I have provided an example and mark scheme of how to answer this question.

I need help answering the set of questions that don't come with the mark scheme as I'm hoping the same methods can be applied to them

thank you

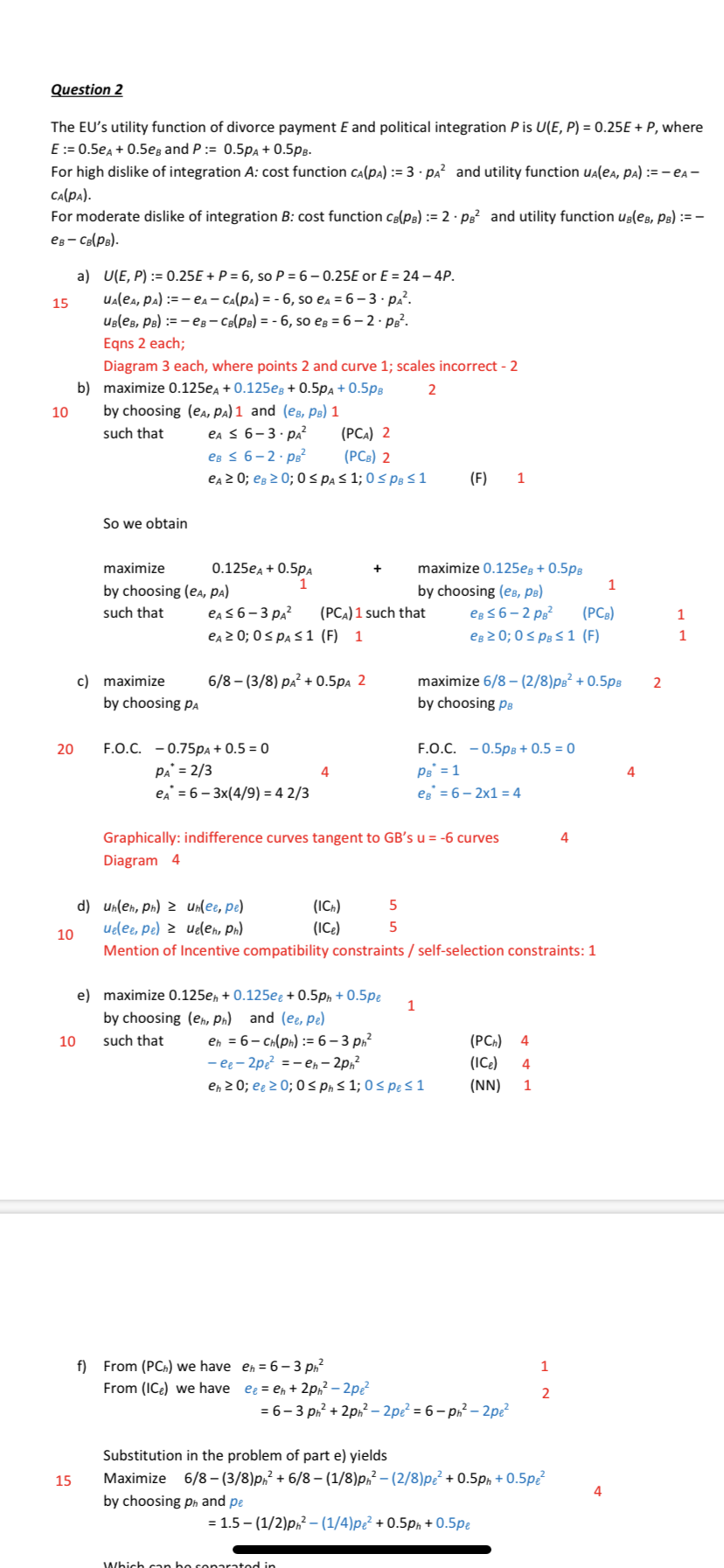

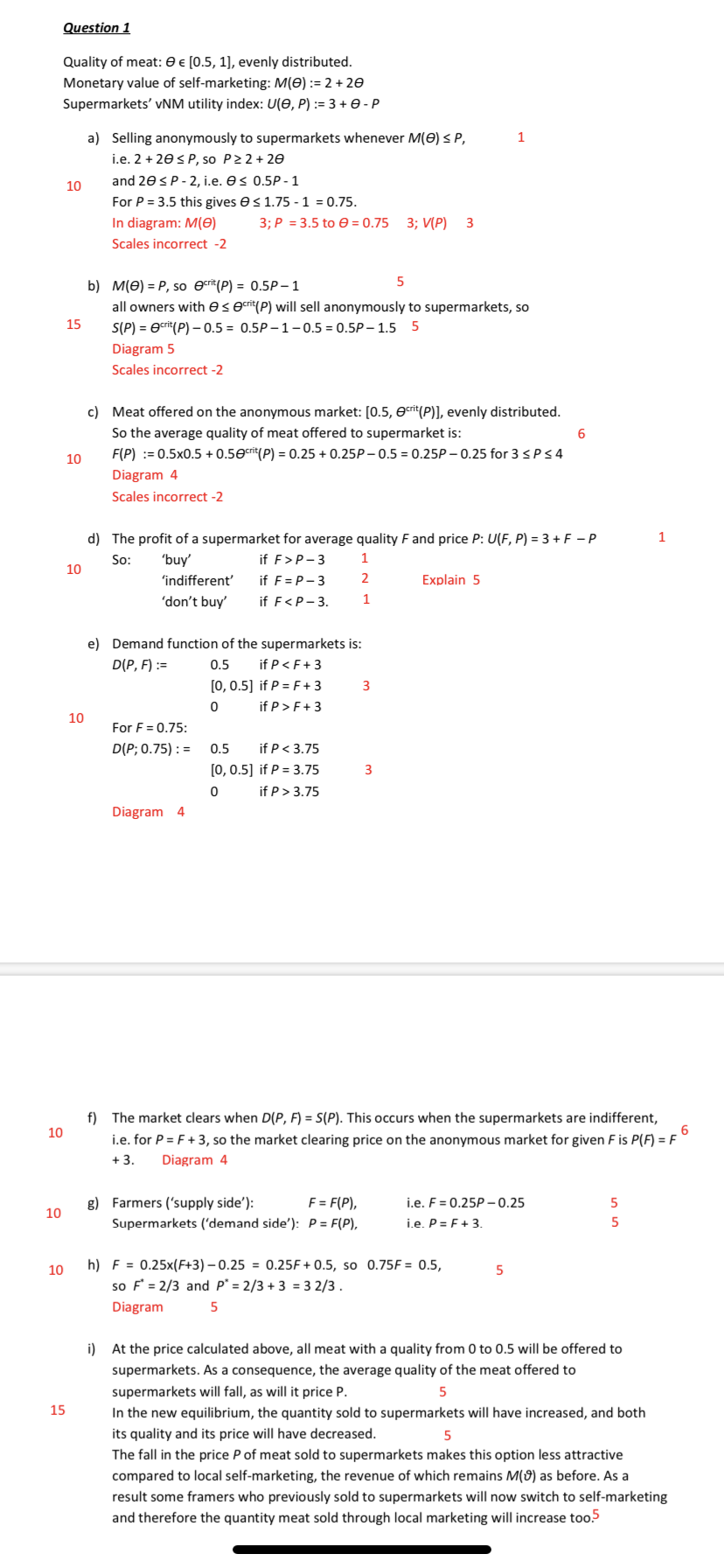

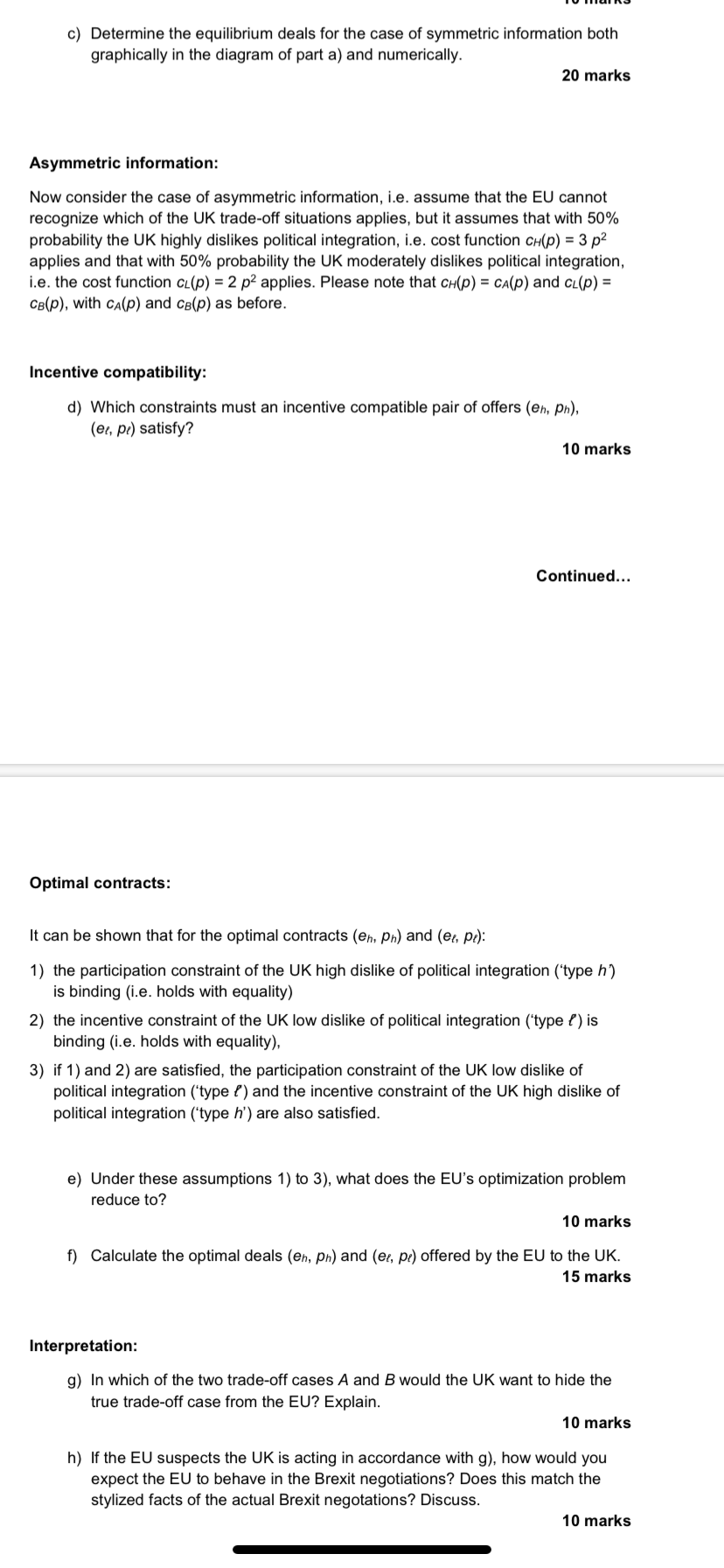

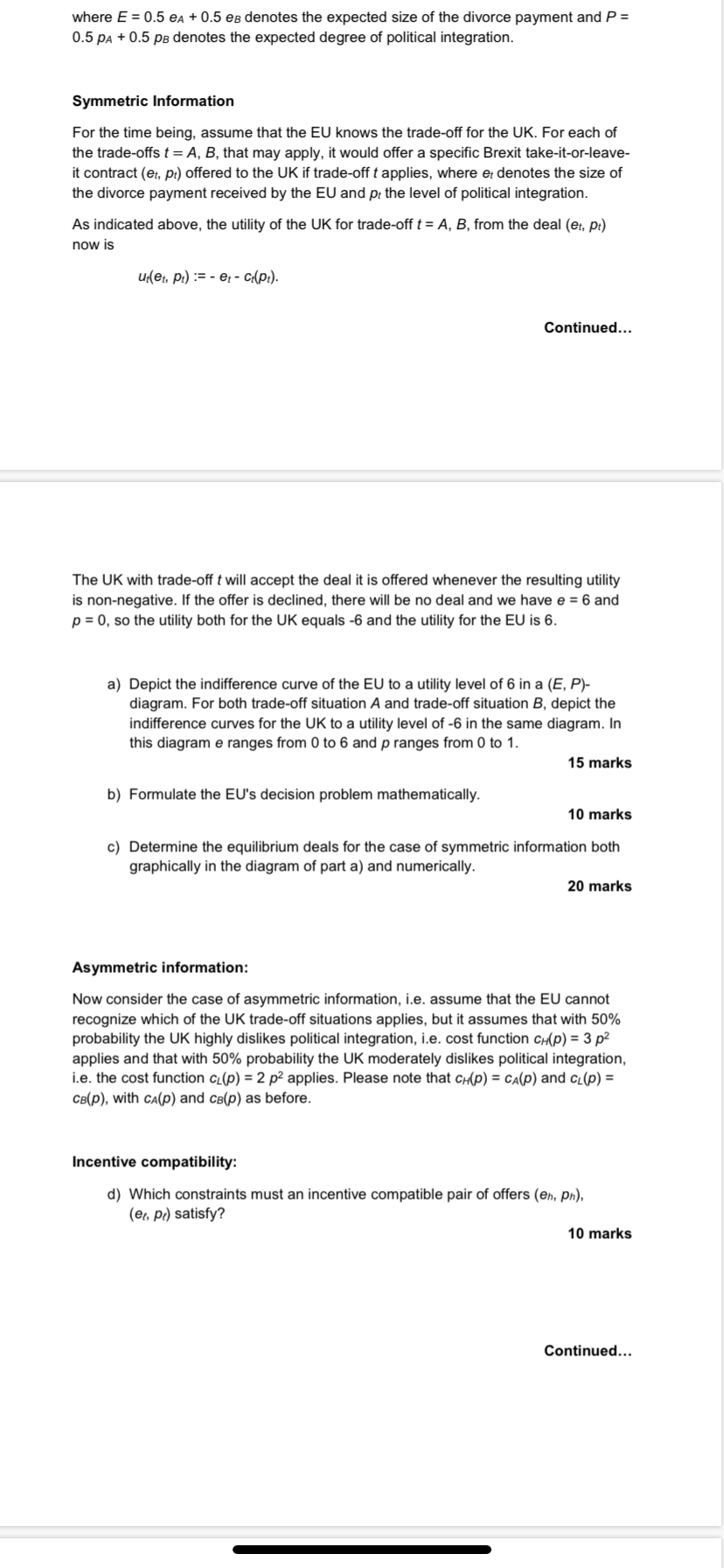

c) Determine the optimal combination of packages (of, 254'), (mi, 23') offered by the health agency graphically in the diagram of part a). Calculate the packages (qA', 2,0 and mg, 25'). 20 marks Asymmetric information: Now consider the case of asymmetric information, i.e. assume that the health agency does not know the type 1': A, B of individual suppliers, but does know that 50% of the suppliers areI of type A (and have low costs) and that the remaining 50% of the suppliers are of type B (and have high costs). That is, the health agency knows that the 'low' cost function can} = 2 q2 applies for 50% of the suppliers and that the 'high' cost function cr-(q) = 5 :32 applies for the other 50% of the suppliers. So we have cdq} = cam} and cH(q) = cam}, with c.4(q) and cq) as before. Incentive compatibility: d) Which constraints must an incentive compatible pair of packages (cu, 2H), (Qt. 2L) satisfy? 10 marks Optimal contracts: It can be shown that for the optimal packages (qr-r, 2H) and (qt, 2L): 1) the participation constraint of the suppliers with high costs ('type H') is binding (i.e. holds with equality} 2) the lncentfve constraint of the suppliers with low costs ('type L') is binding (i.e. holds with equality), 3) if 1) and 2) are satised, then the participation constraint of the suppliers with low costs ('type L') and the incentive constraint of the suppliers with high costs ('type H') are also satised. e) Under these assumptions 1) to 3), what does the health agency's mathematical opljmization problem reduce to? 10 marks Continued... 1) Calculate the optimal packages (qr-1. Zn) and (qt'. 2;) offered by the health agency for the suppliers in the industry to choose from. 15 marks Interpretation: 9) Compare the optimal packages the health agency offers under symmetric information. as in part c). with those under asymmetric information. as in part 1). Discuss. 10 marks h) Suppose the public health agency nds itself in the situation of asymmetric information and offers the packages calculated in part 1). What would you expect the reactions of different lobby groups and of nancial watch dogs to be? Discuss. 10 marks 9mm Consider a continuum of rms seeking developing a Corona virus antibody test. The rms have different prospects for their test's effectiveness. The prospective effectiveness of a nn's test is denoted by 6. with 0 S 9 s 1. The poorest prospective effectiveness is denoted by D. the best by 1. We refer to individual rms by their unique value of 9. The rms' 9 are uniformly (i.e. 