cash balance is $5,000, and that is also the minimum desired. (Do not leave any empty spaces; input a O wherever it is required. Negative answers and amounts to be deducted should be indicated by a minus sign.) be indicated by a minus sign.)" Front Page Video Games Corporation Cash Budget January February March $ 5000 $ 40300 70000 35300 29700 44001 April 74400 May 31200 Net cash flow Beginning cash June 5000 -437001 -43200 -44700 40300 70000 $ 74400 $ 31200 Cumulative cash balance Monthly loan or (repayment) Cumulative loan -13500 18500 5000 38700 43700 5000 4.300 70000 74400 31200 Ending cash balance Og $C $ D $ 18500 $ 62200 Front Page Video Games Corporation Cash Budget July August September 5000 $ 5000 $ 5000 -30200 -23200 -202001 Net cash flow Beginning cash October $ 5000 -4200 November $ 5000 22800 December $ 5000 42200 $ $ 800 Cumulative cash balance Monthly loan or (repayment) Cumulative loan -25200 30200 5000 92400 -18200 23200 5000 -15200 20200 5000 4200 27800 -22800 5000 47200 -42200 5000 5000 Ending cash balance $ $ 115600 $ 135800 $ 140000 $ 117200 $ 75000