Answered step by step

Verified Expert Solution

Question

1 Approved Answer

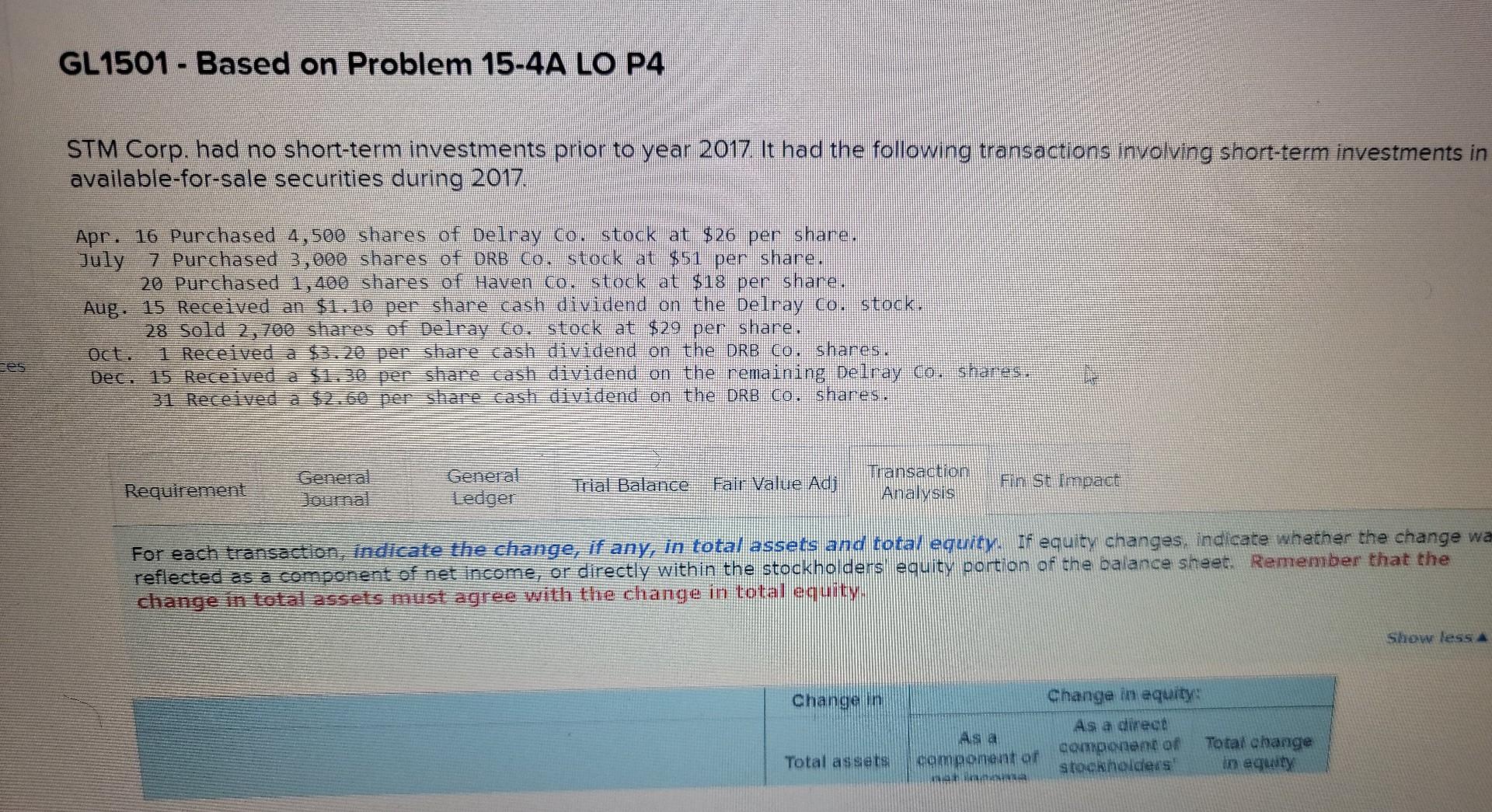

I have solved some of the problem but I am stuck on these parts. GL1501 - Based on Problem 15-4A LO P4 STM Corp. had

I have solved some of the problem but I am stuck on these parts.