'evenly') distributed over the interval [0, 1]. The actual prospective effectiveness of a n-n's test is only known to the rm. An-n can either sell the rights to its test before it is fully developed to one of many (possibly international) health agencies at a price of P, or market the test themselves after it is fully developed and its effectiveness is known. Marketing a test of prospective effectiveness 9 when it is fully developed gives the rm an expected revenue of mei=1 +59. There are as many identical health agencies potentially willing to buy the rights to a test as there are rms, so the health agencies do not derive economic rents from buying tests early. The health agencies have access to unlimited nancial resources. A health agency can only buy the rights to one single test before it is developed. If the nn's test is of prospective effectiveness 6 and the price is P. the health agency obtains a utility of ulQP):=2+9P. Not buying the rights to any test gives the health agency a utility of D. For any price P each health agency knows the average prospective effectiveness F of the not fully developed tests offered in the rights market at that price. But only after the sale of the rights to a test has been completed. the actual prospective effectiveness of the test becomes known to the rm. Sellers (Firms): a) Denote by WP) the rms who are willing to sell the rights to their not fully developed test at a price P. For P = 3 determine V(P) graphically in a diagram. 10 marks b) Denote by 9MP) the 'critical' or 'iuatershed' firm which at price P is indifferent between selling the rights to its test before it is fully developed and waiting to market its test after it has been fully developed. Calculate 9\"\"(P). Determine the supply function S(P) of rights to not fully developed tests. Depict the supply function S(P) in a diagram. 1 5 marks Continued... G) Let F(P) denote the average prospective effectiveness of not fully developed tests offered to the rights market at price P. Determine F(P). Depict HP) in a diagram. 10 marks Buyers (Health agencies): d) At which combinations (F, P} of average prospective effectiveness F of not fully developed test offered to the rights market. and of price P, will health agendas be willing to buy the rights to not fully developed tests? At which combinations (F. P) will they refuse to buy? When will they be indifferent between buying and not buying? Explain. 