Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have sent two images please do asap Assumptions Fixed rate mortgages repaid in the coming year = 20%. Savings deposits that become rate sensitive

I have sent two images please do asap

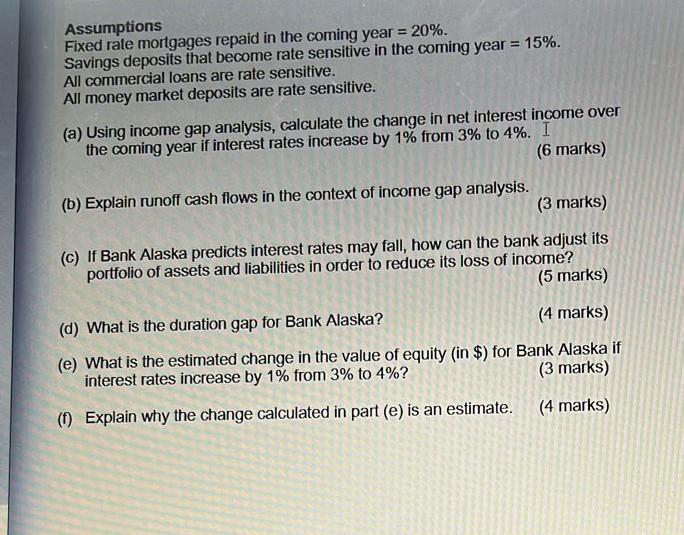

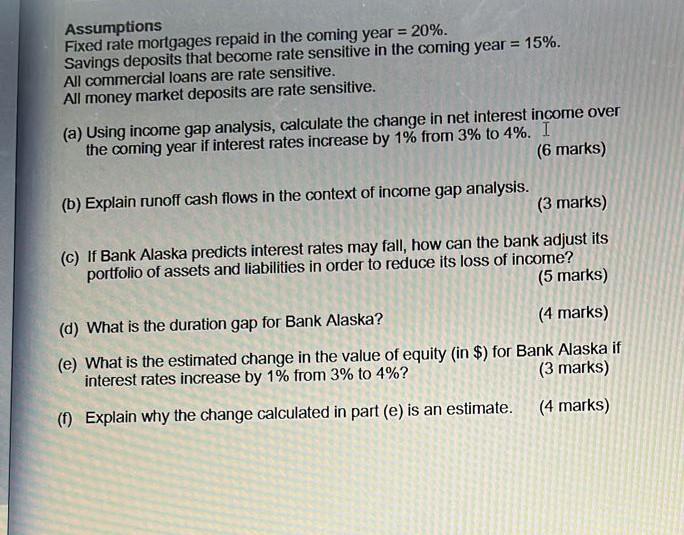

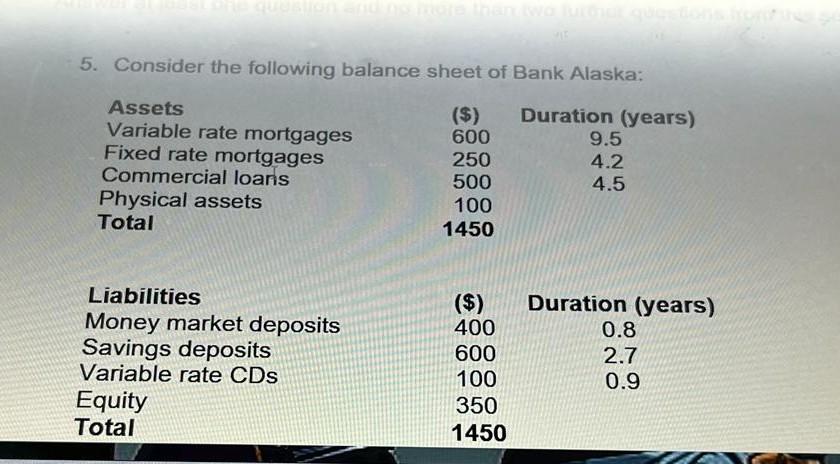

Assumptions Fixed rate mortgages repaid in the coming year = 20%. Savings deposits that become rate sensitive in the coming year = 15%. All commercial loans are rate sensitive. All money market deposits are rate sensitive. (a) Using income gap analysis, calculate the change in net interest income over the coming year if interest rates increase by 1% from 3% to 4%. I (6 marks) (b) Explain runoff cash flows in the context of income gap analysis. (3 marks) (c) If Bank Alaska predicts interest rates may fall, how can the bank adjust its portfolio of assets and liabilities in order to reduce its loss of income? (5 marks) (d) What is the duration gap for Bank Alaska? (4 marks) (e) What is the estimated change in the value of equity (in $) for Bank Alaska if interest rates increase by 1% from 3% to 4%? (3 marks) (1) Explain why the change calculated in part (e) is an estimate. (4 marks) Assumptions Fixed rate mortgages repaid in the coming year = 20%. Savings deposits that become rate sensitive in the coming year = 15%. All commercial loans are rate sensitive. All money market deposits are rate sensitive. (a) Using income gap analysis, calculate the change in net interest income over the coming year if interest rates increase by 1% from 3% to 4%. I (6 marks) (b) Explain runoff cash flows in the context of income gap analysis. (3 marks) (c) If Bank Alaska predicts interest rates may fall, how can the bank adjust its portfolio of assets and liabilities in order to reduce its loss of income? (5 marks) (d) What is the duration gap for Bank Alaska? (4 marks) (e) What is the estimated change in the value of equity (in $) for Bank Alaska if interest rates increase by 1% from 3% to 4%? (3 marks) (1) Explain why the change calculated in part (e) is an estimate. (4 marks) 5. Consider the following balance sheet of Bank Alaska: Assets ($) 600 Duration (years) 9.5 Variable rate mortgages Fixed rate mortgages Commercial loans 250 4.2 500 4.5 100 Physical