Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have seen this same question posted on Chegg, however the answers to 36a are all wrong in those Chegg answer posts. Could you please

I have seen this same question posted on Chegg, however the answers to 36a are all wrong in those Chegg answer posts. Could you please explain how 36a is done?

I can't change the 15%

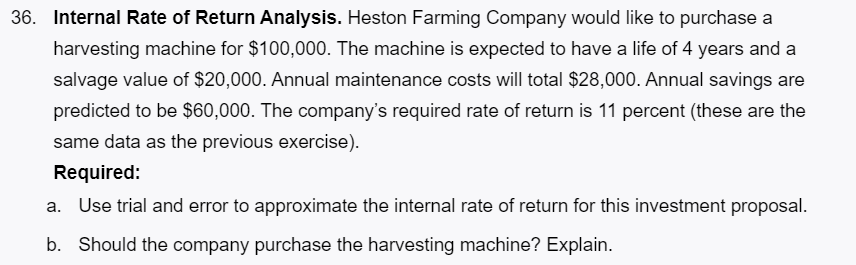

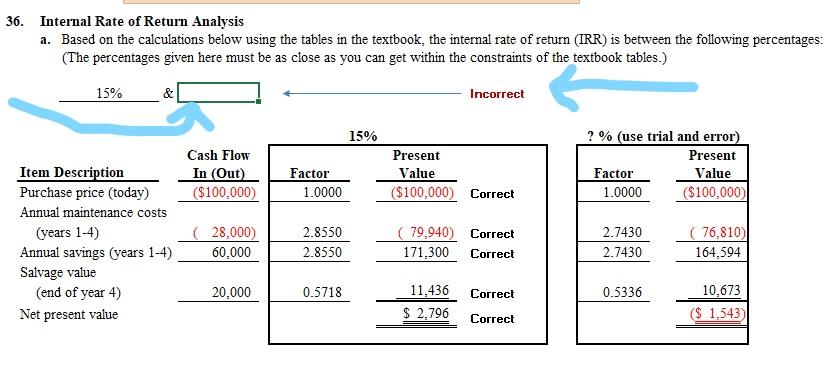

36. Internal Rate of Return Analysis. Heston Farming Company would like to purchase a harvesting machine for $100,000. The machine is expected to have a life of 4 years and a salvage value of $20,000. Annual maintenance costs will total $28,000. Annual savings are predicted to be $60,000. The company's required rate of return is 11 percent (these are the same data as the previous exercise). Required: a. Use trial and error to approximate the internal rate of return for this investment proposal. b. Should the company purchase the harvesting machine? Explain. 36. Internal Rate of Return Analysis a. Based on the calculations below using the tables in the textbook, the internal rate of return (IRR) is between the following percentages: (The percentages given here must be as close as you can get within the constraints of the textbook tables.) 15% & Incorrect 15% Cash Flow In (Out) ($100,000) ? % (use trial and error) Present Factor Value 1.0000 ($100,000) Present Value ($100,000) Correct Factor 1.0000 Item Description Purchase price (today) Annual maintenance costs (years 1-4) Annual savings (years 1-4) Salvage value (end of year 4) Net present value (28,000) 60,000 2.8550 2.8550 (79,940) Correct 171,300 Correct 2.7430 2.7430 ( 76,810) 164,594 20,000 0.5718 Correct 0.5336 11,436 $ 2,796 10,673 ($ 1,543 Correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started