10 marks mm A public health agency would like to purchase PPE (Personal Protection Equipment) for its staff. It would like to do so in a cost-effective way. There are two types of suppliers offering PPEs. They appear in the industry in equal proportions. One type of suppliers face high production costs and the other type of supplier face low costs of production. Let q to denote the amount of PPEs supplied. Depending on the context as specied below. the health agency either knows the cost function of the individual suppliers. or it only knows the fractions of the two types of suppliers in the industry and does not know the individual cost functions. For suppliers with a low production costs. the cost function is cam) = 2 qnz. for suppliers with a high production cost it is cams) = 5 qaz. The health agency makes offers to purchase amounts q of PPEs for lump-sum payments 2. Suppose it offers (q;.. 2') to suppliers of type A and (cs. 23) to suppliers of type B. where qr denotes the amount of PPEs and z; the lump-sum payment for supplier i = A. B. For suppliers of type A the profit from the package (flat. 2..) is: mica. 2n) := 2a - click) = 24 - 2 142 and for suppliers of type B the profit from the package (in. 23) is name. 23) := 23 - ca(qa) = 25 - 5 qaz. The health agency's utility function regarding the total amount 0 of PPEs purchased and overall payments Z is: UlQ.Z):=Q - 0.52 where O = 0.5 in + 0.5 as is the total amount of PPEs purchased and Z = 0.5 Zn. + 0.5 23 the overall payment. Symmetric Information For the time being. assume that the health agency knows the cost function of each supplier. For each of the two types of suppliers. 1' = A. B. the health agency offers a specic take-it-or-leave-it package (at. It). A supplier of type t= A. B. will accept the package whenever the supplier's prot resulting from the package is non-negative. If the offer is declined. both qiand 2: equal zero and the supplier has a prot of zero. a) Depict the indifference curve of the health agency to a utility level of 0 in a (O. Zl-diagram. Both for suppliers of type A and of type B. depict the zero- protit curve in the same diagram with the axis representing all and Zn for supplier A and as and 23 for supplier B. 1 5 marks Continued... b) Formulate the health agency's decision problem mathematically. 10 marks c) Determine the optimal combination of packages (0;. 24'). (mi. 23') offered by the health agency graphically in the diagram of part a). Calculate the packages (QA'. 2.4-) and (Qa'. 23')- 20 marks Asymmetric information: Now consider the case of asymmetric information. i.e. assume that the health agency does not know mmrs. but does know that F...\" d) At which combinations (F. P) of average prospective effectiveness F of not fully developed test offered to the rights market. and of price P, will health agencies be willing to buy the rights to not fully developed tests? At which combinations (F. P) will they refuse to buy? When will they be indifferent between buying and not buying? Explain. 1 It marks e) Let 00'. F) denote the demand for the rights to not fully developed tests at price P, given that the average prospective effectiveness of the tests offered to the rights market is F. Depict the demand D(P: F) for F = 0.6 in the diagram of the supply function 8(P) in part b). At which price does demand equal supply for F = 0.6? Explain. 