assets Total 1450 Liabilities ($) Duration (years) Money market deposits 400 0.8 Savings deposits 600 2.7 Variable rate CDs 100 0.9 350 Equity Total 1450 Assumptions Fixed rate mortgages repaid in the coming year = 20%. Savings deposits that become rate sensitive in the coming year = 15%. All commercial loans are rate sensitive. All money market deposits are rate sensitive. (a) Using income gap analysis, calculate the change in net interest income over the coming year if interest rates increase by 1% from 3% to 4%. I (6 marks) (b) Explain runoff cash flows in the context of income gap analysis. (3 marks) (c) If Bank Alaska predicts interest rates may fall, how can the bank adjust its portfolio of assets and liabilities in order to reduce its loss of income? (5 marks) (d) What is the duration gap for Bank Alaska? (4 marks) (e) What is the estimated change in the value of equity (in $) for Bank Alaska if interest rates increase by 1% from 3% to 4%? (3 marks) (1) Explain why the change calculated in part (e) is an estimate. (4 marks) Assumptions Fixed rate mortgages repaid in the coming year = 20%. Savings deposits that become rate sensitive in the coming year = 15%. All commercial loans are rate sensitive. All money market deposits are rate sensitive. (a) Using income gap analysis, calculate the change in net interest income over the coming year if interest rates increase by 1% from 3% to 4%. I (6 marks) (b) Explain runoff cash flows in the context of income gap analysis. (3 marks) (c) If Bank Alaska predicts interest rates may fall, how can the bank adjust its portfolio of assets and liabilities in order to reduce its loss of income? (5 marks) (d) What is the duration gap for Bank Alaska? (4 marks) (e) What is the estimated change in the value of equity (in $) for Bank Alaska if interest rates increase by 1% from 3% to 4%? (3 marks) (1) Explain why the change calculated in part (e) is an estimate. (4 marks) 5. Consider the following balance sheet of Bank Alaska: Assets ($) 600 Duration (years) 9.5 Variable rate mortgages Fixed rate mortgages Commercial loans 250 4.2 500 4.5 100 Physical assets Total 1450 Liabilities ($) Duration (years) Money market deposits 400 0.8 Savings deposits 600 2.7 Variable rate CDs 100 0.9 350 Equity Total 1450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started