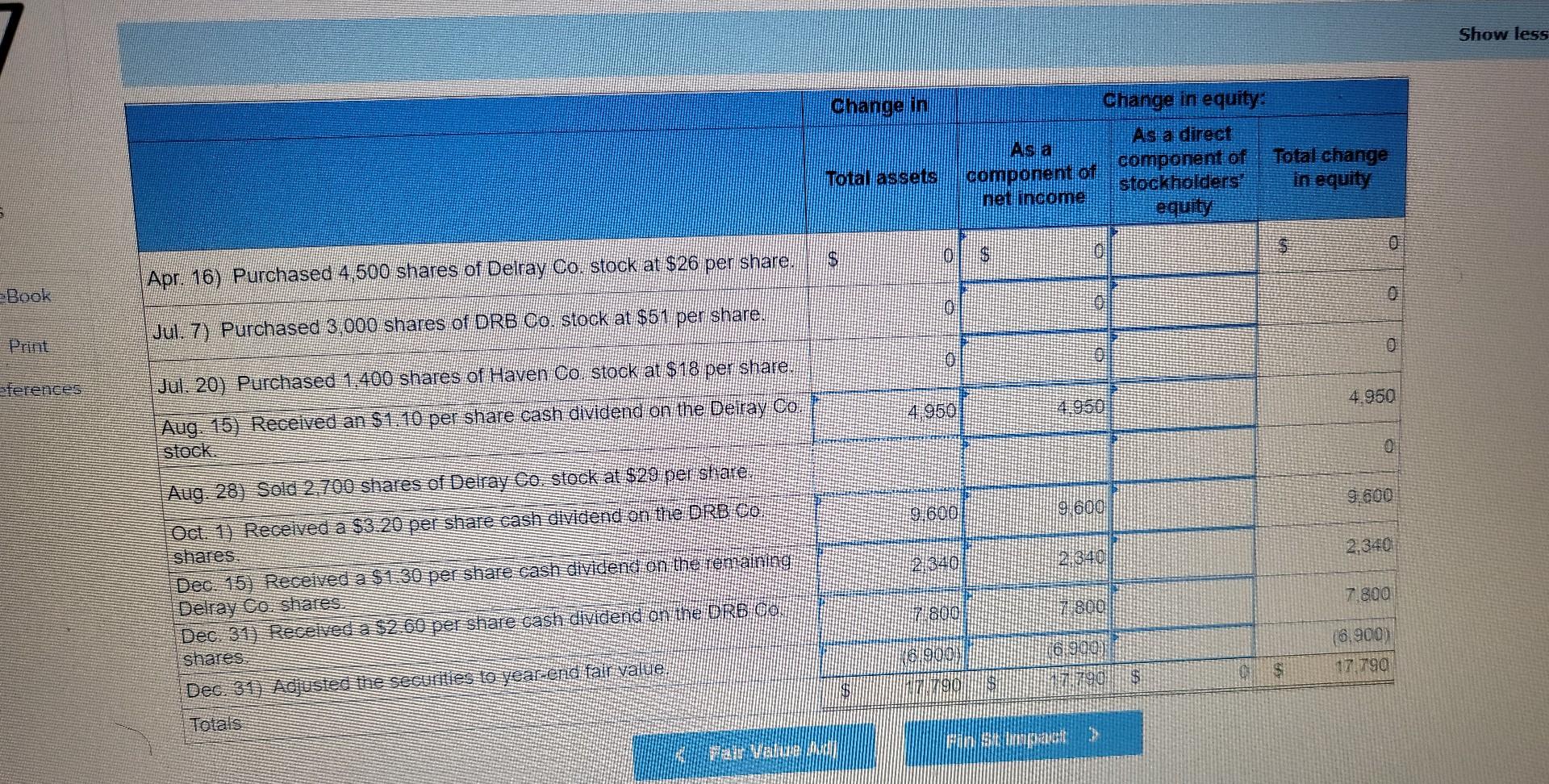

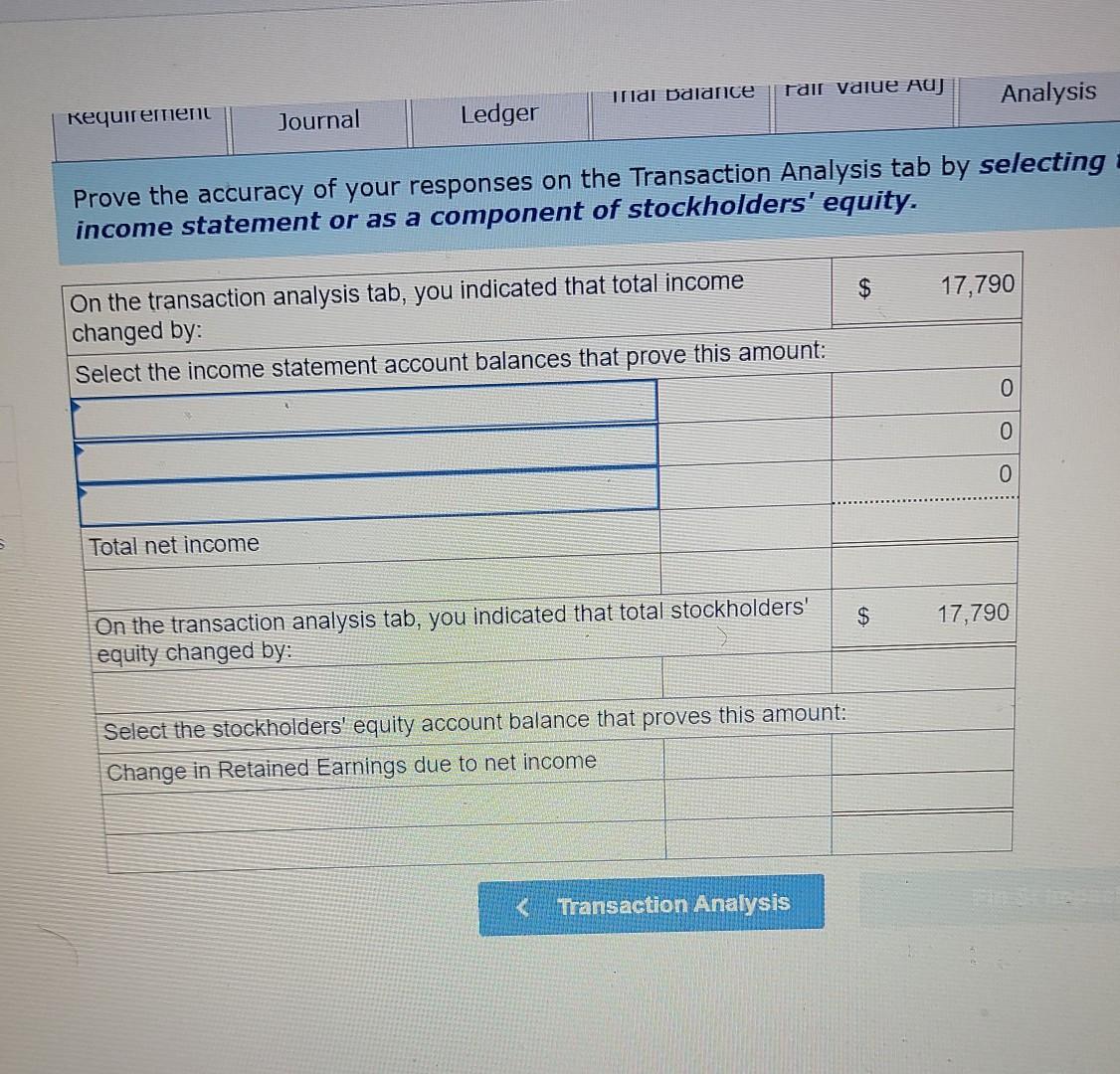

GL1501 - Based on Problem 15-4A LO P4 STM Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. Apr. 16 Purchased 4,500 shares of Delray Co. stock at $26 per share. July 7. Purchased 3,000 shares of DRB Co. stock at $51 per share. 20 Purchased 1,400 shares of Haven 60. stock at $18 per share. Aug. 15 Received an $1.10 per share cash dividend on the Delray co. stock. 28 Sold 2,700 shares of Delray Co.-stock at $29 per share. oct. 1 Received a $3.2e per share cash dividend on the DRB Co. shares. Dec. 15 Received a 13e per share cash dividend on the remaining Delray co. shares. 31 Received a $2.60 per share cash dividend on the DRB Co. shares. General Oma Requirement General Ledger Tial Balance Fair Value Adj Transaction Analysis Fin St Impact For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change wa reflected as a component of net income, or directly within the stockholders equity portion of the balance sheet Remember that the change in total assets must agree with the change in total equity Show less Change in Change in equity: As a direct As a component of Total change component or stockholders in eguty 44 Total assets Show less Change in Change in equity: As a direct As a component of Total change component of stockholders in equity net income equity Total assets . en 0 3 $ 10 Apr. 16) Purchased 4,500 shares of Delray Co. stock at $26 per share. Book 0 0 Jul. 7) Purchased 3.000 shares of DRB Co. stock at $51 per share. o 0 ferences 4.950 Jul. 20) Purchased 1,400 shares of Haven stock at $18 per share. Aug. 15) Received an $1,40 per share cash dividend on the Deitay Co. stock. 4.950 4.950 Aug. 28) Sold 2.700 shares of Delray to: stock at $23 per share. 