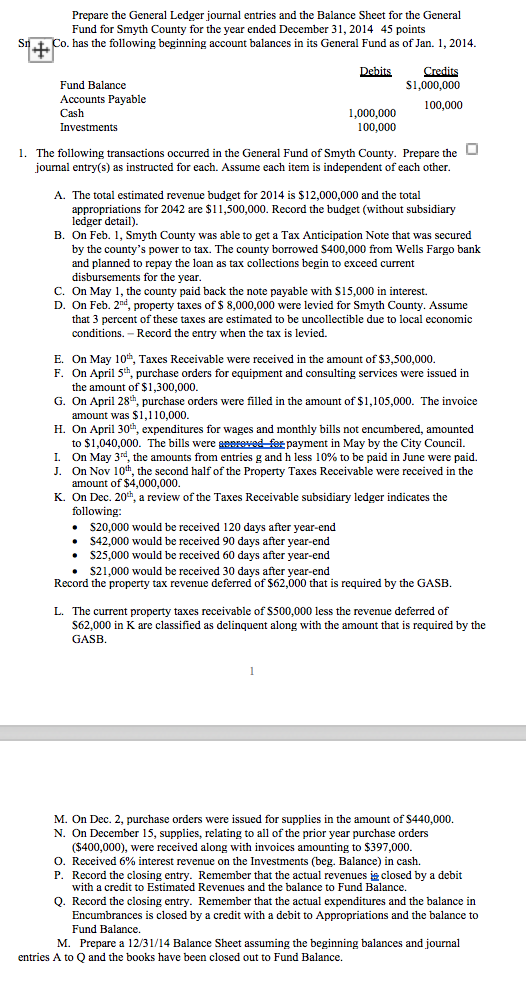

I have solved A-H just seeking help with G-M. Thank you

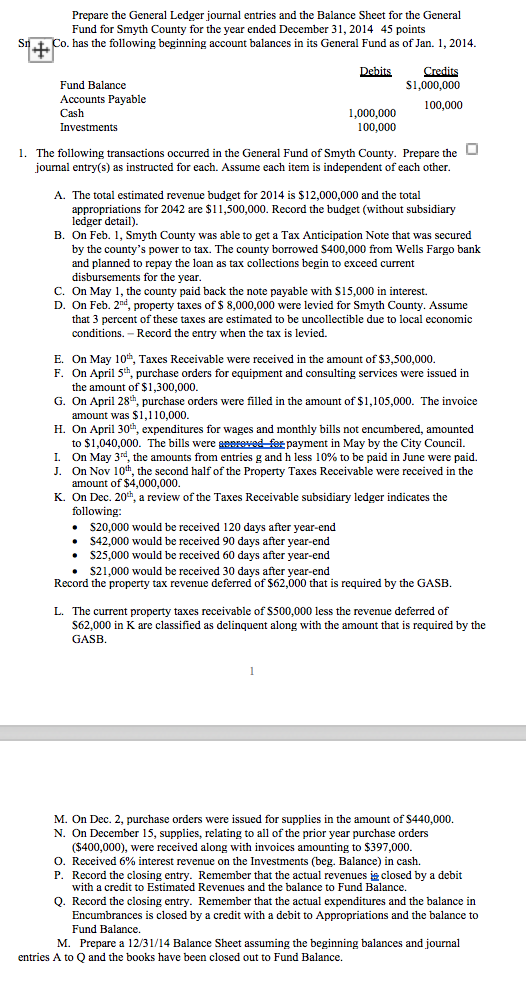

Prepare the General Ledger journal entries and the Balance Sheet for the General Fund for Smyth County for the year ended December 31, 2014 45 points has the following beginning account balances in its General Fund as of Jan. 1, 2014 Des Cres S1,000,000 Fund Balance Accounts Payable Cash Investments 100,000 1,000,000 100,000 1. The following transactions occurred in the General Fund of Smyth County. Prepare the journal entry(s) as instructed for each. Assume each item is independent of each other. A. The total estimated revenue budget for 2014 is $12,000,000 and the total appropriations for 2042 are $1,500,000. Record the budget (without subsidiary ledger detail). B. On Feb. 1, Smyth County was able to get a Tax Anticipation Note that was secured by the county's power to tax. The county borrowed $400,000 from Wells Fargo bank and planned to repay the loan as tax collections begin to exceed current disbursements for the year C. On May 1, the county paid back the note payable with S15,000 in interest. D. On Feb. 2"d, property taxes of 8,000,000 were levied for Smyth County. Assume that 3 percent of these taxes are estimated to be uncollectible due to local economic conditions. - Record the entry when the tax is levied. E. On May 10th, Taxes Receivable were received in the amount of $3,500,000 F. On April 5th, purchase orders for equipment and consulting services were issued in G. On April 28th, purchase orders were filled in the amount of $1,105,000. The invoice H. On April 30,expenditures for wages and monthly bills not encumbered, amounted L On May 3rd, the amounts from entries g and h less 10% to be paid in June were paid. the amount of $1,300,000 amount was $1,110,000 to $1,040,000. The bills were anerevedfspayment in May by the City Council. J. On Nov 10th, the second half of the Property Taxes Receivable were received in the amount of $4,000,000 K. On Dec. 20h, a review of the Taxes Receivable subsidiary ledger indicates the following: $20,000 would be received 120 days after year-end $42,000 would be received 90 days after year-end $25,000 would be received 60 days after year-end $21,000 would be received 30 days after year-end Record the property tax revenue deferred of $62,000 that is required by the GASB L. The current property taxes receivable of S500,000 less the revenue deferred of S62,000 in K are classified as delinquent along with the amount that is required by the GASB M. On Dec. 2, purchase orders were issued for supplies in the amount of $440,000 N. On December 15, supplies, relating to all of the prior year purchase orders ($400,000), were received along with invoices amounting to $397,000. O. Received 6% interest revenue on the investments (beg. Balance) in cash. P. Record the closing entry. Remember that the actual revenuesiclosed by a debit with a credit to Estimated Revenues and the balance to Fund Balance. Q. Record the closing entry. Remember that the actual expenditures and the balance in Encumbrances is closed by a credit with a debit to Appropriations and the balance to Fund Balance. M. Prepare a 1231/14 Balance Sheet assuming the beginning balances and journal entries A to Q and the books have been closed out to Fund Balance