1 0 marks 1) Calculate DiP: F). At which combinations for P and F will the market for rights to notfully developed tests clear? Depict these combinations in the diagram of part c). 1 0 marks Equilibrium: 9) What is the firms' 'supply side' equilibrium condition on the combinations of F and P? What is the health agencies\" 'demand side' equilibrium condition on the combinations of F and P? 1 0 marks h) Determine the equilibrium combination (F. P) graphically in the diagram of part c). Calculate the equilibrium combination (F. P). 1 0 marks Continued... Interpretation: A53ume that health agencies start to worry that there may be a shortage of test kits at a later stage, and therefore become more eager to secure the ghts to a test before it is fully developed. Suppose that as a result their utility function changes from u(6, P) := 2 + 9 P to u(9, P) := 2 +1.256P. i) Adapting the above graphical analysis in a new diagram. how do you expect this change to affect the equilibrium price P' and the average prospective effectiveness F' in the market for rights to not fully developed test? How do you expect this change to affect the conditions in the market for test kits after the all tests have been developed? Discuss. 1 5 marks Continued... f) Calculate D(P: F). At which combinations for P and F will the market for chicken meat clear? Depict these combinations in the diagram of part c). 10 marks Equilibrium: 9) What is the fanners' 'supply side' condition for equilibrium on the combination of F and P? What is the supermarkets' 'demand side' condition for equilibrium on the combination of F and P? 10 marks h) Determine the equilibrium combination (F. P) graphically in the diagram of part c). Calculate the equilibrium combination (F. P). 10 marks Interpretation: Thus far, framers potentially producing chicken meat of a quality of zero to 0.5 were barred from producing due to regulation. In order to boost employment, the regulation of the quality of meat is now eased. leading all farmers 9 e [0. 1] to producing chicken meat. Assume that the potential demand for chicken meat from supennarkets increases accordingly. i) Adapting the graphical analysis as above. how do you expect this change in regulation to affect the price, the quantity. and the average quality of the chicken meat sold to the supennarkets? How do you expect it to affect the local self-marketing of chicken meat? Discuss. 15 marks Gontinuad.. . 