9.600 9.600 9 600 2,340 2340 2.340 7.800 Oct. 1) Received a $3.20 per share cash dividend on the DRB Co., shares Dec. 15) Received a $1:30 per share cash dividend on the remaining Delray Co. shares. Dec 31, Received a $2.60 per share cash dividend on the DRBICO shares Dec. 31 Agustes se securities to year enig fair value 7 800 800 16.900) 61900 16.900 17.790 $ $ 17790 790 Totals NA inal balance rall Value Ad Analysis Requirement Journal Ledger Prove the accuracy of your responses on the Transaction Analysis tab by selecting income statement or as a component of stockholders' equity. $ 17,790 On the transaction analysis tab, you indicated that total income changed by: Select the income statement account balances that prove this amount: 0 0 0 Total net income $ 17,790 On the transaction analysis tab, you indicated that total stockholders' equity changed by: Select the stockholders' equity account balance that proves this amount: Change in Retained Earnings due to net income * Transaction Analysis GL1501 - Based on Problem 15-4A LO P4 STM Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. Apr. 16 Purchased 4,500 shares of Delray Co. stock at $26 per share. July 7. Purchased 3,000 shares of DRB Co. stock at $51 per share. 20 Purchased 1,400 shares of Haven 60. stock at $18 per share. Aug. 15 Received an $1.10 per share cash dividend on the Delray co. stock. 28 Sold 2,700 shares of Delray Co.-stock at $29 per share. oct. 1 Received a $3.2e per share cash dividend on the DRB Co. shares. Dec. 15 Received a 13e per share cash dividend on the remaining Delray co. shares. 31 Received a $2.60 per share cash dividend on the DRB Co. shares. General Oma Requirement General Ledger Tial Balance Fair Value Adj Transaction Analysis Fin St Impact For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change wa reflected as a component of net income, or directly within the stockholders equity portion of