Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have posted this question multiple times because answers continue to be wrong. Please post the answers as how they should be entered in the

I have posted this question multiple times because answers continue to be wrong.

I have posted this question multiple times because answers continue to be wrong.

Please post the answers as how they should be entered in the homework. Thank you!!

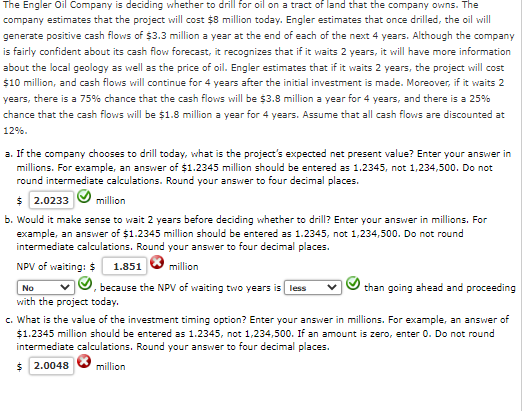

company estimates that the project will cost $8 million today. Engler estimates that once drilled, the oil will generate positive cash flows of 53.3 million a year at the end of each of the next 4 years. Although the company is fairly confident about its cash flow forecast, it recognizes that if it waits 2 years, it will have more information about the local geology as well as the price of oil. Engler estimates that if it waits 2 years, the project will cost 510 million, and cash flows will continue for 4 years after the initial investment is made. Moreover, if it waits 2 years, there is a 75% chance that the cash flows will be 53.8 million a year for 4 years, and there is a 25% chance that the cash flows will be $1.8 million a year for 4 years. Assume that all cash flows are discounted at 12% a. If the company chooses to drill today, what is the project's expected net present value? Enter your answer in millions. For example, an answer of $1.2345 million should be entered as 1.2345, not 1,234,500, Do not round intermediate calculations. Round your answer to four decimal places. $ million b. Would it make sense to wait 2 years before deciding whether to drill? Enter your answer in millions, For example, an answer of $1.2345 million should be entered as 1.2345, not 1,234,500. Do not round intermediate calculations. Round your answer to four decimal places. NPV of waiting: $ million , because the NPV of waiting two years is than going ahead and proceeding with the project today. c. What is the value of the investment timing option? Enter your answer in millions. For example, an answer of $1.2345 million should be entered as 1.2345, not 1,234,500. If an amount is zero, enter 0 . Do not round intermediate calculations. Round your answer to four decimal places. $3 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started