Question

I have started to use the formula but I need help with solutions and explanations for the question preferably with the formula but most importantly

I have started to use the formula but I need help with solutions and explanations for the question preferably with the formula but most importantly an explanation of the solutions.

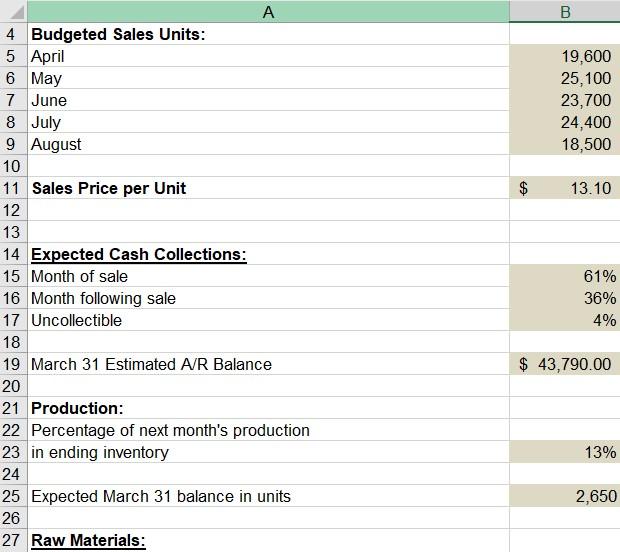

The company is preparing budgets for the second quarter ending June 30, 2023.

Sales Budget

- Budgeted sales of the companys only product for the next five months are:

April 19,600 units

May 25,100 units

June 23,700 units

July 24,400 units

August 18,500 units

- The selling price is $13.10 per unit.

Schedule of Expected Cash Collections

More information:

- All sales are on account.

- The company collects 61% of these credit sales in the month of the sale; 36% are collected in the month following the sale, and the remaining 3% are uncollectible.

- The accounts receivable balance on March 31 was $43,790. All of this balance was collectible.

Production Budget

More information:

- The company desires to have inventory on hand at the end of each month equal to 13% of the following months budgeted unit sales.

- On March 31, 2,650 units were on hand.

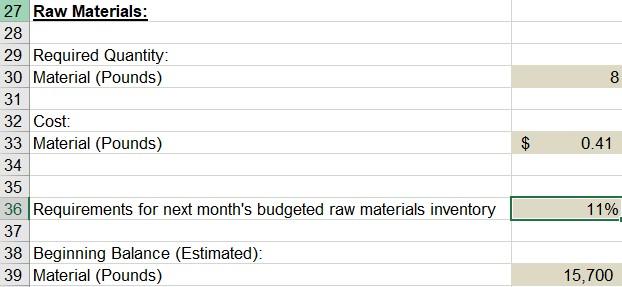

Direct Materials Budget

More information:

- 8 pounds of material are required per unit of product.

- Management desires to have materials on hand at the end of each month equal to 11% of the following months production needs.

- The beginning materials inventory was 15,700 pounds.

- The materials cost $0.41 per pound.

Requirement:

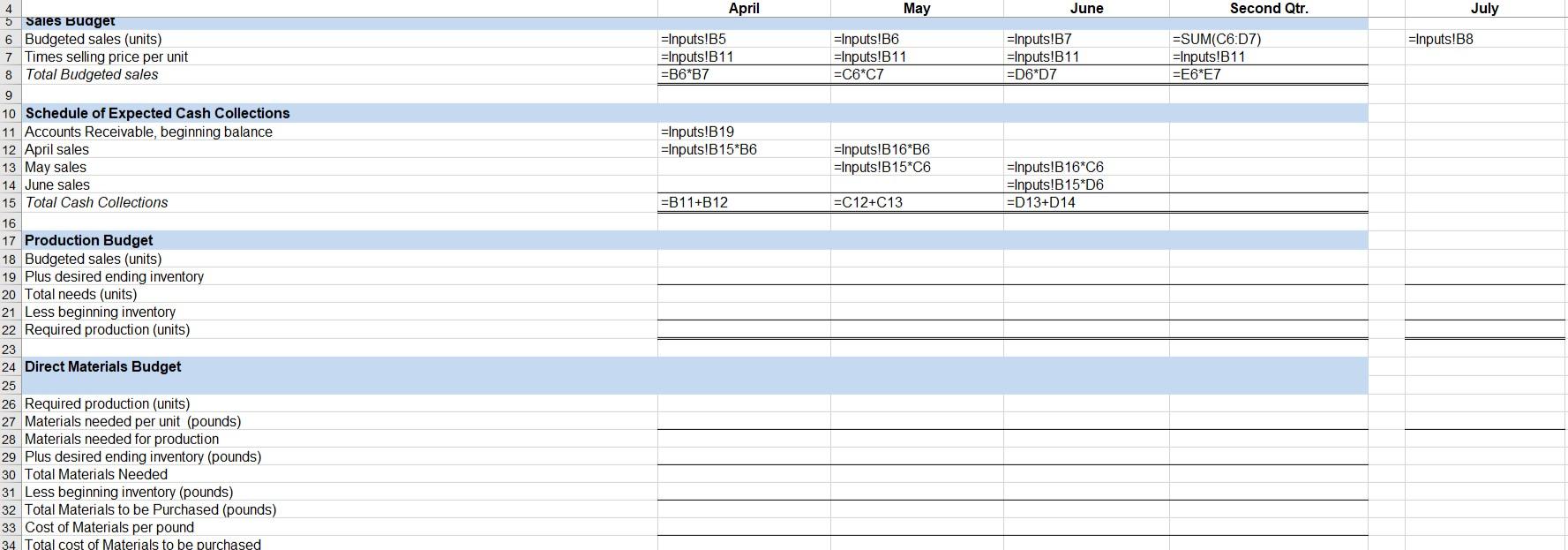

1. Prepare the following budgets for April, May, and June (and second-quarter totals):

a. Sales Budget

b. Schedule of Expected Cash Collections

c. Production Budget

d. Direct Materials Budget

B 19,600 25,100 23,700 24,400 18,500 $ 13.10 A 4 Budgeted Sales Units: 5 April 6 May 7 June 8 July 9 August 10 11 Sales Price per Unit 12 13 14 Expected Cash Collections: 15 Month of sale 16 Month following sale 17 Uncollectible 18 19 March 31 Estimated A/R Balance 20 21 Production: 22 Percentage of next month's production 23 in ending inventory 24 25 Expected March 31 balance in units 26 27 Raw Materials: 61% 36% 4% $ 43,790.00 13% 2,650 8 27 Raw Materials: 28 29 Required Quantity: 30 Material (Pounds) 31 32 Cost: 33 Material (Pounds) 34 35 36 Requirements for next month's budgeted raw materials inventory 37 38 Beginning Balance (Estimated): 39 Material (Pounds) $ 0.41 11% 15,700 4 April May June Second Qtr. July =Inputs!B8 =Inputs!B5 =Inputs!B11 =B6*B7 =Inputs!B6 =Inputs!B11 =C6*C7 =Inputs!B7 =Inputs!B11 =D6*D7 =SUM(C6:07) =Inputs!B11 =E6*E7 =Inputs!B19 =Inputs!B15*B6 =Inputs!B16*B6 =Inputs!B15*C6 =Inputs!B16*C6 =Inputs!B15*D6 =D13+D14 =B11+B12 =C12+C13 5 Sales Budget 6 Budgeted sales (units) 7 Times selling price per unit 8 Total Budgeted sales 9 10 Schedule of Expected Cash Collections 11 Accounts Receivable, beginning balance 12 April sales 13 May sales 14 June sales 15 Total Cash Collections 16 17 Production Budget 18 Budgeted sales (units) 19 Plus desired ending inventory 20 Total needs (units) 21 Less beginning inventory 22 Required production (units) 23 24 Direct Materials Budget 25 26 Required production (units) 27 Materials needed per unit (pounds) 28 Materials needed for production 29 Plus desired ending inventory (pounds) 30 Total Materials Needed 31 Less beginning inventory (pounds) 32 Total Materials to be purchased (pounds) 33 Cost of Materials per pound 34 Total cost of Materials to be purchasedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started