9mm In a Brexit agreement. the EU derives utility from a divorce payment it receives from the UK as well as from political integration with the UK. We use e to denote the divorce payment and p to denote the degree of political integration. In contrast. the UK's dislikes both the divorce payment e and political integration. Its dislike of political integration can be either with a high. awn) = 3 pf. or a moderate. cqps) = 2 p32. The utility functions for the UK that result for the two cases are \"Alan. pa) := - 9A - (MUM) = - 9A - 3 9.42 and \"9(93. Pa) := - ea claws) = - 932 .032. respectively. Depending on the contend. the EU will either know or not know which of the above trade-offs cases. I = A or t = 3, applies for the UK. it the EU's knows which trade-off case 1': A. 3 applies. it considers 9.1, pa or ea. pa as is relevant and the EU's utility functions is U(9r, pr ) := 0.25 (it + pr. it the EU does not know which trade-off case applies. it assumes either of situations A and B may apply. each with a probability of 50%. and it takes the expected value with respect to the two scenarios accordingly. The EU's utility function therefore is: UiE. F) := 0.25 E + P. where E = 0.5 e: + 0.5 ea denotes the expected size of the divorce payment and P = 0.5 p; + 0.5 pa denotes the expected degree of political integration. Symmetric Information For the time being. assume that the EU knows the trade-off for the UK. For each of the trade-offs t = A. B, that may apply, it would offer a specic Brexit take-it-or-leave it contract (9:. pr) offered to the UK it trade-off t applies. where e: denotes the size of the divorce payment received by the EU and pr the level of political integration. As indicated above. the utility of the UK for trade-off f = A. B, from the deal (Br. pr) now is Mei. pr) := - e:_ Question 2 The EU's utility function of divorce payment E and political integration P is U(E, P) = 0.258 + P, where E := 0.5eA + 0.5es and P := 0.5pA + 0.5pg. For high dislike of integration A: cost function CA(PA) := 3 . PA? and utility function uA(eA, PA) := - eA- CA(PA). For moderate dislike of integration B: cost function Cs(Ps) := 2 . ps and utility function us(es, PB) := - es - CB(PB). a) U(E, P) := 0.25E + P = 6, so P = 6 - 0.25E or E = 24 - 4P. 15 UA(eA, PA) := - eA - CA(PA) = - 6, so eA = 6 -3 . PA?. UB(eB, PB) := - es -CB(PB) = - 6, 50 es = 6 - 2 . PB. Eqns 2 each; Diagram 3 each, where points 2 and curve 1; scales incorrect - 2 b) maximize 0.125eA + 0.125es + 0.5pA + 0.5ps 10 by choosing (eA, PA) 1 and (es, PB) 1 such that eA S 6- 3 . PA? (PCA) 2 eB S 6-2 . PB2 (PCB) 2 eA 2 0; eB 2 0; 0 S PA S 1; O S PB S 1 (F) 1 So we obtain maximize 0.125eA + 0.5pA maximize 0.125es + 0.5ps by choosing (eA, PA) by choosing (es, PB) 1 such that eA S 6-3 PA (PCA) 1 such that eB S6 - 2 PB (PCB) eA 2 0; 0 S PA S 1 (F) 1 eB 2 0; 0 S PB S 1 (F) H N c) maximize 6/8 -(3/8) pA2 + 0.5pA 2 maximize 6/8 - (2/8)ps2 + 0.5ps 2 by choosing PA by choosing PB 20 F.O.C. - 0.75pA + 0.5 = 0 F.O.C. - 0.5PB + 0.5 = 0 PA = 2/3 PB = 1 4 eA' = 6 - 3x(4/9) = 4 2/3 eB' = 6 - 2x1 = 4 Graphically: indifference curves tangent to GB's u = -6 curves 4 Diagram 4 d) un(en, ph) > unlee, pe) (1Ch) UT 10 uelee, pe) 2 ue(en, PM) (Ice) 5 Mention of Incentive compatibility