the balance sheet Remember that the change in total assets must agree with the change in total equity Show less Change in Change in equity: As a direct As a component of Total change component or stockholders in eguty 44 Total assets Show less Change in Change in equity: As a direct As a component of Total change component of stockholders in equity net income equity Total assets . en 0 3 $ 10 Apr. 16) Purchased 4,500 shares of Delray Co. stock at $26 per share. Book 0 0 Jul. 7) Purchased 3.000 shares of DRB Co. stock at $51 per share. o 0 ferences 4.950 Jul. 20) Purchased 1,400 shares of Haven stock at $18 per share. Aug. 15) Received an $1,40 per share cash dividend on the Deitay Co. stock. 4.950 4.950 Aug. 28) Sold 2.700 shares of Delray to: stock at $23 per share. 9.600 9.600 9 600 2,340 2340 2.340 7.800 Oct. 1) Received a $3.20 per share cash dividend on the DRB Co., shares Dec. 15) Received a $1:30 per share cash dividend on the remaining Delray Co. shares. Dec 31, Received a $2.60 per share cash dividend on the DRBICO shares Dec. 31 Agustes se securities to year enig fair value 7 800 800 16.900) 61900 16.900 17.790 $ $ 17790 790 Totals NA inal balance rall Value Ad Analysis Requirement Journal Ledger Prove the accuracy of your responses on the Transaction Analysis tab by selecting income statement or as a component of stockholders' equity. $ 17,790 On the transaction analysis tab, you indicated that total income changed by: Select the income statement account balances that prove this amount: 0 0 0 Total net income $ 17,790 On the transaction analysis tab, you indicated that total stockholders' equity changed by: Select the stockholders' equity account balance that proves this amount: Change in Retained Earnings due to net income * Transaction AnalysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started