constraints / self-selection constraints: 1 e) maximize 0.125en + 0.125ee + 0.5ph + 0.5pe by choosing (eh, ph) and (ee, Pe) 1 10 such that eh = 6- Ch(Ph) := 6-3 ph2 (PCh) 4 - ee - 2pe? = - en - 2p2 (ICe) A en 2 0; ee 2 0; 0 S ph S 1; O S pe S 1 (NN) 1 f) From (PCh) we have en = 6-3 p2 From (ICe) we have ee = en + 2p,2 -2pe =6-3p2 + 2p2 - 2pe2 = 6-pn2 - 2pez N N Substitution in the problem of part e) yields 15 Maximize 6/8-(3/8)p2 + 6/8-(1/8)p,2 -(2/8)pe2 + 0.5ph + 0.5pe? by choosing ph and pe 4 = 1.5 - (1/2)p2 -(1/4)pe2 + 0.5pn + 0.5peQuestion 1 Quality of meat: 0 E [0.5, 1], evenly distributed. Monetary value of self-marketing: M(@) := 2 + 20 Supermarkets' vNM utility index: U(0, P) := 3 + 0 - P a) Selling anonymously to supermarkets whenever M(0) S P, i.e. 2 + 20 SP, so P2 2+ 20 10 and 20 S P - 2, i.e. Os 0.5P - 1 For P = 3.5 this gives O s 1.75 - 1 = 0.75. In diagram: M(e) 3; P = 3.5 to @ = 0.75 3; V(P) 3 Scales incorrect -2 b) M(@) = P, so (crit(P) = 0.5P - 1 5 all owners with O s ecrit(P) will sell anonymously to supermarkets, so 15 S(P) = (crit(P) - 0.5 = 0.5P - 1 -0.5 = 0.5p - 1.5 5 Diagram 5 Scales incorrect -2 c) Meat offered on the anonymous market: [0.5, (crit(P)], evenly distributed. So the average quality of meat offered to supermarket is: 6 10 F(P) := 0.5x0.5 + 0.5@crit(P) = 0.25 + 0.25P - 0.5 = 0.25P - 0.25 for 3 SP $ 4 Diagram 4 Scales incorrect -2 d) The profit of a supermarket for average quality F and price P: U(F, P) = 3 + F - P 1 10 So: 'buy' if F > P -3 'indifferent' if F = P - 3 Explain 5 don't buy' if F F + 3 For F = 0.75: D(P; 0.75) : = 0.5 if p 3.75 Diagram 4 10 f) The market clears when D(P, F) = S(P). This occurs when the supermarkets are indifferent, i.e. for P = F + 3, so the market clearing price on the anonymous market for given F is P(F) = FO + 3. Diagram 4 10 g) Farmers ('supply side'): F = F(P), i.e. F = 0.25P - 0.25 Supermarkets ('demand side'): P = F(P), i.e. P = F + 3. 10 h) F = 0.25x(F+3) -0.25 = 0.25F + 0.5, so 0.75F = 0.5, 5 so F' = 2/3 and P* = 2/3+ 3 = 3 2/3 . Diagram i) At the price calculated above, all meat with a quality from 0 to 0.5 will be offered to supermarkets. As a consequence, the average quality of the meat offered to supermarkets will fall, as will it price P. 5 15 In the new equilibrium, the quantity sold to supermarkets will have increased, and both its quality and its price will have decreased. The fall in the price P of meat sold to supermarkets makes this option less attractive compared to local self-marketing, the revenue of which remains M() as before. As a result some framers who previously sold to supermarkets will now switch to self-marketing and therefore the quantity meat sold through local marketing will increase too?10 15 s) 10 h} 10 Mention of Incentive compatibility constraints I self-selection constraints: 1 maximize 0.1251!\" + 0.125eg + 0.5;. + 0.5m bi! ChDOSinE (En. Pu} and (En. Pa) 1 such that er. = 6 :49.) := 6 3 pill (90,} 4 e; 2,08 = er. 29:2 "Cal 4 9;,20;E20;05ph51;05pe51 ("NI 1 From (PCs) we have an = 6 3 pr.' 1 From (IQ) we have as = En + 2M3 - 2.022 2 =63ps1+2pp32pe'=Equal2,012 Substitution in the problem of part e} yields Maximize 618 (313pr + 518 (118}an (2/3; + 0.5p,, + 0.5;): by choosing pa and pa 4 = 1-5 -l1/1an2 - [M11052 + 0.5.0.. + 0.5;); which can be separated in Maximize 6/8 {1/2}pn1 + 0.5;. + Maximize 6/8 (1/41982 + 0.5.0:: by choosing on by choosing pg 4 4 F.O.C. p,,+0.5=0 F.O.C. D.5pg+D.5=O so pn' = 0.5 so pg' = 1 En'=63/4=5.25 Eg' =6{lf4)2 =3.T5 Type A and type it have the same cost functions, as do type B and type 8. 1 Under symmetric information in part c), and under asymmetric infonnation in part f], type B and type 8 have the same level of integration, but under asymmetric information in part f}, type 8 has a faces a lowerdivorce payment to prevent it from lying about its true dislike of integration. 3 Thus, it does not affect the utility of type h whether it faces symmetric infonnation or asymmetric information, but type 8 is better off under asymmetric information than under symmetric information. 3 50 type 8 has an incentive to hide its true dislike of integration, whereas type h does not have such incentive. 3 If the EU suspects that the UK is trying to hide its true dislike of integration, it would reason that this only makes sense for the UK if its true type is B, so it would conclude that the UK is 'bluffing' and its true type is 8. 5 As a oonsequence, it would offera combination (Ea, pg] which puts the Etype on the utility level 6 of its outside option, and make an unattractive offer (eh, p5,) which in combination with (3:, pg) satisfies E's incentive constraint {IQ}, but which violate h's participation constraint (PCs). 5 c) Determine the equilibrium deals for the case of symmetric information both graphlcally in the diagram of part a} and numerically. 20 marks Asymmetric Information: Now consider the case of asymmetric information. i.e. assume that the EU cannot recognize which of the UK trade-off sltuatlons applies. but It assumes that with 50% probability the UK highly dislikes political Integration. i.e. cost function cutp) = 3 .02 applies and that with 50% probability the UK moderately dislikes politlcal integration. i.e. the cost function atlp) = 2 p2 applies. Please note that CHO?) = CAO?) and age) = ostp). with cam) and cage) as before. Incentive compatibility: d) Which constraints must an incentive compatible pair of offers (an. pa). (er. pr) satisfy? 10 marks Continued... Optimal contracts: It can be shown that for the optimal contracts (en. .01.) and (e;. p,): 1) the participation constraint of the UK high dislike of political integration ('type it) is binding (i.e. holds with equality) 2) the incentive constraint of the UK low dislike of political integration ('type r) is binding (i.e. holds with equality). 3) if 1) and 2) are satisfied. the participation constraint of the UK low dislike of political integration ('type f) and the incentive constraint of the UK high dislike of political integration {'type h') are also satisfied. e) Under these assumptions 1) to 3), what does the EU's optimization problem reduce to? 10 marks 0 Calculate the optimal deals (en. .0) and (9:. pr) offered by the EU to the UK. 15 marks Interpretation: 9) In which of the two trade-off cases A and B would the UK want to hide the true trade-off case from the EU? Explain. 10 marks h) It the EU suspects the UK is acting in accordance with g). how would you expect the EU to behave in the Brexit negotiations? Does this match the stylized facts of the actual Brexit negotations? Discuss. 10 marks where E = 0.5 9)! + 0.5 on denotes the expected size of the divorce payment and P = 0.5 m + 0.5 ps denotes the expected degree of political integration. Symmetric Information For the time being. assume that the EU knows the trade-off for the UK. For each of the trade-oil's t = A. B, that may apply, it would offer a specic Brexit take-it-or-leave- it contract (er. pr} offered to the UK it trade-off t applies. where er denotes the size of the divorce payment received by the EU and pr the level of political integration. As indicated above. the utility of the UK for tradeoft t = A, B. from the deal (Br. pr) now is Utter. at := - er - starl- Continued... The UK with trade-off twill accept the deal it is offered whenever the resulting utility is non-negative. If the offer is declined. there will be no deal and we have a = 6 and p = 0. so the utility both for the UK equals -6 and the utility for the EU is 6. a) Depict the indifference curve of the EU to a utility level of 6 in a (E. P}- diagram. For both trade-olf situation A and trade-off situation B. depict the indifference curves for the UK to a utility level of -6 in the same diagram. In this diagram 9 ranges from 0 to 6 and p ranges from 0 to t. 15 marks b) Formulate the EU's decision problem mathematically. 10 marks c) Determine the equilibrium deals for the case of symmetric information both graphically in the diagram of part a) and numerically. 20 marks Asymmetric information: Now consider the case of asymmetric information. i.e. assume that the EU canmt recognize which of the UK trade-off situations applies. but it assumes that with 50% probability the UK highly dislikes political integ'ation. i.e. cost function clip) = 3 p2 applies and that with 50% probability the UK moderately dislikes political integration. i.e. the cost function clip) = 2 1)2 applies. Please note that clip) = out!) and CAD) = cdp). with can!) and catp) as before. Incentive compatibility: d) Which constraints must an incentive compatible pair of offers (an. pa). (9:. pr) satisfy? 10 marks Continued